MediaProduction/iStock via Getty Images

Investment Rundown

The past few months have been quite the rollercoaster for Capital Product Partners L.P. (NASDAQ:CPLP) as the stock price went from under $14 in late December to now nearly $18 in stock price. The reason seems to have come from increased hostilities in the Red Sea region which CPLP operates in along with rapidly rising shipping spot prices. But perhaps above all has been the closing of an agreement to acquire vessels totaling around $3.1 billion which was named the Umbrella Agreement. The deal has ensured the CPLP can expand its asset base continue to build out its earnings potential and deliver shareholder value.

The market size of CPLP is not that big, just shy of $1 billion, but I do think it offers a pretty good opportunity to get some exposure to the global shipping industry. The conflicts in the Red Sea have meant shipping spot rates are rapidly increasing and CPLP is a great way to benefit from this volatility. I do think it will average out over the long-term but CPLP is taking a lot of measures to ensure they hold a strong position in the future of this market, and that brings me confidence to rate the business a buy now.

Company Segments

CPLP is a Greece-based shipping company offering marine transportation services. The company’s fleet handles various cargoes, including liquefied natural gas, containerized goods, and dry bulk cargo. It operates under voyage and time charters and owns a diverse range of vessels, such as Neo-Panamax and Panamax container vessels, cape-size bulk carriers and LNG carriers. Additionally, it works with the production and distribution of oil and natural gas products.

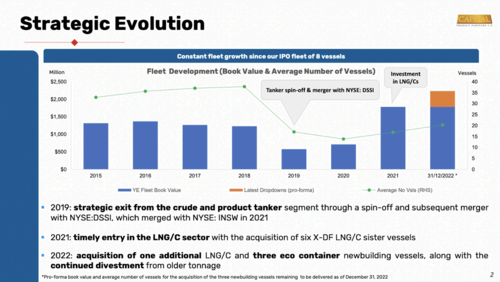

Company Evolution (Investor Presentation)

Back in 2019, the company had a spin-off which was in an effort made to help diversify against the crude and product tanker segment the company had. In the past few years, CPLP has made further strategic moves like entering in the LNG/C sector as the company acquired six X-DF-LNG/C sister vessels. The acquisition was valued at $599 million and CLPL managed to fund around $147 million of it with cash the rest was purchased with debt, which meant CPLP saw a pretty quick increase in its long-term debts, in FY2021 reaching over $1.2 billion. Since CPLP has prioritized paying down a lot of this it’s now below $500 million.

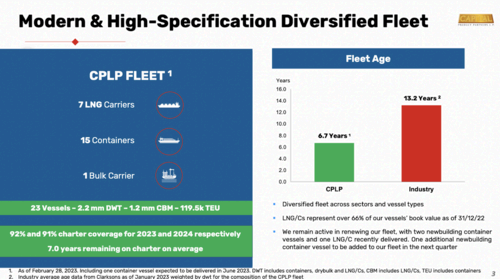

Fleet Overview (Investor Presentation)

CPLP has also finalized the acquisition of 11 newbuild liquefied natural gas carrier vessels from Capital Maritime & Trading Corp. for $3.13 billion, under an agreement established on November 13, 2023, as I mentioned earlier on. This positive news ensures that CPLP is actively growing its asset base and is something the market views very positively as the stock price rises fast following the news. This move involved CPLP entering into share purchase agreements for 100% equity interests in the companies owning these vessels, marking a significant expansion of CPLP’s fleet and capabilities in the LNG transportation sector. On top of this, CPLP has been very good in not purchasing or acquiring old fleets which would just bring up the depreciation costs of the company quickly. With a 6.7 years average age compared to 13.2 years, the industry has only seen a rising depreciation because of an expanding asset base. Depreciation rose to $79 million last 12 months, a CAGR of 33.8% since 2019, but the total assets grew by a CAGR of 49.6% during the same period, largely driven by expansion in gross property, plant & equipment. This is a trend I will be watching over the next several years to see that CPLP manages to keep a young fleet, able to generate strong earnings whilst keeping depreciation costs low.

Earnings Highlights

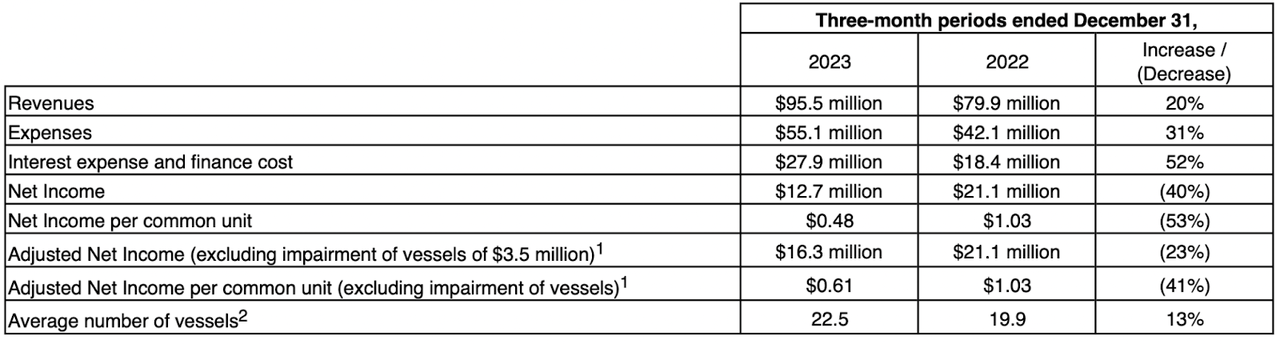

Earnings Highlights (Earnings Report)

On February 2 CPLP released its Q4 and full-year results for fiscal year 2023. Revenues grew steadily YoY to $95.5 million, a 20% increase. Net income fell however sharply by 40% to $12.7 million for the quarter. But as I have made it clear, there is a lot of vitality in the industry and some of the recent rising shipping spot rates won’t be visible until the Q1 FY2024 report is released later this spring.

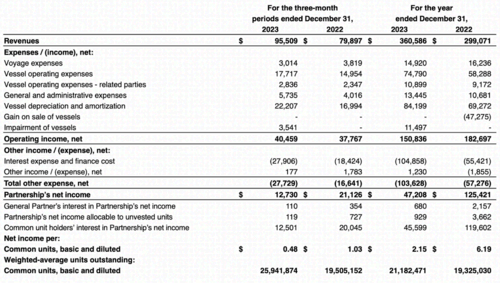

Income Statement (Earnings Report)

Diving deeper into the income statement we can see that the rising expense came from vessel operating expenses and vessel depreciation. These increases were around $6 – 7 million more YoY but did not mean that the operating income saw a decline. Operating income grew by 7.3% YoY, which of course is less than the top line, which shows the impact that rising expense has on the income statement from CPLP. That meant that CPLP would post a significant EPS decline was rising interest expense, the result of CPLP taking on debt to fund some acquisitions these past years. Last quarter it was $27.9 million in total, or $104 million for the full year, a near 100% increase compared to FY2022.

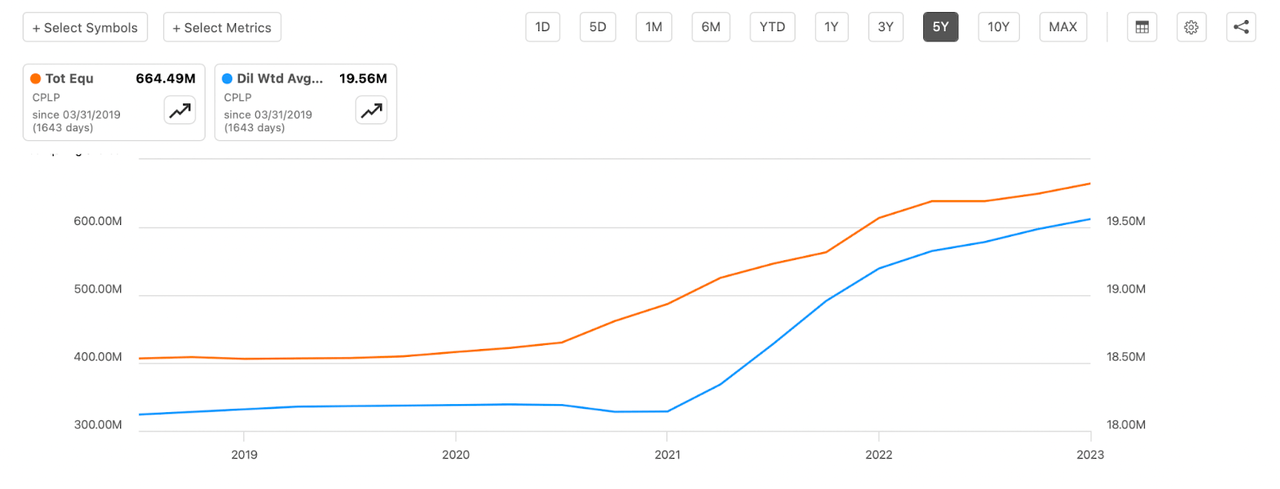

Equity & Shares (Seeking Alpha)

Over the past few years, the shares outstanding by the company have been rising, but not to an extent that I think should warrant a lot of concern. The dilution has been made to raise capital to fund some acquisitions, like the one finalized in December. What I want to highlight with this chart is that CPLP is trading at a significant discount on its equity value. Equity per share comes out to $33.2 indicating an 86% discount. This discount doesn’t seem so warranted as ROA has remained high and stable between 3 – 5% these past few years. I do expect the next earnings report to show a strong increase in ROA to around the 6% it had back in 2021. But, with that said I am also aware that the volatility in the market could warrant some discount right now to get a solid investment case here. With a 15% discount on the equity per share, I would be landing at a price target of $28.2 for CPLP, and this upside is worthwhile buying into right now, even after the significant run-up the past month.

Risks

Risks with a company like CPLP are often about high depreciation. CPLP has made an effort to have a low average fleet age which should overall bring down expenses somewhat. But what should still impact the business is if we enter into a period of lower activity in the sector, which would still leave CPLP with a high expense but not necessarily the same amount of revenues to help cover this. I can see this posting a risk to investors in the short term but I think the qualitative asset base that CPLP has built up should help balance out this over the long-term. That is also how you need to view CPLP, a long-term pick that will fluctuate but still manages to deliver value through both a dividend and buybacks. Risks are therefore not sufficient enough here to trump the buy thesis I hold.

Final Words

I like to follow the shipping industry quite a lot. It often gives a very clear indication of how some economies are doing. A lot of activity in the industry often means a lot of consumer demand. CPLP finished a very important deal in late December which brought up its number of operating vessels by a lot of greatly increased its future revenue potential. Trading at a significant discount to its NAV also supports a strong buy thesis here as investors are getting a generous margin of safety. I am initiating coverage on CPLP and will be doing so by rating it a buy now.