Shares of image-browsing platform Pinterest (PINS -10.78%) plunged on Friday following its financial report for the fourth quarter of 2023. Pinterest stock was down 11% as of 10 a.m. ET, which is a big drop. But the market frankly doesn’t appear to know how to react to its Q4 report. Shares had bounced all over the place in after-hours trading, from close to flat to down almost 30%.

Why is the market conflicted?

On one hand, Pinterest’s Q4 growth and guidance for the upcoming first quarter of 2024 were below Wall Street’s expectations. On the other hand, growth is accelerating, the company announced a huge new partnership, and many analysts are raising their price targets for the stock today. If not for these positives, it seems that Pinterest stock would have plunged quite a bit more.

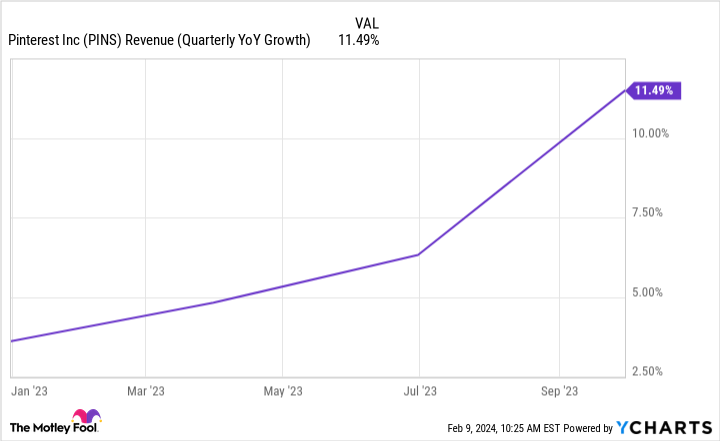

Regarding growth, Pinterest had nearly 500 million global monthly active users to end 2023. Moreover, Q4 revenue was up 12% year over year to $981 million. That’s the company’s fourth consecutive quarter of acceleration in its top-line growth rate. And guiding for Q1 revenue growth of at least 15%, it could hit a fifth consecutive quarter of acceleration.

PINS Revenue (Quarterly YoY Growth) data by YCharts

One other noteworthy item for Pinterest in Q4 was its much improved profitability. By keeping operating expenses in check (and even reducing sales and marketing substantially) the company earned net income of over $200 million, which equated to a strong profit margin of 21%.

Will new partnerships boost growth?

Pinterest generates revenue from displaying ads. It recently announced an advertising partnership with Amazon that is now live. And in its Q4 earnings call, it announced its next partnership is with Alphabet‘s Google.

Pinterest’s management said that third-party partnerships didn’t meaningfully boost Q4 numbers, but it went on to say, “We are now seeing it contribute more meaningfully to our growth this quarter, and we expect that to continue going forward.”

Therefore, with growth accelerating and promising partnerships coming online this year, I’m a little surprised to see the market throw Pinterest stock out today. I believe it’s a buying opportunity for investors willing to take a long-term view.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Jon Quast has positions in Pinterest. The Motley Fool has positions in and recommends Alphabet, Amazon, and Pinterest. The Motley Fool has a disclosure policy.