skynesher/E+ via Getty Images

If you’re anything like me, you’re looking at the S&P 500 approaching 5,000 and thinking: is there anything left to buy that’s not trading at a bloated multiple? Especially in the growth space, is there anything reasonable that won’t bite me if valuation multiples compress?

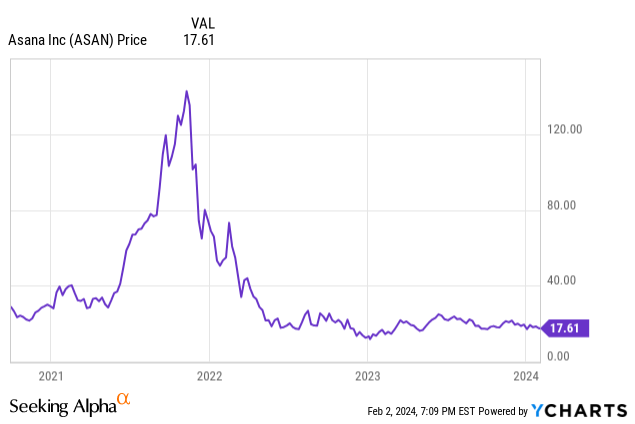

That’s where Asana (NYSE:ASAN) comes in. This collaboration software provider has not seen the same recent rallies as many of its tech peers, roughly flat since the start of 2024 even after only seeing single-digit gains in 2023 (substantially worse than most other software stocks). It’s a great time, in my view, for investors to re-assess the bull case for this reasonably valued software vendor.

I last wrote a bullish note on Asana in October, when the stock was trading at similar ~$18 levels. Needless to say, Asana has missed out on a lot of the last quarter’s rally in tech stocks, and for no good reason. While it’s true that Asana’s growth rates are decelerating, I’d say that the latest valuation more than compensates for that risk. And at this juncture in the markets, I’d prefer to lean on a cheaper (yet slower growing) tech stock than an overvalued growth star. It’s worth noting as well that Asana has done a tremendous job at reducing its losses, and is nearly approaching breakeven on a pro forma operating margin basis.

The next catalyst for Asana is its Q1 earnings release (expected on March 11). Expectations have drifted so low for this company that I think buying ahead of earnings is a wise move. Beyond the short-term catalysts, here is what I view to be the long-term bull case for Asana:

- Asana’s long-term demand will be bolstered by the ongoing shift to remote and distributed teams. More and more companies are embracing a distributed working model, if not a fully remote one. With fewer in-person touchpoints, software tools become critical to keeping teams together and in sync.

- Massive global TAM. Asana believes it has a $51 billion TAM by 2025 and is applicable to the global base of ~1.25 billion information workers. By that metric, Asana’s current user base represents only <5% of the global eligible workforce.

- Star leadership and insider buying. Asana continues to be led by its founder Dustin Moskovitz, who keeps buying shares as the stock dips.

- Land and expand. Asana adopts the classic software go-to-market playbook, which is to prove its concept and value with smaller teams at first, but eventually expand to entire organizations and companies. Dollar-based net retention rates are clocking in above 140% for companies spending more than $100,000 annually on Asana, a leading indicator that Asana’s traction among larger enterprises is growing.

- Huge gross margin profile. Asana’s pro forma gross margins are in the ~90% range, making it one of the highest-margin software companies in the market. While the company isn’t profitable today, that gross margin profile gives Asana plenty of leeway to scale profitably when it’s larger, as nearly every dollar of incremental revenue flows through to the bottom line.

From a valuation standpoint: at current share prices near $17, Asana trades at a market cap of $3.92 billion. After we net off the $530.0 million of cash and $44.9 million of debt on Asana’s most recent balance sheet, its resulting enterprise value is $3.43 billion.

Meanwhile, for FY25 (the year for Asana ending in January 2025), Wall Street analysts have a consensus revenue target of $724.8 million for the company, representing 12% y/y growth. This puts Asana’s valuation at 4.7x EV/FY25 revenue – quite a bargain for a tech stock still growing at a current mid-teens pace.

Stay long here and wait patiently for the rebound.

Q3 download

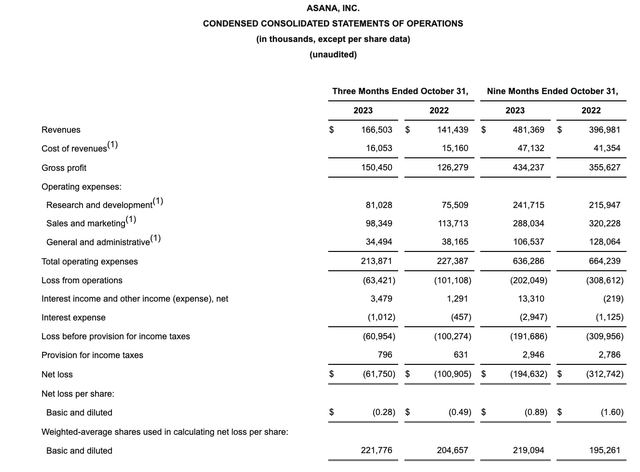

Let’s now go through Asana’s latest quarterly results in greater detail. The Q3 earnings summary is shown below:

Asana Q3 results (Asana Q3 earnings release)

Revenue grew 18% y/y to $166.5 million, slightly ahead of Wall Street’s expectations of $164.1 million (+16% y/y). Growth continued to decelerate relative to Q2’s 20% y/y pace.

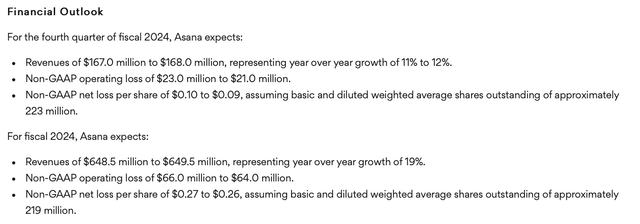

Unfortunately, Asana does expect growth trends to worsen in Q4 – as its latest guidance calls for growth to decelerate to 11-12% y/y.

Asana outlook (Asana Q3 earnings release)

Management continues to cite headwinds from the macro climate, which is especially impacting the company’s renewal base. Deal cycles continue to be longer than usual, though management notes that it is beginning to see signs of stabilization. As per CEO Dustin Moskovitz’s remarks on the Q3 earnings call:

As you can see, our investments in the enterprise are beginning to pay off as we further our partnerships with some of the largest companies across major industries.

While the macroeconomic headwinds continue, especially impacting business in our renewal base, we are seeing signs of stabilization in new business.

Overall, awareness and demand for work management continues to expand. Across our total customer base, we are at over 3 million paid seats, showing increasing adoption of Asana worldwide.”

Still, in spite of renewal headwinds, the company reports that net revenue retention rates still remain above 120% from customers spending more than $100k in ARR – indicating that large enterprises are still engaging in seat expansion with Asana and spending more.

The company rolled out a slew of new AI/automation-powered features. Among them is a feature called Smart Status, which can automatically identify blind spots and open questions on projects. The company notes that customer response to its AI solutions has been strong, potentially paving the way for a re-acceleration in growth rates.

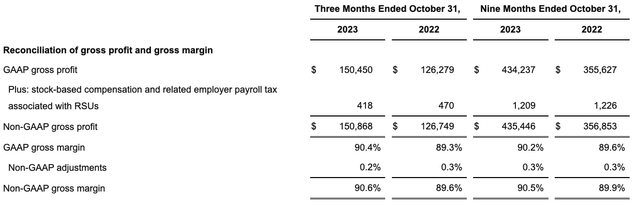

Profitability is another great offsetting relief to slower growth. Asana already has some of the highest gross margins in the software industry; in Q3, the company’s pro forma gross margins expanded a further 100bps to 90.6%:

Asana gross margins (Asana Q3 earnings release)

Notably, pro forma operating margins improved dramatically to -5.9%, more than thirty points better than -37.2% in the year-ago Q3. In particular, note that the company spent 20 points (as a percentage of revenue) less on sales and marketing. Less sales coverage may be impacting growth rates, but it’s certainly helping the bottom line.

Key takeaways

To me, Asana is too cheap to ignore in an expensive market. The company continues to grow at a respectable mid-teens pace while paving the path toward breakeven profitability. Added AI features continue to keep its product fresh and distinguish it from competitors. Stay long here and buy ahead of earnings.