Asadnz/E+ via Getty Images

As an investor, I take pride in my track record. Unfortunately, nobody is right 100% of the time. Every so often, what I thought was going to be a good prospect turns out to be a dud. And the latest example of that I would like to point to involves Holley (NYSE:HLLY), an enterprise that is dedicated to providing customers with aftermarket parts for cars and trucks. Estimates vary as to how many vehicles are on the road in the US alone. The most typical estimate that I see is between 290 million and around 300 million. Naturally, this makes the space that Holley operates in quite large. Add on top of this the fact that the average age of vehicles on the road is growing, which means that aftermarket parts demand will likely continue rising, and you can imagine why I was bullish about the business when I wrote about it in August of 2022.

Since then, things have not gone exactly as planned. While the S&P 500 is up a whopping 22.4%, shares of Holley have dropped by 17.5%. That’s a massive disparity that I can only call a significant disappointment. To be clear, this decline was not exactly unwarranted. The data provided so far for 2023 shows some meaningful weakness from a revenue and profit perspective, cash flow data is mixed, but not exactly pleasant. The most recent data suggests that the worst times for the business might be over. But when you consider just how volatile performance has been from a fundamental perspective, shares are not cheap enough to me. I know this is a turnaround from my prior opinion of the company well over a year ago. But during this time, I have gotten even more strict when it comes to my criteria. Because of this, I’ve decided to downgrade the stock from a ‘buy’ to a ‘hold’.

A look at recent volatility

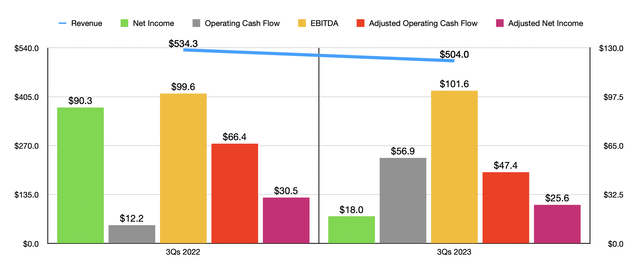

While it would be tempting to focus on data from the 2022 fiscal year, we are now well into 2024 and our time would best be spent focusing on 2023 results. As of this writing, we only have data covering the first nine months of that year. But that data is not particularly pleasant. During the first nine months of 2023, revenue for the institution totaled $504 million. That represents a decline of 5.7% compared to the $534.3 million generated the same time one year earlier. Management attributed this drop to supply chain constraints in electronic components, as well as a return to more normal levels of demand as the COVID-19 pandemic wound down. Lower unit volumes resulted in a reduction in revenue of $43.2 million. Thankfully, some of this was offset by higher pricing that contributed positively to the tune of $12.9 million to the company during this window of time.

The drop in revenue brought with it a decline in profits as well. A massive $56.6 million swing associated with the change in fair value of warrant liabilities, not to mention some other factors, pushed net income down from $90.3 million to $18 million. Even if we make certain adjustments, net profits went from $30.5 million in the first nine months of 2022 to $25.6 million the same time of 2023. It is true that operating cash flow rose from $12.2 million to $56.9 million. But if we adjust for changes in working capital, we get a drop from $66.4 million to $47.4 million. Meanwhile, EBITDA for the company managed to rise from $12.2 million to $101.6 million.

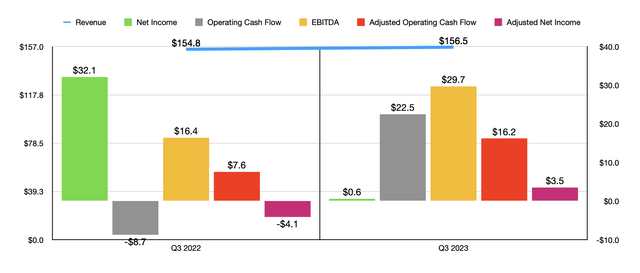

If this is the only data that we were to look at, I would be quite pessimistic indeed. However, if we zoom in on only the third quarter of 2023 relative to the same time one year earlier, the picture starts to look a bit better. In this case, revenue actually managed to inch up from $154.8 million to $156.5 million. That increase, management said, was driven mostly by a $2.4 million rise involving higher pricing that was only offset to the tune of $0.6 million by lower unit volumes.

Despite this improvement on the top line, and the fact that it was driven by higher pricing, net profits for the business actually fell from $32.1 million in 2022 to only about $0.6 million. This was in spite of a nice improvement in the firm’s gross profit margin from 31.3% to 37.3%. The change was largely the result of a massive fair value of warrant liability and fair value of earn out liability that both benefited the company the same time last year. On an adjusted basis, net profits actually expanded from a loss of $4.1 million to a gain of $3.5 million. Other profitability metrics also improved drastically. Operating cash flow went from negative $8.7 million to positive $22.5 million. On an adjusted basis, it expanded from $7.6 million to $16.2 million. And lastly, EBITDA for the company expanded from $16.4 million to $29.7 million.

This improvement on the bottom line should help the company outperform compared to what it achieved in 2022. Back then, EBITDA totaled $114.7 million. For 2023, management forecasted a reading of between $123 million and $128 million. But this should be on lower revenue of between $645 million and $675 million, compared to the $688.4 million the company reported for 2022. If we strip out other cost items estimated by management, operating cash flow should be around $40.5 million for 2023.

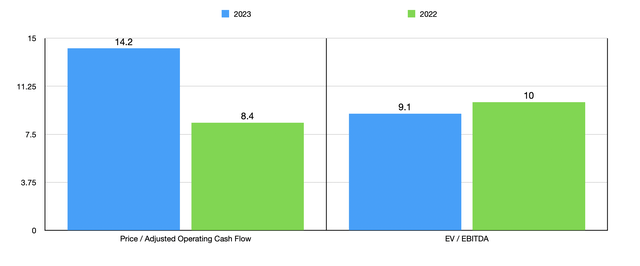

Using these estimates, I was able to value the company as shown in the chart above. I then compared the company to five similar enterprises as shown in the table below. If we use the 2023 estimates, I found that three of the five businesses ended up being cheaper than it when it comes to the price to operating cash flow approach. Meanwhile, using the EV to EBITDA approach, three of the five businesses are cheaper as well. This shows that, from a pricing perspective, the stock is more or less in the middle of the pack, perhaps tilted slightly in the direction of the higher priced firms.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Holley | 14.2 | 9.1 |

| Standard Motor Products (SMP) | 5.0 | 7.8 |

| Modine Manufacturing (MOD) | 22.4 | 13.8 |

| Patrick Industries (PATK) | 4.8 | 8.0 |

| Garrett Motion (GTX) | 2.3 | 5.7 |

| Cooper-Standard Holdings (CPS) | 25.2 | 69.2 |

Another factor to take into consideration is leverage. As of the end of the most recent quarter, Holley had net debt of $573.3 million. This gives it a net leverage ratio of 4.57. As the table below illustrates, this is substantially higher than four of the five competitors that I compared it to. This means that there is increased risk. The good news is that management is well aware of this. In December, the company announced that it paid down another $25 million worth of debt on its first lien borrowings. This brought total debt reduction up to $50 million since September of last year. Ultimately, that should save the company $2 million per annum in interest expense. However, the business does still have some progress to make before leverage drops to more reasonable levels.

| Company | Net Debt / EBITDA |

| Holley | 4.57 |

| Standard Motor Products | 0.92 |

| Modine Manufacturing | 0.81 |

| Patrick Industries | 2.65 |

| Garrett Motion | 2.32 |

| Cooper-Standard Holdings | 53.25 |

Takeaway

The ultimate objective of a value investor should be to buy shares of a company that are trading at a discount to their intrinsic value. The fact of the matter is that, based on the estimates I have, Holley it’s not exactly expensive. Relative to similar firms, it is perhaps around fair value. And on an absolute basis, I would argue that it might be slightly on the cheap side of the spectrum. The firm is also experiencing what could be the start of a recovery when we look at the most recent quarterly results. However, there are some issues to deal with. Debt is still high and the volatility and financial results from one time to the next necessitates some sort of discount. Investing becomes much more difficult when dealing with companies that are experiencing regular fluctuations in revenue and profits. Consistency lends itself to safety. So given these factors, I believe that a more appropriate rating for the business at this time would be a ‘hold’.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.