Avalon_Studio/E+ via Getty Images

Business Overview/Investment Thesis

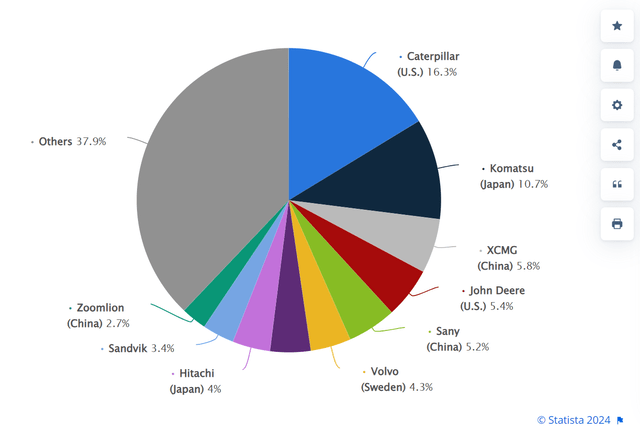

Caterpillar is a leading company within the industrial equipment/manufacturing space. Caterpillar is the world’s largest manufacturer of heavy equipment and holds 16.3% of total global market share.

$CAT Total Global Market Share (Per Statista)

$CAT Global Market Share (Statista)

The investment thesis around Caterpillar has three components:

1/ Caterpillar should benefit as the United States continues to invest in revitalizing its infrastructure around the country. As the company is the leading provider of heavy machinery, it is poised to continue capturing market share and driving revenue growth.

2/ The global economy seems to be accelerating (not contracting), with real GDP increasing 3.3% in Q4 (above estimates). Once business executives finally come to terms with the fact that the United States economy is in better shape than previously anticipated, I anticipate a capex cycle to begin – with a primary beneficiary being $CAT.

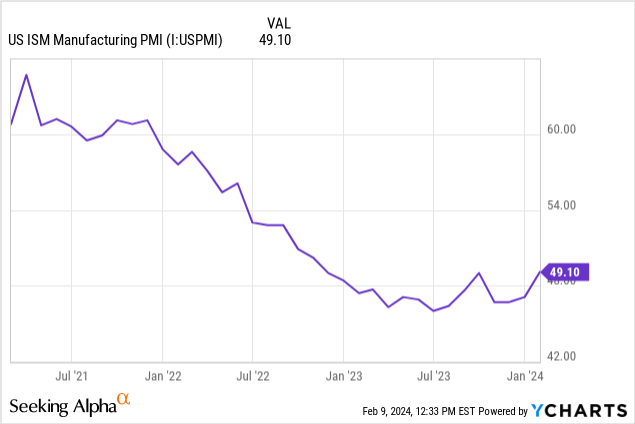

3/ (this sort of tags along with #2), but ISM Manufacturing PMIs look to be in a bottoming process, showing an economic expansion could be underway in the US. What sector drives an economic expansion? Industrials. And I believe CAT is an industry-leader that is poised to benefit.

Caterpillar is a leading company known for manufacturing heavy equipment, power solutions, and locomotives. It holds the distinction of being the world’s largest manufacturer of heavy equipment, commanding a market share of over 13% in 2021. The company operates through four main segments: construction industries, resource industries, energy and transportation, and Caterpillar Financial Services.

Revenue Growth Drivers

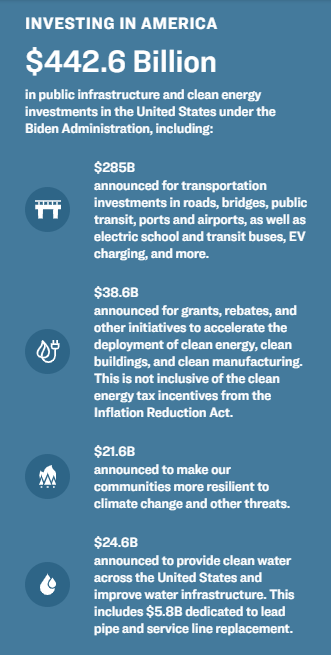

The main revenue driver I want to highlight comes from the White House, and that is President Biden’s Build Back Better Plan.

As the graphic below shows, the US Government is investing $442.6B in publican infrastructure and clean energy projects in the United States. $285B of this $442.6B announced (64%) is slotted for investments in roads, bridges, public transit, ports, and airports, airports, and more.

Build Back Better Spending Plan (whitehouse.gov)

This creates a massive opportunity for a company like Caterpillar who commands the largest global market share within the heavy machinery/construction equipment industry.

I also see private spending picking up as US business executives come to terms with the fact that the economy looks just fine here.

As mentioned previously, GDP came in strong in the 4th quarter of 2023, underscoring just how well the country is doing. Manufacturing PMI is also starting to recover which shows the economy could be moving into an expansion.

Manufacturing PMI Could be “Curling Up”

Once this is fully digested, I believe a capex cycle will be underway and Caterpillar will be a primary beneficiary of that.

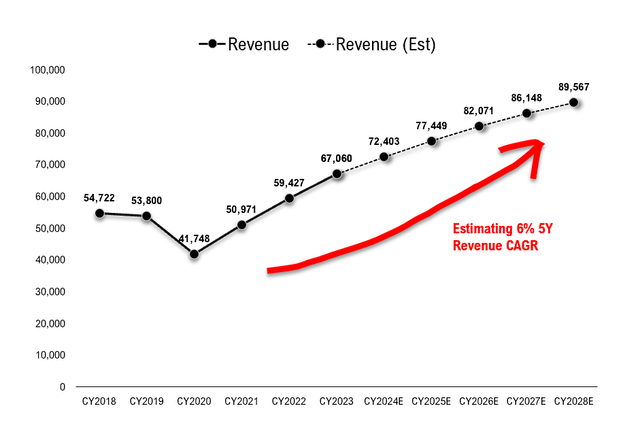

that leads me to my specific revenue estimate which is outlined below.

10K Filings + The Black Sheep Calculations

Public Investment (Build Back Better Plan) in US (whitehouse.gov)

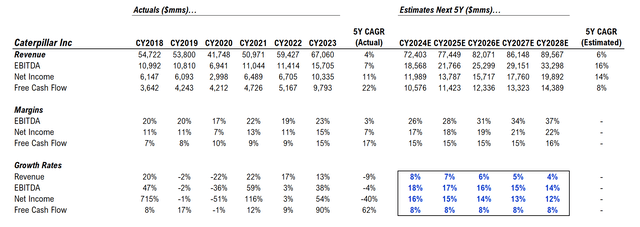

I see Caterpillar’s revenue increasing at a 6% 5Y CAGR from $67B in 2023 to $90B by 2028 due to this cyclical uptick in both government and private spending for Caterpillar’s heavy machinery.

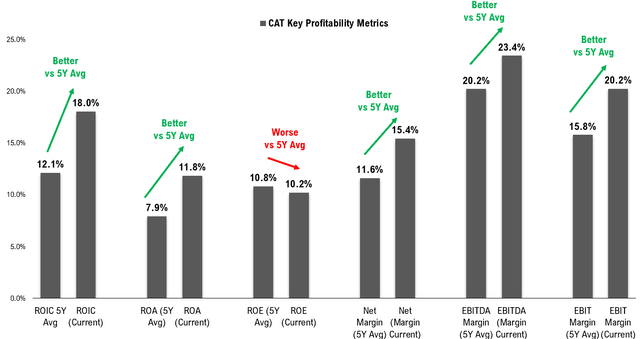

Profitability Summary

And that brings us to profitability. In terms of Caterpillar’s ability to turn a profit, 5 out of 6 of the key profitability metrics I track are currently above their 5-Year averages, respectively. The 6 metrics are ROIC, ROA, Net Margin, EBITDA Margin, and EBIT Margin. Of the 6, the only metric that is below its 5-year average is the company’s ROE. This is likely due to the cyclical nature of $CAT, and with the economy picking back up, I don’t see this as a long-term concern.

CAT Key Profitability Metrics (10K Filings + The Black Sheep Calculations)

I wanted to highlight that the company’s ROIC is 5.9% above its 5-Year Long-term average (now 18.0% vs 12.1%), and its EBIT Margin is 4.4% above its long-term average (now 20.2% vs 15.8%).

These are resilient numbers, especially given they are calculated in both a Covid-era (where supply chain glitches destroyed most companies profitability) and an inflationary period (current). CAT was able to “power through” both of these periods and increase their profitability which is a testament to its management and business.

Below I show my key EBITDA, Net Income, and Free Cash Flow assumptions for Caterpillar:

Key Growth Items for $CAT (10K Filings + The Black Sheep Calculations)

For the reasons I listed above, I see strong growth across revenue, EBITDA, net income, and free cash flow.

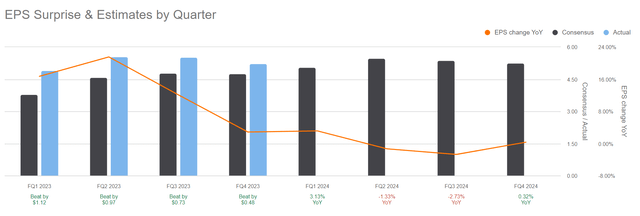

Beating EPS

I always like to see management teams that guide low, but deliver on the bottom line and beat.

EPS Estimates vs Actuals for $CAT (Seeking Alpha Premium Feature)

Caterpillar has one of these management teams. Take a look at the past 4 quarters of EPS:

- FQ1 2023: Beat by $1.12

- FQ2 2023: Beat by $0.97

- FQ3 2023: Beat by $0.73

- FQ4 2023: Beat by $0.48

- 100% hit rate on “beats” in 2023.

I see 2024 as no different as the company continues to capitalize on the Build Back Better Plan and a capex cycle picks up as the economy gains steam.

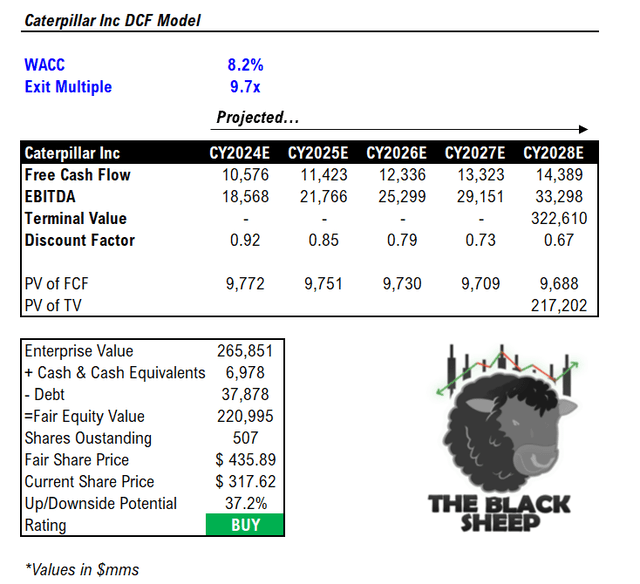

DCF Model/Valuation

Given the revenue growth drivers outlined above, I now want to explain how I come to my $436 price target on CAT.

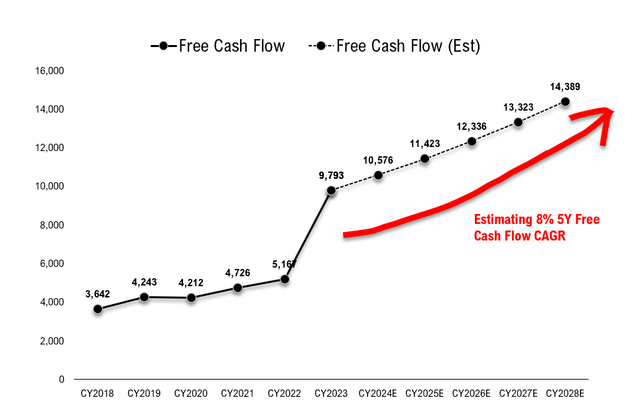

Below is my free cash flow projection. I see an 8% 5Y CAGR over the next 5 years, driven by a cyclical pickup in demand for Caterpillar’s heavy machinery.

The Black Sheep Free Cash Flow Estimates (10K Filings + The Black Sheep Estimates)

This free cash flow assumption leads me to my DCF model which is outlined below:

DCF Model Done by The Black Sheep (10K Filings + The Black Sheep Estimates)

I assume an 8.2% WACC and 9.7x exit multiple on 5th year EBITDA of $33,298. After summing all free cash flows discounted at the proper rate, adding the terminal value, subtracting net cash, and dividing by shares outstanding, I arrive at a fair share price of $435.89. This leads me to believe Caterpillar is undervalued by ~37.2% at current levels.

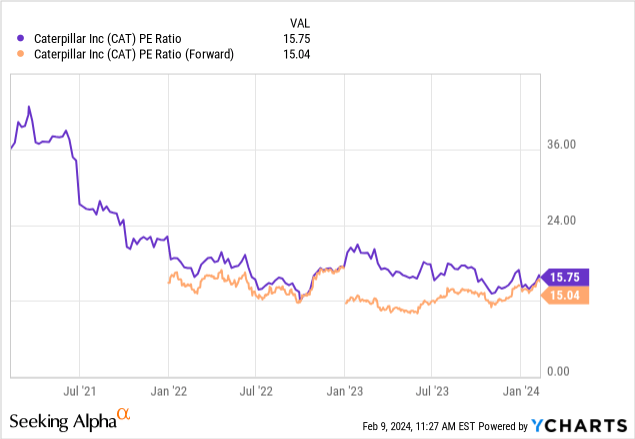

Even taking a look at Caterpillar’s PE ratio (both TTM and Forward), you can see the amount of de-risking in the name.

So, from both a multiple perspective and absolute perspective, Caterpillar seems “cheap” to me.

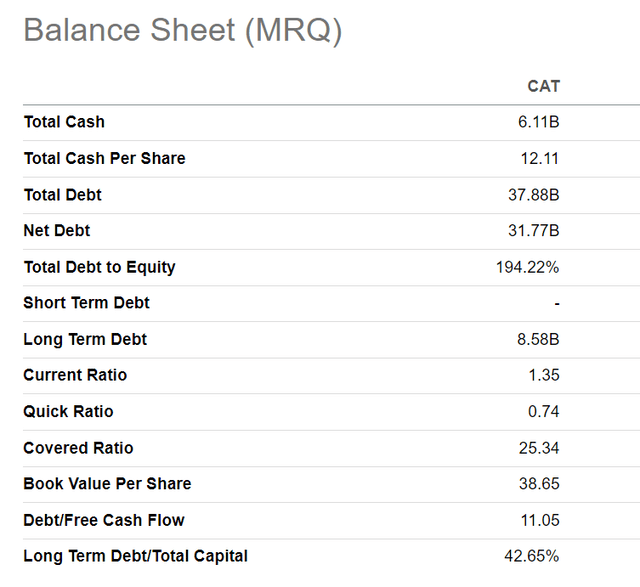

Balance Sheet

Taking a look at Caterpillar’s balance sheet, I wanted to highlight three key pieces of information. Firstly, the company has $6.11B of cash ($12.11/share), so there is a solid cash cushion. Caterpillar’s current ratio is 1.35 which is strong. Traditionally, anything over 1.35 is considered to be “good” as it shows current assets are larger than current liabilities. And lastly, while the company has $31.77B of net debt, its coverage ratio is 25.34, showing how healthy of a spot the company is in to meet its debt obligations.

Seeking Alpha Peer Analysis Feature (Seeking Alpha)

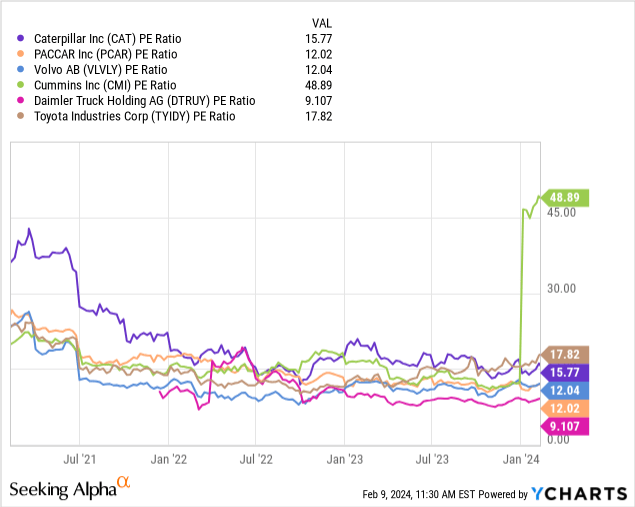

Peer Analysis

While there are not many direct peers to Caterpillar (given the company truly is the dominant player within the heavy machinery space), I have added its closest competitors to a chart below and showed the PE ratio of each.

As you can see, Caterpillar is in the middle-range, with a PE of 15.77. This puts it just about “average” in terms of relative valuation within its peer group.

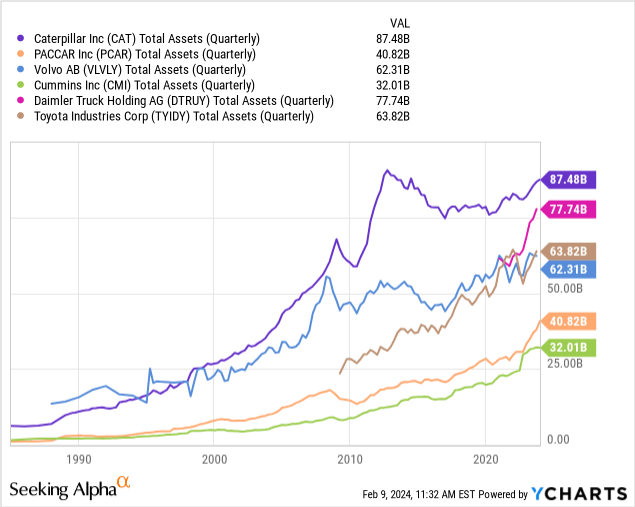

In terms of size, I outlined its peers’ size by showing their total assets on the chart below.

This shows Caterpillar’s size relative to its peers. It is clearly the largest and I feel this gives it a competitive advantage as it continues to provide best in-class heavy machinery/equipment for both private enterprises and the government.

Conclusion

Caterpillar has a lot of good things going for it. The company is set to take advantage of an impending faucet of government dollars that will be spent on improving infrastructure around the country. Additionally, private spending should increase as the economy has proved much more resilient than many first anticipated. I see Caterpillar as the main beneficiary of these cyclical tailwinds and given my DCF-based valuation, assign a fair share price of $436. This leaves ~37% of upside for investors to take advantage of.