peeterv

Earnings of Hanmi Financial Corporation (NASDAQ:HAFC) will likely decline this year as subdued loan growth will likely be unable to compensate for margin pressure and normal operating expense growth. Overall, I’m expecting the company to report earnings of $2.32 per share for 2024, down 11.5% year-over-year. Investors appear to have overreacted to the prospects of an earnings decline as the stock is currently quite undervalued. The year-end target price suggests a high upside from the current market price. Additionally, Hanmi is offering an attractive dividend yield of over 6%. Due to the high total expected return and a decline in risks, I’m upgrading Hanmi Financial to a buy rating.

Expecting the Margin’s Decline to Somewhat Flatten

Hanmi’s net interest margin fell by a total of 75 basis points in 2023, which was worse than my expectations mentioned in my last report on the company issued in May 2023. Hanmi’s deposit mix deterioration throughout last year was much worse than I had anticipated. Non-interest-bearing deposits slipped to 31.9% of total deposits by the end of 2023 from 41.2% at the end of 2022.

The deposit migration was partly due to rising interest rates which incentivized depositors to chase yields and shift their funds into higher-rate accounts. Now that interest rates are likely to decline this year, this incentive will disappear. Therefore, I’m expecting the deposit mix to stabilize at the current level for the year ahead. As a result, the pressure on the margin from deposit mix deterioration will likely end soon.

However, rate cuts will likely pressurize the margin through most of this year. Hanmi Financial’s loan portfolio is quick to re-price; therefore, the average asset yield will start to slip soon after the first interest-rate cut. As mentioned in the earnings presentation, around 24% of the loan portfolio re-prices within 1-3 months. Further, around 56% of loans are either variable-rate or fixed-rate loans maturing within a year. In other words, 56% of loans can be expected to re-price downwards within a year. On the other hand, the average deposit cost is quite sticky as non-interest-bearing accounts make up 32% and time deposits make up 39% of total deposits.

Considering these factors, I’m expecting the margin to dip by four basis points in 2024.

Loan Growth Rate Likely to Remain Stable

After showing lackluster performance for the first nine months of 2023, loan growth shot up in the last quarter to lead to full-year loan growth of 3.7%. The management mentioned in the conference call that it expects the net loan growth in 2024 to be in the low to mid-single-digit range.

In my opinion, the management’s target can be easily achieved as it isn’t too ambitious. The loan portfolio has grown at a compounded annual growth rate of 6.1% over the last five years; therefore, low-to-mid single-digit growth shouldn’t be difficult to achieve for the management.

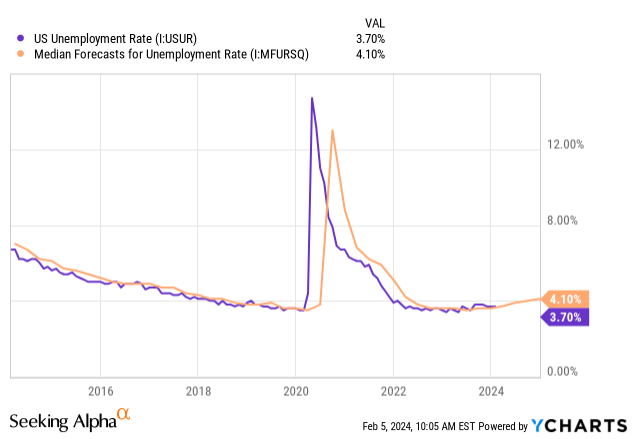

Further, the economy is currently in a better position compared to not only the last five years but also the last ten years. Hanmi Financial caters to multi-ethnic communities in California, Texas, Illinois, Virginia, New Jersey, New York, Colorado, Washington, and Georgia. As Hanmi’s markets are quite widespread and diverse, the national average is an appropriate proxy for the company’s local markets. As shown below, the country’s unemployment rate is currently in a much better position than in previous years. Moreover, professional forecasters estimate that the unemployment rate will continue to remain much better than in previous years.

Considering these factors, I’m expecting the loan portfolio to grow by 4.1% in 2024, which is close to the growth rate for 2023 but below the average growth rate for the last five years. I’m expecting deposits to grow in line with loans. The following table shows my balance sheet estimates.

| Financial Position | FY19 | FY20 | FY21 | FY22 | FY23 | FY24E |

| Net Loans | 4,549 | 4,790 | 5,079 | 5,896 | 6,113 | 6,361 |

| Growth of Net Loans | (0.4)% | 5.3% | 6.0% | 16.1% | 3.7% | 4.1% |

| Other Earning Assets | 657 | 762 | 924 | 862 | 878 | 904 |

| Deposits | 4,699 | 5,275 | 5,786 | 6,168 | 6,281 | 6,536 |

| Borrowings and Sub-Debt | 208 | 269 | 353 | 479 | 455 | 469 |

| Common Equity | 563 | 577 | 643 | 638 | 702 | 742 |

| Book Value Per Share ($) | 18.3 | 19.1 | 21.1 | 21.0 | 23.1 | 24.5 |

| Tangible BVPS ($) | 17.9 | 18.7 | 20.7 | 20.6 | 22.8 | 24.1 |

| Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Earnings Likely to Dip Due to Margin Contraction, Expense Growth

Earnings of Hanmi Financial will most probably dip this year partly because of net interest margin contraction. Additionally, operating expenses will likely continue to grow at the usual mid-single-digit range, which will pressure earnings. On the other hand, below-average loan growth will likely support the bottom line. Overall, I’m expecting Hanmi Financial to report earnings of $2.32 per share for 2024, down 11.5% year-over-year. The following table shows my income statement estimates.

| Income Statement | FY19 | FY20 | FY21 | FY22 | FY23 | FY24E |

| Net interest income | 176 | 181 | 195 | 238 | 221 | 218 |

| Provision for loan losses | 30 | 45 | (24) | 1 | 4 | 4 |

| Non-interest income | 28 | 43 | 40 | 34 | 34 | 27 |

| Non-interest expense | 126 | 119 | 124 | 130 | 137 | 144 |

| Net income – Common Sh. | 33 | 42 | 98 | 101 | 80 | 70 |

| EPS – Diluted ($) | 1.06 | 1.39 | 3.22 | 3.32 | 2.62 | 2.32 |

| Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Risks Have Diminished

When I last updated my investment thesis on Hanmi Financial during the second quarter of 2023, the sudden bank failures and runs on banks appeared ominous. Hanmi was especially precariously placed because it shared the same Californian markets as some of the failed banks, namely First Republic Bank, SVB Financial, and Signature Bank. I adopted a hold rating at that time because I thought the company’s risks were too high. Since then, the risks have declined with no new bank failures in the last several months. Moreover, although the company’s uninsured deposits are a sizable 40% of total deposits, they are sufficiently covered. The liquidity available to Hanmi totaled $2.3 billion at the end of 2023, which is about 1.1 times the uninsured deposits.

However, the following two areas still carry moderately high risk.

- Office exposure. Office real estate loans make up a sizable 9.3% of total loans. I believe the occupation of office properties will only get worse from now onwards as tools enabling remote work continue to evolve and corporations try to cut back costs.

- Unrealized losses. Due to interest rate hikes and the subsequent depletion of the market value of fixed-rate securities, Hanmi amassed unrealized mark-to-market losses of around $101 million on its Available-for-Sale securities portfolio. These losses are 14% of the total equity book value.

Dividend Yield is Over 6%

Hanmi Financial is offering an attractive dividend yield of 6.3% at the current quarterly dividend rate of $0.25 per share. The dividend appears secure due to the following two reasons.

- Normal Payout Ratio. The earnings and dividend estimates suggest a payout ratio of 43% for 2024, which is in line with the five-year average of 42%.

- Adequate Capitalization. The company’s total capital ratio stood at 14.95% at the end of December 2023, as opposed to the minimum regulatory requirement of 10.50%. Therefore, regulatory requirements will not force a dividend cut in my forecast horizon.

Upgrading to a Buy Rating

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Hanmi Financial. The stock has traded at an average P/TB ratio of 0.88x in the past, as shown below.

| FY20 | FY21 | FY22 | FY23 | Average | ||

| T. Book Value per Share ($) | 18.7 | 20.7 | 20.6 | 22.8 | ||

| Average Market Price ($) | 11.2 | 19.4 | 24.7 | 18.2 | ||

| Historical P/TB | 0.60x | 0.94x | 1.20x | 0.80x | 0.88x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $24.1 gives a target price of $21.3 for the end of 2024. This price target implies a 34.3% upside from the February 2 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 0.68x | 0.78x | 0.88x | 0.98x | 1.08x |

| TBVPS – Dec 2024 ($) | 24.1 | 24.1 | 24.1 | 24.1 | 24.1 |

| Target Price | 16.5 | 18.9 | 21.3 | 23.7 | 26.1 |

| Market Price | 15.9 | 15.9 | 15.9 | 15.9 | 15.9 |

| Upside/(Downside) | 3.9% | 19.1% | 34.3% | 49.5% | 64.7% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 7.1x in the past, as shown below.

| FY20 | FY21 | FY22 | FY23 | Average | ||

| Earnings per Share ($) | 1.39 | 3.22 | 3.32 | 2.62 | ||

| Average Market Price ($) | 11.2 | 19.4 | 24.7 | 18.2 | ||

| Historical P/E | 8.1x | 6.0x | 7.5x | 6.9x | 7.1x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $2.32 gives a target price of $16.5 for the end of 2024. This price target implies a 4.0% upside from the February 2 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 5.1x | 6.1x | 7.1x | 8.1x | 9.1x |

| EPS 2024 ($) | 2.32 | 2.32 | 2.32 | 2.32 | 2.32 |

| Target Price ($) | 11.9 | 14.2 | 16.5 | 18.8 | 21.1 |

| Market Price ($) | 15.9 | 15.9 | 15.9 | 15.9 | 15.9 |

| Upside/(Downside) | (25.2)% | (10.6)% | 4.0% | 18.6% | 33.3% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $18.9, which implies a 19.2% upside from the current market price. Adding the forward dividend yield gives a total expected return of 25.5%.

In my last report, I determined a target price of $22.3 for the end of 2023, which implied a 53.3% price upside at the time of the report issuance. Nevertheless, I adopted a hold rating at that time because the risks were high. As discussed above, the company’s risk level has declined. Further, the updated total expected return is quite attractive. Therefore, I’ve decided to upgrade Hanmi Financial to a Buy Rating.