MonthiraYodtiwong

With many market indexes at or near record highs, it is getting harder to find value, but I have been seeing buying opportunities arise in individual stocks. Many of these opportunities are coming when a company accounts for disappointing news or an earnings or guidance miss. As is often the case, investors tend to overreact to disappointing news in the short term and that can give the rest of us much better entry points, for either a short-term trade or the longer-term upside a stock might have.

With this strategy, I like to buy big pullbacks when I see that the company fundamentals are still strong, as they say, buy a broken stock, but not a broken company. This strategy could be even more rewarding if you buy a big pullback in the stock of a company that is in a sector that is likely to benefit from tailwinds in the coming years. With this in mind, I see what could be a “golden” buying opportunity in a mining stock that recently plunged based on shorter-term headwinds, but it could be favorably impacted by industry tailwinds over the next couple of years, along with new growth potential that is specific to this company starting around 2025. Let’s take a closer look:

B2Gold (NYSE:BTG) is trading in the $2 range after a recent plunge, but don’t let the stock price fool you because, unlike many low-priced stocks, this company has a very strong balance sheet; it is a profitable company, plus it is a low-cost gold producer and it offers a very generous dividend. This company has operations and mines in Finland, Mali, Uzbekistan, Namibia, and the Philippines.

Source: B2Gold Investor Presentation

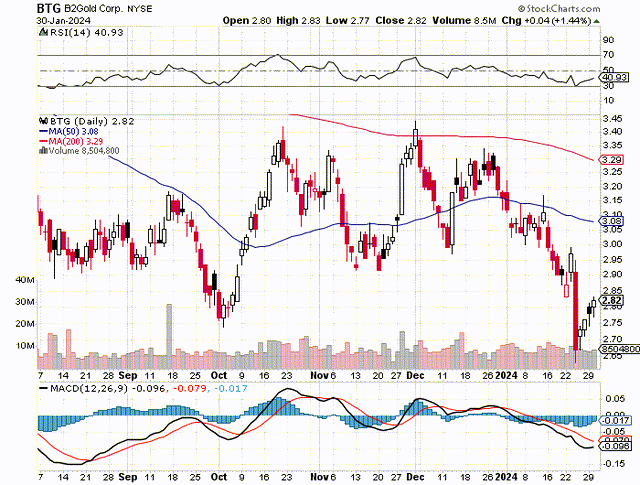

The Chart:

As the chart below shows, B2Gold shares were trading for around $3.30 in December, but have since plunged to around $2.70 on the recent news regarding reduced output. The stock appears oversold now, as it trades well below the 50-day moving average of $3.08 per share, and even further below the 200-day moving average of $3.30 per share.

Why The Stock Just Plunged:

On January 24, 2024, B2Gold announced there would be a reduction in 2024 production from 2023 levels which stood at about 1,061,000 ounces of gold. The company expects 2024 to be in the range of 860,000 to 940,000 ounces of gold. A recent Seeking Alpha article by Arundhati Sarkar (news editor) detailed the reasons for the reduced output and stated:

“The expected decrease in gold production relative to 2023 is predominantly due to lower production at the Fekola Complex as a result of the delay in receiving an exploitation license for Fekola Regional from the Government of Mali, delaying the 80,000 to 100,000 ounces that were scheduled in the life of mine plan to be trucked to the Fekola mill and processed in 2024” B2Gold Corp (BTG) said.

While this is a disappointment in the short term, it only appears to delay the inevitable which is expected to be a significant production increase in 2025. The above article goes on to say that the company expects 2025 output to hit record levels somewhere between 1,130,000 to 1,260,000 ounces of gold. The high end of this estimate would represent about a 20% increase from 2023 levels and an even larger increase from 2024 levels. This suggests that 2024 is a transition year for the company but it is one that could be positioning the company and the stock for outperformance as 2025 approaches.

The Balance Sheet And Earnings Estimates:

This company has an impressively strong balance sheet, with about $309 million in cash and just around $49 million in debt. In terms of earnings estimates, the company is expected to earn 30 cents per share for 2023, with earnings declining (because of reduced production) to about 21 cents per share for 2024. However, earnings are expected to nearly double in 2025 to 39 cents per share. If this level of earnings is achieved in 2025, it implies this stock is only trading for around 7 times the 2025 estimates which suggests significant undervaluation.

The Dividend:

Over the past few years, B2Gold has become a dividend growth stock, although it does not appear to be getting much credit for this or the generous yield it offers. For example, in 2019, the quarterly dividend was just 1 cent per share. However, it has been rising and the company now pays 4 cents per share as a quarterly dividend. Based on the current share price, this provides a yield of nearly 6%. I’d consider that a “golden” yield not just because of the industry it is in, but also because it is better than what you can get in a money market fund. So, this dividend yield is very compelling and it will become even more so if the Federal Reserve lowers interest rates. This dividend pays shareholders to wait for a significant share price rebound, which could likely be coming as production potentially surges in 2025. The expected increases in production and earnings in 2025 could also position the company to announce an increase in the dividend. The next dividend is expected to be paid in February.

What I Like About B2Gold:

Buying the pullback in B2Gold could make even more sense now because gold prices could be poised to rise and that creates incremental gains in terms of profit margins for a low-cost producer. I also see numerous other positives including the fact that this company has a very strong balance sheet, and it is a low-cost gold producer. On top of all this, I like the significant increase in output that is expected in 2025. Finally, the icing on the cake is the very generous dividend yield of nearly 6% and the rebound potential this stock offers.

At the current share price, B2Gold is trading below book value which is around $3.05 per share. On average, gold mining stocks often trade for about 1.7 times book value, so this is another indication that B2Gold shares are undervalued. If the shares were to trade at 1.7 times the $3.05 per share book value, the stock could be trading for about $5.20. The yield on the S&P 500 Index (SPY) is currently around 1.7%, and with B2Gold shares currently yielding nearly 6%, this is another sign that the stock is undervalued. This yield will only grow more valuable to investors as interest rates decline, and that could boost the share price in the future.

Clive Johnson is the CEO of B2Gold and he has a history of building and growing gold companies. Prior to his CEO position at B2Gold, Mr. Johnson was the CEO of Bema Gold which was acquired by Kinross Gold (KGC). If Mr. Johnson has similar plans for B2Gold, this company could be an acquisition target, but in my opinion, probably not until gold production is in full stride, which could be some time starting in 2025 and beyond.

I think this stock is a buy based on company projections, as well as because of the balance sheet strength and because of the generous dividend. I also think the recently announced exploration results from the Antelope deposit in Namibia could set the company up for significant growth and share price appreciation beyond 2025. Plus, I think this stock is a buy beyond all of these company-specific reasons because the industry fundamentals for gold appear ripe to provide a multi-year bull market. While this stock has not performed well for most investors over the past couple of years, you have to consider that gold has basically been treading water, and that has kept most gold mining stocks in the penalty box due to the major increase in interest rates. By 2025, there could be a major reversal in rates, combined with a major increase in production and a potential rally in gold prices which should be very supportive to B2Gold’s share price.

Remember when investors were unloading shares of Meta Platforms (META) for about $100, (an incredibly low valuation) because profits were down in 2022, and this was in spite of the fact the company had a strong balance sheet and solid future business prospects? Now that stock trades for nearly $400 per share. I think investors selling now could also be giving up on B2Gold at exactly the wrong time which is when the valuation is very low and future business prospects remain very strong, perhaps better than ever with the unique combination of potentially much higher gold prices and significant production increase in 2025 and beyond.

Based on my cash flow projections of roughly $600 million for 2025, I estimate the present value of this stock to conservatively be at least $4 per share. This is based on current gold prices of just over $2,000 per ounce, so this estimate will indeed be very conservative if gold advances in the coming year or so. Since gold miners have relatively fixed costs, an increase in the price of gold can have an exponentially positive impact on profits and that is why gold mining stocks can make huge runs during bull markets for gold.

B2Gold’s Antelope Project Could Be Another Upside Catalyst In 2025:

On January 31, 2024, B2Gold announced very positive drilling results at the Antelope deposit which is located at its Otjikoto Mine in Namibia. This exploratory drilling was done just 3 kilometers South of the open pit at phase 5 of the Otjikoto Mine which means it could have significant cost benefits due to the proximity of the Otjikoto processing mill. These new deposits have the potential to greatly extend the life of this mining project and boost production in the coming years. Regarding these promising drilling results, B2Gold said the Antelope deposit had the potential and goal to increase gold production levels to over 100,000 ounces per year from 2026 to 2031.

Why I Like The Gold Sector:

Gold prices have held up surprisingly well in spite of the massive interest rate hikes from the Federal Reserve. Now that interest rates appear to be poised to decline over the next couple of years, gold could be a prime beneficiary of this looser monetary policy. The recent “dovish” outlook from the Federal Reserve has already sparked a rally in gold back over the $2,000 per ounce level and this could just be the beginning. The other factor that could be a huge positive for gold and mining stocks is the fact that global debt and U.S. Government Debt levels have exploded in recent years and the debt levels are now growing exponentially. This makes many investors want to buy gold because it cannot be printed like the U.S. Dollar or other fiat currencies. Instability around the world, including wars, also makes gold an attractive asset class for many investors.

A recent CNBC article summarizes why 2024 could be a bullish year for gold, and why new record highs could be coming for this asset class, it states:

“Every time real interest rates have gone down, the Western investor has switched from being a gold seller to being a gold buyer,” Leigh Goehring, the other half of Goehring & Rozencwajg, said to CNBC.

MacRury echoed this sentiment, pointing to historical context as a reason he believes gold prices could hurtle towards new highs.

“Past easing cycles over the last 20+ years have corresponded with strong gold prices, and we expect to see gold set new record highs in 2024,” he wrote.

Another recent CNBC article points out the bullish view that Bernstein analyst Bob Brackett has on gold right now, which is due to the multi-decade historical pattern of gold rising when interest rates decline. It states:

“The pattern of gold rising on lower rates is supported by 50 years of history, with the precious metal rallying in seven of the nine previous rate cut cycles, according to Brackett.”

Potential Downside Risks:

One of the biggest potential risk factors is obviously the price of gold which dictates how much or how little a gold mining company can make. If gold prices were to plunge for some reason, this could significantly impact profit margins. Other major risks facing mining companies like B2Gold are labor strikes, mine safety issues, environmental concerns, and regulations as well as unstable jurisdictions and geopolitics.

In Summary:

It is rare to find a low-priced stock that can offer everything B2Gold can offer shareholders, which includes a very strong balance sheet, a generous dividend, as well as potential for a rebound in the share price. On top of all this, shareholders will get a near 6% yield while they wait for a higher share price. If gold prices break out, this stock could outperform, especially as we get closer to increased production levels and potentially much higher earnings in 2025.

No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor.