CHUNYIP WONG

Investment Thesis

Fidelity Blue Chip Growth ETF (BATS:FBCG) warrants a hold rating due its mediocre performance in comparison to other large-cap growth ETFs. Additionally, FBCG has a relatively high expense ratio and low dividend yield compared to alternative funds. Finally, FBCG contains several holdings that are at risk of being overvalued considering several factors including growth and profitability. Due to these factors, there are several other large-cap growth ETFs that may be more desirable for investors seeking long-term capital growth through large-cap stock exposure.

Fund Overview and Compared ETFs

FBCG is an ETF, or exchange-traded fund, that seeks long-term capital growth. The fund invests at least 80% of its weight on well-established holdings that have large or medium-sized market capitalizations. With an inception in 2020, FBCG has 159 holdings and $1.14B in AUM. For comparison purposes, other funds examined in this article are the T. Rowe Price Blue Chip Growth ETF (TCHP), the Vanguard Growth ETF (VUG), and the Schwab U.S. Large-Cap Growth ETF (SCHG).

Each of these compared funds have slightly different objectives or tracked indexes and therefore different holdings as I will discuss later. TCHP seeks to achieve long-term capital growth by investing in companies with above average earnings growth. VUG seeks to track the performance of the CRSP U.S. Large Cap Growth Index. It is heaviest on technology (54.80%) followed by consumer discretionary (20.40%) and industrials (8.80%). SCHG seeks to track the return of the Dow Jones U.S. Large-Cap Growth Total Stock Market Index. The fund therefore invests in large-cap U.S. equities that exhibit growth style characteristics.

Performance, Expense Ratio, and Dividend Yield

Because FBCG’s inception date was in 2020, a 3-year time window is used for performance comparison between the fund and its compared ETFs. FBCG’s 3-year compound annual growth rate, or CAGR, is 5.30%. TCHP has the lowest 3-year CAGR of funds compared at 3.28%. VUG has a 3-year CAGR of 7.70%. Finally, SCHG has the greatest 3-year CAGR at 9.44%. Of note, all these funds are below the 3-year CAGR of the S&P 500 Index of 9.97%.

3-Year Total Price Return: FBCG and Peer Large-Cap Growth ETFs (Seeking Alpha)

A downside for FBCG is its expense ratio. The fund is the most expensive compared to peers at 0.59%. Although this could be justified if FBCG outperformed competitors in capital appreciation, the fund has underperformed over the past few years.

Because FBCG and compared ETFs are focused on growth, they have low dividend yields. FBCG’s dividend yield is negligible at 0.02%. Investors seeking a growth ETF with some dividend yield may favor VUG with a yield of 0.56% or SCHG with a 0.44% dividend yield.

Expense Ratio, AUM, and Dividend Yield Comparison

|

FBCG |

TCHP |

VUG |

SCHG |

|

|

Expense Ratio |

0.59% |

0.57% |

0.04% |

0.04% |

|

AUM |

$1.14B |

$511.42 |

$200.55B |

$24.43B |

|

Dividend Yield TTM |

0.02% |

N/A |

0.56% |

0.44% |

|

Dividend Growth 3 YR CAGR |

58.74% |

N/A |

0.32% |

2.03% |

Source: Seeking Alpha, 30 Jan 24

FBCG Holdings and Comparative Differences

Because FBCG and its peer ETFs are large-cap growth funds, much of their weight is on large and mega cap tech companies. For FBCG, almost 60% of its weight on its top 10 holdings. Despite this top-heavy weight, the fund is well diversified with over 150 holdings.

Top 10 Holdings for FBCG and Other Large-Cap Growth ETFs

|

FBCG – 159 holdings |

TCHP – 76 holdings |

VUG – 208 holdings |

SCHG – 251 holdings |

|

MSFT – 10.15% |

MSFT – 14.02% |

AAPL – 12.99% |

MSFT – 12.92% |

|

NVDA – 9.81% |

AAPL – 10.08% |

MSFT – 12.76% |

AAPL – 11.69% |

|

AAPL – 9.63% |

AMZN – 8.14% |

AMZN – 6.45% |

NVDA – 6.59% |

|

AMZN – 9.10% |

GOOGL – 6.54% |

NVDA – 5.31% |

AMZN – 6.15% |

|

GOOGL – 6.64% |

NVDA – 6.27% |

GOOGL – 3.77% |

GOOGL – 3.81% |

|

META – 4.99% |

META – 4.95% |

META – 3.59% |

META – 3.79% |

|

UBER – 2.62% |

UNH – 3.26% |

GOOG – 3.14% |

GOOG – 3.23% |

|

LLY – 2.34% |

V – 3.24% |

TSLA – 3.07% |

AVGO – 2.26% |

|

NFLX – 2.22% |

LLY – 2.98% |

LLY – 2.27% |

TSLA – 2.26% |

|

SNAP – 2.21% |

MA – 2.63% |

V – 1.82% |

LLY – 2.19% |

Source: Multiple, compiled by author on 30 Jan 24

All ETF investors know that a fund’s future performance is tied to the returns of its individual holdings. Key differences between FBCG and other large-cap growth ETFs are its heavier weight on NVIDIA Corporation (NVDA), Uber Technologies Inc. (UBER), and Snap Inc. (SNAP). Despite some favorable metrics with each of these holdings, they also have several red flags discussed below.

NVDA – Proceed with Caution

NVIDIA Corporation saw an incredible year in 2023. Just a few metrics to substantiate its meteoric rise are a 57% YoY revenue growth, 154% YoY EBITDA growth, and 42.1% net income margin. Investors poured into NVDA sending its share price up over 200% in one year and over 1,600% over the past five years. NVIDIA’s growth will likely continue. The graphics processing unit market is expected to see strong growth with a 32.70% CAGR through 2029. However, this has resulted in a high valuation for the company. NVDA’s forward P/E ratio currently stands at 51.07, over double its sector median. Additionally, its forward EV/sales ratio is 795% higher than its sector median. Therefore, while I like NVIDIA and ETFs that contain it as a top holding, investors should proceed with caution. FBCG has the heaviest weight on NVDA compared to peer ETFs at 9.81%.

UBER – High Valuation with Low Profitability

The second difference is Uber Technologies, Inc. While the company is growing with a YoY revenue growth of 23.77%, it lacks substantial profitability to warrant a buy. Although UBER saw a 32.41% gross profit margin over the past year, its net income margin is only 2.93%. Additionally, the company has a return on total capital of just 0.98%. Despite low profitability, the company has a high forward P/E ratio of 50.66, or 172% higher than its sector median. Additionally, its EV/EBITDA is 122.39, or 849% higher than its sector median. Given this overvaluation, UBER will likely be a laggard among FBCG’s top holdings looking forward. FBCB is the only ETF examined with UBER in its top 10 holdings.

SNAP – Struggling with Lack of Growth

The third difference is Snap Inc., Snapchat’s parent company. The company has struggled to “distinguish itself from other digital media companies” and saw a share price decline from $83.11 in September 2021 down to under $10 last fall. Additionally, it has experienced a YoY revenue growth of -1.21% and -12.12% YoY working capital growth. SNAP also has profitability concerns with a -26.84% EBITDA margin and -50.53% return on common equity. Despite these troubling metrics, its valuation is still unfavorable. The company’s forward P/E ratio stands at 218.58, over 1,000% higher than its sector median. Additionally, its forward EV/EBITDA is 247.49, over 2,000% higher than its sector median. Therefore, I consider SNAP overvalued and a holding that will drag FBCG down compared to peers.

Valuation and Risks to Investors

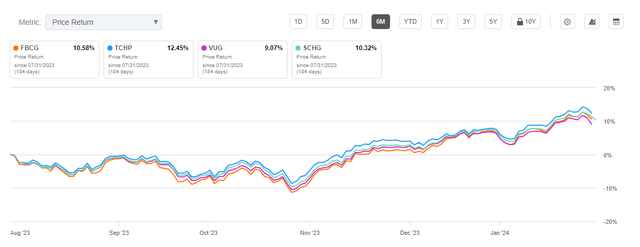

FBCG is currently trading at $34.28 at the time of writing this article. This is near the upper limit of its 52-week range of $22.54 to $35.35 and below its all-time high of $36.36 seen back in November 2021. FBCG’s performance over the past six months has been roughly on par with competitors ETFs. However, it has slightly lagged TCHP which has a heavier weight on MSFT and AAPL.

Six Month Price Return: FBCG and Large-Cap Growth Peers (Seeking Alpha)

FBCG has mixed valuation signals in comparison to other large-cap growth ETFs. While it has the lowest P/E ratio at 28.50, its P/B ratio is comparatively high at 12.75. Because of the overvaluation of several of its holdings, as discussed previously, I expect FBCG to lag TCHP, VUG, and SCHG over the next year. While large-cap growth will likely benefit from reduced interest rates, the holdings mix for these other peer funds appears more favorable.

Valuation Metrics for FBCG and Peer Competitors

|

FBCG |

TCHP |

VUG |

SCHG |

|

|

P/E ratio |

28.50 |

34.64 |

37.20 |

33.86 |

|

P/B ratio |

12.75 |

12.77 |

9.90 |

8.19 |

Source: Compiled by Author from Multiple Sources, 31 Jan 24

All growth ETFs examined in this article are more volatile than “the market” overall. This volatility can be measured by the beta value for each fund. A beta value greater than 1.0 indicates volatility greater than its compared index. FBCG, for instance, has a beta value of 1.31. This is greater than TCHP’s 3-year beta of 1.15 as well as VUG’s beta of 1.17 compared to the Dow Jones U.S. Total Stock Market Index. Therefore, investors can expect slightly more volatility with FBCG compared to other peer ETFs examined.

Concluding Summary

While large-cap growth ETFs will likely perform well for long term buy-and-hold investors, certain funds are more favorable than others. Since FBCG’s inception, VUG and SCHG have outperformed in both dividend yield and capital appreciation. Additionally, FBCG has the highest expense ratio among peer funds compared in this article. Looking forward, FBCG has several holdings that appear overvalued considering their growth and profitability. Therefore, FBCG warrants a hold rating and there are other large-cap growth funds that may yield greater return on investment.