Poca Wander Stock

Investment Outlook

Guidewire Software, Inc. (NYSE:GWRE) has produced moderate revenue growth and an increasingly positive earnings trajectory.

I previously wrote about Guidewire in September 2023 with a Hold outlook on valuation concerns.

While valuation isn’t cheap, the P&C industry is healing and Guidewire is producing improved earnings and free cash flow per share on increasing efficiencies and a more scalable revenue mix.

I’m Bullish on GWRE shares in the near term on improving fundamentals.

Guidewire’s Approach And Market

Guidewire generates revenue from subscription & support, licenses and professional services.

In recent quarters, its professional services and license revenue streams have been trending lower as a percentage of total revenue.

This is helpful to increasing GWRE’s operating leverage, since professional services revenue can take more time and money to scale versus subscription sales.

Also of note, more revenue has been coming from the United States and the EMEA region in recent quarters.

The global insurance operations software market was an estimated $11.6 billion in 2021 and is forecasted to reach $32.2 billion by 2032, according to a market research report by Business Research Insights.

This growth, if achieved, would represent a CAGR (Compound Annual Growth Rate) of 9.73% from 2022 to 2032.

The primary drivers of this expected growth are a desire by P&C companies to improve their underwriting, risk assessment and claims processes through digitization.

Machine learning and AI applications will also figure into the growth of the industry, with the ability to gather more information from the increasing use of sensors in IoT environments, from buildings to automobiles.

However, two aspects that may slow the adoption of new software solutions are the need to integrate with existing, legacy systems, which is difficult and various regulatory and compliance requirements as insurance firms deal with sensitive customer data.

Also, the industry for providing software to P&C firms is frequently changing. For example, direct competitor Duck Creek Technologies was acquired in early 2023 by private equity firm Vista Equity Partners for $2.6 billion.

This development will be one to watch and see, as the tie-up may result in greater investment in Duck Creek’s offerings and/or combination with other companies to grow the firm’s capabilities and footprint.

Recent Financial Trends And Valuation

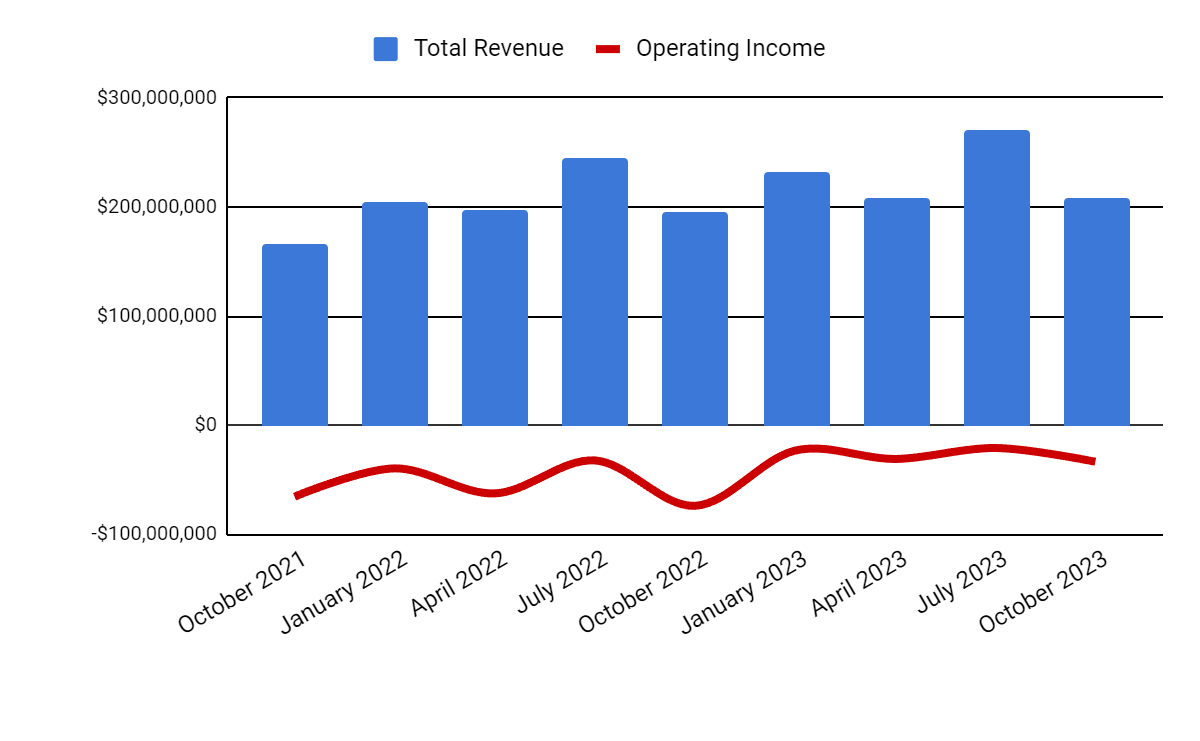

Total revenue by quarter (columns) has continued to trend higher but only with a mid-single digit growth rate; Operating losses by quarter (line) have remained substantial but have been reduced significantly year-over-year, by nearly 55% in FQ1 2024.

Seeking Alpha

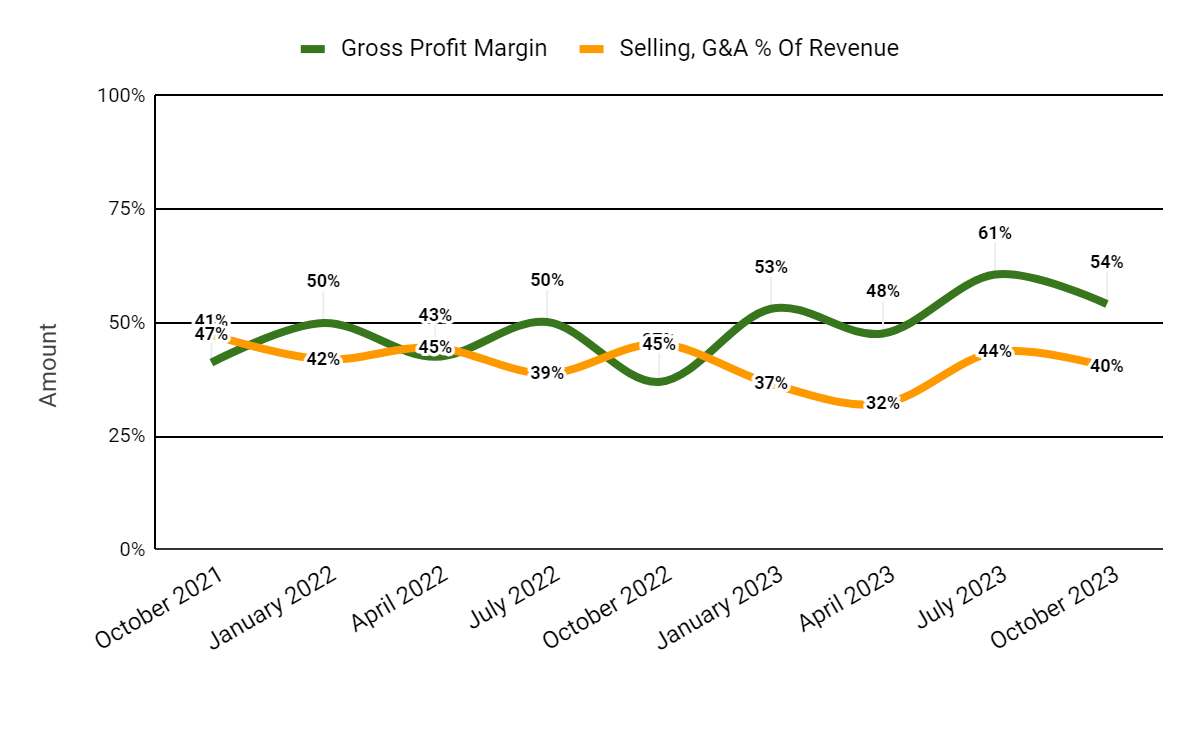

Gross profit margin by quarter (green line) has trended higher as a result of increasing gross margin in its subscriptions & support revenue category and from reduced cloud infrastructure costs; Selling and G&A expenses as a percentage of total revenue by quarter (orange line) have trended lower due to improved sales cycle dynamics and greater efficiencies from its selling and marketing organization.

Seeking Alpha

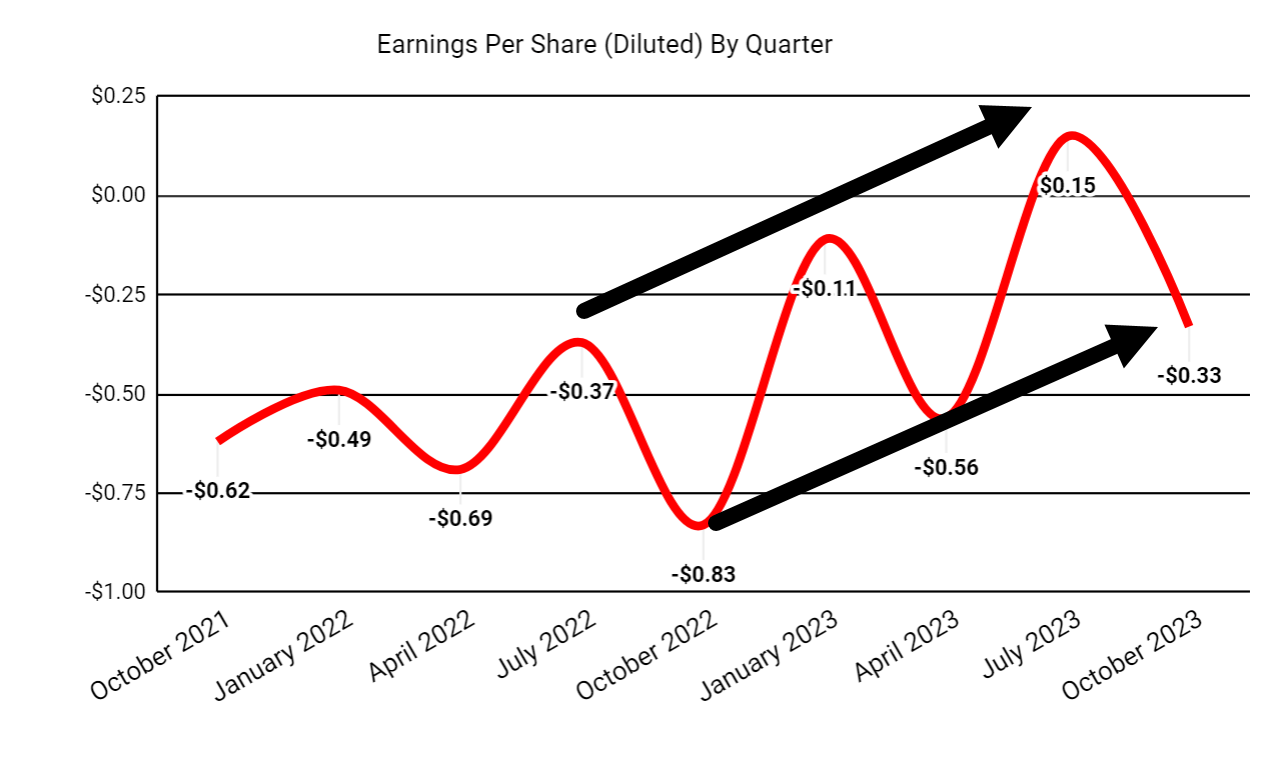

Earnings per share (Diluted) have continued their seasonal changes, with higher highs and higher lows indicating an improving earnings trajectory:

Seeking Alpha

(All data in the above charts is GAAP).

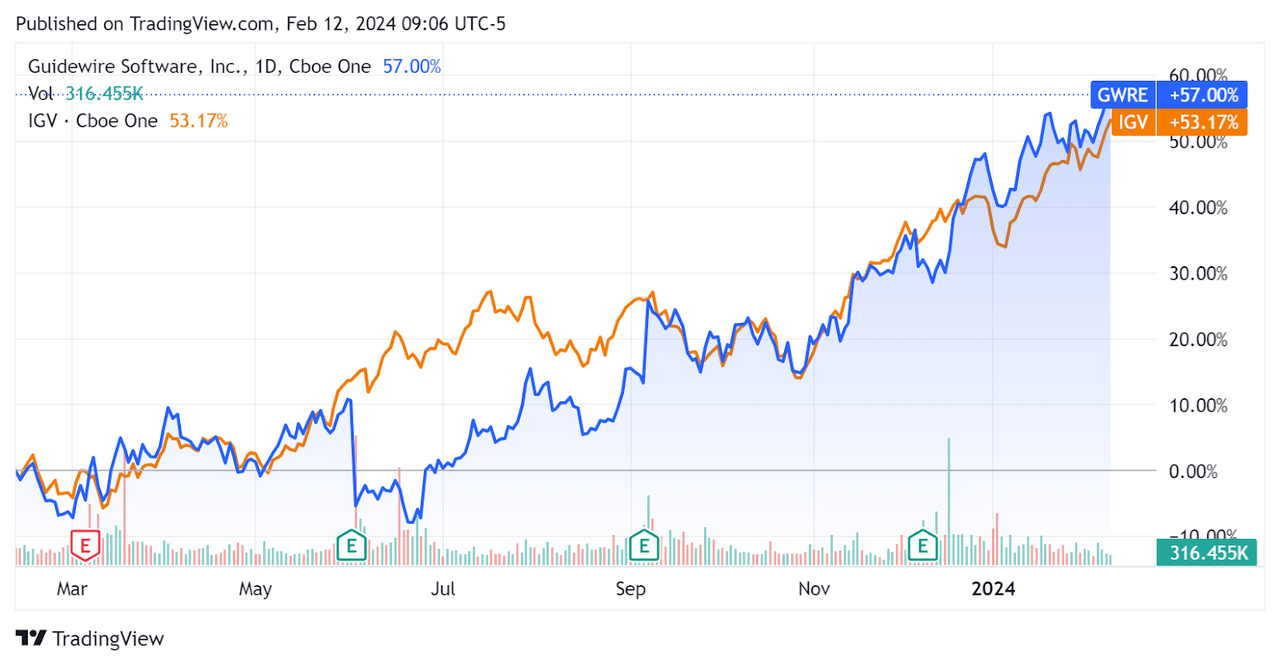

Compared to the iShares Expanded Tech-Software Sector ETF (IGV), the two securities’ price changes in the past year have been strikingly similar, except for a three-month period from June-September:

Why I’m Bullish About Guidewire

Guidewire is producing improved earnings results; it is seeing sales cycles shorten as the P&C industry moves past the suddenly high inflation environment immediately after the end of the pandemic.

Gross profit margin is rising and SG&A expenses are dropping as a percentage of revenue, indicating increasing efficiencies of scale, although these efficiencies will vary from quarter to quarter.

I’m also pleased that the company’s largest and most scalable revenue stream, Subscription & Support revenue, is increasing in its percentage of total revenue, improving Guidewire’s operating leverage over time.

GWRE’s longer-term prospects are brightening as the P&C industry has become less resistant to digitization and has begun to focus more on upgrading its legacy, on-premises solutions to take advantage of new possibilities in alternative data sources and processing.

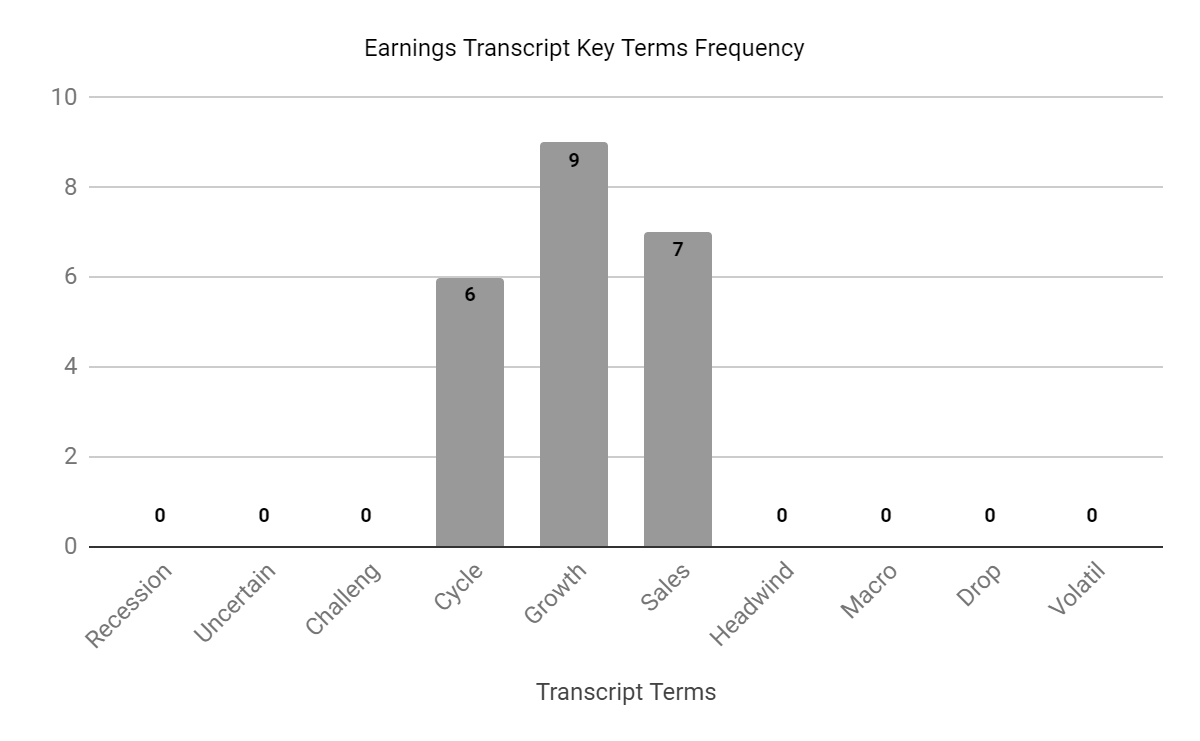

Also, I prepared an analysis of the company’s most recent earnings call transcript that shows no negative mentions of various keywords and phrases:

Seeking Alpha

In previous quarters, management and analysts often spoke about a “challenging” or “uncertain” sales environment, so the improvement in sentiment is telling.

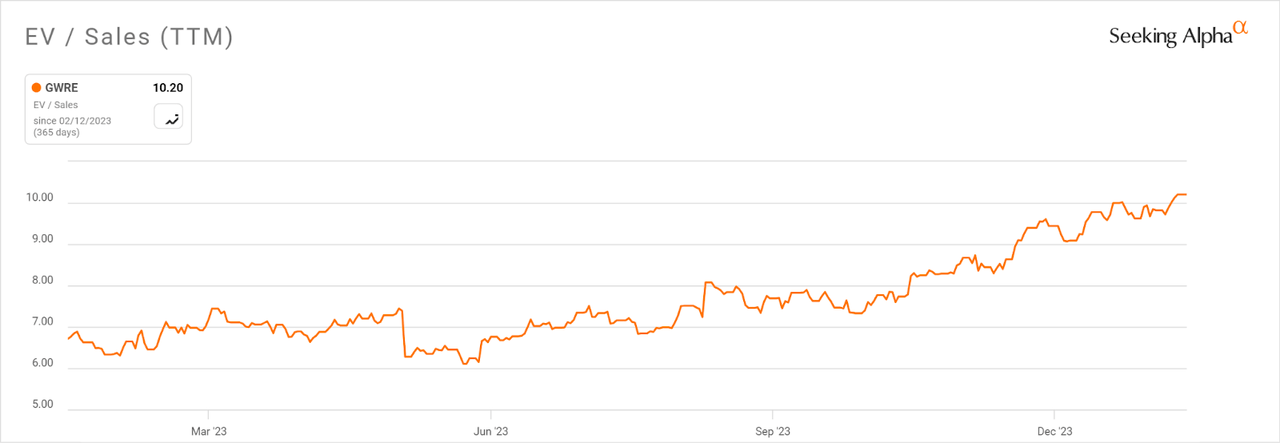

GWRE’s stock has seen a surge in its valuation multiple in the past 12 months, as this Seeking Alpha EV/Sales chart shows:

The EV/Sales multiple for GWRE has increased by 52% over the past year, accounting for nearly all the stock’s gain (57%) in the past twelve months.

So, as the P&C market has improved and as cost-of-capital assumptions have dropped in recent quarters, the stock’s multiple has risen, indicating the market is assigning a higher discounted value to the stock.

Also, the firm’s earnings results have improved, as has free cash flow per share.

The question for investors, will this happy result continue? While it may not continue on its present trajectory, I’m Bullish on Guidewire Software, Inc. due to shortening sales cycles, improving operating leverage, and free cash flow per share.

My outlook on GWRE is a Buy at around $117 per share.