Liens

Overview

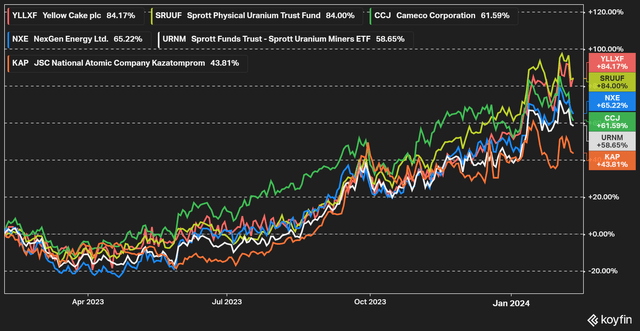

Yellow Cake (OTCQX:YLLXF) is an investment vehicle that owns physical uranium, with its primary listing in the UK. The stock has along with the Sprott Physical Uranium Trust (OTCPK:SRUUF) been one the better performing uranium stocks over the last year. I have over the last few years covered Yellow Cake frequently and I have also owned the stock during much of the period, my prior articles on the stock can be found here.

Figure 1 – Source: Koyfin

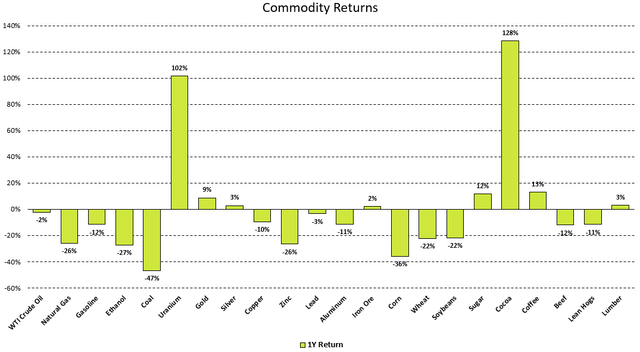

Uranium has been one of the better performing commodities over the last year, trailing cocoa slightly. Yellow Cake has lagged the price of uranium over the last year, which is primarily because the discount to net asset value (“NAV”) has increased somewhat over the last year.

Figure 2 – Source: Koyfin & TradingView

Valuation

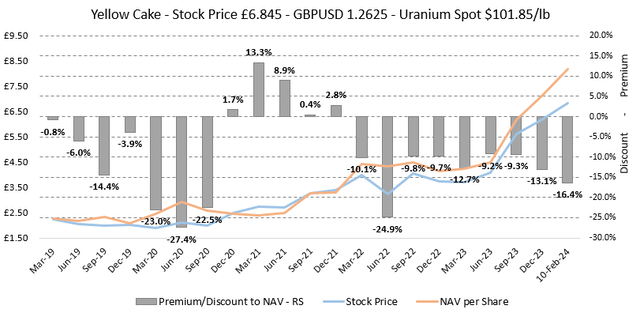

Over the last 5 years, Yellow Cake has seen its share price fluctuate around net asset value, with a slight premium to NAV during much of 2021 when the sentiment was more positive, and a discount to NAV when the sentiment was worse. However, we have seen the stock trade at a persistent discount to NAV over the last couple of years.

Figure 3 – Source: Yellow Cake & TradingView

I have expressed my frustration with management not rectifying this discrepancy, as it could easily have been sorted by selling a small amount of uranium, where the liquidity is then used to buy back shares until the discount decreases. That would be accretive to shareholders, where you would effectively sell uranium at spot and buy back uranium exposure on a per share basis, at a discount to spot, until such time as the discount is small enough that it no longer justifies buybacks.

Having primarily invested in natural resource companies over the last decade, I have learned to lower my expectations when it comes to capital allocation by management teams. So, I do think we can expect roughly a 10% discount to NAV to persist going forward.

Presently, the discount to NAV is at 16.4%, which I do think is likely to at least decrease over time. The 16.4% discount to NAV can be compared to 6.4% for the Uranium Trust as of yesterday’s close. The Uranium Trust has regularly had a smaller discount to NAV than Yellow Cake, but the 10 percentage point difference is at the higher end of what we regularly see. So, I would consider Yellow Cake relatively more attractive than the Uranium Trust today.

Recent Uranium Development

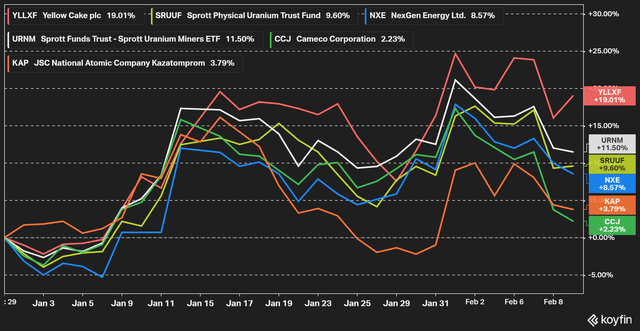

Figure 4 – Source: Koyfin

Most uranium equities have had a positive start to 2024, where the announcements from Kazatomprom have now doubt played an important role. Kazatomprom did in January announce that the production guidance for 2024 was in doubt and did on the 1st of February lower its 2024 production guidance by about 9Mlbs of uranium. That equates to about 5% of the global annual uranium demand. The elevated 2025 guidance is also very much at risk.

Some investors have feared that Kazatomprom might halt this uranium bull market by flooding the market with uranium, which should be much less of a concern following the recent announcements from Kazatomprom. In fact, the company could end up having to buy in the spot market to fulfill contract commitments.

Uranium equities did last week see some weakness in conjunction with the Cameco Q4-23 conference call. At least I think the reaction was because management at Cameco spent a lot of time talking about reserve growth, mine life extensions, the possibility to increase throughput of its tier 1 assets, and ability to restart tier 2 production.

With a uranium price around $100, we are likely to see additional uranium supply coming from many corners of the world. However, the main problem for the uranium market remains, and that is time. There are some smaller uranium projects that can ramp up in 1-2 years, but most projects of any size are likely to take 3-4 years. Also, Cameco will not ramp up anything that is not covered by long-term contracts. So, I would not read too much into the recent Cameco Q4-23 conference call.

Conclusion

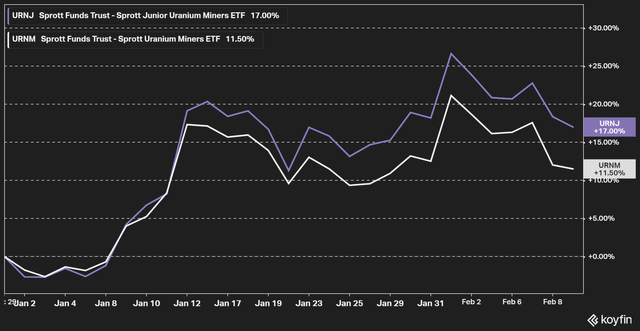

We have so far in 2024 seen the Sprott Junior Uranium Miners ETF (URNJ) outperform the Sprott Uranium Miners ETF (URNM), which I think we will continue to see.

Figure 5 – Source: Koyfin

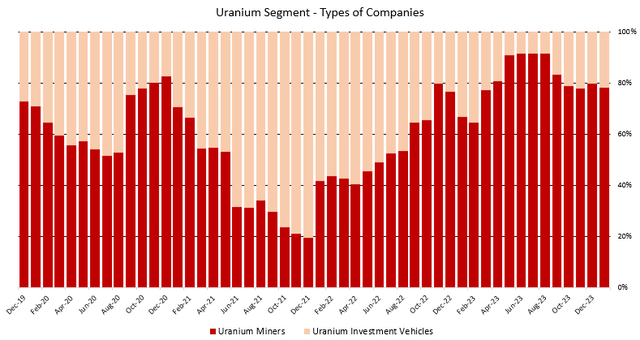

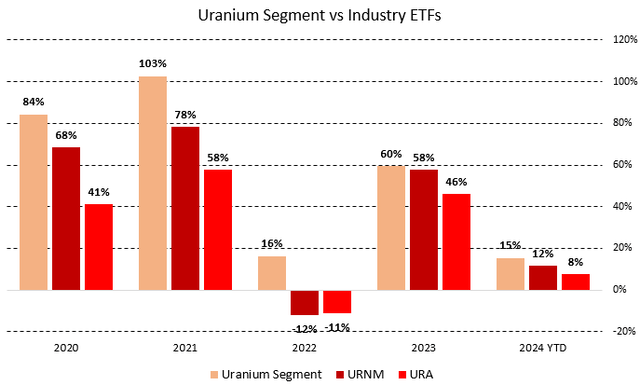

In that environment, the uranium investment vehicles might not have the highest returns in the industry. With that said, it is extremely difficult predict exactly how all segments of the uranium industry will perform. So, I continue to think holding a percentage of your portfolio in the investment vehicles provides a good balance to the uranium portfolio, which has served me very well over the years.

Figure 7 – Source: My Uranium Portfolio

Figure 8 – Source: My Uranium Portfolio Performance vs Industry ETFs

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.