Javier Ghersi/Moment via Getty Images

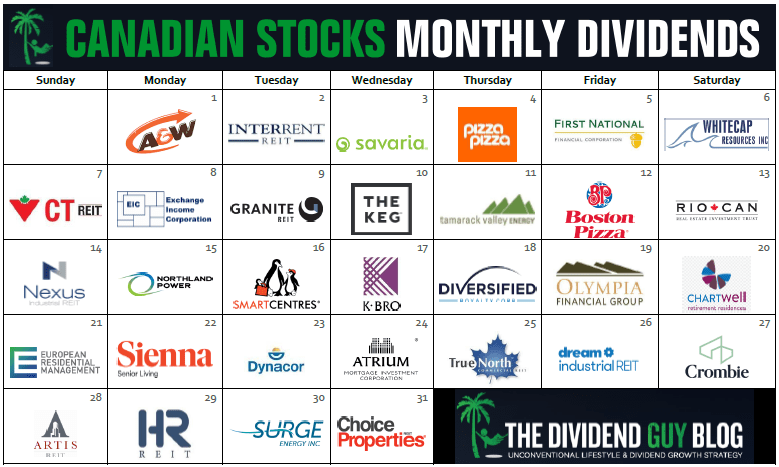

Get dividends every month! What better way to enjoy a stress-free retirement or to draw an income while travelling the world. Canadian stocks paying dividends every month offer the convenience of monthly income. Budgeting, paying monthly bills, and planning just get much easier.

Most Canadian companies that pay dividends do so quarterly. However, there are several safe dividend payers that pay monthly so you can get that convenience.

Why only Canadian stocks? It’s no secret, I love many U.S. companies as investments. However, there are few U.S. stocks that pay monthly dividends and, among those that do, almost none that I like. The reason is simple: many haven’t increased their dividend or have cut it. Others are Master Limited Partnerships (MLPs) in oil & gas, and you know I’m not a fan of the energy sector.

Why do companies pay quarterly or monthly

You might wonder why some companies pay their dividends monthly and others quarterly.

Since companies report their financial results every quarter, it’s logical to pay dividends using the same frequency. With a quarterly payment, companies hold on to their liquidities longer than if they paid every month.

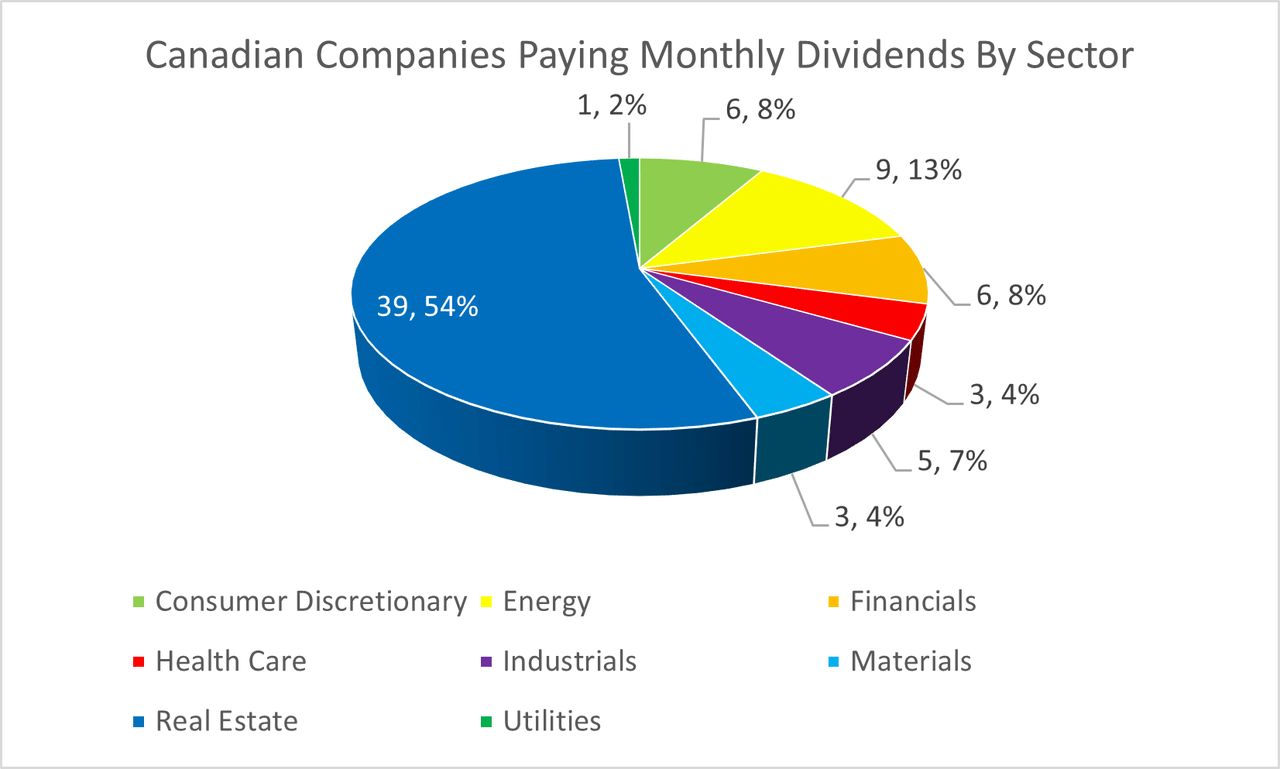

As you can see below, REITs make up most of the monthly dividend payers in Canada, followed by energy companies, with financial services and consumer discretionary companies tied for third place. Among them, you’ll find the industrial REIT Granite (GRP.UN) (GRT.UN:CA), residential REIT InterRent (OTC:IIPZF, IIP.UN:CA), and the industrial company Exchange Income Corp (OTCPK:EIFZF, EIF:CA).

Why so many REITs? Well, since their customers pay them rent every month, REITs receive predictable revenue every month. In other sectors, we often see fluctuating revenue because of seasonal buying patterns or the timing of product launches or promotional events.

Since REITs have mostly monthly income, it’s convenient for them to pay their dividends using the same schedule. “Get paid every month!” is also a powerful marketing message they use to attract investors.

Are monthly dividend stocks safe?

You assess the dividend safety of monthly dividend payers the same way you do for those that pay quarterly: examine trends of revenue, profit, and dividend growths; review the quarterly results; ensure that the (appropriate) payout ratio is under control and that the company will likely keep growing in the future.

Monthly dividend payers still report their financial results every quarter. Remember to multiply your monthly dividend by three to make sense of the metrics stated in their quarterly earnings press release.

Absence of dividend growth

Just like you would any other stock, look out for the absence of dividend growth. If there’s no dividend growth for a year, you might hold on to your position if you’re confident it’s only a short-term problem. Be sure to monitor its results closely though.

For me, as a dividend growth investor, a company unable to augment its dividend for over a year is a dubious investment. The dividend safety score we assign to companies at DSR highlights such companies. A score of 2 signals that the dividend hasn’t grown and perhaps a dividend cut is coming. A score of 1 means the dividend has been cut.

Things to look out for with REITs

In addition to dividend growth, or absence of dividend growth, you should also be mindful of the following for REITs.

Geographical concentration

REITs, whose assets are heavily concentrated in a single area or province, are vulnerable to economic downturns in the area. For example, Boardwalk (OTCPK:BOWFF, BEI.UN:CA) was a very popular REIT whose properties were all in Alberta. In the early 2000s, the Boardwalk surfed the oil boom, acquiring more properties and growing its dividend. Then, there was the oil bust and an economic crisis in Alberta. Boardwalk had to cut its dividend and change its structure and business model to diversify and minimize future risk.

Funds from operations (FFO or AFFO) per unit

Monitor the REIT’s FFO per unit – or adjusted FFO (AFFO) per unit – rather than EPS. When calculating EPS, REITs include significant non-cash depreciation due to their large assets and profits made from selling properties. Neither the depreciation charges nor the profit from selling properties reflect how well or poorly the REIT runs its core business – the business of renting out its properties and collecting rent from tenants. Depreciation and proceeds from property sales are handled differently when calculating FFO and AFFO, making them better indicators of a REIT’s operational performance.

FFO/AFFO payout ratio

To get capital to buy more properties and grow their revenue, REITs often issue new units (shares). Then things go south; interest rate hikes, a recession, or an oversupply situation might force them to lower rents to get tenants. With the new properties, revenue and profit might still grow. However, the higher number of units means the FFO/AFFO per unit might start falling. The FFO/AFFO payout ratio increases because the REIT uses a bigger chunk of its profit per unit to pay the dividend. If the FFO/AFFO payout ratio goes close to, or over 100, the REIT will have to cut the dividend.

100% in monthly dividend stocks – a good plan?

Having a portfolio made up exclusively of monthly dividend-paying stocks would make things really easy, wouldn’t it? Unfortunately, it would make it very hard to diversify across sectors, and to pick the best stocks in each sector. There’s a good selection of REITs, but few financials or healthcare companies, and no consumer staples or information technology companies.

Don’t use a monthly dividend schedule as a main criterion for choosing stocks. For the sake of convenience, you’d miss out on great companies that will provide you with generous total returns and put your retirement at risk due to the lack of diversification.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.