Romance and business are a combustible mix for top executives. None more so than the relationship between Mohsin Issa, the billionaire Asda tycoon, and leading accountant Victoria Price, a power player in her own right.

Professional networking site LinkedIn is usually a place to promote career achievements, rather than personal milestones.

But sharp-eyed followers of Price, one of the UK’s top tax experts, would have noticed a video posted last year of herself sporting a chunky diamond engagement ring.

Their affair – which has been an ill-hidden secret in the City for months – has renewed speculation about the future of Britain’s third largest supermarket chain.

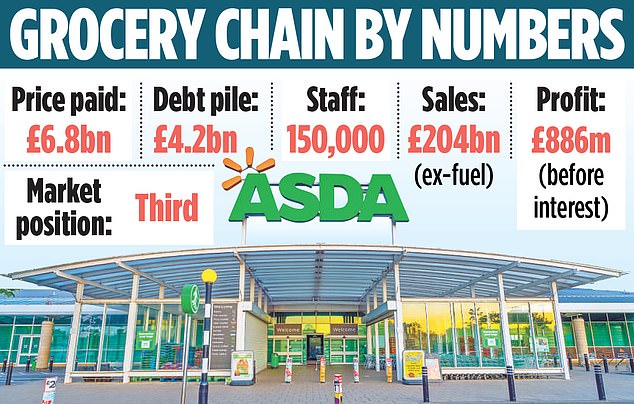

The engaged couple finally went public about their involvement last week. The announcement raises multiple questions about the future of Britain’s third largest supermarket, which is laden with more than £4 billion of debt.

Power play: The relationship between brothers Mohsin and Zuber has been complicated by Mohsin’s engagement to top accountant Victoria Price

The ring displayed on LinkedIn, said to be worth £50,000, is only for ‘everyday’ wear. Price’s ‘real’ rock is said to have cost a staggering £1 million.

As a self-made billionaire such costly baubles are well within Mohsin’s means. But his engagement to Price, a former tax partner at EY, the grocer’s former auditors, has deepened the rift between Mohsin and his younger brother and business partner Zuber, who reportedly wants out of Asda.

The siblings shocked the City when they bought the grocery giant in a controversial £6.8 billion debt-fuelled deal three years ago.

Asda has been struggling under the leadership of the Issas, losing market share to German discounters Aldi and Lidl.

Meanwhile, rising interest rates have increased Asda’s borrowing burden.

The chain has been without a chief executive for 18 months, leaving Mohsin in charge. He has been criticised by MPs over his lack of retail experience and his inability to answer simple questions about Asda’s finances.

Reports in the Sunday Telegraph suggested Zuber is trying to sell his 22.5 per cent stake in Asda so he can focus on EG Group – the former EuroGarages petrol retail empire that is the foundation of the brothers’ estimated £5 billion fortune.

One possible buyer is private equity group TDR Capital, which already co-owns both Asda and EG Group with the Issas. TDR declined to comment.

So where does all this leave Asda? The couple are understood to have first met in 2016 – two years before Price presented the Issas with an Entrepreneur of the Year award sponsored by EY, where she was a tax partner.

The affair was ‘a slow burner’, according to a friend of hers, partly because both of them were married at the time.

Things started to get more serious in 2022 when Price divorced her second husband, citing ‘irreconcilable differences’.

By that time the Issas had bought Asda, whose auditors were EY.

The fact that Price was a tax partner at a firm that checked Asda’s accounts, while romantically involved with a director of the same audit client, raised red flags at the Big Four accountancy firm.

Price had to explain why she took her sons to the British Grand Prix at Silverstone in July 2022 when the tickets cost more than £100 gift limit for EY partners.

Asda declined to comment, but a source close to the company insisted that Asda does not pay for hospitality of any kind.

Price also had to disclose to EY that her eldest son, now 23, worked as a supervisor in the local Asda store on Deeside in 2022.

A source close to Asda said: ‘Every colleague, without exception, was subjected to Asda’s normal hiring procedures and hired in accordance with them.’

Price is also understood to have worked as a tax adviser to Mohsin and the Issa family while at EY.

She became a familiar face at the Blackburn compound where he lived with his wife Shamima, Zuber and the brothers’ parents, Vali Issa and Zubeda Ali. The neighbouring mansions were dubbed the ‘five ugly sisters’ by locals.

Price’s lawyers insist that she never worked on Asda business, was not a personal tax advisor and disclosed her relationship with Mohsin to EY ‘at the outset’.

The law firm added: ‘EY have confirmed to her that she met all her obligations and made all appropriate disclosures to the firm’s ethics and compliance teams throughout her career.’

EY declined to comment.

What is not contested is that EY resigned the Asda audit the day before Price left the firm, saying it quit by mutual agreement following Asda’s acquisition of EG’s UK forecourts business, and because of ‘timetable requirements’ of the audit.

Price has since taken up a high-powered tax role at management consultancy Alvarez & Marsal.

Opinions about the Issas are divided. Some say they got lucky – and rich – using other people’s money in an era of cheap debt.

‘They are a bit Marmite, but I think the ‘chancer’ label is unfair,’ said retail expert Richard Hyman.

‘Chancers don’t invest in a business like they have when everyone else is talking about cutting costs.’

Others query the Asda business model. Under Mohsin’s leadership, the grocer has gone ‘all-in’ on petrol forecourt and convenience retailing – piling more debt on to Asda’s balance sheet in the process.

It is a business that he and Zuber know inside out – and where Asda is expanding fast. Asda has snapped up hundreds of sites from the Co-op and, more recently, from EG Group, adding to its debt pile.

These outlets are being converted into convenience stores with fuel pumps attached and re-named Asda Express. ‘Whatever you might say about them they are not asset-strippers,’ said Hyman.

Rival grocer Morrison has gone down a different path. It has just sold its 337 fuel forecourts and over 400 adjacent sites to Motor Fuel Group in a £2.5 deal to help reduce its debt. Morrison chairman and retail veteran Sir Terry Leahy said forecourt retailing was best left to specialists like MFG.

Asda can raise cash to pay down debt by selling and leasing its store estate – 70 per cent of which is freehold, among the highest in the sector, Hyman added.

And despite concerns about Mohsin’s ability to run the supermarket chain, he has assembled a strong retail team around him, including Liz Evans, who runs George, and Kris Comerford from Tesco.

To entrepreneur Tom Beahon, the Issas are ‘role models’. With his brother Phil he co-founded sportswear brand Castore. Beahon told The Mail on Sunday: ‘They invested in us and instilled an ambition to shoot for the stars.’

A recent fundraising valued Castore at £950 million. It means the Issas, who were the largest outside shareholders, have made another fortune.

Will this Midas touch – and brotherly love – prevail in their business empire? Only time will tell.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.