Helder Faria/Moment via Getty Images

With consumers increasingly obsessed with online shopping, sometimes it’s nice to look over a more traditional company with a more straightforward bricks-and-mortar business model within an easy to understand industry.

Today we’ll be looking at Ethan Allen Interiors (NYSE: ETD), a home furnishing manufacturer and retailer that dates back to the 1930’s. Still a very North America-centric furniture maker, they sport 139 retail outlets, which they refer to as “design centers,” aiming to court customers to embrace the high-end, high-margin products.

The furniture business is a big one, but with recent declines in new home starts, and the company still not fully recovered from the Covid-19 pandemic, the critics who’ve been long predicting doom and gloom are out in force. Yet Ethan Allen still gives all the appearances of a top of the market value play, and the historical contrarian darling seems far from doomed.

Understanding Ethan Allen

For years, Ethan Allen has been a high end furniture maker, and sells through their own retail outlets. Their furniture is heavily produced in North America by themselves, and internationally for their foreign-located wholesale outlets.

The furniture in question is almost entirely wooden, and lumber is their most important raw material. The designs are constantly being changed, in a process Ethan Allen refers to as “constant reinvention.”

It’s important because they need to offer products suitable to consumer tastes, but also make sure they can differentiate themselves from competitors. Given how many of the competitors are lower cost and reliant on import goods, it’s important to make clear what Ethan Allen is all about.

“Constant reinvention” does that, but what it really means is constantly reorganizing with an eye toward improved products and reduced costs. In the past this worked really well, but it also sounds really expensive, and ensures a near constant flow of expenditures on the process.

While they do offer online sales, their retail is still built around the idea of in-store sales. They’ve gone to a lot of trouble to set up the retail stores to show off their products, and it only makes sense they intend to use them for all they’re worth.

The Risk

More and more sales of everything are done online, and that’s potentially a big problem for Ethan Allen. Best case they are able to continue to sell the high end products on their website, but even then, it invites comparison to similar but lower cost furniture from different competitors, almost obliging them to offer lower prices themselves, hurting margins and likely sales.

Sales have already been harmed more than a little by Covid-19, and continued economic uncertainty has people spending less and looking for bargains. In the world of Ethan Allen, that’s not them.

Being dedicated to wood furniture made out of lumber, the price of raw materials could also fluctuate, and in the case of sudden increased expenses it could be very bad for business.

Even if the raw materials remain stable, lower cost imports are constantly a threat, risking customers choosing cheap furniture and foreign suppliers. Though Ethan Allen sells all over the world, they are very centered on US business, and any popular or even palatable alternatives could do serious harm to them going forward.

Anything that could drive the sale of imports is a bad thing for Ethan Allen. This means not just geopolitical matters and economic issues, but also potentially trade policy. If trade policy opens up or eases access to US markets, sales from competitors would be helped and by extension, Ethan Allen would suffer.

By the Numbers

| Cash and Equivalents | $55 million |

| Inventories | $141 million |

| Total Current Assets | $326 million |

| Total Assets | $722 million |

| Total Current Liabilities | $141 million |

| Total Liabilities | $249 million |

| Shareholder Equity | $473 million |

| Price/Book | 1.58 |

(source: 10-Q report from 2Q via SEC)

Current ratio is 1.32, and cash on hand is at a respectable level. Inventory is roughly in line with what it has been in recent years, despite the backlog on their sales. Though the backlog is down year over year, overall it is still 60% higher than pre-pandemic levels.

Ethan Allen doesn’t exactly have straight competitors domestically to do apple-for-apple comparisons with. The price/book value isn’t terribly high for manufacturing companies with such a high margin business. It is also roughly in line with what it has been in recent years.

Post-Covid Growth Recovery

| 2021 | 2022 | 2023 | 2024 (1H) | |

| Net Sales | $685 million | $818 million | $791 million | $331 million |

| Cost | $292 million | $333 million | $311 million | $130 million |

| Gross Margins | 56.5% | 59.2% | 60.7% | 60.7% |

| Operating Income | $77 million | $138 million | $137 million | $40 million |

| Diluted EPS | $2.37 | $4.05 | $4.13 | $1.26 |

(source: 10-K and 10-Q from SEC)

Though the struggles of FY2021 are mostly over and recovered in the past couple of years. That said, net sales in FY2024 and FY2025 are only projected to be $673 million and $691 million, which is not exactly a sign of growth over those recent years.

A key to keeping the company profitable is the gross margin, which in both 2023 and the first half of this year has settled in at 60.7%. That’s plenty, and maintaining that, which means contending with lower cost options and foreign competitors, would allow them to weather the storm as they try to get back to pre-covid revenues.

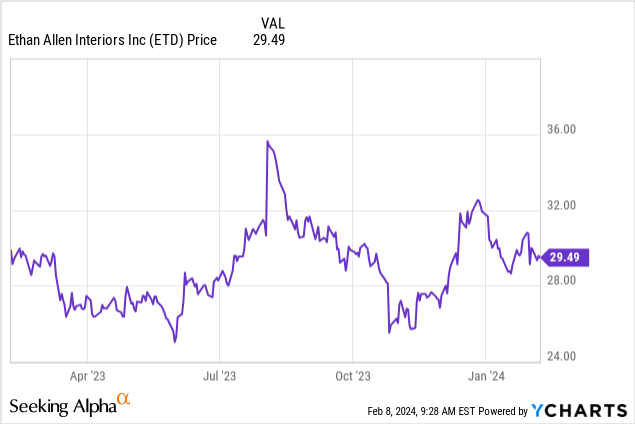

Ethan Allen has missed analyst estimates two straight quarters. If they do manage the estimate of $2.79 earnings for FY2024, that would give us a P/E ratio of 10.60. That isn’t terrible, especially assuming dividends are consistent, but with revenue over $100 million down year over year, it could stand to be a bit lower.

Dividends are paid quarterly and have recently been 36 cents per share. These dividends have been on the rise in recent years, and for the end of the fiscal years, it’s been fairly common for a special dividend to be declared. Even without the special dividends, the yield is 4.8%, which is a solid return in and of itself.

Estimates of diluted EPS in FY2025 are a bit recovered, at $3.03. This again assumes that the estimate misses don’t happen on a regular basis, and nothing gets revised downward as a result.

That’s not to say negative results will keep happening, and even then the projection for 2025 is better than 2024. If that continues to improve, hopefully for investors it won’t take too long to return to the highly profitable years of 2022 and 2023.

| 2021 | 2022 | 2023 | 2024 (1H) | |

| Operating FCF | $130 million | $69 million | $100 million | $30 million |

| Investing FCF | ($7 million) | ($14 million) | ($101 million) | ($4.3 million) |

| Financing FCF | ($91 million) | ($49 million) | ($47 million) | ($33 million) |

(source: 10-Q and 10-K from SEC)

FY2024 is only half over, so to spend more on finance than made on operations would be a bit hasty to conclude. Still, the spending in FY2023 is concerning, as Ethan Allen has, as of the most recent 10-Q, $55 million in cash on hand. That’s not terrible for a company that size, but it can go through all that cash very fast if it allows itself to overspend. With revenue still not recovered from economic problems of recent years, returning to positive cash flow is doable, but it will require serious discipline. The alternative would be debt, which no one wants to see.

Conclusion

With such a heavy reliance on bricks and mortar, a lot of people have looked down on Ethan Allen as though it is an outdated model for years. Yet time and again, they have managed to reinvent themselves and have maintained this value-level PE ratio. With the perennial pessimism surrounding them they’re kind of a signature contrarian play. Will the Covid pandemic be the thing that finally breaks their model in the long run? Maybe, but I think betting against Ethan Allen would be a big mistake.

With analyst estimates for 2024 and 2025 being what they are, this isn’t a bad time to take a deeper look at a company in mid-recovery. They’re surely a buy at these levels, but may also be worth waiting on to see if they earnings misses are a thing of the past.

The catalyst for Ethan Allen would be growing their revenue and income back to where it was before the pandemic, and maintaining the gross margin seems like it should be sufficient to ensure that a return to 2022 revenue could leave us with a huge, huge cash generator that, competition aside, should be comfortable in most portfolios.