Dimitri Otis/DigitalVision via Getty Images

Strattec Security Corporation (NASDAQ:STRT) is an American manufacturer of auto parts, particularly keys, locks, and electric control systems.

A year ago, in February 2023, I wrote about Strattec. Back then, I considered the company to be an interesting player in a very competitive industry that had managed to keep some of its profitability via alliances. However, I did not consider the stock an opportunity given the long-term negative trends against the company.

In this review, I find that the stock has appreciated almost 35% since the previous article. The reason, I believe, is anticipation of a new cycle in the company’s operations, plus excitement around managerial changes and investor involvement in the company.

I still find the stock to be unattractive for a long-term investor. The reason is that the new managerial team is yet to be defined, let alone established, while implementing a successful strategy. However, I understand that many readers would find a speculative buy of Strattec to play its cycle a compelling idea.

Cyclicality from inputs

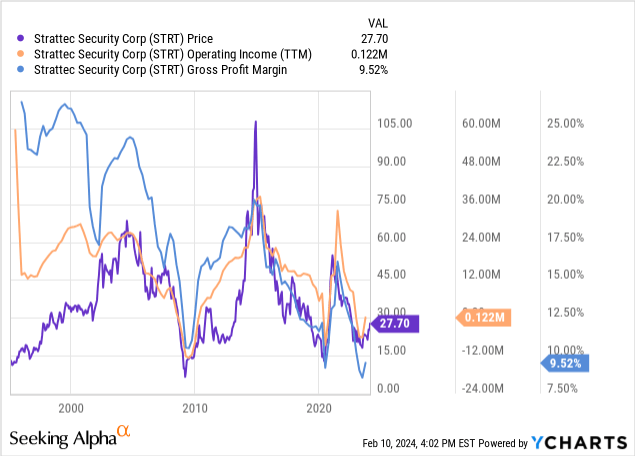

One cannot always find such a clear correlation between a company’s margins, operating income, and stock price, as is the case for Strattec in the chart below.

The company has suffered from marked operating income cycles that have generated rallies and busts in its stock price.

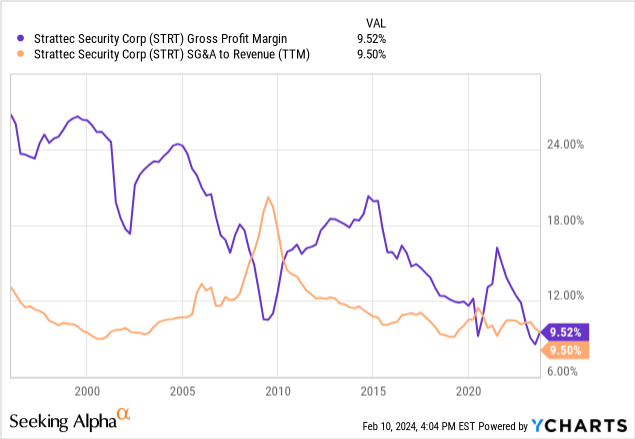

Further, those cycles in operating income were caused by cycles in the company’s gross margins. Strattec’s gross margins trend is unequivocally downwards, from 25% in the 2000s to the current 9.5%, but in the middle, it has had peaks and valleys.

On the other hand, Strattec’s revenues have consistently climbed, with a few peppered interruptions. In my opinion, the mix of relatively stable revenues but unstable and cyclical gross margins is a sign of input cost cyclicality.

When Strattec lands a contract with a vehicle manufacturer, prices are set years in advance, including discounts as the company rides down the experience curve of manufacturing a specific piece. Manufactured volumes do not change drastically year over year. This means that revenue is relatively predictable.

On the other hand, when the plastics and metals in Strattec’s products change prices, they compress or expand the company’s gross margins. Although Strattec has clauses in its contracts with OEMs to pass some input costs (and conversely has to increase its payments to suppliers according to input costs), these take time, and so the peaks and valleys are generated.

Unfortunately, the long-term trend continues to be for compressing margins, and therefore the window during which the company can post operational profits is shortening.

Cycle and corporate change speculation

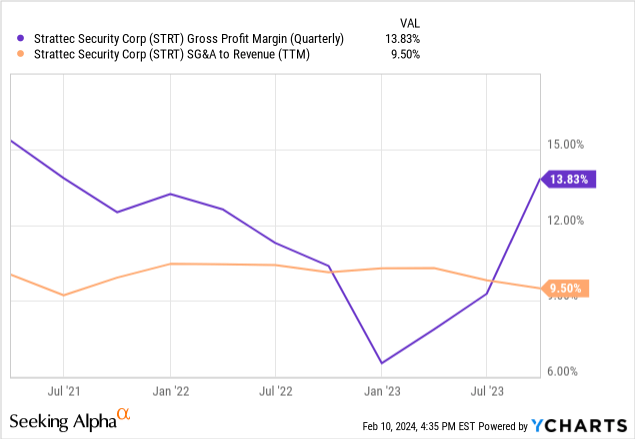

If we look at the chart above, we could be tempted to believe that the company’s gross margins have bottomed and that it is now about to initiate a new gross margin expansion cycle. If history is of any help, this should increase the company’s operating profits, and help lift the stock price up.

Changes in Strattec also fuel the speculation that ‘this time is different’. Last year, GAMCO (Gabelli Funds), which holds an 18% stake in the company, recommended two directors to the Board.

After this addition, the company sold its stake in the JV that handled most of its international operations (VAST LLC) in exchange for the missing equity portion of a local subsidiary. In this way, the company released some value ($18 million plus the equity stake) and shifted focus toward the domestic market.

Then, in November, Strattec announced that its CEO, who had been at the company’s helm since 2012, would be stepping down and temporarily replaced by the company’s COO. Finally, in January 2023 one of the directors appointed by GAMCO was made executive Chairman.

Valuation and conclusions

All of this makes for a great speculative story. The company’s margins start to expand (mostly because of cyclical reasons) at the same time as a new managerial team starts transforming the company’s strategy. Further, this managerial team has some relationship with a legendary value manager, Gabelli Funds.

I believe the above story makes some sense, although I prefer not to invest in that way, and do not recommend readers to do that. If the company’s long-term trajectory is still down, a cyclical increase in profitability should be discounted by most rational investors. If one buys speculatively for a (short-lived) cyclical gain, one is expecting a ‘greater fool’ to come to buy one’s stock.

The managerial changes are indeed promising and could fuel irrational hopes, helping the strategy, but for long-term investors, more evidence is needed. The new CEO has not been announced yet, and the company still has to develop and implement (successfully) a strategy. The company’s industry is still highly competitive.

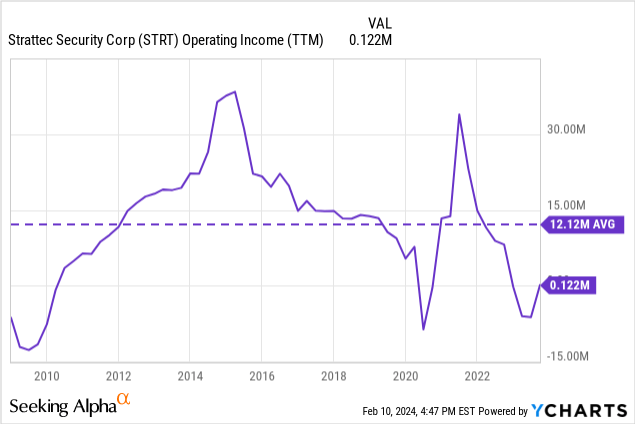

From a long-term perspective, the company can be valued via operating profits. In my last article, I added other income from the company’s emerging markets JV, but given that the JV stake was sold, we can concentrate purely on operating income now.

Across the last two cycles, the company generated $12 million in average operating income. Using current US income taxes, that would translate to about $9 million in NOPAT. This is compared to an EV of $135 million, or about 15x EV/NOPAT multiple. This seems excessive, given the company’s historical trend.

The picture does not change substantially for net income and market cap because the company has very little debt ($13 million consolidated, with $1 million yearly interest expenses) and has about the same amount of cash.

Again, this is from a long-term-oriented, evidence-based investment, which is not the only way to invest. One may also speculate on the above-mentioned cycles and changes, and that is a valuable strategy too.