- Average two-year fixed rate fell by 0.37 percentage points in January to 5.56%

- This was the biggest monthly fall since December 2022, says Moneyfacts

- But some lenders are now upping rates again, so what should borrowers do?

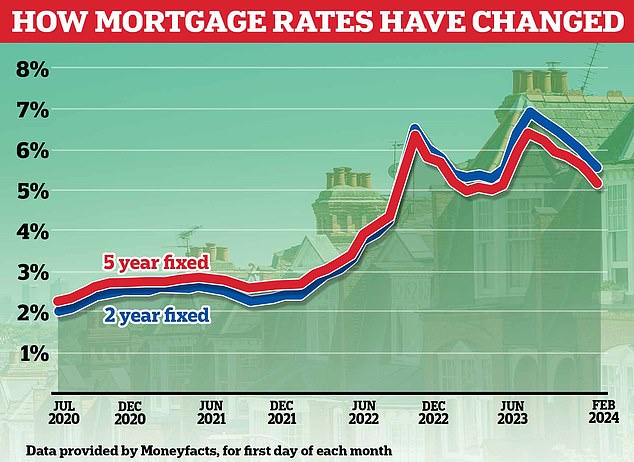

Average fixed mortgage rates fell for the sixth consecutive month in January, according to the latest figures from financial researchers at Moneyfacts.

The overall average two-year fixed rate fell by 0.37 percentage points from 5.93 per cent to 5.56 per cent over the month.

Meanwhile, the average five-year fixed rate mortgage fell from 5.55 per cent to 5.18 per cent.

This represented the biggest monthly fall since December 2022.

Mortgage lenders have been cutting rates since August when average two year-fixed rate reached a peak of 6.85 per cent and average five-year fixes hit 6.37%

Mortgage lenders have been cutting rates since August when average two year-fixed rate reached a peak of 6.85 per cent and average five-year fixes hit 6.37 per cent.

It means the average borrower fixing a £200,000 mortgage for two years with a 25 year repayment term, could expect to pay £1,234 a month now compared to £1,394 a month back in August.

At the start of this year, a mortgage price war opened up with more than 50 mortgage lenders cutting their residential rates – some more than once.

The cuts have largely come to a standstill over the past two weeks, though, with some lenders now increasing their rates.

The average two-year fix has risen from 5.56 per cent to 5.59 per cent and the average five-year has gone from 5.18 per cent to 5.23 per cent.

From tomorrow, Nationwide Building Society said it will be increasing some of its fixed and tracker rates by up to 0.25 per cent.

But borrowers securing the cheapest deals can still get a rate of just below 4 per cent when fixing for five years or just above 4 per cent when fixing for two years.

The cheapest five year fixed rate available to someone buying or remortgaging with at least a 40 per cent deposit or equity stake in their home is currently 3.93 per cent, with a £999 fee.

Someone buying with a 40 per cent deposit can fix for two years for as low as 4.2 per cent, again with a £999 fee.

The advice to anyone approaching their remortgage is to act now rather than wait in hope of lower rates.

Market expectations for interest rates are reflected in swap rates. Mortgage lenders price their fixed rates according to Sonia swap rates in particular.

Today, five-year swaps are currently at 3.88 per cent and two-year swaps at 4.41 per cent.

Both of these are up compared to the start of the year when five-year swaps were 3.4 per cent and two-year swaps were 4.04 per cent.

Rachel Springall, finance expert at Moneyfacts, said: ‘Those borrowers who have waited patiently in recent months to re-finance, or indeed are preparing for when their mortgage deal expires, would be wise to review rates, as lenders are closely monitoring the volatile swap rate market, which tends to influence fixed rate pricing.

‘There have been big expectations for fixed rates to fall further, and whether now is the right time to refinance will come down to an individual’s circumstances.

‘Lenders are in constant review of their ranges, and it is likely rates will fluctuate in the coming weeks due to the noises surrounding future rate expectations.’