Zerbor

RDVI Strategy

FT Cboe Vest Rising Dividend Achievers Target Income ETF (BATS:RDVI) is an actively managed fund launched on 10/19/2022. It has a stock portfolio of 50 stocks, a 12-month distribution rate of 8.46%, and an expense ratio of 0.75%. Distributions are paid monthly.

As described by First Trust, the fund “seeks to provide investors with current income with a secondary objective of providing capital appreciation.”

RDVI tracks the same underlying index as First Trust Rising Dividend Achievers ETF (RDVY), and additionally sells call options to enhance distributions. More specifically:

the Fund will pursue its investment objective by investing primarily in U.S. exchange-traded equity securities contained in the Nasdaq US Rising Dividend Achievers™ Index and by utilizing an “option strategy” consisting of writing (selling) U.S. exchange-traded call options on the S&P 500® Index or exchange-traded funds that track the S&P 500® Index.

To be eligible in the Nasdaq US Rising Dividend Achievers Index, companies must:

- be in the top 1,000 market capitalizations of the NASDAQ US Benchmark Index with an average daily trading volume of over $5 million,

- not be classified as REIT,

- have paid a dividend in the trailing 12-month period greater than the dividend paid in the trailing 12-month period three and five years prior,

- have EPS in the most recent fiscal year greater than in the 3 prior fiscal years,

- have a cash-to-debt ratio above 50%,

- have a trailing 12-month payout ratio below 65%.

Companies passing these criteria are ranked by a factor combining dividend increase over the previous five years, current dividend yield, and payout ratio. The 50 best-ranked companies are included in equal weight. If exposure to a sector is over 30%, the lowest-ranked company in that sector is replaced with the next highest-ranked company from another sector. The index is reconstituted annually and rebalanced quarterly.

RDVI Portfolio

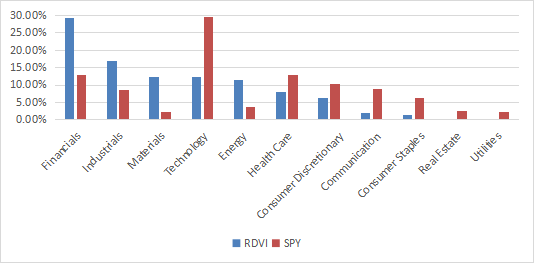

The heaviest sector is financials with 29.4% of asset value, followed by industrials (16.9%). Materials, technology and energy are between 11% and 13%, whereas other sectors are below 8%. Compared to the broad index S&P 500 (SP500), RDVI massively overweights financials, industrials, materials and energy. It underweights mostly technology, communication, consumer staples and ignores real estate and utilities.

Sector breakdown (Chart: author; data: First Trust, SSGA)

The portfolio is rebalanced in equal weight on a quarterly basis, but position sizes may drift with price action. As of writing, the top 10 holdings, listed in the next table with fundamental metrics, represent 21.6% of asset value. The heaviest position weighs 2.24%, so risks related to individual companies are low.

|

Ticker |

Name |

Weight |

EPS growth %TTM |

P/E TTM |

P/E fwd |

Yield% |

|

American Express Company |

2.24% |

13.93 |

18.12 |

15.88 |

1.18 |

|

|

Mueller Industries, Inc. |

2.21% |

-3.49 |

9.01 |

10.42 |

1.21 |

|

|

Mastercard Incorporated |

2.19% |

15.73 |

38.97 |

32.08 |

0.57 |

|

|

Microsoft Corporation |

2.17% |

22.94 |

36.52 |

34.93 |

0.74 |

|

|

Accenture plc |

2.15% |

-1.99 |

34.37 |

30.30 |

1.39 |

|

|

Lam Research Corporation |

2.14% |

-30.47 |

32.18 |

28.63 |

0.96 |

|

|

Nucor Corporation |

2.14% |

-37.39 |

10.32 |

14.09 |

1.16 |

|

|

Visa Inc. |

2.14% |

22.06 |

32.39 |

27.92 |

0.75 |

|

|

Abbott Laboratories |

2.13% |

-16.50 |

35.06 |

24.77 |

1.92 |

|

|

Reliance Steel & Aluminum Co. |

2.13% |

-22.20 |

12.17 |

13.28 |

1.38 |

Fundamentals

RDVI looks much cheaper than the S&P 500 regarding valuation metrics, as reported in the next table. Nevertheless, these numbers are biased by the sector breakdown: “price-to-something” ratios are lower in the financial sector, and also less reliable. More interestingly, RDVI also has much better growth metrics.

|

RDVI |

SPY |

|

|

Price/earnings TTM |

10.81 |

23.61 |

|

Price/book |

1.9 |

4.19 |

|

Price/sales |

1.69 |

2.7 |

|

Price/cash flow |

9.14 |

16.37 |

|

Earnings Growth |

27.08% |

15.43% |

|

Sales Growth |

19.73% |

11.44% |

|

Cash Flow Growth |

44.47% |

7.98% |

Data: Fidelity.

Among the 50 stocks held by the fund, two are risky regarding my metrics. In my portfolio reviews, risky stocks are companies with at least 2 red flags among: bad Piotroski score, negative ROA, unsustainable payout ratio, bad or dubious Altman Z-score, excluding financials and real estate where these metrics are unreliable. Here, risky stocks weigh only 3.9% of asset value, which is a good point. However, keep in mind that 29.4% of the portfolio (financials) is not assessed in this count.

According to my calculation of aggregate metrics reported in the next table, quality is similar to the benchmark: the average Piotroski F-score is a bit lower, and the return on assets is a bit higher.

|

RDVI |

SPY |

|

|

Atman Z-score |

3.75 |

3.67 |

|

Piotroski F-score |

5.43 |

5.99 |

|

ROA % TTM |

8.31 |

6.99 |

Historical Performance

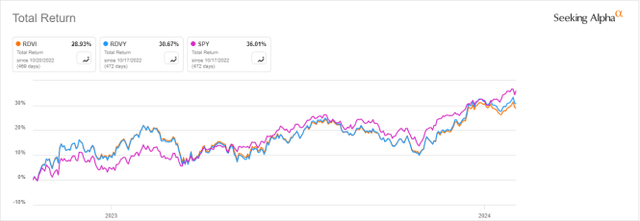

The next chart plots total returns since inception of RDVI, RDVY (tracking the same index without options) and SPY. RDVI is close behind RDVY and both have underperformed the broad benchmark. However, RDVI’s track record is too short to assess the potential of the strategy in the long term.

RDVI vs RDVY, SPY (Seeking Alpha)

Competitors

The next table compares the characteristics of RDVI and five ETFs implementing buy-write strategies in the S&P 500 universe (holding stocks and selling call options):

- First Trust BuyWrite Income ETF (FTHI).

- Global X S&P 500 Covered Call ETF (XYLD).

- Invesco S&P 500 BuyWrite ETF (PBP).

- JPMorgan Equity Premium Income ETF (JEPI).

- Global X S&P 500 Covered Call & Growth ETF (XYLG).

|

RDVI |

FTHI |

XYLD |

PBP |

JEPI |

XYLG |

|

|

Inception |

10/19/2022 |

1/6/2014 |

6/21/2013 |

12/20/2007 |

5/20/2020 |

9/18/2020 |

|

Expense Ratio |

0.75% |

0.85% |

0.60% |

0.29% |

0.35% |

0.60% |

|

AUM |

$697.45M |

$422.31M |

$2.75B |

$94.14M |

$31.62B |

$62.49M |

|

Avg Daily Volume |

$6.35M |

$4.01M |

$21.23M |

$368.04K |

$203.59M |

$538.71K |

|

Yield TTM |

8.61% |

7.68% |

10.14% |

4.00% |

7.96% |

4.73% |

RDVI is the third-largest fund in this group, has the second-highest fee and the second-highest yield.

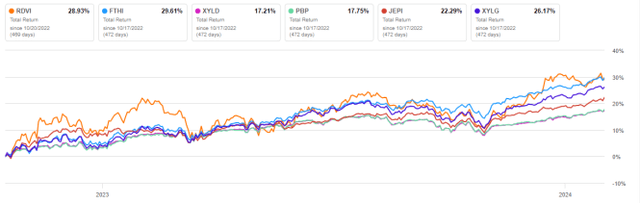

Regarding total return since inception, RDVI is the second-best performer, almost on par with FTHI. It was ahead of the competition for a significant part of this period.

RDVI vs competitors since inception (Seeking Alpha)

Takeaway

FT Cboe Vest Rising Dividend Achievers Target Income ETF combines a dividend growth strategy and an S&P 500 option strategy with a primary objective of current income. It is overweight in financials, but well-diversified across holdings thanks to an equal-weight methodology. Valuation and growth metrics look attractive, whereas quality is similar to the benchmark.

The FT Cboe Vest Rising Dividend Achievers Target Income ETF track record is short, but promising in its category: it has performed well among ETFs implementing a buy-write strategy with S&P 500 options.