Olivier Le Moal

Recently, my father made a move by selling his thriving business in Europe for over $1 million, paving the way for his well-deserved retirement.

With a lifetime of dedication to a different industry, he has turned to me for assistance in planning his retirement and managing the proceeds from the sale to sustain his lifestyle through investment income.

Although my own retirement is still more than 30 years away, and my investment focus leans toward capital appreciation rather than high-yield portfolios, I decided to help my dad in this important transition.

First and foremost, I recognize the evolving landscape of retirement planning. While many investors tend to adopt a more conservative approach as they near retirement age, the reality of increasing life expectancy cannot be ignored.

In our country, where the average life expectancy stands at 81.2 years—one of the highest globally—my dad, currently aged 60, potentially has another two decades ahead. This means that while he requires a stable, reliable income from his investments, there’s still a need to maintain some level of growth in his portfolio.

The key characteristics of the businesses owned in one’s retirement portfolio should be:

- Durable business

- Strong balance sheet

- High quality, non-cyclical earnings

- Safe and growing Dividends

What I often observe is that retirees tend to prioritize chasing dividend yield regardless of the associated risks. A prime example of this can be seen in businesses like Altria (MO) and British American Tobacco (BTI), whose underlying operations are in a state of terminal decline. These businesses are unlikely to sustain EPS growth in the long term, which ultimately poses a risk to their dividends unless they find new avenues for top-line growth.

Conversely, there are businesses that opt to cut their dividends or spin off parts of their operations, which ultimately impacts the final payout negatively. Examples include AT&T (T) and W. P. Carey (WPC).

Another common mistake is investing in businesses that no longer exhibit healthy dividend growth rates. After decades of relatively low inflation, the years 2021 to 2023 have underscored the impact of inflation. Without sufficient growth in dividends to counter inflation, retirees may face a real decline in their purchasing power, particularly if they live well beyond the average life expectancy.

For example:

Don’t get me wrong, I do appreciate some of these businesses, and I’m even an investor in a few myself. However, my interest lies more in factors like dirt cheap valuation or a potential return to the mean of valuation driving capital appreciation, rather than simply chasing yield, which could ultimately be harmful to retirees in the long run.

In essence, successful retirement planning should focus on:

- Diversification

- Sufficient dividend growth to outpace inflation

- Mitigating the risk of dividend cuts

- Considering capital appreciation, adjusted according to one’s age.

When approaching retirement, one of the key factors is healthcare insurance. While my dad will automatically receive full coverage insurance provided by the government, given that we live in Europe, the situation is quite different for US investors who need to factor in this expense when planning for retirement.

Accumulating a large enough capital for retirement can be challenging for many. Not everyone has $1,000,000 to invest and live comfortably off dividends. It’s important to also take into account income received from social security. In my dad’s case, he’s expected to receive around $2,000 net monthly.

Determining how much one needs for retirement is essential. Naturally, this varies greatly from person to person depending on lifestyle. As a general guideline in the western countries, once a family has paid off their house, having a monthly income of $5,000 for a single retiree is often considered sufficient to comfortably enjoy the golden years, beyond just covering basic expenses like utilities, gas, and food.

While there are different strategies for retirement investing, like the 4% withdrawal rule, which suggests a $1,000,000 portfolio could yield a $40,000 budget before taxes, I don’t think it’s a great strategy. This is especially true given the risks of high inflation and longer life expectancy, which could pose problems later in retirement.

For example, if someone’s portfolio dropped by 20% to $800,000, following the 4% rule would mean they could only withdraw $32,000 before taxes. I believe this is too low for today’s retirement needs and could add unnecessary stress during what should be enjoyable years.

On the flip side, aiming for an annual income of $50,000 would require a starting portfolio of at least $1,250,000. But for many people, reaching that amount may be quite a stretch.

With that said, let me introduce you to a sample portfolio that I’ve constructed for my dad, which is projected to generate $50,000 before taxation purely from dividends.

Considering that he’ll need to pay around 25% capital gains tax on the dividends in his country of residence, this would leave him with $3,125 monthly net dividend income alongside further capital appreciation.

When we add the social security benefits, he’s set to enjoy an average of $5,125 to fund his well-deserved retirement.

Dad’s Retirement Portfolio

While I typically build my own portfolio by handpicking individual stocks, limiting myself to around 25 for in-depth tracking, I understand the value of simplicity for others.

In this sample portfolio, I’ve deviated slightly by including one favored ETF. This single ETF adds significant diversification within this 10-security portfolio, striking a balance between manageable size and broad exposure. This approach can be particularly valuable for non-professional investors seeking a less hands-on but well-diversified portfolio.

| Investment | % Weight | $ Allocation | % Yield | Income | 5Y Div. Growth | 3Y EPS Forward Growth | Exp. Return |

| (SCHD) | 25.0% | 250,000 | 3.5% | 8,750 | 13.0% | 7.5% | 11.0% |

| (EPD) | 12.5% | 125,000 | 7.9% | 12,075 | 3.1% | 5.0% | 14.7% |

| (O) | 12.5% | 125,000 | 5.8% | 7,238 | 3.7% | 4.5%* | 10.3% |

| (OTCPK:ALIZY) | 10.0% | 100,000 | 4.7% | 4,680 | 5.7% | 6.3% | 11.0% |

| (ABBV) | 7.5% | 75,000 | 3.6% | 2,663 | 8.7% | 6.5% | 10.1% |

| (NEE) | 7.5% | 75,000 | 3.3% | 2,490 | 11.0% | 7.5% | 10.8% |

| (ARCC) | 7.5% | 75,000 | 9.6% | 7,200 | -1.3% | 0.5% | 10.1% |

| (TXN) | 7.5% | 75,000 | 3.3% | 2,438 | 12.8% | 7.0% | 10.3% |

| (PEP) | 5.0% | 50,000 | 2.9% | 1,455 | 6.6% | 7.2% | 10.1% |

| (MCD) | 5.0% | 50,000 | 2.3% | 1,145 | 8.3% | 8.0% | 10.3% |

| Total | 100.0% | 1,000,000 | 5.0% | 50,133 | 7.7% | 6.1% | 11.1% |

*FFO instead of EPS growth

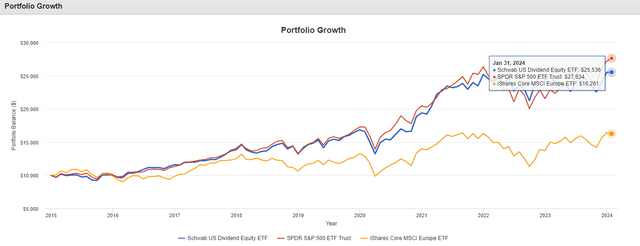

You might raise an eyebrow at the limited European exposure in this portfolio, especially considering it’s designed for a European investor. European equities haven’t exactly kept pace with their US counterparts lately. Over the past 15 years, the MSCI Europe Index (IEUR) has lagged behind the S&P 500 (SPY), delivering a 5.5% CAGR compared to a much steeper 11.84%.

Given this historical underperformance and the perceived challenges facing European companies, such as higher tax rates, aging population, lack of innovation and heavy regulation, I am expecting this underperformance to continue.

European vs. US Equities Return (Portfolio Visualizer)

This sample portfolio boasts a yield of 5%, equating to an annual income of $50,133 before taxes. By handpicking individual stocks for the portfolio, we gain an advantage in striking a good balance between dividend growth and current yield.

The portfolio’s 5-year dividend growth stands at 7.7%, with expectations for this trend to continue. Forward 3-year EPS growth projection of 6.1%, the portfolio could potentially deliver up to an 11.1% pre-tax return, falling just short of the performance of the S&P 500 (SP500) in recent years.

The holdings are carefully diversified across various industries, featuring businesses with enduring models, all boasting yields of at least 2% or more. The dividend growth for each holding is no less than 3%, except for Ares Capital, which is a Business Development Company—I’ll discuss this below.

The forward 3-year EPS growth is also focused on companies expected to achieve a minimum growth rate of around 5%, aiming to drive long-term capital appreciation alongside a substantial income stream.

1. Schwab US Dividend Equity ETF sets the bar as the go-to choice for dividend growth investors seeking sustainable and high-quality dividends. With a portfolio of 104 holdings and average P/E of 16.1x, it presents a valuation friendly option to tap into dividend growth. The ETF’s impressive 37.3% return on equity signals the high quality of the underlying stocks. Its largest sectors include allocation of 17.2% in Industrials, 16.7% in Healthcare, and 15.9% in Financials. Its top holdings feature among other, Broadcom (AVGO) at 5.03%, Home Depot (HD) at 4.34%, and Chevron (CVX) at 3.97%, focusing on stability and sustainability of dividends.

2. Enterprise Products Partners is a midstream infrastructure provider with a stable business model that is not highly vulnerable to oil and gas price swings. It generates consistent revenues through its expansive pipeline network spanning over 50,000 miles, which transports natural gas, natural gas liquids, crude oil, petrochemicals, and refined products. The company offers an enticing distribution yield of 7.85%, backed by a robust 1.7x distribution coverage ratio. Currently, the stock is trading at a blended P/E ratio of 10.35x, with expected EPS growth to continue at 5% annually over the next 3 years. Historically, similar growth periods have assigned the company a valuation of 16x its earnings, implying a significant discount to fair value and margin of safety.

3. Realty Income, also known as the ‘monthly dividend company,’ Realty Income is an ‘A-‘ rated REIT with a very stable business model. Its growth is further bolstered by Realty Income’s focus on single-tenant properties with triple-net leases, ensuring tenants are responsible for most property expenses. The company boasts a highly diversified tenant base with defensive business models, each tenant exposure being less than 5% of the total portfolio. Among others, major tenants include successful businesses such as Dollar General (DG), FedEx (FDX), and Tractor Supply Company (TSCO). Realty Income pays a 5.8% dividend yield, which has experienced slower growth, remaining below 4% over the past 5 years. However, the company is trading at a significant discount, with the P/FFO being 12.8x, significantly lower than the historical average of 19.3x over a similar forward growth duration of 4.5% annually.

4. Allianz stands out as the sole European stock in the portfolio. From its roots in Munich, Germany, it has evolved into a multinational corporation, specializing in insurance and asset management. With operations spanning across 70 countries, Allianz is renowned for its top-tier insurance products. Offering a solidly covered 4.7% dividend yield, the company continues to growth its dividend over 5% annually, even as the business has reached maturity. Projections suggest a further increase in EPS by approximately 6.3% over the next 3 years. Currently valued at 10.7x, Allianz appears undervalued compared to past periods with lower growth, which saw valuations surpassing 12.6x.

5. AbbVie was established as an independent pharmaceutical company following its spin-off from Abbott Laboratories (ABT) in 2013, AbbVie has quickly grown to become one of the largest pharma companies in its short history. The catalyst behind much of AbbVie’s success is Humira, which has become the most lucrative franchise in pharmaceutical history, generating a staggering $120 billion in revenue for AbbVie since 2016. Although the company is currently facing headwinds such as the Humira patent cliff, Immunology remains the largest segment, contributing 52% of net revenue. However, AbbVie’s current portfolio is significantly more diversified than before, with a strong pipeline of new drugs. AbbVie pays a 3.6% dividend yield accompanied by significant growth of 8.7% over the last 5 years. While the stock is not a bargain today, it is trading at a fair valuation of 15.7x its earnings, with 6.5% EPS growth expected over the next 3 years.

6. NextEra Energy holds the title of the world’s largest utility company, with an impressive 58 gigawatts of generating capacity and a customer base exceeding 5 million in Florida alone. Known for its commitment to clean energy, NextEra is heavily investing in renewable sources such as solar and wind power across 30 US states and expanding into Canada. Despite facing some selling pressure due to heightened rates and carrying a net debt of $70.5 billion, NextEra remains a robust business. Trading at a modest 17.6x its earnings, significantly lower than its average valuation since 2013 of 23.8x, today’s valuation presents a compelling buying opportunity. Projections foresee an EPS growth rate of 7.5%, accompanied by a well-covered dividend yield of 3.32%, expected to increase at a high single-digit rate in the coming years.

7. Ares Capital isn’t just any company; it’s the largest Business Development Company or “BDC” in the US. This unique structure allows them to provide debt financing to small and mid-sized businesses, earning income from interest and fees. Think of it as a specialized bank focusing on these specific companies. BDC regulations require high diversification and leverage limits, ensuring stability for investors while enabling attractive potential returns, mainly through dividends. BDCs are required by law to distribute at least 90% of their taxable income, similar to REITs, but this structure allows BDCs to avoid corporate income tax, leading to higher potential returns for investors. BDC income can be cyclical, so dividend amounts may vary depending on their performance hence the decrease in distribution of -1.3% over the past 5 years. The growth over the next 3 years is expected to be subdued, with only a 0.5% annual projection, yet one should buy this company for the 9.6% dividend yield.

8. Texas Instruments is a global semiconductor company renowned for its expertise in designing and manufacturing analog and embedded processing chips. While TXN does not focus on cutting-edge chip production, the company boasts a unique advantage: it oversees both chip design and manufacturing in-house, ensuring exceptional quality and customization. In contrast, competitors like AMD (AMD) and NVIDIA (NVDA) rely on external manufacturers such as TSMC (TSM) to produce their designs, introducing risks and complexities into their supply chains. TXN has emerged as a top choice for dividend investors, increasing its dividend by an impressive 333% over the last decade. Presently, the company offers a healthy dividend yield of 3.3%, with an annual growth rate of 12.8% over the past 5 years. Despite recent headwinds in the semiconductor industry, particularly over the past 2 years, the stock is trading at a fair value of 23x its earnings. While growth prospects may be somewhat subdued over the next 3 years, with expected EPS growth of 7%, TXN remains a solid dividend growth stock.

9. PepsiCo is far more than just a traditional soda company; it is a well-diversified food and beverage giant, generating billions in revenue from iconic products such as the world’s favorite tortilla chips, Doritos, and the refreshing Pepsi itself. Operating as a defensive business, PepsiCo has exhibited steady growth. Despite being a mature business, since 2013, the company has managed to achieve a 6% annual growth in EPS through enhanced efficiency in manufacturing and supply chain. This growth expectation is anticipated to be maintained over the next 3 years. With an “A+” credit rating, the company seldom trades at a discount, particularly during periods of economic uncertainty when it is regarded as a pillar amidst the storm. Currently valued at 22.8x its earnings, PepsiCo appears to be fairly valued. Additionally, with a growing dividend of 6.6% annually over the past 5 years, it presents itself as an excellent defensive pick for retirement.

10. McDonald’s is a traditional defensive pick that complements any portfolio. While it may not initially seem like an exciting stock, its consistent and gradual growth has actually resulted in market outperformance with lower volatility over the past decade. Recently, McDonald’s stock has experienced a slight pullback following its latest earnings report, attributed to geopolitical tensions in the Middle East leading to boycotts in Muslim-majority countries due to perceived pro-Israeli stances. However, such events are often short-lived, and with an expected 8% growth in EPS over the next 3 years, the stock is trading at a fair valuation of 24.3x earnings, consistent with previous periods exhibiting similar growth. Although the company offers the lowest dividend yield among the selections here at only 2.3%, it is steadily growing. McDonald’s defensive business model and wide moat compensate for the lower distribution, ultimately reducing overall portfolio volatility.

Takeaway

Reaching retirement is a fantastic accomplishment, but truly enjoying it hinges on strategic financial planning. This involves carefully allocating your capital to businesses with robust models, strong financials, reliable earnings, and consistent dividend growth.

While having enough money is crucial, capital allocation becomes the driving force for a fulfilling retirement. Many retirees prioritize stability and income, but we can’t neglect the rising life expectancy. This necessitates incorporating moderate growth elements into the investment strategy to combat inflation and preserve purchasing power over the long term.

Thankfully, my dad has achieved the impressive milestone of financial freedom, allowing him to envision a comfortable retirement sustained by dividends and social security. To further enhance his financial independence, I’ve built a portfolio offering a 5% dividend yield, coupled with an anticipated 6.1% average EPS growth. This combination has the potential to deliver not only a substantial income stream to fund his lifestyle, but also total returns are comparable to the market.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.