Patrick J. Endres/Corbis Documentary via Getty Images

For investors that want attractive yield, some of the best opportunities can be found in the energy market. Although the energy market is typically associated with extreme amounts of volatility because of price fluctuations, one segment of the space that does very well over the long run is the pipeline/midstream market. A great example of an attractive prospect in this space is Enterprise Products Partners (NYSE:EPD), a massive player with a market capitalization of $57.90 billion as of this writing. All combined, the entity owns over 50,000 miles of pipelines, more than 300 million barrels of storage capacity for things like NGLs, crude oil, petrochemicals, and refined products, and around 14 billion cubic feet of natural gas storage capacity.

The stability offered by this market allows the company to generate significant and reliable cash flows. And the yield of the stock as of this time happens to be 7.73%. This is about as attractive as you get without going into some truly risky types of assets. Relative to other players in the market, Enterprise Products Partners is a solid company, but not necessarily the most appealing. But as the most recent quarter just showed, the firm continues to grow its top and bottom lines and shares remain attractively priced on an absolute basis. Given these factors, I do believe that a solid ‘buy’ rating on the stock makes sense at this time.

A solid business to rely on

In early November of 2023, I wrote a bullish article about Enterprise Products Partners. Even though there was some volatility in the market more broadly, the company had held up well. From the prior article that I had written about it until then, shares had seen downside of only 0.5%. That compared to a 6.8% drop seen by the S&P 500 over the same window of time. This was attributable to the strong fundamentals of the company and its cheap share price. And that encouraged me to keep the company rated a ‘buy’. Unfortunately, since then, the shoe has been on the other foot. While shares are up, inclusive of dividends, by 2.1% since the last article, the S&P 500 has seen upside of 14.4%.

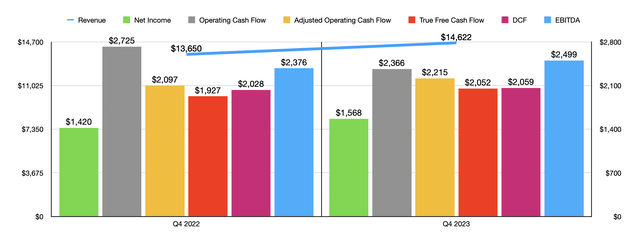

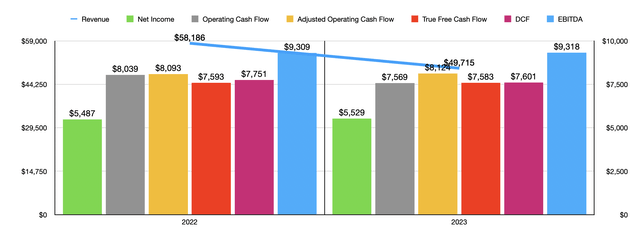

Author – SEC EDGAR Data

As disappointing as this is, the fact of the matter is that management continues to do quite well from an operational standpoint. Consider the final quarter of the 2023 fiscal year. During that time, revenue for the enterprise came in at $14.62 billion. That’s 7.1% above the $13.65 billion generated one year earlier. This may come as a surprise if you are not terribly familiar with this market. But revenue is not all that significant. What is more important our margins that the company is able to capture with its assets. And the data on that front is quite positive as well. Net income for the final quarter of 2023, for instance, totaled $1.57 billion. That’s up nicely from the $1.42 billion generated one year earlier. As you can see in the chart above, every profitability metric for the company, with the exception of regular operating cash flow, improved year over year.

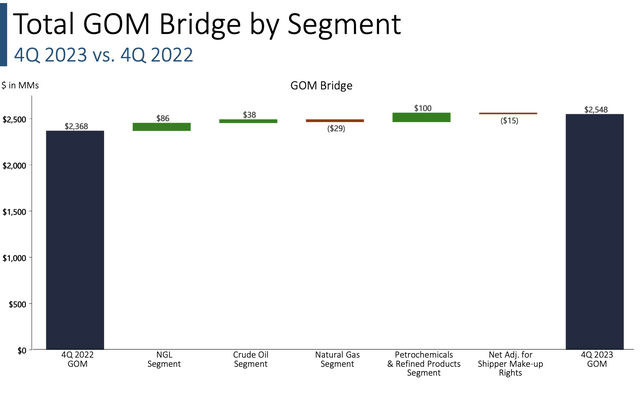

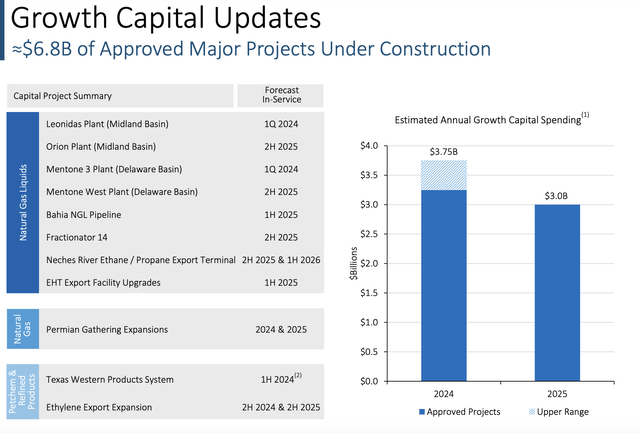

Enterprise Products Partners

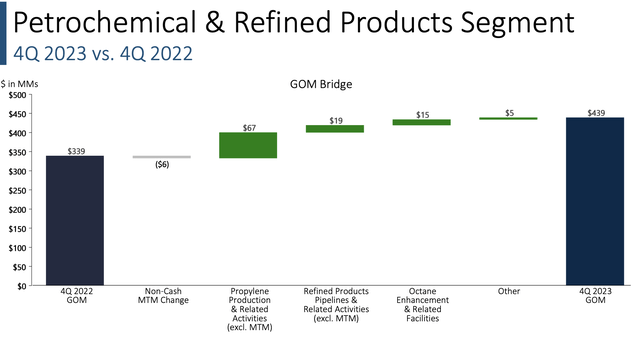

Much of that improvement came from two different operating segments. The most significant player was the Petrochemicals & Refined Products segment. Of the $180 million increase in gross operating margin seen by the company from the final quarter of 2022 to the final quarter of last year, $100 million was attributable to this segment. The most significant contributor to that was a $67 million positive impact caused by properly in production and related activities. This was driven by higher properly in sales volumes and a growth in margins associated with it, as well as higher properly in processing revenue from one of the company’s facilities. Another $19 million worth of improvement for this segment involved refined products pipelines and related activities. This, according to management, was driven by higher average transportation fees and a reduction in operating costs. Higher storage and other related revenues also helped as well.

Enterprise Products Partners

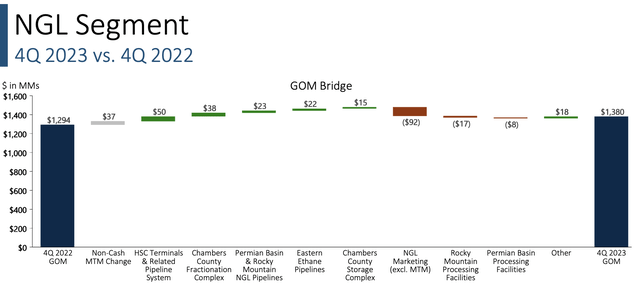

Enterprise Products Partners

The other big contributor to this margin expansion was the NGL segment. The company benefited to the tune of $86 million from this segment alone. There were several factors involved here, including $50 million associated with the firm’s HSC terminals and related pipeline system as transportation volumes increased and management was able to charge higher transportation fees. The firm benefited to the tune of $38 million from the Chambers County fractionation complex that began service in July of last year. Another $23 million came from the Permian Basin and Rocky Mountain NGL pipelines that the company has that management attributed to higher transportation volumes and a rise in average transportation fees. And $22 million was thanks to its eastern ethane pipelines that management chalked up to higher transportation fees and a nice rise in transportation volumes.

Author – SEC EDGAR Data

As you can see in the chart above, the final quarter of the 2023 fiscal year was a little special. For 2023 as a whole, revenue was actually down for the company. And while profits and some cash flow metrics were up year over year, some were down as well. All things considered, 2023 ended up being a rather mixed year for shareholders. But it’s important for investors to know that the long term is what matters most. And on that front, management is dedicated to continued growth.

Enterprise Products Partners

After spending $2.75 billion on organic growth expenditures last year, management has forecasted spending between $3.25 billion and $3.75 billion this year. This is in addition to $550 million that would be spent on sustaining capital expenditures. And in 2025, the firm plans to spend yet another $3 billion on growth initiatives. This does not mean that the business will neglect direct returns to shareholders. While keeping leverage more or less unchanged, the firm is also buying back stock and increasing its distribution. In fact, on a year over year basis in the final quarter of last year, the firm raised its distribution by 5.1%. This marks the 25th year in a row in which the company has increased its distributions. And during 2023 in its entirety, management bought back 7.2 million shares of stock for $187 million. In fact, since going public, the firm has returned $52 billion back to its shareholders.

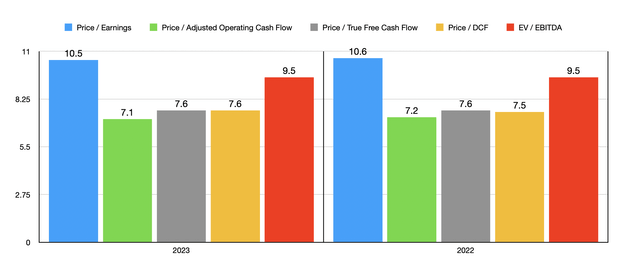

Author – SEC EDGAR Data

Even if the company does not continue this trend, I would say that the future for shareholders is bright. In the chart above, you can see how shares are priced using results from 2022 and 2023. The stock is a bit cheaper on a forward basis, but not materially so. Any time I see a firm trading at cash flow multiples that are in the single digits, my ears immediately perk up. Of course, it is important to note that relative valuation matters as well. In the table below, I compared the company to five similar firms. I did this using two of the valuation metrics. On a price to operating cash flow basis, three of the five ended up being cheaper than Enterprise Products Partners. But when it comes to the EV to EBITDA approach, that number drops to two of the five.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Enterprise Products Partners | 7.1 | 9.5 |

| TC Energy (TRP) | 7.0 | 19.9 |

| Kinder Morgan (KMI) | 6.7 | 10.8 |

| The Williams Companies (WMB) | 7.9 | 9.7 |

| Cheniere Energy (LNG) | 4.1 | 2.9 |

| Energy Transfer (ET) | 4.7 | 8.5 |

Takeaway

From what I can see at this time, Enterprise Products Partners remains a really solid opportunity for shareholders. No, this business probably will not make you rich. But over the long run, the distributions and capital appreciation caused by share buybacks and continued investments should result in attractive returns. The stock is undervalued in my view, as is the industry as a whole. But this doesn’t necessarily mean it has the greatest upside. My personal favorite, Energy Transfer, is more appealing in my view. But for investors who want a quality prospect that pays out a nice chunk of cash, Enterprise Products Partners it’s definitely worth considering.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.