PM Images/Stone via Getty Images

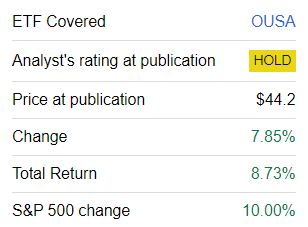

I have a history of neutral coverage on the ALPS O’Shares U.S. Quality Dividend ETF (BATS:OUSA), with the first note published in June 2021. I have never been especially enthusiastic about its investing philosophy, as its well-rounded strategy produced interesting, sound factor balances but only acceptable, hardly outstanding returns. For the dividend part of the equation, its yield has never been large enough for my taste. In fact, I even called it ‘miniature’ in the August 2023 article. Truly, a DY that is only on par with one of the iShares Core S&P 500 ETF (IVV) is far from appealing.

However, my analyses illustrated that OUSA does deliver on the low volatility and profitability fronts. And today’s article offers a reassessment of its portfolio, paying attention to changes in factor exposures, which is necessary to identify strengths and vulnerabilities investors who are mulling over buying into it should monitor.

An OUSA strategy recap

First and foremost, I should remind my dear readers that OUSA’s strategy was different in the past. As described in the fact sheet, it initially tracked the FTSE USA Qual/Vol/Yield Factor 5% Capped Index after its launch in July 2015 but then abandoned it in June 2020, opting for the O’Shares U.S. Quality Dividend Index. Also, in the wake of “the completion of a strategic transaction with SS&C Technologies, which owns SS&C ALPS Advisors,” it was reorganized in June 2022.

Even though there are similarities between the FTSE and the O’Shares indices, I prefer not to include the fund’s returns delivered prior to June 2020 in my performance analysis section.

An overview of the index’s methodology is provided in the OUSA summary prospectus. In short, it:

is constructed using a proprietary, rules-based methodology designed to select equity securities from the S-Network US Equity Large-Cap 500 Index that have exposure to the following four factors: 1) quality, 2) low volatility, 3) dividend yield and 4) dividend quality.

The idea is to select the 100 worthiest names. Importantly, the index ignores the energy, materials, and real estate sectors.

Remarks on OUSA performance attribution

Since my previous note published in August 2023, OUSA has underperformed the S&P 500 index. Overall, 2023 was more of a bleak year for the fund as it trailed IVV in nine out of twelve months, delivering a total return of almost 13% lower, a sharp reversal from its about 8.7% alpha in 2022. It has also had a rather lackluster start to 2024 as its dividend & quality-centered strategy lagged IVV by 79 bps in January.

Seeking Alpha

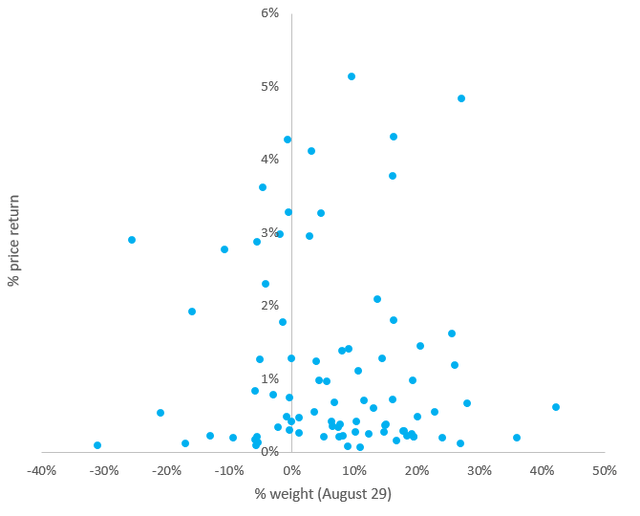

Why did that happen? Let us discuss what stocks, sectors, and factors were most likely among the main culprits. An important remark worth making here is that the analysis below covers 84 (~96% weight as of February 2) out of 100 stocks in the August version of the portfolio since the remaining 16 were removed between August 28 and February 2 due to the index reconstitution. The following scatter plot is supposed to demonstrate the proportion of stocks that gained and declined during the period concerned.

Created by the author using data from Seeking Alpha and the fund

As we can see, there have been a few outstanding performers in the OUSA portfolio that have grossly contributed to its return since then, including the five most successful companies:

| Stock | Sector | EY | Price return |

| Broadcom (AVGO) | Information Technology | 4.9% | 42.19% |

| Trane Technologies (TT) | Industrials | 4.4% | 35.94% |

| Costco Wholesale (COST) | Consumer Staples | 2.7% | 28.03% |

| Microsoft (MSFT) | Information Technology | 3.4% | 27.04% |

| QUALCOMM (QCOM) | Information Technology | 7.5% | 26.87% |

Created by the author using data from Seeking Alpha and OUSA. The price return was calculated using price data as of February 3 and August 29

The holdings below had the steepest price declines:

| Stock | Sector | EY | Price return |

| Archer-Daniels-Midland Company (ADM) | Consumer Staples | 8.9% | -31.14% |

| Pfizer (PFE) | Health Care | 9.1% | -25.63% |

| Bristol-Myers Squibb Company (BMY) | Health Care | 12.1% | -20.98% |

| Brown-Forman (BF.B) | Consumer Staples | 3.0% | -17.03% |

| United Parcel Service (UPS) | Industrials | 5.7% | -15.99% |

Created by the author using data from Seeking Alpha and OUSA

Regarding factors, I hypothesized that less generously priced stocks (i.e., those with larger earnings yields) were the laggards while those with more impressive forward revenue growth rates were the winners, chiefly thanks to the longer-duration equities revival at the end of the year inspired by expectations for lower interest rates. And it turned out that the group of those with negative price returns had a higher median forward EY, a lower P/S, and a lower revenue growth rate.

| Group | Median Revenue Fwd | Median EY Fwd | Median P/S |

| Stocks that gained | 6% | 4.5% | 3.92 |

| Stocks that declined | 4.2% | 5.9% | 3.87 |

Calculated by the author using data from Seeking Alpha and OUSA. Based on forward EYs and forward revenue growth as of August 29

Moreover, in the group that gained, there are twelve companies with double-digit revenue growth rates; there are just two such names in the opposite group. So, it seems the hypothesis was correct: the zeitgeist switched in favor of more expensive, growthier names, and this is what was the major underlying driver of OUSA’s performance during the period.

Regarding sectors, the top contributors were IT and industrials. The top detractors were consumer staples. Again, this is expected, assuming the market zeitgeist.

OUSA factor mix discussion

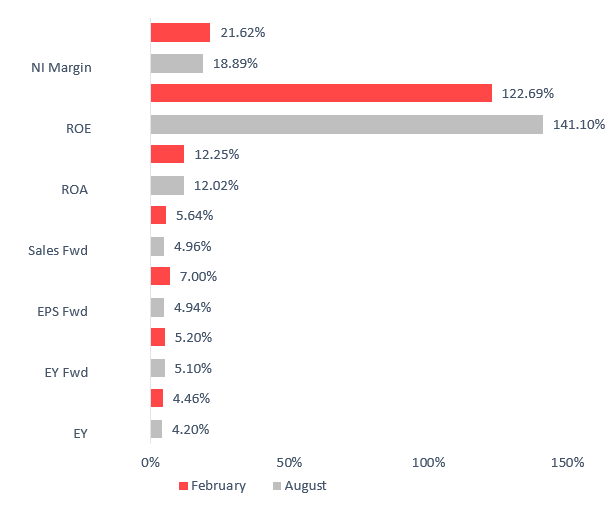

The issue is that OUSA has been consistently delivering on quality while lagging meaningfully on value (including its inconsiderable dividend yield) and growth. This has not changed since August 2023, even despite a few names being removed and a few added. Let me collaborate with the factor data.

Calculated using data from Seeking Alpha and the fund

As we can see, the fund has a solid weighted-average net margin and a double-digit Return on Assets. ROE is less reliable here as it is distorted primarily by debt-heavy Home Depot (HD) and Oracle (ORCL). Besides, 99.8% of its net assets are allocated to stocks with a B- Quant Profitability rating or higher. This is impressive. Nevertheless, its earnings yield remains fairly small. Also, growth (revenue and EPS) characteristics are rather bleak.

There are more data points worth sharing:

| Metric | 28-Aug | 2-Feb |

| Market Cap | $406.52 billion | $540.36 billion |

| P/S | 5.38 | 6.4 |

| 24M beta | 0.52 | 0.85 |

| 60M Beta | 0.85 | 0.87 |

| Median Net Debt/EBITDA (ex financials; negative figures were excluded) | 1.98 | 1.68 |

Calculated by the author using data from Seeking Alpha and the fund

As illustrated by the beta coefficients, OUSA does deliver on the low volatility factor.

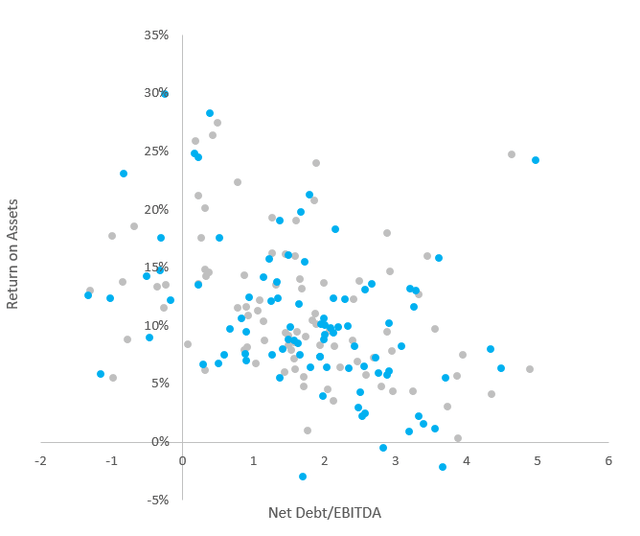

The next chart I would like to share is the one combining Return on Assets and Net Debt/EBITDA; the financial sector (13.3% weight) was removed.

Calculated using data from Seeking Alpha and the fund

The blue points represent stocks from the August version of the portfolio; the grey points represent those from February 2. As can be seen, most holdings have a Net Debt/EBITDA ratio well below 3x, with the portfolio-wise figure just below 2x. At the same time, there are numerous names with ROA above 10%. Please bear in mind that in a few cases, negative Net Debt/EBITDA resulted from negative net debt figures (i.e., cash and cash equivalents exceeded total debt) and not from negative EBITDA.

OUSA dividend characteristics

Since August, OUSA’s small weighted-average dividend yield has compressed further, now standing at ~2%.

| Portfolio | DY | Div Growth 3Y | Div Growth 5Y |

| February 2024 | 2.04% | 12.04% | 10.97% |

| August 2023 | 2.3% | 10.1% | 10.3% |

Calculated by the author using data from Seeking Alpha and the fund

The fund itself is yielding just 1.76% vs. IVV’s 1.39%.

On the positive side, its portfolio has double-digit WA dividend growth rates, while almost 77% of the holdings have a Quant Dividend Safety rating of B- or higher.

Does OUSA deserve a rating upgrade?

As the analysis above once again illustrated, OUSA has an excellent proposition for investors who are on the hunt for portfolios of adequately leveraged, grossly profitable dividend-paying names. There are a few issues, though. Quality has its price, as I have numerous times emphasized in my articles on the fund in the past. I am skeptical about investing in expensive, growth-light portfolios with market-like dividend yields, with OUSA being no exception. Its past returns do not justify a Buy rating as well, as the ETF underperformed IVV since the index change, with the annualized return delivered during the June 2020-January 2024 period being 3.2% lower, though it had a 2.2% lower standard deviation, no coincidence for a strategy favoring less volatile names. Still, for a fund with a 48 bps expense ratio, this is a disappointing result. That is to say, the Hold rating is maintained.