Anton Petrus/Moment via Getty Images

Altria (NYSE:MO) is a “Dividend King” and there are only about 55 companies that currently qualify for this title. To make this list, a company needs to have at least 50 years of consecutive dividend increases. Altria has a 54-year history of consecutive dividend increases. The company has been able to do this in spite of major regulations and in spite of declines in tobacco usage, which is impressive. The tobacco industry has consistently been able to make up for reduced volumes by increasing prices, and this trend appears poised to continue. While it is concerning to see a company that expects reduced volumes in the future, it could continue to raise prices, and I think there is a strong chance that smokeless products and cannabis (when it is potentially legalized in all 50 states) will offer Altria new opportunities for growth.

Q4 Results Were Good Enough

The decline in sales has been concerning for investors, and as a recent Seeking Alpha article points out, Altria has been missing revenue estimates for many quarters now. Because of this, expectations for Q4 were not high. Fortunately, Altria delivered in-line results with non-GAAP earnings per share of $1.18, although revenues came in at $5.02 billion, which was a miss by $60 million. The company also said it expected 2024 earnings to come in at $5 to $5.15 per share. The Board of Directors (having recently completed a $1 billion share buyback), also announced a new $1 billion share buyback, which is expected to be completed by the end of 2024. Since Altria was able to match analyst estimates for Q4, and since it earned $1.18 per share, this is good enough, and it allows Altria to comfortably pay a $0.98 quarterly dividend. The guidance of $5+ per share in earnings in 2024 is also enough to comfortably pay the generous dividend it offers.

Earnings Estimates And The Dividend

With management expecting Altria to earn $5 to $5.15 per share for 2024, the dividend is fully covered and then some. With the dividend totaling $3.84 per share for the year, this stock is now yielding about 9.8%. Furthermore, the dividend appears safe, since the payout ratio is around 75%. Continued share buybacks can also help boost earnings per share, and therefore keep the payout ratio at a reasonable level and also allow the company to increase the dividend, just as it has been doing for so many years.

As an example, in 2013, the quarterly dividend was 44 cents per share. However, thanks to annual dividend increases, the quarterly dividend is now 98 cents per share. That means the dividend has more than doubled in just around 10 years. If Altria continues to buy back shares, and if it develops growth potential in related industries in the future, this could allow it to significantly increase the dividend over the next 10 years, just as it has for the past 10 years.

Here Is How Altria’s Dividend Could Double Your Money In About 7 Years

Not long ago, cash balances were earning almost nothing. But these days, I love earning around 5% on my cash that’s parked in money market funds. I don’t expect a return to a Zero Interest Rate Policy or “ZIRP”; however, it seems likely that interest rates will give up at least some of the gains we have seen, especially if and when an economic slowdown or recession occurs. This means it is an ideal time to lock the higher yields we are enjoying now by buying select stocks that offer a generous and sustainable dividend. By doing this, investors could be poised to lock in high yields and also position themselves for capital gains that could occur when interest rates decline.

With this in mind, Altria’s generous payout, which is high enough to roughly double your money in just about seven years or so. This is based on the rule of 72, whereby you divide 72 by the yield. For example, 72 divided by 10 (from a nearly 10% yield), means it will take about 7.2 years to double your money.

Altria Has A Major Asset It Could Monetize For More Dividends In The Future

Altria owns a major stake in Anheuser-Busch InBev (BUD). According to a Barron’s article the stake is worth about $11 billion and it might monetize this asset someday. If this asset is sold, the cash it raises might be used to pay a special dividend or it could be used to buy back shares. Altria currently has a market capitalization of about $71 billion, so an asset sale of $11 billion could be enough to buy back about 15% of the shares outstanding, which would boost earnings per share for the remaining shareholders. Altria has roughly 1.8 billion shares outstanding, so if they sold the stake in Anheuser-Busch InBev for $11 billion, this works out to just over $6 per share in proceeds that could be paid out as a special dividend. Anheuser-Busch InBev shares currently trade for about $60 per share, but traded for over $120 per share in 2016 and 2017. Perhaps Altria management is waiting and hoping for the stock to return to these levels, in which case the value of this stake would be about double the current value and therefore be potentially worth around $22 billion, which would represent a very major gain from current levels.

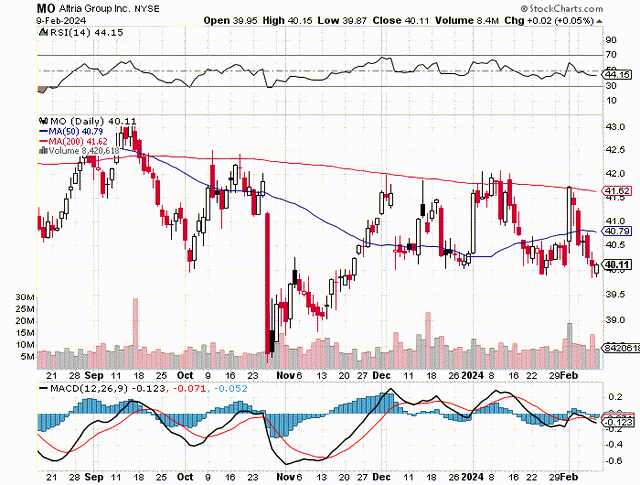

The Chart

As the chart below shows, Altria shares dropped from around the $41 level to just about $38, after the company reported weaker than expected Q3 results on October 26, 2023. The stock has recovered a bit and has since been in a trading range, roughly between $40 to $42 per share. The 50-day moving average is $40.79 and the 200-day moving average is $41.62. Altria is still in this trading range, even after Q4 earnings, and that is a positive.

stockcharts.com

Cannabis Could Be Altria’s Future Growth Driver

It seems clear that the major tobacco companies in the U.S. have been treading very carefully and avoided making the potential misstep of getting directly involved in the cannabis industry. U.S. Federal law still makes marijuana illegal (along with related products) and that makes getting into this business directly way too risky for a company like Altria right now. However, there are a number of bills before Congress that could legalize marijuana on a Federal level. This would be a gamechanger and this is when I expect companies like Altria to act aggressively to directly enter this industry. Altria has already shown some serious interest in cannabis by investing in the industry as well as supporting it. In 2019, Altria acquired a 45% stake in Cronos Group, Inc., which is a Cannabis company located in Canada. Regarding this investment, Altria states:

“This investment positions Altria to participate in the emerging global cannabis sector, which we believe is poised for rapid growth over the next decade. It also creates a new growth opportunity in a category that is adjacent and complementary to our core tobacco businesses.”

I believe Altria could just be waiting for cannabis to be legalized on the Federal level, and perhaps that will be the moment that they decide to sell the Anheuser-Busch InBev stake. This is a huge asset, and the proceeds, or at least some of them, could be used to acquire a leading cannabis company. This could be the growth driver that Altria needs to alleviate investor concerns, and expand the price to earnings multiple. In addition, Altria appears to publicly support the legalization of cannabis on a Federal level, by stating:

“We support a comprehensive federal framework for all cannabis products that is based on science and evidence, and we believe it is time for a national dialogue about that regulatory framework.”

The Potential Downside Risks

The main potential risk seems to obviously be that fewer people are smoking these days, and regulations and bans seem to be increasing. If Altria doesn’t transform itself by moving into high-growth categories like perhaps cannabis, the shares could trade at an even lower price to earnings ratio in the future. If management makes investments or acquisitions that are ill-conceived, that is another potential risk factor.

In Summary

There are definitely some potential downside risks when investing in tobacco stocks, so I would not take a big stake in terms of positioning in my portfolio. But the dividend yield is so compelling that, in my opinion, it makes sense to own some shares. I would scale into a position and see how the stock does over the next couple of quarters. The dividend is very generous and could continue to see small annual increases thanks to Altria’s ability to raise prices and because it could monetize the stake it has in Anheuser-Busch InBev. Even if this stock goes nowhere over the next seven years or so, the dividend alone is enough to double your money in that time frame.

If interest rates decline in the next couple of years, investors could be willing to pay more for this stock, and that could give investors who buy now some potential capital gains. I think the concern over declines in tobacco volumes are more than offset by the potential positives which include a decline in interest rates, continued share buybacks, the potential for Altria to monetize a major asset, and the potential for the company to raise prices and perhaps get into higher growth industries such as cannabis. If declining interest rates at some point converge with a new growth driver such as cannabis for Altria, this stock could be re-rated much higher. It’s not just Q4 results that show Altria can keep on paying the generous dividend, it is also the guidance it provided for 2024, and of course the multi-decade history it has of paying dividends.

No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor.