neilkendall

On Thursday afternoon, Eastman Chemical (NYSE:EMN) reported mixed earnings. Back in November, I suggested investors sell shares. Since then, they have risen 14%, which is a solid absolute return, though it has lagged the S&P 500’s 17% return. While I am not surprised to see shares lag the S&P, the magnitude of their rally has exceeded my expectations. Given results are not better than I expected, I would continue to recommend avoiding EMN stock.

Seeking Alpha

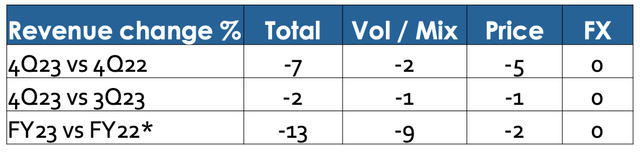

In the company’s fourth quarter, Eastman earned $1.31, which beat estimates by a penny even as revenue fell by 7% to $2.2 billion. Adjusted EBIT margins of 10.1% were down 120bp from Q3 as EPS declined by $0.16 sequentially. On the positive side, Eastman closed the sale of Texas City Operations for $490 million. This has bolstered its financial position. EMN now has $548 million of cash on hand and $4.3 billion of net debt, which is down $360 million from a year ago. On the cash flow front, Eastman had $260 million in favorable working capital in Q4; this was $367 million for the year. It generated $546 million of free cash flow; $179 million net of working capital in 2023. As you can see, EMN continues to see pressure on both volumes and pricing.

Eastman Chemical

Advanced Materials is Eastman’s primary unit and produces plastics and chemicals for consumer goods, autos, and construction. We saw some deceleration here with sales falling 4% from last year and 5% from last quarter. Autos remains the primary source of strength while construction and medical have been weak. Faced with lower demand, EMN has reduced capacity utilization, taking the opportunity to do maintenance work. Pricing is down 1% with volumes driving the rest of the decline. In Q3, prices were up 1% from last year, so my hope that Q3 showed stabilization was a bit premature. In 2024, management expects adjusted EBIT over $450 million. That is a significant increase from the $395 million in 2023. That is because its Kingsport methanolysis facility is set to generate revenue soon and is expected to contribute $75 million to 2024 EBITDA. Excluding this, EBIT will fall another ~5% in 2024.

Its AFP unit (additives and functional products) continues to face headwinds with revenue down 15% from last year and 4% sequentially. Building and construction weakness continues to be the primary headwind. The Chinese construction market is a critical end market for this unit. With news that Evergrande is being liquidated, it is hard to feel anything but cautious on the Chinese real estate sector. Management expects EBIT to be similar to 2023’s $436 million. However with H2 EBIT running at a ~$350 million pace, this may be a bit optimistic.

I have written in the past that I am fairly positive on the US construction market, which is why I have recommended companies like Nucor (NUE). That is because much of the strength in US construction is due to federal government spending, which is noncyclical and has been passed into law. The Chinese real estate sector is much opaquer, and it is hard to know when the Chinese government will step in to support activity. If we see a larger policy response from China, I expect EMN to benefit as demand for its chemicals quickly recovers. I do not see signs this is imminent, and the sector continues to face pressure, which is why EMN revenues have continued to fall. This is a reason I am negative on shares, but if China does act more aggressively, that is an upside risk to the stock. It is important to be clear EMN is likely more levered to Chinese construction activity than US construction activity.

Its Fiber unit has continued to benefit from the delayed pass-through of higher natural gas prices in Europe, which have helped margins recover. EBIT margins expanded from 18% last year to nearly 33% this year, and this tailwind should continue for at least another quarter.

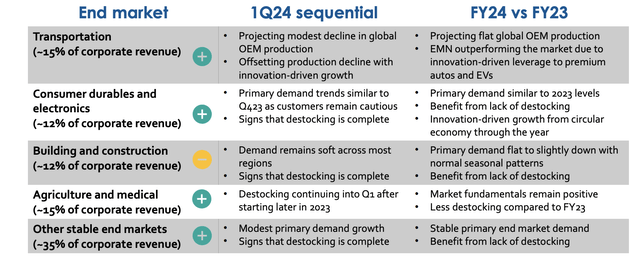

On the positive side, Eastman believes customers have largely destocked inventories with aggressive actions last quarter in agriculture, medical, and packaging. Several of its end markets are starting to show some “modest recovery.” Because customers were working down inventory, EMN faced worse demand than end market activity in 2023. With this headwind largely complete, EMN results should at least match end market activity.

As you can see below, Eastman is painting an optimistic picture on customer demand in 2024. It generally sees growth outside of construction, where China is an ongoing problem as noted above. It is important to note that while EMN is targeting growth across multiple markets, this is “back half weighted” because in Q1, it expects sequential declines in transportation and agriculture with consumer electronics broadly stable.

Eastman Chemical

I am not saying that this positive growth will not materialize as forecast, just that this positive momentum is not quite here yet, and another sequential weakening in Q1 could worry markets that this recovery takes longer to be realized. Essentially, the lack of destocking is a clear positive for the company, but whether we see material growth is still unclear. Additionally, as Eastman highlights, it has significant electric vehicle exposure. Based on comments from Tesla (TSLA), Ford (F), and others, this growth may moderate in 2024 relative to initial hopes.

In 2024, Eastman is guiding to $7.25-$8 in EPS, which should translate to $1.4 billion in operating cash flow. Management is also guiding to no more than $800 million in cap-ex. In other words, free cash flow should be at least $600 million. This is consistent with my November forecast for $625 million in 2024 free cash flow. It also expects higher share repurchases vs the $150 million in 2023

This free cash flow performance is better than 2023, particularly considering working capital will be less of a tailwind, and it is consistent with activity troughing in H1 2024. I do not consider this guidance unrealistic; it is similar to my expectations. However, it seems to me shares are pricing in an outcome at least this good, if not substantially better. EMN is a cyclical, commodity chemical company with a market capitalization just under $10 billion. That gives it a forward free cash flow yield of ~6.2%. That is a full valuation, particularly given its exposure to the Chinese construction market, which could just as easily get worse as get better.

As investors digest these earnings, I see the potential for Eastman to underperform as it is clearer that management sees some further sequential weakening in Q1, making its forecast growth in 2024 uncertain. Additionally, even if this recovery materializes, shares full reflect it. I continue to see shares returning to the mid-$70’s and would avoid the stock, with the primary upside risk being a more forceful policy response from the Chinese government to boost construction.