Caziopeia

Although the appliances industry might not seem all that exciting, it does offer the potential for some significant upside if you can buy a firm in this space at a good price. That’s where the beauty of value investing comes into play and truly shines. Even a business that is experiencing a weakening of financial condition can offer tremendous upside. And a great example of this can be seen by looking at Hamilton Beach Brands Holding (NYSE:HBB), a producer and seller of small electric household and specialty housewares appliances, as well as certain commercial products that are used in restaurants, hotels, and elsewhere.

Back in July of last year, I wrote a follow-up article discussing the investment worthiness of Hamilton Beach Brands. At that time, shares had been experiencing some downside. This was in spite of the fact that management was pushing out new products and engaging in cost-cutting initiatives. Because the company was still cash flow positive and trading at very low multiples, not only on an absolute basis but also relative to other players in the space, I had no choice but to keep it rated a ‘buy’. Since then, investors have been rewarded handsomely, with shares up 93.1% compared to the 7.3% rise seen by the S&P 500. Now that the stock has moved up, it’s important to be mindful of the goal of value investing. The goal is not necessarily to capture every penny of upside possible. Rather, it’s to capture the easy money that’s on the table. At this point, I feel like that goal has been achieved, and then some. Because of this, and in spite of continued improvement recently on the bottom line, I am downgrading the company to a ‘hold’.

Mixed results and fair value

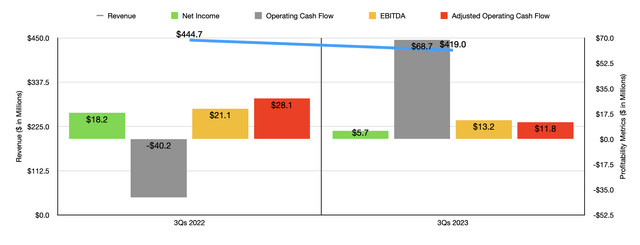

If you were to look at the financial results achieved by Hamilton Beach Brands for the first nine months of the 2023 fiscal year compared to the same time in 2022, your initial inclination might be to run for the hills. This is because that data, on the whole, does not paint a very pretty picture. Revenue in the first nine months, for instance, totaled $419 million. That’s down rather considerably from the $444.7 million generated the same time one year earlier. A reduction in unit volume and a change in product mix was responsible for $15.6 million of the company’s revenue decline. A reduction in average sales prices pushed sales down by another $11.7 million. In fact, revenue would have been even lower had it not been for a $1.6 million benefit that the business received from foreign currency fluctuations.

Author – SEC EDGAR Data

With this drop in sales came, unfortunately, a decline in profits. Net income of $5.7 million paled in comparison to the $18.7 million in profit achieved one year earlier. On top of suffering from the drop in revenue, the company saw some of its cost items increase. The most significant involved selling, general, and administrative costs. These rose from 15.1% of sales to 18.7%. However, the reason is a bit tricky. You see, during the first quarter of 2022, the business recognized a $10 million insurance recovery. This is something that will not be repeated in future periods. Without this, the rise in this cost item would have been from 17.4% of sales to 18.7%. This was largely related to higher employee-related expenses.

Other profitability metrics for the business were mixed but mostly worse. The one bright spot was operating cash flow. It went from negative $40.2 million to positive $68.7 million. But if we adjust for changes in working capital, we would actually get a drop from $28.1 million to $11.8 million. And lastly, there is EBITDA. According to the data provided, it fell from $21.1 million in the first nine months of 2022 to $13.2 million during the first nine months of 2023.

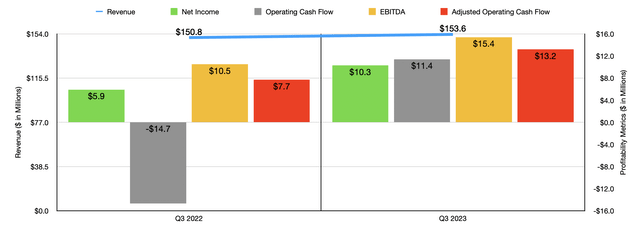

Author – SEC EDGAR Data

The picture for the business does change for the better when we look at the most recent quarter, which is what has investors excited. For the third quarter of 2023, revenue totaled $153.6 million. That’s up slightly from the $150.8 million reported one year earlier. It is true that the company benefited to the tune of $1.2 million from foreign currency fluctuations. However, average sales prices hit revenue to the tune of $13.9 million. In fact, the only thing that stopped revenue from falling was a $15.5 million benefit associated with higher unit volumes and a change in product mix. Even though the commercial market was an area of weakness for the firm, sales in the Latin American and Mexican consumer markets jumped nicely. Management did not provide any additional details as to why this was. But I would imagine that, as the world started to normalize again, demand for appliances at home as opposed to commercial appliances would increase as people would start eating at home more often, especially with higher prices impacting consumer spending.

The growth in volume and change in product mix also seem to have a positive impact on costs. The company’s net profit nearly doubled from $5.9 million to $10.3 million. The biggest improvement on the cost side came from the cost of sales, which dropped from 76.9% of revenue to 73.9%. Management attributed this to lower product costs, as well as a reduction in distribution and warehousing expenses, all of which combined more than offset the margin compression that would normally accompany a decision to cut prices. Net profits weren’t the only bright spot for the firm. Operating cash flow went from negative $14.7 million to positive $11.4 million. On an adjusted basis, it grew from $7.7 million to $13.2 million. And lastly, EBITDA went from $10.5 million to $15.4 million.

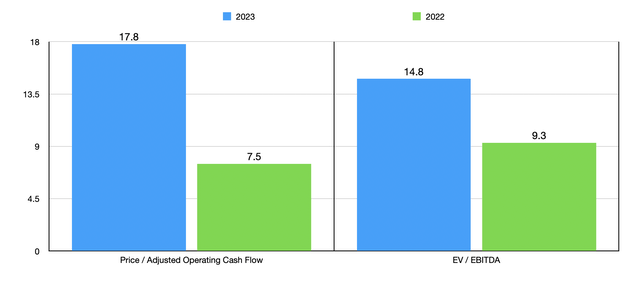

Author – SEC EDGAR Data

This sudden change on the top and bottom lines does make valuing the company rather difficult. If we simply annualize results for the nine months of 2023 relative to the same time in 2022, we would get adjusted operating cash flow of $15.1 million and EBITDA of $21.5 million. This is probably the most conservative reading for these metrics we can expect if we assume that the third quarter is indicative of better times to come. Using those estimates, I was able to value the company as shown in the chart above. But I also valued it using data from 2022. There is a rather significant disparity as the chart shows. But in both cases, shares are massively more expensive than they were back in July of last year. In the table below, I then compared Hamilton Beach Brands to four similar firms. If we use a more conservative 2023 estimate, three of the four companies were cheaper than our prospect. And when it comes to the EV to EBITDA approach, only one of the three companies with positive readings ended up being cheaper.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Hamilton Beach Brands | 17.8 | 14.8 |

| Traeger (COOK) | 5.2 | 302.7 |

| Helen of Troy (HELE) | 7.4 | 11.8 |

| National Presto Industries (NPK) | 14.4 | 15.0 |

| Aterian (ATER) | 20.3 | N/A |

Takeaway

As things stand, both the absolute valuation and relative valuation of Hamilton Beach Brands are difficult to determine. It’s always most difficult when a company is going through a major change. In the best case, shares do look cheap compared to some of our firms and don’t look bad on an absolute basis. In the worst case, the company is perhaps closer to fairly valued on a relative basis and pricey on an absolute one. As a value investor, it’s important to be overly conservative and to have a good margin of safety. And even in the best scenario, which is one where the firm’s financials come to mirror what was seen in 2022, I don’t see much of a margin of safety at all. Because of this, I have decided to downgrade the stock from a ‘buy’ to a ‘hold.’

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.