PeopleImages/iStock via Getty Images

Shares of Zymeworks (NASDAQ:ZYME) are moving higher lately, led by an overall recovery of biotech stocks, and, perhaps, by increased investor interest in the company’s emerging antibody-drug conjugate (‘ADC’) platform.

Zymeworks and its partner Jazz Pharmaceuticals (JAZZ) also continued to make progress with zanidatamab. In my previous article on Zymeworks, I said the deal with Jazz provides a new life for the company and a strong cash balance to expand its pipeline.

Partner Jazz expects to report the topline results from the phase 3 trial of the candidate in patients with gastroesophageal adenocarcinoma (‘GEA’) in late 2024. This is by far the most important event for Zymeworks in the next 12-18 months, followed by preclinical and clinical progress of the emerging pipeline which can generate more upside than zanidatamab in the long run, but also carries significantly higher development risks and has much longer development timelines.

The readout of zanidatamab in GEA patients is by no means a slam dunk event, but the data this candidate generated to date across early-stage trials look good and with potential for zanidatamab (likely in combination with tislelizumab) to become an important treatment option for these patients.

Jazz expects zanidatamab to be a $2 billion+ drug with GEA as one of the more important indications

I wrote about zanidatamab and Zymeworks back in October 2022 when the deal with Jazz was announced and what it means for both companies. As it relates to Zymeworks, it gave up on a good portion of the upside in exchange for a significant reduction in annual expenses and a cash infusion that would allow it to focus on its preclinical projects and pipeline expansion.

Since October 2022, zanidatamab generated positive data in patients with biliary tract cancer (‘BTC’) that resulted in Jazz initiating a rolling BLA submission to the FDA which it expects to complete in the first half of the year. The approval should result in an undisclosed milestone payment to Zymeworks and the company starting to collect royalties on net sales that start at 10% and peak at 20% from Jazz, and tiered royalties of up to 20% from partner BeiGene (BGNE) in the Asia-Pacific region that excludes Japan and India.

This indication represents a relatively small market of approximately 12,000 patients with approximately 7,500 new cases each year in the United States, and as such, is unlikely to drive significant royalties for Zymeworks.

I wrote about the GEA readout in my recent article on Jazz Pharmaceuticals and will summarize my thoughts and expand on them here as this is a far more relevant event for Zymeworks than it is for Jazz.

The GEA market is far more significant with 63,000 patients in major geographies and the combined opportunity of 75,000 in the two markets could make zanidatamab a $1 billion+ product for Jazz and Zymeworks, in which case it could receive as much as $200 million in annual royalties on net sales, based on a market penetration rate of 15-20% and a net price per patient per year of at least $100,000.

I should add that these estimates do not include the contribution from the Asia-Pacific region, and I assume that the net price of zanidatamab will be 3-4x lower compared to the net price in major Western geographies, but the larger addressable market could compensate for the lower price and zanidatamab royalties from BeiGene could be decent as well. Based on these assumptions, I would estimate the peak annual potential of zanidatamab in BeiGene’s territories in the $300-500 million range for BTC and GEA and in the $600 million to $1 billion range if the label of the product is expanded to include breast cancer (and assuming the data are both positive and competitive).

The topline results from the GEA trial are expected in late 2024. Jazz decided to increase the enrollment from 714 to 918 patients to increase the power to detect statistically significant overall survival benefit, and there are two shots on goal with zanidatamab in combination with chemotherapy and zanidatamab in combination with chemotherapy and BeiGene’s PD-1 antibody tislelizumab. The control arm is a combination of trastuzumab (Herceptin) and chemotherapy.

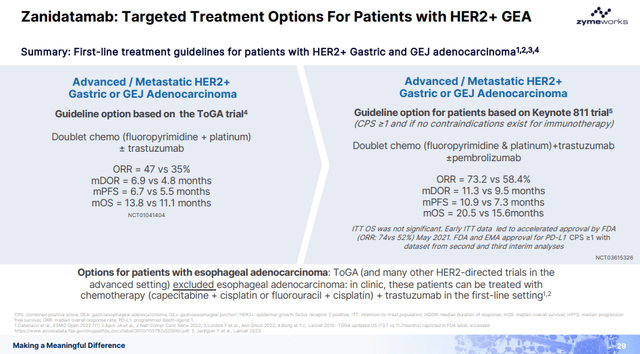

Based on the evolving treatment landscape, it seems likely that the triple combination of zanidatamab, tislelizumab, and chemotherapy will be the relevant treatment arm. Keytruda (pembrolizumab) in combination with trastuzumab and chemotherapy extended median progression-free survival and overall survival in gastric or gastroesophageal junction adenocarcinoma patients by 3.6 months and 4.9 months, respectively, and reported an overall response rate (‘ORR’) of 73.2% versus 58.4% for the combination of trastuzumab and chemotherapy.

Zymeworks investor presentation

So, while the goal of the trial is that both zanidatamab arms report better data than the trastuzumab and chemotherapy combination, the market is moving toward the triple combination with PD-1 antibodies and this is the treatment arm that will likely be used commercially.

I expect this trial to show positive results as zanidatamab is likely a better HER2 drug than trastuzumab based on the data I have seen in previous trials.

The data in the targeted GEA population look good too. With the caveat of cross-trial comparisons, this is how the triple combination of zanidatamab, tislelizumab, and chemotherapy compares to Keytruda, Herceptin, and chemotherapy:

- 75.8% ORR for the zanidatamab triple combination versus 73.2% for the Herceptin triple combination.

- The median duration of response of 22.8 months versus 11.3 months.

- Median progression-free survival of 16.7 months versus 10.9 months.

As these are not results from a controlled trial of zanidatamab, but combined results in 33 patients in two phase 1b/2 trial cohorts, my estimated probability of success is 70%. This is a subjective assessment based on the available data and the known efficacy and safety profile of zanidatamab.

Positive results would further reinforce Jazz’s plans to further explore zanidatamab in other indications such as breast cancer where the addressable market is roughly twice the size of the combined addressable market in BTC and GEA.

So, how much would this be worth for Zymeworks shareholders? To put things into perspective, Zymeworks’ current market cap is approximately $820 million and the enterprise value is $365 million based on the year-end cash balance of $455 million.

If zanidatamab becomes a $1 billion a year drug in Jazz territories and a $300 million a year drug in BeiGene territories, Zymeworks would be entitled to up to $260 million in royalties a year and $400 million if annual sales reach Jazz’s $2 billion projection plus another $200 million if net sales reach $1 billion in BeiGene territories.

My present value estimate of Zymeworks’ royalty stream based on $1.3 billion in net sales ($1 billion in Jazz territories plus $300 million in BeiGene territories) is $15 per share, assuming the royalties are taxed (but I estimate they will not be taxed at least into the mid-2030s based on Zymeworks’ accumulated deficit of $660 million at the end of Q3 2023 and expected continued losses as it increases pipeline investments) and up to $25 per share if net sales reach $2 billion a year. These estimates assume that zanidatamab is both clinically de-risked and approved for BTC and GEA at the low end of the range and the two indications plus breast cancer are approved at the high end.

To be clear, this would not be the value of Zymeworks, the company, but the value of the zanidatamab royalty stream that does not include up to $525 million in regulatory milestones and up to $862.5 million in commercial milestones from partner Jazz, and an additional nearly $200 million from partner BeiGene.

Zanidatamab could also be a source of non-dilutive funding down the road, should the company decide to partially or completely monetize the royalty stream to ramp up the investments in the emerging and what is looking like rapidly expanding bispecific and multispecific antibody pipeline and the ADC pipeline.

Pipeline expansion ahead of schedule

Zymeworks’ CEO Kenneth Galbraith praised his R&D team at the JP Morgan Healthcare Conference last month, saying it is one year ahead of schedule in terms of pipeline progression.

The company now expects Investigational New Drug (‘IND’) applications and first in human studies of ZW171 and ZW191 candidates in 2024 and ZW220 and ZW251 in 2025. The previous goal was to produce one candidate per year in the next five years, starting in 2024.

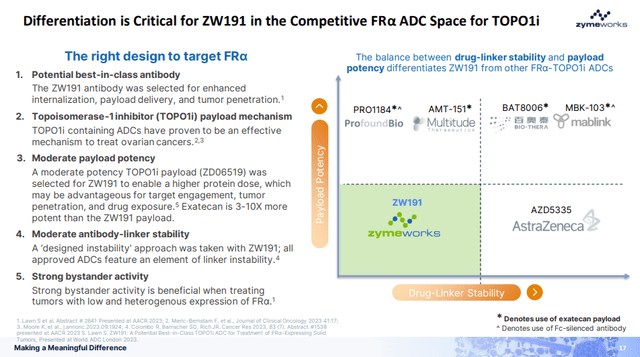

The preclinical data for ZW191, the first ADC candidate, look promising.

ZW-191 is an FRα-targeting ADC using a novel and differentiated TOPO1i payload with an opportunity to treat a broader range of FRα-expressing cancers, and Zymeworks believes that “the balance between drug-linker stability and payload potency differentiates ZW191 from other FRα-TOPO1i ADCs” as shown on the presentation slide below.

Zymeworks investor presentation

I currently have no strong view on Zymeworks’ emerging pipeline as it is still largely unproven, but the upside potential is considerable if this becomes a platform that can sustainably bring new and attractive candidates into the clinic. And ADCs are a hot field at the moment, evidenced by Pfizer’s (PFE) acquisition of Seagen for $43 billion, AbbVie’s (ABBV) acquisition of Immunogen for $10 billion, and Johnson & Johnson’s (JNJ) acquisition of Ambrx for $2 billion.

Risks

The key risk for Zymeworks in the next 12 months is the phase 3 readout of zanidatamab in GEA patients. Success is by no means guaranteed, and based on my probability of success estimate of 70%, there is a 30% probability that zanidatamab combinations fail to show a favorable treatment benefit. There is also a possibility that the trial is a success but with efficacy that is no better than the Keytruda-Herceptin-chemotherapy triple combination. If we see this kind of success, I doubt the share price of Zymeworks would benefit, and it could even fall. However, this would still be an approvable combination, albeit with likely lower peak sales potential.

The study failing or showing suboptimal positive results could also have negative implications for the other pipeline shots on goal such as breast cancer.

Even so, Zymeworks is well funded with a runway into the second half of 2027 which should be sufficient for the next stage of value creation with the new clinical candidates. This would then transfer the risk to the early-stage pipeline that is largely unproven and would elevate the risk profile of the company from a late-stage royalty on zanidatamab company/investment thesis to an early-stage company in an increasingly competitive ADC treatment landscape.

And increasing competition is also a major long-term risk. I have rarely seen a field evolve so rapidly as the ADC field in the last few years. A promising candidate today may turn into an inferior product in 2-3 years or less.

Conclusion

Zymeworks is well funded to execute the planned pipeline expansion which itself is ahead of schedule, but the key catalyst for the stock is the phase 3 readout of zanidatamab in GEA patients in late 2024. Success is not guaranteed, but the risk-reward looks favorable for the long side and I estimate that the probability of success is 70%.

Should the trial fail, we could see the stock trade lower and investors would then turn their attention to the emerging early-stage pipeline which has significantly more upside than zanidatamab itself, but which carries significantly higher development risks in a rapidly evolving and increasingly crowded treatment landscape.

The chart also looks good at the moment with the stock pushing past resistance levels – the stock was featured in the Growth Stock Forum’s Trading Ideas Update last Monday.