RonFullHD

Synopsis

Lennox (NYSE:LII) is a company that designs, manufactures, and markets a range of heating, ventilation, air conditioning, and refrigeration products, which are sold through a network of independent dealers and distributors.

LII’s historical financials have shown strong revenue growth in 2021 and 2022. On top of that, its margins have remained robust over the years. Moving onto its full-year 2023 result, revenue growth has slowed down significantly to 6% compared to the double-digit rates in 2021 and 2022. Looking ahead, its acquisition of AES is expected to continue supporting its growth outlook as it has played a key role in 4Q23’s growth. However, the destocking situation is expected to flow into 1Q24, which will create some headwinds. Given the deceleration in revenue growth rate in 2023, its current share price lacks sufficient margin of safety. Therefore, I am recommending a hold rating for LII.

Historical Financial Analysis

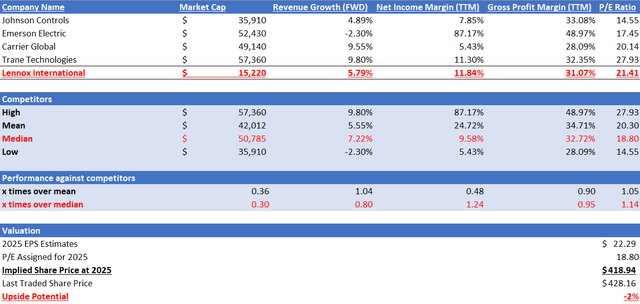

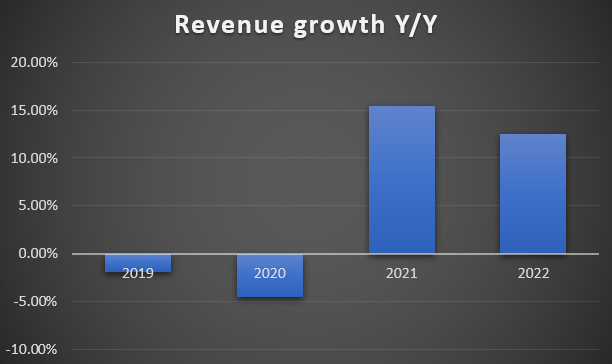

LII’s historical financial results have been volatile, but it has been showing a strong recovery ever since 2020. In 2020, revenue fell 5% due to the impact of the COVID-19 pandemic on its commercial and refrigeration segments. In 2021, revenue was up 15% due to higher sales volumes and an improved combined price and mix. In 2022, revenue growth continued to be strong, at 12.50%.

Author’s Chart

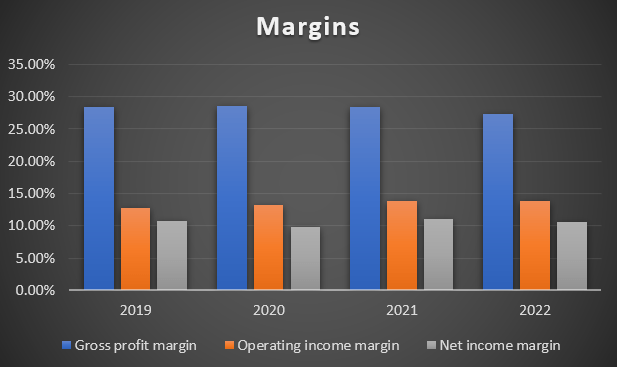

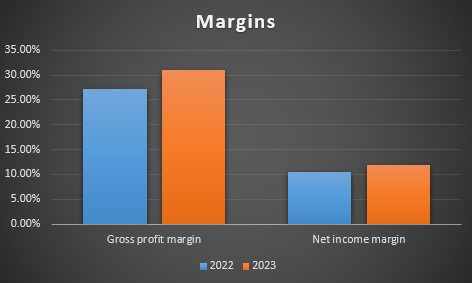

Moving down the P&L, LII’s margins remained robust over the last 4 years. In 2022, the gross profit margin reported was 27.23%. Its operating margin was 13.80%, while its net income margin was 10.54%. In 2019, gross profit margin was 28.36%, operating income margin was 12.82%, and net income margin was 10.73%.

Author’s Chart

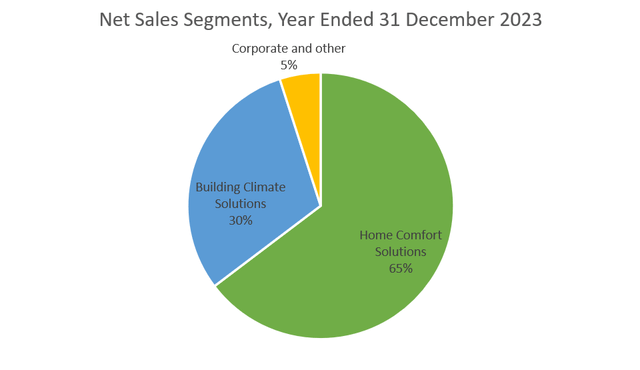

Net Sales Segments

Their major segments fall under Home Comfort Solutions [formally known as residential], making up ~65% of the revenue, while Building Climate Solutions [formally known as commercial segments] make up ~30%. Under Home Comfort Solutions, they produce and sell a wide variety of HVAC equipment and accessories. These are sold under several brand names via a network of their dealers and independent distributors. Under Building Climate Solutions, they produce and market unitary heating and cooling systems in North America. Mostly for use in light commercial settings such as low-rise office buildings, eateries, shopping malls, and schools. Aside from equipment sales, they also provide services such as installation, maintenance, and services. 88% of commercial revenue comes from equipment sales, while the rest lies in service. The remaining 5% is under Corporate and others; they produce and sell equipment for the commercial refrigeration market.

4Q23 Earnings Results Analysis

LII released its 4Q23 earnings results on 31 January 2024. In this quarter, revenue increased 6% year-over-year to $1.2 billion. Its core revenue, which excludes European operations, grew 7% year-over-year to $1.1 billion. The 6% revenue growth is attributed to better pricing and a favorable mix, but was partially offset by lower volume. Under the home comfort solutions segment, revenue increased by 1%, while under the building climate solutions segment, revenue grew by 19%.

Moving onto profitability, the operating income reported was $185 million, which represents an operating income margin of 16%. Its operating income grew 41% year-over-year. Diluted EPS grew an impressive 52% to $4.04, but on an adjusted basis, diluted EPS was up lower but still at a commendable 41% to $3.63.

Full Year 2023 Results

On a full-year 2023 basis, total revenue also increased by 6% to $5 billion. Same as in 4Q23, this growth is attributed to better pricing and a favorable mix but was partially offset by lower volume. For its home comfort solution segment, revenue grew at a modest rate of only 1%, while its building climate solution revenue was better at 18%. Lastly, corporate and other increased 6% year-over-year.

In terms of full-year profitability, operating income grew 20% to $790 million, which represents an operating margin of 15.9%. Its full-year diluted EPS increased 19% to $16.54. On an adjusted basis, diluted EPS grew 27% to $17.96.

Looking at its full-year 2023 margin against 2022, it is clear that it has expanded slightly, but the expansion is modest. FY23 gross profit margin reported was ~31.07% vs. 2022’s ~27.23%. FY23’s net income margin was ~11.84% vs. 2022’s ~10.54%.

Author’s Chart

Destocking Situation Overflowing into 2024

In 2023, LII faced an unprecedented level of destocking. In 4Q23, 2-step distribution channel sales volumes were impacted by the destocking situation, which caused a volume decrease of more than 20%. On a more positive note, its direct-to-contractor sales were still robust.

Looking ahead, management is expecting some destocking to flow into 1Q24, but they are confident that by the second half of the year, the destocking situation will recover. One of the reasons for that is that distributors will start to prepare for the A2L transition. However, management does not anticipate any massive pre-buy activities due to inventory fatigue.

Inflation Reduction Act Impact Not as Expected

Secondly, the inflation reduction act [IRA] that was introduced in 2022 is anticipated to drive up demand. One of the aims of the act is to reduce carbon emissions, and this can be done by promoting take-ups and upgrades to energy-efficient technologies. In addition, this act would possibly encourage the purchase of more energy-efficient products, thus further bolstering demand and the growth outlook. However, in the most recent 4Q23, management had little expectation of the act bolstering growth as the impact for full-year 2023 was less than expected.

AES Acquisition

LII has recently acquired Architectural Engineering Services [AES] Industries, one of the biggest manufacturers of roof curbs and drop-box diffuser systems in the US, committed to service and sustainability for the light commercial market. They provide services for installation, adapter curbs, and recycling. This will be included in the LII Commercial Business segment, increasing capacity for turnkey installations and improving cross-selling opportunities. Aside from aligning with LII’s strategic goals, it also creates a new revenue stream for the business. It also allows LII to have greater cost efficiencies as AES produces parts and accessories in-house, especially in core adaptors. This helps boost profitability and build a stronger competitive advantage in the industry.

Comparable Valuation Model

The following four competitors are extracted from LII’s annual report. In terms of market size, LII is significantly smaller than its competitors. LII’s market capitalization is $15.22 billion compared to its competitors’ median of $50.78 billion. In terms of forward revenue growth, LII’s growth rate is below its competitors’ median. LII forward revenue growth rate is 5.79% while its competitors’ median is 7.22%.

Moving onto profitability, LII’s gross profit margin TTM of 31.07% is below its competitors’ median of 32.72%. However, it outperformed in terms of net income margin TTM. LII reported 11.84% while its competitors’ median is 9.58%.

Currently, LII’s forward P/E ratio is trading at 21.41x, higher than its competitors’ median of 18.80x. However, it is trading below its 5-year average of 22.56x. Given its weak full-year 2023 results and lower forward growth outlook compared to competitors, I believe that LII should be trading at its competitors’ median P/E of 18.80x. Using 18.80x, my target share price is $418.94, which reflects a small downside of 2%.

Risk

As discussed above, its acquisition of AES has continued to produce positive results, which helped support its 4Q23’s growth. In addition, the destocking situation is anticipated to recover in the second half of 2024. These tailwinds will potentially drive the next few quarters’ results higher. If LII’s upcoming quarter’s earnings results were to beat market estimates, we might see its share price appreciate as the market revises its expectations.

Conclusion

In conclusion, LII’s past financial results have shown strong growth and recovery from the negative impact of COVID-19. Despite fluctuating revenue, its margins over the past four years have remained stable. For its latest full-year 2023 result, revenue growth has decelerated drastically when compared to 2021 and 2022. On a brighter note, 2023 margins have remained robust when compared to the previous year.

Looking ahead, the challenging destocking situation LII faced in 2023 is expected to flow into the first quarter, but management expressed confidence that it will recover by the second half of the year. In addition, the anticipated tailwind from the IRA was not as impactful as expected in 2023. However, on a positive note, its acquisition of AES continues to produce positive results, which helped to drive growth for 4Q23. Given the deceleration in revenue growth for 2023 and the destocking overflowing situation, combined with my target share price indicating no upside potential, I am recommending a hold rating as of now.