George Rose/Getty Images News

Introduction

Phillips 66 (NYSE:PSX) has become one of my favorite stocks to cover. In general, I have always liked covering the company due to its significant footprint in the refinery and chemical industries.

However, in my most recent article, published on December 5, I covered a major new development, including an activist investor, going with the title “60% Gains Plus Dividends With Phillips 66 If Elliott Is Right.”

Here’s a part of my takeaway (emphasis added):

Since my November article on Phillips 66, activist giant Elliott Investment Management has entered the scene with a $1 billion stake and a bold letter to the board.

Identifying key issues like underperformance and operational lapses, Elliott proposed a strategic overhaul. The company responded positively, welcoming changes.

With a focus on cost-cutting, divestitures, and a commitment to shareholder value, Phillips 66’s future seems promising.

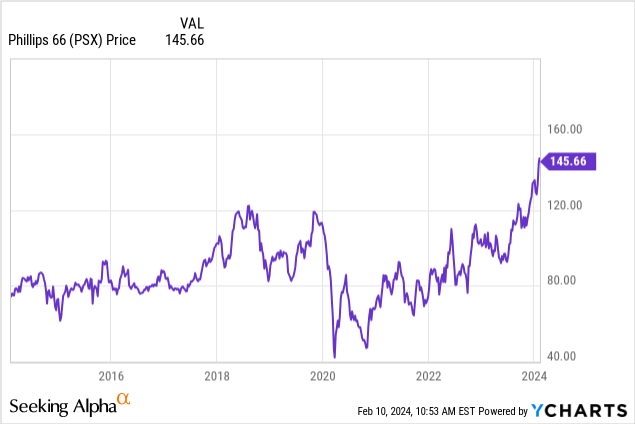

Since December 5, PSX has returned 14%, beating the 10% return of the S&P 500 by a more than decent margin.

In this article, we will discuss the company’s recently released earnings and new developments that hint at promising value creation.

We will also discuss the current risk/reward, as PSX yields just 3% after its recent rally, which may be a disadvantage for investors seeking income – especially in light of the energy sector being a source of often elevated yields.

So, with all of this in mind, let’s dive into the details!

Phillips 66 Is Poised For Growth

Generally speaking, all eyes are on cost reduction, core assets, and increasing long-term capital returns.

This is what I wrote in my last article in light of the opportunities that Elliott sees:

- It believes in the company’s $14 billion mid-cycle EBITDA target by 2025, with more than $1 billion in improvements from the refining segment via both operating cost and commercial improvements.

- The company is selling $3 billion of non-core assets.

- The company is increasing its long-term capital return policy.

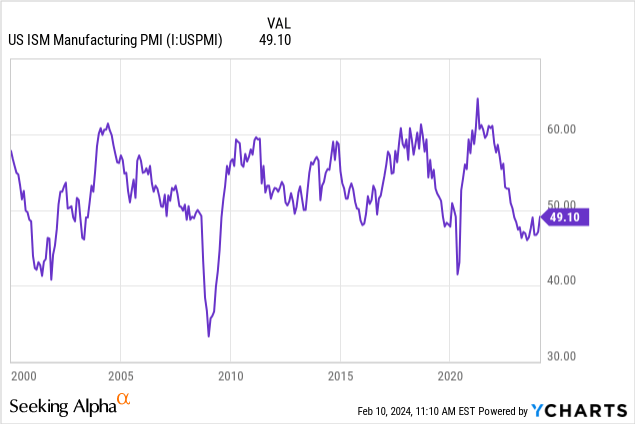

Having said that, the financial results for the fourth quarter showed resilience despite challenging market conditions like very poor manufacturing sentiment.

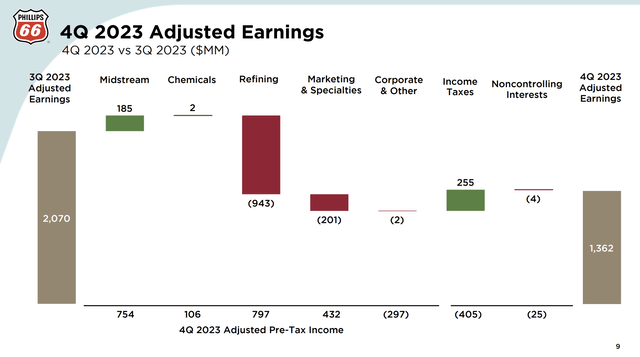

Adjusted earnings stood at $1.4 billion, or $3.09 per share. As we can see below, refining was the biggest driver of weakness on a quarter-over-quarter basis.

While this may look like bad news, analysts were looking for a number that was $0.71 lower!

Phillips 66

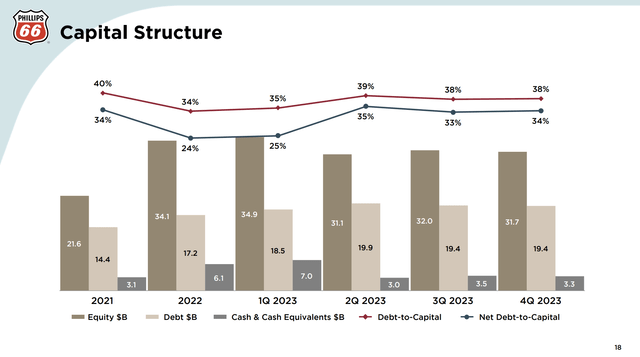

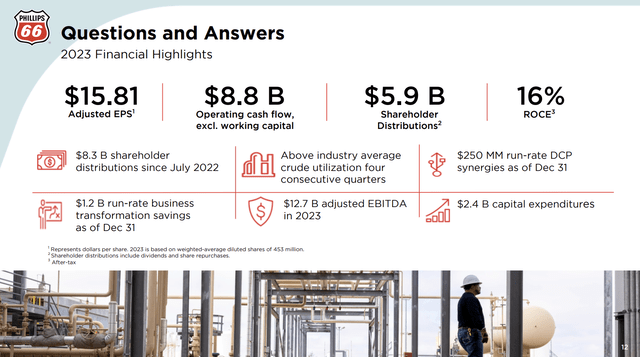

Furthermore, despite capital spending amounting to $634 million for the quarter, the company maintained a healthy balance sheet, with a net debt-to-capital ratio of 34% at year-end 2023.

Phillips 66

Return on capital employed was reported at 16% for the year, indicating efficient utilization of resources.

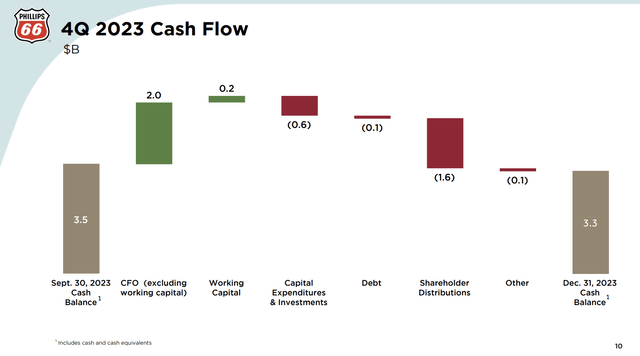

Zooming in a bit on cash, the company’s cash flow analysis for the fourth quarter highlights its prudent financial management.

Starting with a cash balance of $3.5 billion, cash from operations, excluding working capital, amounted to $2.0 billion.

A working capital benefit of $207 million was mainly attributed to reduced inventory, partially offset by movements in accounts receivables and payables.

The company funded capital spending of $634 million, repaid approximately $100 million in debt, and returned $1.6 billion to shareholders through share repurchases and dividends, resulting in an ending cash balance of $3.3 billion.

Phillips 66

So far, so good.

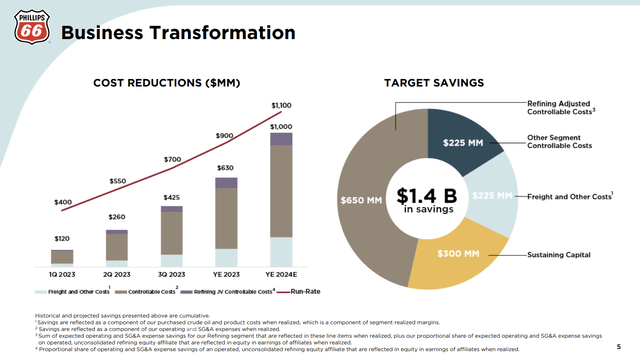

What matters way more than these numbers is the company’s business transformation.

During its 4Q23 earnings call, the company explained that its business transformation efforts have been geared towards reducing costs to sustain higher cash generation, which is essentially the core of what activists and shareholders are looking for.

By the end of 2023, the company achieved significant progress in this regard, with a total of $1.2 billion in run rate savings. This included $900 million from cost reductions and $300 million from sustaining capital efficiencies.

Phillips 66

Notably, sustaining capital, which historically averaged about $1 billion per year, increased by approximately $200 million due to the consolidation of DCP Midstream.

Despite this increase, the company managed to reduce sustaining capital spending to under $900 million in 2023, resulting in a $300 million benefit reflected in the 2024 capital plan.

Adding to that, in light of the DCP Midstream integration, the company noted that stable cash generation from the Midstream business has grown to a level that covers the company’s top capital priorities, including funding sustaining capital and the dividend.

Furthermore, with regard to capital spending, the company emphasized its disciplined approach to capital allocation, which has resulted in an average return on capital employed of 13% since its formation in 2012, which is nearly double its cost of capital!

This approach ensures that capital is directed toward projects and initiatives that offer the highest returns, thereby maximizing shareholder value.

As I already briefly mentioned, the company ended the year with a full-year ROCE of 16%.

Phillips 66

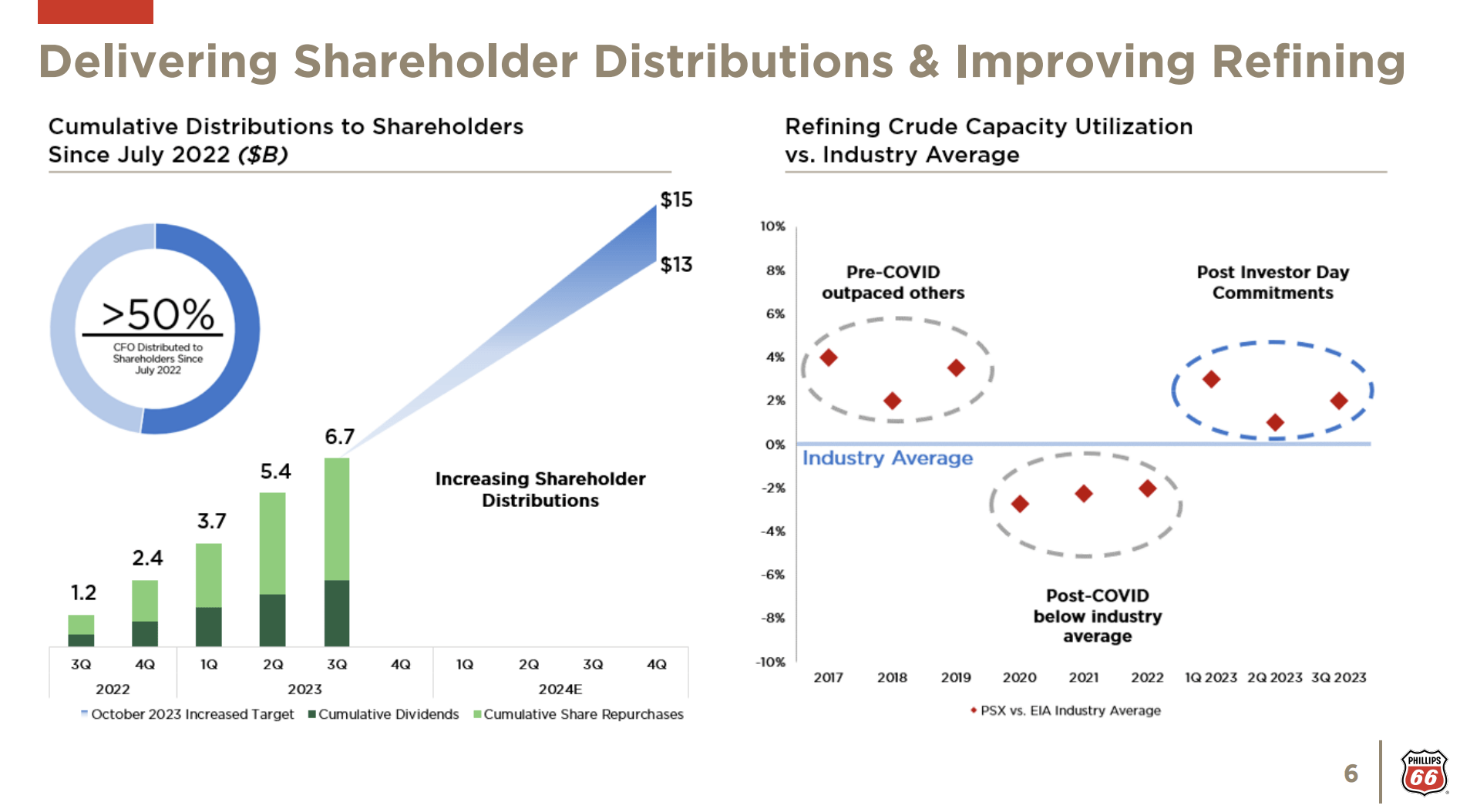

In terms of strategic priorities and achievements, the company provided an overview of its progress in executing its plan to increase mid-cycle adjusted EBITDA and grow shareholder distributions.

The company aims to increase mid-cycle adjusted EBITDA by 40% to $14 billion by 2025, with a significant portion of this growth expected to come from areas outside of refining.

Moreover, notable achievements include distributing $8.3 billion through share repurchases and dividends since July 2022, with a target of $13 billion to $15 billion by the end of 2024.

Phillips 66

The company also highlighted improvements in Refining operating performance, with crude utilization rates consistently above the industry average for four consecutive quarters.

Phillips 66

With regard to its dividend, the company hiked its dividend by 8.2% on February 8, 2023. Since then, the company has paid $1.05 per share per quarter, which translates to a yield of 2.9%, protected by a payout ratio in the mid-20% range.

The five-year dividend CAGR is 12.8%.

Given the company’s ambitious shareholder distribution plans, investors remain in a fantastic spot, which is why its dividend is a lot more attractive than it may look.

Furthermore, analysts expect the company to generate $6.0 billion in free cash flow this year, which translates to 9.6% of its $62.6 billion market cap.

This opens the door to aggressive buybacks and consistent dividend growth in the high-single-digit to low-double-digit range.

Valuation

Because of the company’s promising growth rates, I believe it is fair to stick to the valuation I used in my prior article, which is based on Elliott’s assessment that PSX could generate roughly $9.0 billion in mid-cycle free cash flow.

Using a 10% free cash flow yield (10x FCF multiple), the company has a fair market cap of $90 billion.

Elliott Financial Management

The current market cap is $62.6 billion, which implies roughly 44% upside from the current price and a price target of $209.

With that in mind, I believe that if the company is successful, the market will apply an 8-9% FCF yield valuation, which could pave the way for even more upside.

It also needs to be said that the market has finally recognized the company’s turnaround potential.

The chart below shows the ratio between PSX’s stock price and the VanEck Refinery ETF (CRAK). Including dividends, PSX has outperformed the CRAK ETF with increasing momentum since Elliott got involved.

TradingView (PSX/CRAK Ratio – Including Dividends)

- Over the past three months, PSX is up 30%, excluding its dividend.

- During this period, CRAK has rallied just 8%.

Going forward, I expect outperformance to continue, as I have faith in PSX’s ability to become a more streamlined and profitable refinery player in the years ahead.

Takeaway

Phillips 66’s strategic initiatives have bolstered financial resilience and shareholder value.

Despite market challenges, the company’s focus on cost reduction and efficient capital allocation has yielded impressive results.

With $1.2 billion in savings achieved and a robust long-term growth plan, including increased shareholder distributions and ambitious EBITDA targets, the company is well-positioned for continued success.

Analysts anticipate strong free cash flow generation, supporting aggressive buybacks and dividend growth.

With significant upside potential in valuation, Phillips 66’s trajectory reflects a promising outlook for investors, underlining its transformation into a more profitable player in the refining sector.

Pros and Cons

Pros:

- Strategic Transformation: PSX’s focus on cost reduction and efficient capital allocation has led to $1.2 billion in savings, enhancing profitability.

- Robust Financials: Despite market challenges, PSX maintains a healthy balance sheet, with a net debt-to-capital ratio of 34% and a solid return on capital employed of 16%.

- Shareholder Value: The company’s commitment to increasing shareholder distributions, supported by dividend hikes and aggressive buybacks, makes it an attractive investment option.

- Growth Potential: With ambitious targets to increase mid-cycle adjusted EBITDA by 40% and strong free cash flow generation expected, PSX offers promising growth prospects.

Cons:

- Market Volatility: PSX operates in a volatile market, prone to fluctuations in crude oil prices and refining margins, which could impact its financial performance.

- Dependency on Refining Developments (Big Picture): The company’s reliance on the refining segment exposes it to risks associated with this industry, such as regulatory changes and geopolitical developments.

- Valuation Uncertainty: Despite promising growth rates, uncertainty surrounding valuation persists, with potential upside dependent on market sentiment and execution of strategic initiatives.