Edwin Tan

Investment Thesis: I take the view that Expedia Group (NASDAQ:EXPE) has the capacity for further upside based on an attractive P/E ratio, continued earnings growth, and impressive revenue growth across the B2B segment.

In a previous article back in September, I made the argument that Expedia Group could see significant growth from here based on strong growth in gross bookings coupled with a lower long-term debt to total assets ratio.

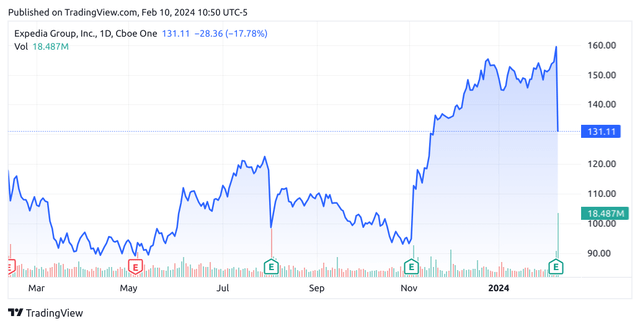

While the stock has seen substantial growth from a price of $99 since then, Expedia recently saw a sharp drop to $131.11 at the time of writing:

The purpose of this article is to assess whether Expedia Group has the ability to see continued growth from here taking recent performance into consideration, and whether the recent drop in stock price is a cause for concern.

Performance

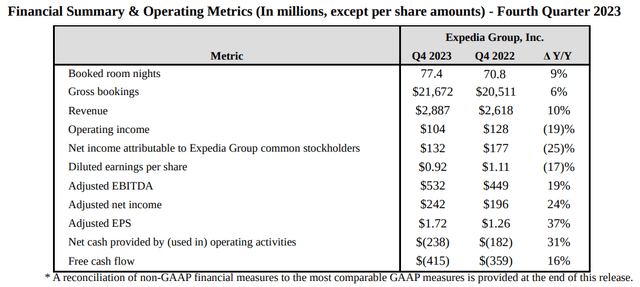

When looking at the most recent earnings results for Expedia Group, we can see that gross bookings and revenue saw healthy growth at 6% and 10% respectively year-on-year, while that of adjusted earnings per share was up by 37%.

Expedia Group: Q4 2023 Earnings Release

While this is impressive, the substantial growth we have seen in the stock has been significantly influenced by share buybacks of $5 billion as announced last November.

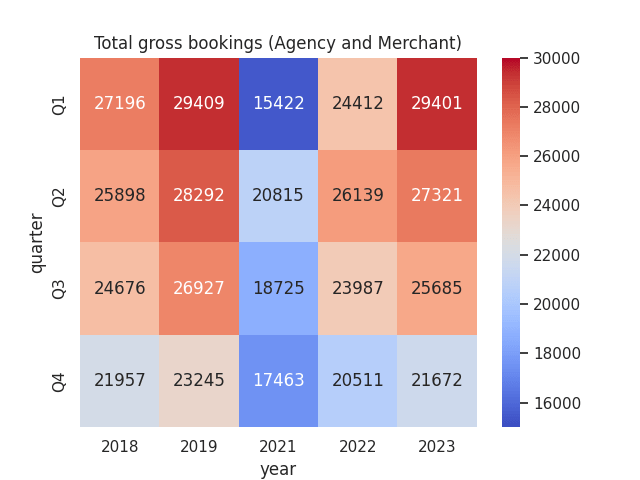

I had previously made reference to the fact that despite gross bookings seeing a plateau towards the end of 2022, bookings have seen a strong rebound to pre-COVID levels and all four quarters of 2023 have seen higher gross bookings as compared to the prior year quarter. However, it is notable that gross bookings for Q4 of $21.6 billion missed prior analyst forecasts of $22 billion.

Figures (in USD millions) sourced from Expedia Group Q4 2019 and Q4 2023 Earnings Releases. Heatmap generated by author using Python’s seaborn visualisation library.

With that being said, we can see that on a seasonal basis – Q4 is typically a season of lower bookings due to lessened demand over the winter months. Moreover, we still see an improvement in gross bookings of 5.6% from that of the prior year quarter. In this regard, I am not overly concerned about Expedia’s gross bookings performance based on this quarter.

I had previously commended Expedia Group on its reduction of long-term debt relative to total assets – we can see that the same has risen in September yet slightly lower than that of December 2022. It is also notable that this was primarily due to the reduction in total assets – long-term debt itself has only seen a marginal increase over this period.

| Metric | Dec 2022 | Dec 2023 |

| Long-term debt (excluding current maturities) | 6240 | 6253 |

| Total assets | 21561 | 21642 |

| Long-term debt to total assets ratio (%) | 28.94% | 28.89% |

Source: Figures sourced from Expedia Group Q4 2022 and Q4 2023 Earnings Releases. Figures provided in USD millions except the long-term debt to total assets ratio. Long-term debt to total assets ratio calculated by author.

Valuation

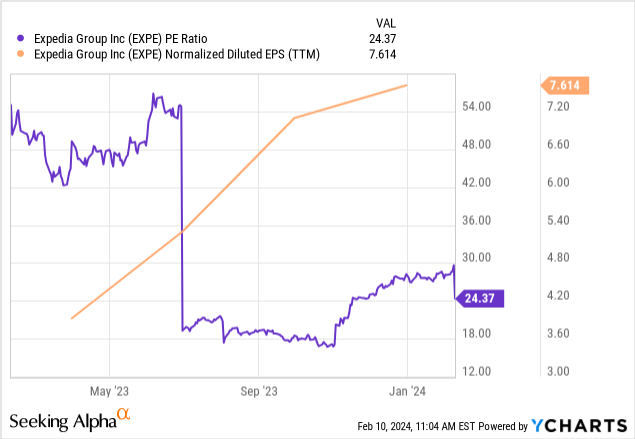

As regards my take on the above results and the implications for the growth trajectory of the stock going forward, my previous article had judged fair value for Expedia Group to lie within the $120-140 range, on the basis of the P/E ratio of 17.57x at the time trading at a five-year low, and a level of near 50x as seen in 2019 being more realistic. Given that the stock was trading in the $120-140 range in 2019, I expressed my view that the stock could reach such heights again.

Additionally, when we observe the current earnings trajectory for the stock, we can see that the P/E ratio currently trades at 26.35x, which is still well below the level of 50x seen in 2019.

ycharts.com

Additionally, it is also notable that growth in earnings per share has been keeping good pace with that of the P/E ratio. In this regard, there has been substantial earnings growth to back up the rise in price – and I take the view that Expedia Group’s target price may in fact lie substantially above my prior estimated range.

Assuming a three-year period, growth in earnings per share of 10% per year, a terminal P/E ratio of 25x and 50x and a discount rate of 7% (as a proxy representing an assumed long-term rate of return on the S&P 500), I calculate the following for Expedia:

| Year 1 | Year 2 | Year 3 | |

| EPS @ 10% growth per year | 7.61 | 8.38 | 9.21 |

| EPS @ 7% discount rate | 7.12 | 7.32 | 7.52 |

| Discounted EPS * 25x | 177.90 | 182.88 | 188.01 |

| Discounted EPS * 50x | 355.79 | 365.77 | 376.03 |

Source: Author’s Calculations.

We can see that with an assumed terminal P/E ratio of 25x – the target price in year 3 comes in at $188, while this is vastly higher at $376 for a terminal P/E ratio of 50x.

I take the overall view that the stock should see a minimum target price of $188 within the next three year period – with scope for the stock to go significantly higher depending on the trajectory for the P/E ratio – bullish sentiment on the stock would be expected to boost the ratio back to the prior level of 50x.

Risks and Looking Forward

In my view, a substantial driver of earnings growth going forward will be the degree to which gross bookings can see substantial growth above and beyond that of pre-COVID levels. While “revenge travel” resulted in a substantial rebound for gross bookings – inflation pressures and substantially higher hotel prices could pose the risk that booking demand levels off this year.

While gross bookings for Q4 came in lower than that of Q2 and Q3 as expected due to a dip in seasonal demand – bookings has still continued to see growth from that of the prior year quarter, which has given a further boost to the stock

Moreover, Expedia Group has been showing impressive growth across the B2B segment – having reached a record of $995 million in Q3 and $864 million in Q4 – the latter of which represents growth of 28% from the prior year quarter. The reason this is significant is that even with B2C comprising the larger market, I take the view that if we continue to see growth across the B2B segment, then this could counteract any potential slowdown in revenue growth from the consumer side, as businesses are likely to be less price sensitive than the former. In this regard, I take the view that continued B2B growth has the capacity to spur on further revenue growth on the whole.

With regards to future growth prospects, revenue growth across the B2C unit has remained strong even with concerns about travel demand growing from here. In particular, with the group having greater exposure to the vacation rental market through VRBO. While Airbnb (ABNB) has traditionally been the leading player in this market – VRBO has the advantage of allowing hosts access to the overall larger customer base of the Expedia Group, and as such has become a formidable competitor to Airbnb in this regard.

From this standpoint, should we see pressure on hotel demand due to pricing – Expedia Group has the advantage of being able to provide more competitive vacation rental options through VRBO – and the fact that the group has diversified in this way makes it better able to withstand pressures across the hotel sector. In this regard, I take the view that B2C revenues as a whole have the capacity to continue seeing strong growth.

The primary driver of the recent drop in stock price that we have seen has been due to 1) a plateau in air fares following post-pandemic highs, and 2) an announcement of change in CEO. This indicates that we could see revenue growth start to moderate in 2024 given an expected softening in ticket prices, and with CEO Peter Kern stepping down – this has generated some uncertainty as to the future of the stock and the sharp drop in price likely reflects profit-taking on the part of investors in that regard.

That said, I continue to take the view that earnings growth has the capacity to continue seeing growth over the longer-term and my view is that the recent reaction to announcements in Q4 may be overblown. While revenue across air fares may see a softening, revenue across the lodging segment forms a much larger portion of the Expedia Group’s business, and there is no particular sign of a slowdown across this segment. From this standpoint, I continue to see upside for the stock from here.

Conclusion

To conclude, Expedia Group has continued to see strong growth in gross bookings and earnings. While a potential slowdown in booking growth for 2024 remains a risk, I take the view that the stock remains attractively priced and further booking growth remains possible given strong B2B performance. I continue to take a bullish view on Expedia Group.