Assembly/DigitalVision via Getty Images

Background

Granite Point Mortgage Trust (NYSE:GPMT) is a commercial real estate trust that has a mix of commercial properties that they lease out to tenants. I wrote about them a few years ago and actually recommended them when they were under $5 at the time. I thought the pandemic hit their share price too hard and they were trading at way too large of discount to their book value. I got the call right, as they went up around 200% before I sold the last of my shares. However, I can’t help but feel I just got lucky as almost everything that wasn’t going bankrupt right at that time was recovering.

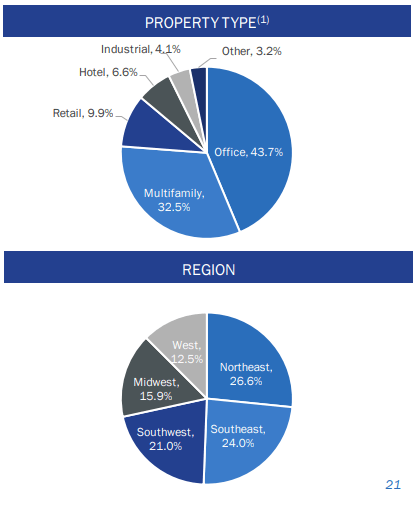

I have recently reviewed GPMT to see if I want to buy back in now that the share price is all the way back down under $6 and the yield is back up to double digits. Even though they trade at similar prices to when I made my call on them in 2020, I think there is more to worry about today. Their book value has been steadily falling ever since the pandemic and they still have a worrying amount of troubled properties- mostly due to a large percentage of their portfolio being in office spaces. Here is a breakdown of their product mix:

Granite Point Investor Relations (Granite Point Investor Relations)

As you can see, GPMT is very well diversified by region. It’s the property type that worries me. I don’t have any reason to believe Multifamily is especially troubled, but Office properties have been pressured ever since the pandemic and I expect they will continue to be for several more years. Even with many businesses returning to the office, there are still many more that have not and there are many that have done a hybrid situation. I, for instance, work full time from home. My company kept part of its office space, but has downsized from what they had before. Because of the nature of long leases, I still expect Office properties to be pressured for a while longer. It has put businesses in the driver’s seat and property rental places with too much inventory fighting over tenants.

Office properties being pressured has been evident ever since the pandemic. Pre-pandemic (end of 2019), GPMT had a book value of $18.58. By the end of 2020, it had fallen to $16.92. At the end of 2021, it was $16.70. By the end of 2022, it was down to $14.86. At the end of Q3 2023, they had a book value of $13.28. With GPMT having a dividend of $0.80 a year, that means the majority of those years, the loss in book value far outpaced the dividend. This means that GPMT’s dividend should really be looked at like a return of capital, rather than a return on capital.

The Case for Buying/Holding

Even though the book value has fallen more than $5 since 2019, GPMT still trades at a very large discount to book. Their price today of $5.55 puts them at 41.8% of book value. This coupled with their dividend that sits just over 14%, there seems to be quite a bit of cushion that the book value could keep falling before it gets down to par and a lot of dividends that could be paid out over that time.

Perhaps with the more dovish fed that we saw near the end of 2023 and rates finally looking to fall some in 2024, the pressure on book value will stop or at least slow. I’m not sure how much of the declines in book value have been purely because of GPMT’s individual properties or how much has been due to how fast interest rates rose in 2021-2023. I just know that every quarter there either seems to be another write-off or more money put toward CECL reserves that are basically anticipated write-offs.

There’s also a chance that office spaces are more stable than I think finally. I tend to think that the office sector will continue to be pressured, but there’s always the chance that businesses that were reducing their office size have already done so and that there could even be a recovery in this area of the portfolio. Until I see real signs of this, I’m still going to assume a long downturn for Office properties, much in the way Mall properties have been pressured for around a decade as Amazon and others disrupted the industry.

I think the Buy case for GPMT is basically tied to a recovery in the Office portion of their portfolio and for that to happen soon (next year or two). If GPMT can finally stop taking so many write-offs and increasing their CECL reserves due to the large chunk of their portfolio that is Office, then not only is the 14% dividend more likely to keep getting paid out for longer, but there could even be a sizable appreciation in share price to get back closer to book value. Locking in a 14% return on cost as well as price appreciation makes for a very good best case scenario.

The case where GPMT ends up being a solid Hold, but not really a screaming Buy falls somewhere in between what has been happening over the last 4 years and the immediate reversal of the Office sector as mentioned above. Perhaps the Office sector keeps being pressured, but the worst is over and book declines slow considerably. Also maybe interest rates falling finally helps GPMT out a little. I see this as a more likely scenario than the Buy scenario described above. In this scenario, book value keeps falling, but at a slower pace, and GPMT is able to keep paying out there dividend at the current rate for many years. In this scenario, GPMT could see 14% returns from the dividend, but the share price either stays the same or falls slowly as the book value keeps falling.

The Case for Selling

With GPMT trading at such a large discount to book value, it may seem like there is a large margin of safety. However, in my experience all it really takes is a dividend cut to decimate the share price. If nothing turns around for GPMT soon, they may decide they’d rather not keep paying out a return of capital that is not sustainable in the long run.

When investing in real estate investment trusts (REITs), most investors are searching for yield. The most important thing when buying for yield is getting a yield that won’t be cut within the next few years. The main reason I say this is that when most everyone is invested in a security for its yield, the share price is almost always decimated when that yield is cut. Not only does it lower the yield, but it also destroys investor confidence. Also it usually means that the company is still under pressure and that their could be more dividend cuts coming.

A 14% yield can be very tempting, and sometimes it works out, but I think a lot of investors cling to thinking along the lines of, “even if this dividend is cut in half, it’s still a very good yield going forward”. In practice, I have seen time and time again that the share price drops much, much more than would be expected of a dividend cut. Cutting a high dividend is a hit to majority of people that invest in that security in the first place and points to continued issues. In short, there just aren’t enough people around that still want to own a stock that has just had a large dividend cut, even if the resulting yield is still very high.

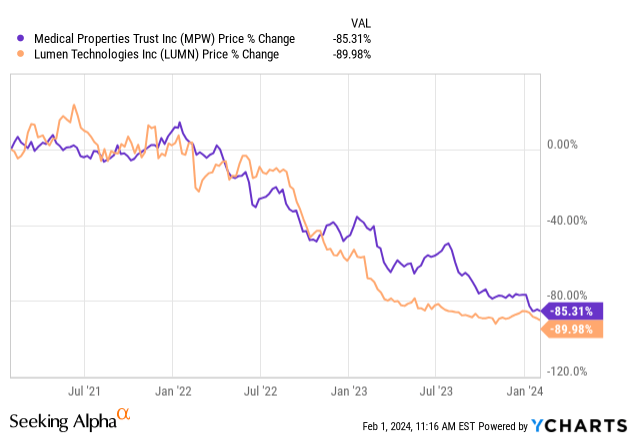

If you want to see how this has played out with some other companies in the recent past, take a look at Lumen Technologies (LUMN) in 2022 or Medical Properties Trust (MPW) in 2023. Both of them had double-digit yields as it was generally known that they were high risk companies and the dividends weren’t a certainty. You’ll find many articles on Seeking Alpha and elsewhere with analysts claiming LUMN or MPW would be able to maintain their high dividends and eventually right the ship. However, in both cases, the dividend was cut- for LUMN it was cut entirely, for MPW it was cut right about in half (from a $0.29 quarterly dividend to $0.15). Here is what the cuts did to their respective share prices:

Now these are just a couple of examples from recent memory as I have followed both companies for a number of years. Luckily for me, I traded around with LUMN back in 2020, but decided eventually that the high yield and chance for recovery just wasn’t worth the risk, so I exited that name completely back then. I actually came out positive on LUMN, gaining both some dividends and a small appreciation in the share price, but it could have ended very poorly for me if I did not time it right. For MPW, I also traded in and out of, but have been overall down on those trades. Luckily, I avoided most of the 85% decline in MPW, but still felt enough of it that the declines outpaced the dividends I collected during that time. Both of these examples show that with troubled companies that cut their dividend, timing has to be almost perfect to come out on top.

Conclusion

I urge investors of GPMT and potential investors to be wary of the 14% yield and the large discount to book value. While these aspects would make for outsized returns if GPMT has actually reached a more stable state and book value declines slow considerably or cease altogether. It is much more likely that the large yield and discount to book are indicative that investors see the writing on the wall and realize it is very risky even at these low prices.

If the dividend is cut anytime in the next 2-3 years, I expect overall returns will be negative. If they manage to pay out this dividend for 4-5 years, then it could be a decent hold. If GPMT never cuts the dividend or keeps it for the next decade, then they will make for a great Buy, but I just don’t see that scenario as very likely. I don’t know what exactly will happen with GPMT, but I do think it’s too much risk for the potential payout, so that’s why I’m avoiding the name for now. I am not calling them an outright sell until I see if they can recover with lower interest rates likely coming. For now, I rate GPMT a Hold.