Artificial intelligence (AI) investing is in full swing. Companies making use of AI and selling AI products are seeing strong business growth and market enthusiasm, potentially making them great stocks to own right now.

However, there are plenty of AI stocks that should be avoided, as they’re overpriced with little to show for success. To help you avoid those stocks, I’ve got a look at some top AI stocks to buy in February.

Alphabet

Alphabet (GOOG 0.33%) (GOOGL 0.29%) has long been driven by CEO Sundar Pichai to be an AI-first company. This goal is becoming a reality, as AI is transforming all parts of Alphabet’s business.

Alphabet’s generative AI model, Gemini, which beat top competitor ChatGPT in many benchmarks, is already improving the Google search engine and giving phones like Samsung‘s S24 AI capabilities.

Alphabet’s primary business is advertising — with about 76% of revenue coming from ads — and it’s testing using generative AI to build better ad campaigns and bolstering search to draw in advertisers. With ad revenue growing 11% year over year in the most recent quarter, things are looking good.

Overall, Alphabet’s revenue rose 13% in Q4, and earnings per share (EPS) increased from $1.05 in the year-ago period to $1.64. That shows how strong this business is, yet the stock doesn’t demand the same premium as other tech companies.

It trades for 25 times earnings — about the same as the average of the S&P 500. Alphabet is an above-average company trading at market-average prices. As a result, investors shouldn’t be afraid to load up on Alphabet.

Taiwan Semiconductor Manufacturing Co.

Taiwan Semiconductor Manufacturing Co. (TSM 0.50%) is the world’s largest contract chip manufacturer. Because it doesn’t make chips for itself but for others, it can capitalize on nearly all areas of AI proliferation, as its cutting-edge chips are in nearly every piece of AI hardware.

While these chips only make up a fraction of the overall AI revenue that comes from building data centers, according to Taiwan Semiconductor CEO C.C. Wei, it’s still enough that he expects TSMC’s AI-centric chip revenue to grow at a 50% compound annual growth rate (CAGR). By 2027, he expects AI chips to make up a high-teens portion of the company’s revenue.

That forecast shows how big of a trend AI is for Taiwan Semiconductor, and with its long-term revenue guidance of 15% to 20% CAGR still in play, Taiwan Semiconductor will continue to be a fantastic stock to own.

With the stock trading for 18.5 times earnings estimates, it’s in the same boat as Alphabet compared with the broader S&P 500, which trades at 20 times forward earnings.

With TSMC’s revenue slated to grow faster than the overall market, it’s a strong buy.

UiPath

UiPath (PATH 2.84%) is a rare case of an AI-using software company that doesn’t demand a massive premium. Its robotic process automation (RPA) software automates repetitive tasks, which frees employees up to do more critical thinking instead of clicking through the same process every workday.

UiPath uses AI to increase the amount of processes it can automate and even has an AI product to discover new tasks to automate.

UiPath’s product has become quite popular, with annual recurring revenue rising 24% to $1.38 billion in the quarter that ended Oct. 31, it’s third quarter of fiscal 2024. However, many market researchers expect RPA adoption to explode over the next decade. Grand View Research projects the market will be worth $31 billion by 2030, compared with the roughly $3 billion it’s worth today.

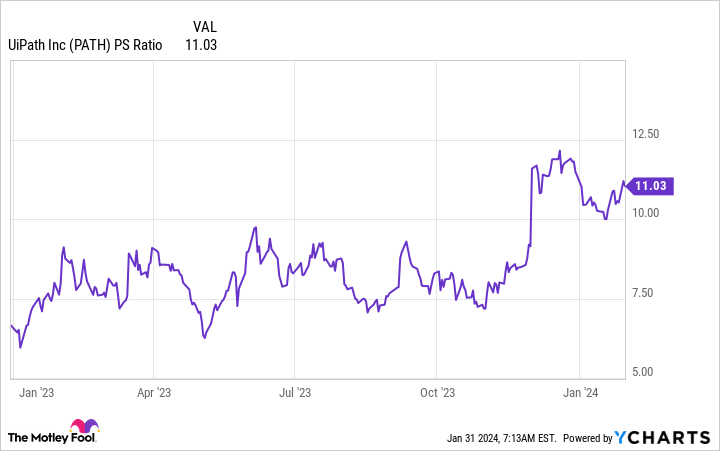

That’s massive growth, and UiPath is well positioned to capitalize on the rise. With the stock trading at 11 times sales, it’s not expensive, either.

PATH PS Ratio data by YCharts

These three companies are examples of AI stocks that aren’t overpriced and have tremendous growth prospects. These are among the top AI stocks to buy in February, and you’re not likely to be disappointed by purchasing these stocks now.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet, Taiwan Semiconductor Manufacturing, and UiPath. The Motley Fool has positions in and recommends Alphabet, Taiwan Semiconductor Manufacturing, and UiPath. The Motley Fool has a disclosure policy.