Shares of DocuSign (DOCU -1.96%) fell as much as 7.4% in trading on Tuesday after the company announced a restructuring and layoffs. As of 2:45 p.m. ET shares are down 3%.

Layoffs continue in tech

DocuSign announced a restructuring plan “designed to strengthen and support the Company’s financial and operational efficiency” while also delivering growth. The plan includes eliminating about 6% of the workforce, or about 440 jobs. Most of the cuts are expected to be in sales and marketing.

As part of the release, management said it will “meet or exceed” fourth-quarter and fiscal 2024 guidance provided in December. That included revenue of $696 million to $700 million for the quarter and non-GAAP (adjusted) operating margin of 22.5% to 23.5%.

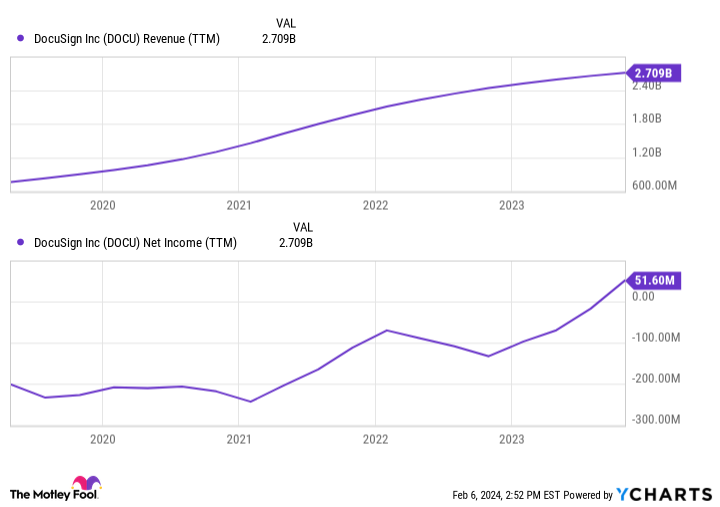

You can see below that growth has slowed but margins have improved and management now needs to improve the bottom line to keep the stock moving higher.

DOCU Revenue (TTM) data by YCharts

Some cuts are bad news

Layoffs and cost cuts can help a company’s bottom line and improve efficiency, but when cost cuts coincide with a declining business it’s a sign of trouble. Third-quarter 2023 revenue rose just 9% and the midpoint of Q4 2024 guidance implies a 5.8% growth rate.

Meanwhile, margins have eroded throughout fiscal 2024, and as more competitors enter the documents space it’s possible layoffs are just going to offset decreasing margins. I don’t see these layoffs helping with growth and that’s ultimately a problem for a company that’s barely breakeven with a very high-gross-margin business.

Travis Hoium has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends DocuSign. The Motley Fool has a disclosure policy.