bjdlzx

Diamondback Energy, Inc. (NASDAQ:FANG) announced a merger with Endeavor Energy Partners (which is privately owned). This will continue the long tradition of Diamondback increasing free cash flow and earnings at a rate in excess of the industry as the company grows with yet another merger or acquisition. Management is using a combination of stock and cash for the purchase to keep the debt ratio low and then will quickly repay some of that debt (as they have done many times in the past). The stock price is likely to continue to grow at a pace that many growth stocks do even though this is a cyclical industry.

Shareholder Story

This stock has been that rare growth story in a cyclical industry. The company is getting quite large. Therefore, it is harder for management to “move the needle” with each acquisition. Hence the rather sizable announcement today.

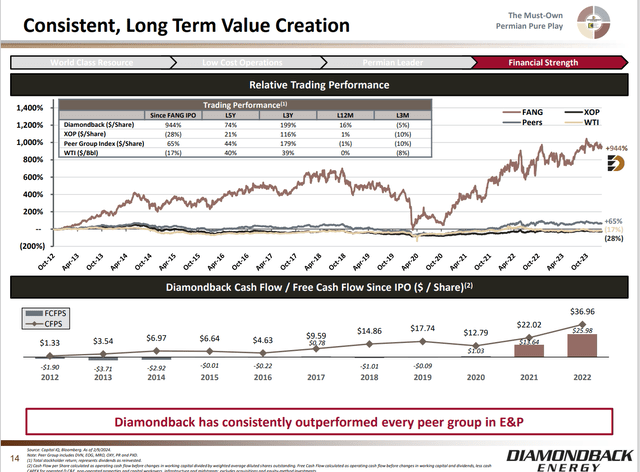

Diamondback Energy Value Creation Since IPO (Diamondback Energy Endeavor Merger Presentation February 2024)

This stock, as shown above, has definitely cycled. It has also outperformed most measures if held throughout the business cycle. That puts this IPO (initial public offering) stock in a very rare class, as most studies show that more than 95% of all IPO’s disappear without a trace.

As long as management keeps that cash flow and free cash flow growing over time in this volatile industry, this one is probably a buy and hold (and a strong one at that) for those with the stomach to handle the share price volatility.

Note also that you could have invested for a considerable time after the pandemic and still made quite a bit of money.

The Deal

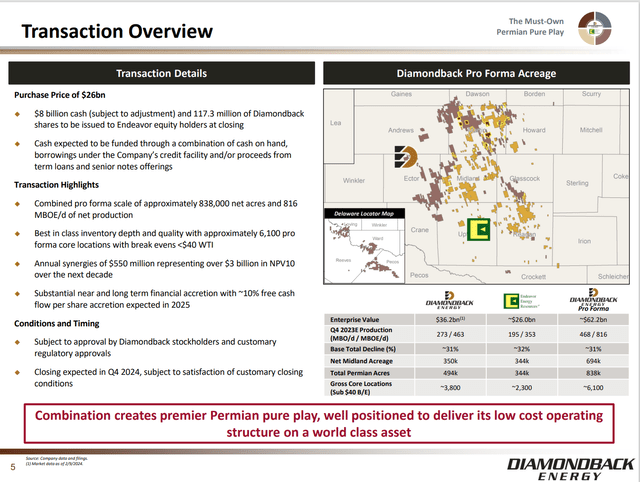

Diamondback is going to issue stock of 117 million shares while adding roughly $8 billion in debt.

Diamondback Energy Merger With Endeavor Detail Summary (Diamondback Energy Endeavor Acquisition Presentation February 2024)

Note that the acreage is in several cases “bolt-on.” Larger contiguous positions often allow for more long (and profitable wells) than is the case when the properties were under separate owners.

Management does intend to raise the base dividend to $.90 per share beginning with the fourth quarter 2023, declaration. However, shareholders will only participate in the return of 50% of free cash flow until the post combination debt levels reach 10 billion.

Management did not state this, but they often will sell some noncore holdings for some more cash flow to help repay debt.

The other key here is all the locations that break even when drilled at less than $40. Diamondback is one of the more profitable companies in the industry. Therefore, this management, in particular, has a priority to find superior acreage.

Cost Savings

Technology keeps moving forward in this industry. Therefore, Diamondback Energy often reports as many or more locations at yearend than the year before even without acquisitions because new technology enables cost cutting which keeps oil price increases over time from matching inflation. Now, there are spikes from time to time where the news will state otherwise for short periods of time.

But long term, a lot of these deals get better as technology moves forward. It is a safety valve that many industries do not have.

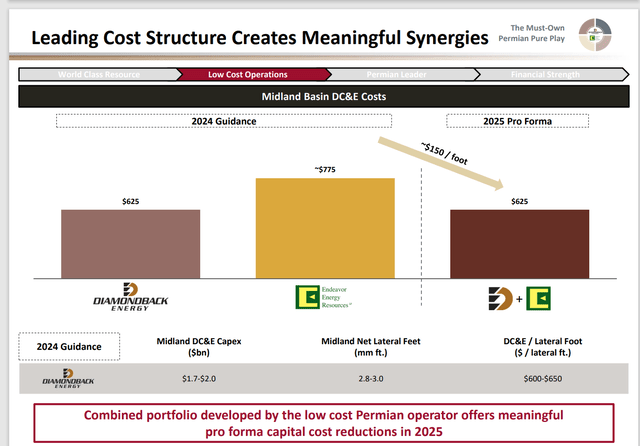

Diamondback Energy Potential Post Merger Cost Savings (Diamondback Energy Endeavor Merger Presentation February 2024)

Management mentions several potential cost savings. The most visible one is shown above. But the key concept is that management often announces new methods from technology advances that enable better performance throughout the business and result in additions to Tier 1 acreage. Therefore, the more acreage that management has, the bigger the benefits of these advances.

The net result is that there are benefits from the combination itself. But there are continuing benefits throughout the industry that at least partially offset cost increases.

Some of these advances will allow additional intervals to be cost competitive in the future. This is yet another benefit of technology advances. Every couple of years I write about a new basin coming online or a new interval where the operator announced a “discovery.”

The end result is a lot more built-in safety than is the case in many other industries out there (at least for the time being).

Risks

The biggest risk is always an unexpected commodity price downturn that is severe and sustained for a long period of time. This management minimizes that risk by being investment grade. Therefore, the company already has low debt levels combined with the promise to quickly repay debt down to $10 billion.

The next risk with any larger merger is that large mergers have a low success rate. Oftentimes, the logistics after the merger are daunting. Here, management argues that similar cultures and the “bolt-on” characteristics of a fair amount of the acreage will minimize a lot of larger merger risks. This acreage is right in management’s backyard. Therefore, management knows this acreage very well.

The biggest risk is the loss of key personnel, particularly the CEO. This is that rare IPO that has produced above-average returns. That often points to a management that has a rare level of ability. Therefore, key management losses for any reason could prove critical.

For Shareholders

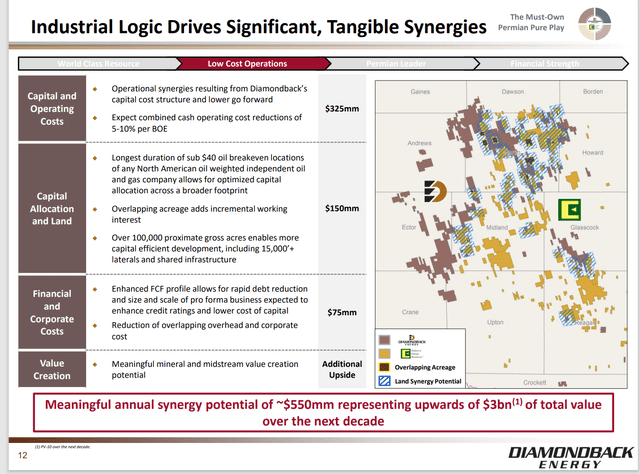

Management does show a summary of expected synergies:

Diamondback Energy Expected Overall Merger Benefits (Diamondback Energy Endeavor Merger Corporate Presentation February 2024)

What is always left out of the picture is the tangible benefits of getting superior acreage. Competition for Midland basin acreage is clearly heating up. This acreage has often been cheaper than Delaware Basin acreage. But the profitability has been comparable. Now much of the industry is racing to acquire this acreage as was the case with the Delaware Basin a few years back.

Investors can expect that eventually there will be money that pushes this acreage up to unreasonable levels. That is likely to happen soon. In the meantime, expect superior management like the management of Diamondback Energy to find a cheaper way to expand operations in the future.

Diamondback was one of the first to expand into the Midland Basin. It will likely be the first to go elsewhere as well.

Management is guiding to 10% more free cash flow after the acquisition. That is likely to affect fiscal year 2025. Understand that commodity price fluctuations can magnify or mitigate that guidance once we get there.

But over time, this management has grown cash flow and free cash flow at a brisk pace. For the time being, investors can expect that brisk pace to continue. For me, this is a strong buy and I will hold until the story changes.

I buy good management and love a good growth story. With Diamondback Energy, Inc., I get both. With the industry out of favor, I get both very cheaply compared to many other industries.