Bloomberg/Bloomberg via Getty Images

With the S&P 500 recently crossing the psychologically significant 5,000 threshold, it’s a great time for investors to hit the brakes and consider how to manage our portfolios for the balance of 2024. In my perspective, it’s an excellent time to put a heavy bias on value stocks that have room to see multiples expansion in 2024.

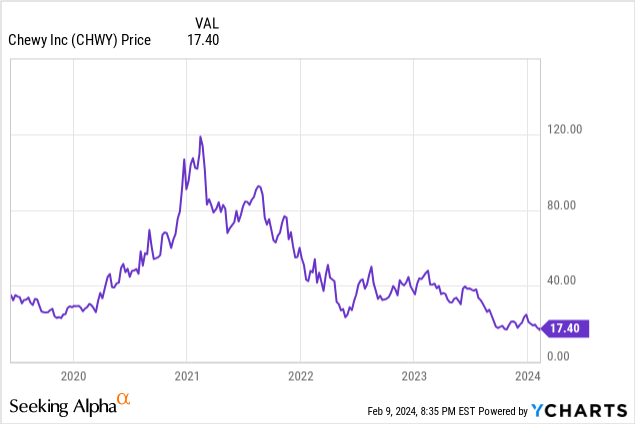

Chewy (NYSE:CHWY), in my view, is a prime candidate here. Amid a tech sector that has seen sweeping gains since the start of November, e-commerce stocks – and particularly Chewy – are still in the red. After falling more than 60% over the past year, Chewy stock has slid another ~20% so far in 2024.

No need to fear, the bull case here is still very apparent

I last wrote on Chewy in November when the stock was trading closer to $20 per share. And while it has dramatically underperformed the broader markets in that timeframe, I remain bullish on Chewy and find no significant red flags that threaten the bull case for this company.

There are a number of factors to consider here. Though Chewy’s stock pattern looks like a falling knife, it’s important to recognize that the competitive landscape has not changed. Chewy has long been a customer favorite well-known for its generous customer service policies, and has long carried recognition for quality versus competitors like Amazon (AMZN), which doesn’t have a significant specialization or reputation in the pet category.

I also continue to believe that more and more spend among consumer staples will shift toward online and e-commerce. In particular, note Chewy’s strength in Autoship, which has reached a $2+ billion quarterly run rate and makes up more than three-quarters of Chewy’s revenue. It’s completely a convenience factor: running out to a local Petco to buy pet supplies seems antiquated in a time when customers can simply schedule recurring shipments to arrive at their doorsteps.

We like as well the fact that Chewy is focused on profitability – and we’ll cover the company’s recent headcount reductions in more detail in the next section.

For investors who are newer to this name, here is my full long-term bull case for Chewy:

- Category leader and beloved consumer brand. Chewy has built up quite a lot of brand equity around being a very customer service-oriented company. This has helped the company build up a base of more than 20 million active customers, many of whom have their orders on autoship plans.

- International expansion opportunities. So far, Chewy has been primarily a U.S. company, but pet ownership is a worldwide market. Chewy launched Canada in the third quarter of 2023, and future country expansion can continue to widen Chewy’s overall TAM.

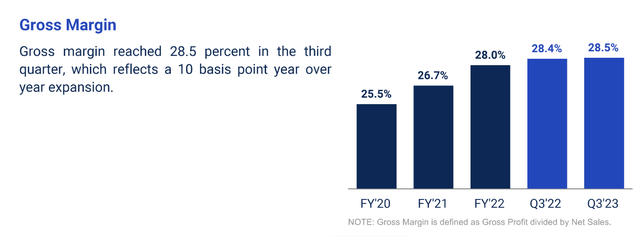

- Margin expansion driven by expanding product categories. Chewy’s push to grow its own brand (Tylee’s), plus focus more on selling higher-margin hardgoods, has proven very effective at producing margin expansion. Gross margins have recently expanded to ~29%, vs. low-20s at the onset of the pandemic. In addition, Chewy’s success at passing on price increases to its customers has allowed it to preserve this gross margin progress even in the current inflationary environment.

- Constant product innovation. More to the point above, the company recently also launched its own pet wellness brand “Vibeful,” which gives it access to a pet health and wellness TAM that it sizes at $2.4 billion alone.

- Nascent opportunities in pet telehealth and pet insurance. The craze in telehealth and doctor consultations via your mobile device is spilling over into the pet world, too. The company’s “Chewy Health” offering has built out a “Connect With A Vet” service, and it also has rolled out a pet pharmacy as well. In August, the company rolled out its “CarePlus” pet insurance plan, which was recently bolstered through a new partnership with Lemonade’s (LMND) pet insurance vertical. This is a broad, new opportunity for Chewy that can both accelerate its growth and grow its margins.

Of course, there are risks here. Chewy has its tentacles in many growth opportunities, as mentioned above: and missteps on its international operations or its foray into insurance or telehealth could cost the company dearly. Continued macro difficulties could also push cash-strapped consumers to “trade down” on their pet purchases and opt for cheaper goods or buy from discount channels. So far, while we have seen spending on Chewy ease from pandemic-era levels, the company is still managing to grow its top line at a high single-digit pace.

The next catalyst for Chewy is its Q4 earnings release, expected in early March. Stay long here and be patient for the rebound.

The narrative will shift toward profitability in 2024

Toward the end of 2023, Chewy announced a major layoff of 200+ employees, pushing for efficiency at the same time that many other tech companies are optimizing for the bottom line. While certainly a symptom of slowing top-line growth, this is a good catalyst for Chewy to achieve strong margin leverage in 2024.

The company has not yet guided anything yet for 2024, and its Q4 guidance covered only revenue (top line growth is expected to decelerate further to 3% y/y). Recent layoffs, however, combined with easing logistics costs that many other companies have reported, have the potential to shift the Chewy narrative away from slowing growth and toward Chewy’s expanding margins.

One of the core components here alongside opex savings is a consistently improving gross margin. In Chewy’s most recent quarter, gross margins hit a record of 28.5%; and since the pandemic, gross margins have seen 300bps (more than 10%) of improvement.

Chewy margins (Chewy Q3 shareholder letter)

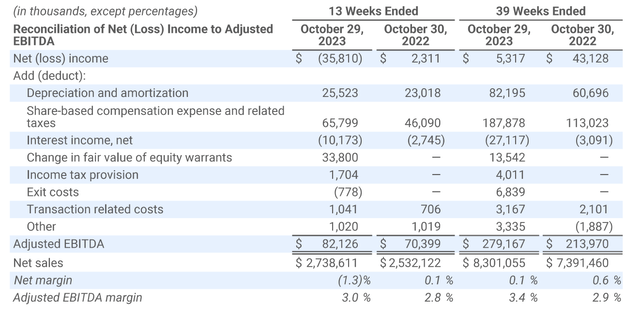

Considering Chewy’s adjusted EBITDA margins right now are still so slim, every 10bps here counts for quite a bit. In 2023 year to date, the company has gained 50bps of margin leverage.

Chewy adjusted EBITDA margin (Chewy Q3 shareholder letter)

Layoffs and more supply chain optimization can take this achievement further in 2024.

Strong early Black Friday read to offset weak expectations

Though Chewy has not released Q4 results yet, the company noted alongside its Q3 earnings release in December that results for Black Friday and Cyber Monday were better than expected. Per CEO Sumit Singh’s remarks on the Q3 earnings call:

We observed strong customer purchasing intent during this important holiday shopping week. Traffic and sales exceeded our expectation across all categories, including hard goods, and conversion rates were up year over year. New customer acquisition was 40% higher than our Q3 weekly average. While we have seen trends return to pre-holiday levels, our Black Friday and Cyber Monday performance is encouraging. Specifically, while consumer spending behavior remains opportunistic in the current environment, our results illustrate that Chewy’s value proposition continues to resonate loudly and will prevail when consumer demand and industry inputs improve.”

Chewy noted as well that market competitors grew only in the low single digits in Q3, where Chewy grew 8% y/y – so recent demand slowdowns are more macro driven than company-specific. It’s worth noting as well that consensus right now is calling for just 2% y/y growth to $2.77 billion in revenue in Q4, which is below Chewy’s own guidance of $2.78-$2.80 billion in revenue. Consensus doesn’t usually sit beneath a company’s own guidance, especially when it has offered bullish remarks on an important shopping holiday within the expected quarter.

In other words, given expectations for Chewy are so muted, it’s a great time for the company to surprise and delight the markets with earnings beat when it next reports in March.

Valuation and key takeaways

At current share prices near $17, Chewy trades at a market cap of $7.51 billion. After we net off the $957.2 million of cash on the company’s most recent balance sheet, Chewy’s resulting enterprise value is $6.55 billion.

For the current fiscal year FY25, meanwhile, (the year for Chewy ending in January 2025), Wall Street analysts are expecting the company to generate $11.64 billion in revenue, or 5% y/y growth. If we conservatively assume Chewy holds its current adjusted EBITDA margin profile of 3.4% (YTD FY24) on that revenue base, the company would generate $396 million of adjusted EBITDA, and its valuation stands at 16.5x EV/FY25 revenue.

That’s of course not a multiple that immediately screams “cheap” – but given the levers to margin expansion (layoffs, gross margin gains, revenue re-acceleration and international expansion, and more services offerings such as telehealth) I’d say this is still a great stock to bet on.