_laurent

Introduction

Last Thursday, the French giant LVMH (OTCPK:LVMHF) (OTCPK:LVMUY) presented its annual results for the year 2023. The purpose of this article is to review the points that I consider most relevant and important from this results presentation and update my company valuation models.

Before we begin, it may be helpful for you to revisit the article I wrote about LVMH in October. The main idea I wanted to convey with that piece was that the market was mistaken in judging the growth the company would experience in the coming quarters. We anticipated a slowdown in sales, but this was not necessarily a bad thing. First, because after the aggressive growth seen post-pandemic, a return to a slower but healthier sales growth was expected. Second, it was crucial to preserve the terminal value of its most exclusive brands. I recommend taking a look since several points I highlighted in that article have materialized. Now, let’s break down the results of this past year, 2023, for LVMH.

Top-line performance

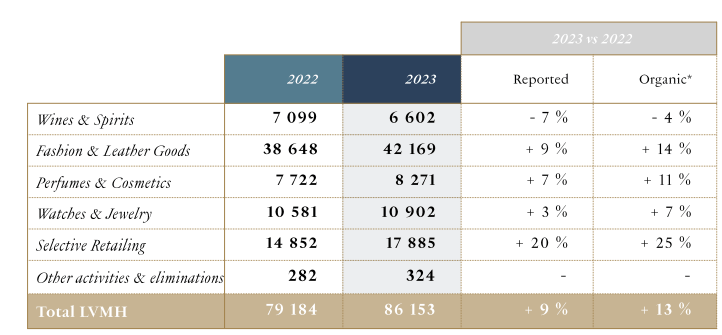

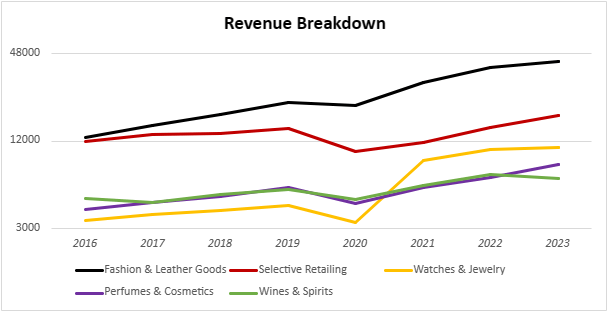

Regarding the sales growth, I believe we have good news for 2023, especially in the last quarter. When comparing the year’s figures, we see that the Fashion & Leather Goods segment, which is the most important, has shown an extraordinary 14% organic growth and 9% when currency changes are excluded. Other segments that remain very strong are Perfumes & Cosmetics, and especially Selective Retailing, although the latter was the most affected during the pandemic and is now recovering to 2019 levels. These segments are growing organically at 11% and 25%, respectively.

On the other hand, the Watches & Jewelry segment maintains an organic growth of 7%, which I consider quite good. Finally, the only part of the business that has decreased is Wines & Spirits, down 4% organically. Later on, we will see that they are beginning to see signs that we may already be at the bottom of the beverage cycle, and 2024 could be the year it starts to rebound. However, this decline is to some extent normal since the alcoholic beverage sector is cyclical, and other competitors like Diageo or Pernod Ricard are also experiencing even greater declines in their sales. The other two factors affecting this segment also seem to be normalizing in 2024, which are inventory levels, especially in the US, and the comparable base will no longer be as challenging as it was during the demand boom after the pandemic.

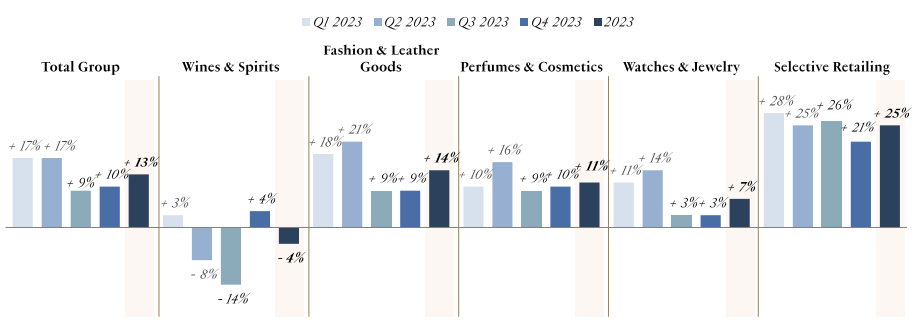

LVMH FY23 Annual Report

If we look at the quarterly growth of each segment, the first thing I would like to highlight is the resilience of all parts of the business in Q4. Some investors had concerns that a potential economic slowdown could impede LVMH’s growth, but it seems that this has not been the case. Despite facing a very tough comparable base (remember that LVMH grew by 43% in 2021 and 23% in 2022), the group’s growth has been 10%, with the particular resilience of the fashion, cosmetics, and retailing segments standing out. On the other hand, it is also noteworthy to mention that the beverage segment has grown by 4% in the last quarter after two consecutive quarters of declines. As mentioned before, this could be a sign that we have already reached the bottom or that we are close, but I would still be cautious for the moment.

LVMH FY23 Annual Report

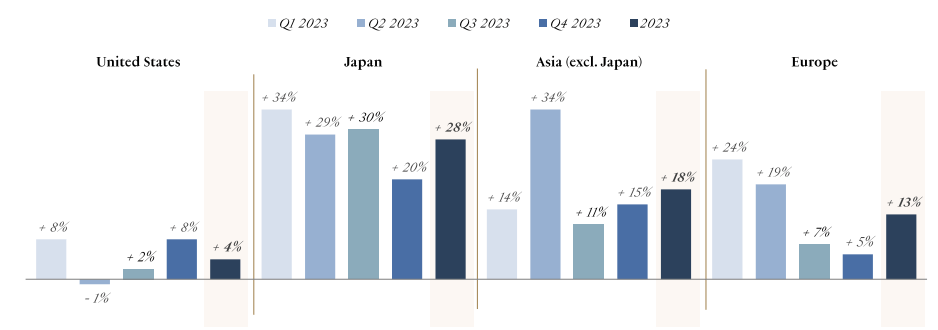

Breaking down by geographies, we can observe that another major concern the market had regarding the luxury sector has not materialized. There was a certain worry about growth in China, given the slowdown in its economy and China’s COVID policies. However, as we can see in the following graph, this has not occurred. Asia has grown by 18% throughout the year and 15% in the last quarter, highlighting that LVMH continues to have growth potential in these regions despite market concerns. On the other hand, it is positive to see an 8% growth in the United States, which had experienced somewhat weaker quarters, and the incredible strength that the Japanese market continues to demonstrate.

LVMH FY23 Annual Report

Finally, in this graph, we can see the growth that each business segment has experienced in recent years.

Author’s Calculations from LVMH Annual Reports

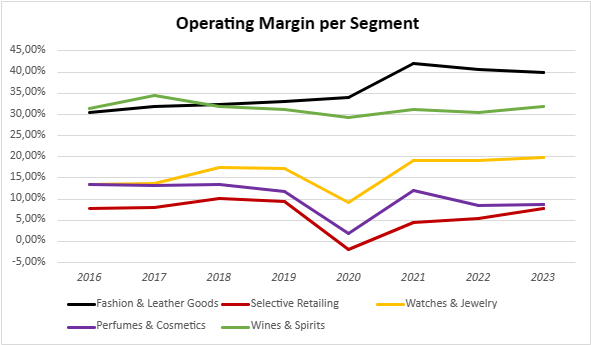

Margins

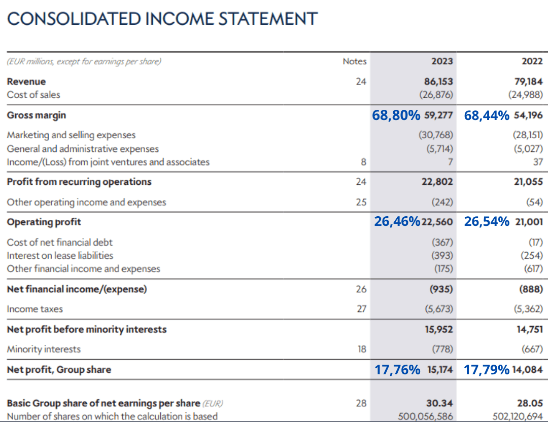

It’s interesting to note that despite all the macroeconomic turbulence faced by LVMH this year, they have managed to maintain margins at the same levels, if not slightly expand them.

The gross margin has increased just under half a point, highlighting the company’s pricing power and ability to pass on cost increases to customers without affecting demand. Operating expenses grow slightly above sales, eroding the operating margin by a few basis points, but nothing to be concerned about. They continue to hold a solid 26.5%. Once financial expenses and taxes are deducted, we arrive at a net margin of 18.5%, slightly higher than the previous year. During 2023, LVMH implemented a small share buyback plan, not too significant but causing EPS to increase to €30.34 per share.

LVMH FY23 Annual Report

As we can see, few significant changes in terms of margins. They have managed to carry out a very good overall management, maintaining margins that were already quite high and even slightly increasing them. For quite a few years now (excluding the pandemic years), a very good job has been done in this regard, gradually but steadily increasing margins.

Author’s Calculations from LVMH Annual Reports

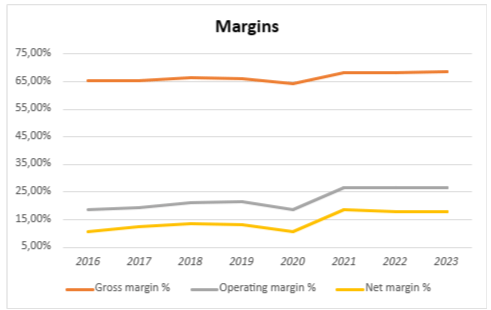

If we delve into a detailed analysis by segment, several noteworthy observations emerge. Firstly, we notice that for the second consecutive year, Fashion & Leather Goods has slightly decreased its margin. From my perspective, this is not too concerning, considering these are minor declines following the strong expansion in 2021 and the inflationary wave. Maintaining operational margins at 40% is very positive. To put this number into context, their main competitor, Hermes, has an operating margin of 44%. It’s worth noting that Hermes focuses solely on the absolute luxury market, whereas LVMH Fashion & Leather Goods includes premium fashion brands with less pricing power.

On the other hand, it is surprising that Wines & Spirits has been able to improve its margin in a year with so many challenges. According to the management, they attribute this improvement to their strict pricing policy demonstrating the strong pricing power that the group’s brands have. Watches & Jewelry achieves its highest margin ever, highlighting the excellent work being done to optimize their brands, especially with Tiffany’s.

Parfums & Cosmetics maintains its margin around 8.5%. Here, I believe there is still significant room for improvement. Before 2020, margins were close to 15%, and their main competitor in this niche, L’Oréal, can easily surpass 20%. Hence, there is likely to be a notable margin expansion in this segment in the coming years, or at least that is what I would like to see.

Lastly, Selective Retailing is not only the fastest-growing part of the business but is quickly recovering its pre-pandemic margins. Good work is being done in this regard, and we might see margins approaching 10% next year if tourism, especially in Asia, continues to rebound strongly.

Author’s Calculations from LVMH Annual Reports

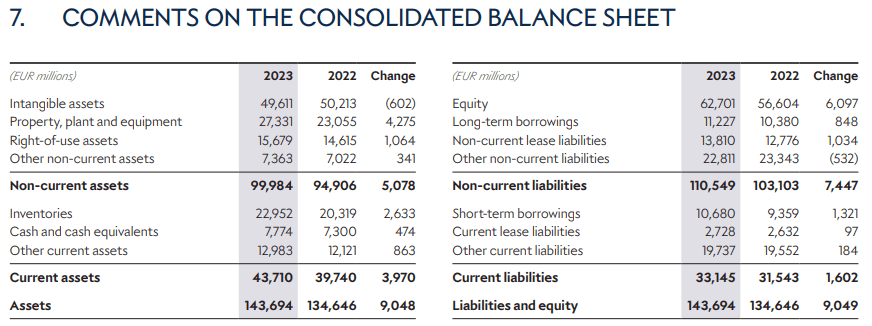

Balance sheet

As for the company’s financial situation, there are not many significant changes. ‘Property, plant and equipment’ have increased significantly due to extraordinary investments, which we will discuss later. On the other hand, the increase in inventories could be considered negative in other types of businesses, but given the nature of LVMH’s business, where inventory assets practically do not depreciate, it has minimal impact. They also mention that exchange rates have affected this aspect.

Furthermore, the financial solvency is very solid. Cash has increased to €7.7 billion, while long-term debt is only €11.2 billion, which has increased due to the aforementioned investments. This robust financial situation, coupled with high cash generation, positions LVMH ideally to continue growing organically and pursue mergers and acquisitions if they come across interesting opportunities. It’s worth noting that since the acquisition of Tiffany’s four years ago, there have been no major acquisitions, and now the conditions are ideal to resume acquisitions when good opportunities arise.

LVMH FY23 Annual Report

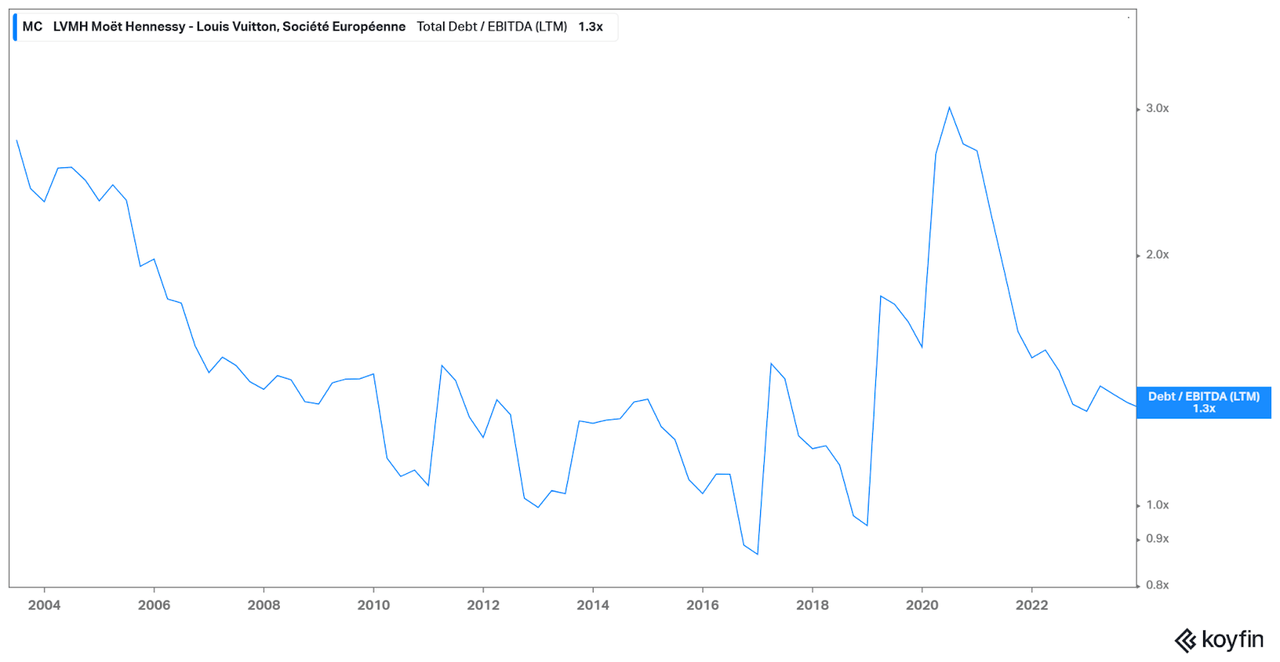

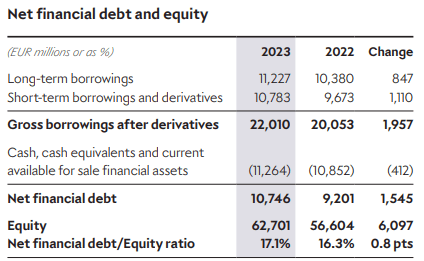

One of my favorite ratios for analyzing solvency, especially in mature companies like this, is the Total Debt / EBITDA ratio. At a glance, you can see how many years of EBITDA the company would need to repay all its debt. In LVMH, we observe a gradual reduction in this ratio over the last decade until it reached 3x with the acquisition of Tiffany’s. After this transaction, it decreased again to 1.3x. Once again, this ratio underscores the solid financial position of the company and its readiness to pursue acquisitions if suitable opportunities appear.

In this table, we can see a more concise summary of the group’s cash and debt position. As we mentioned, very low leverage levels, healthy, and perfectly manageable for a company of LVMH’s size.

LVMH FY23 Annual Report

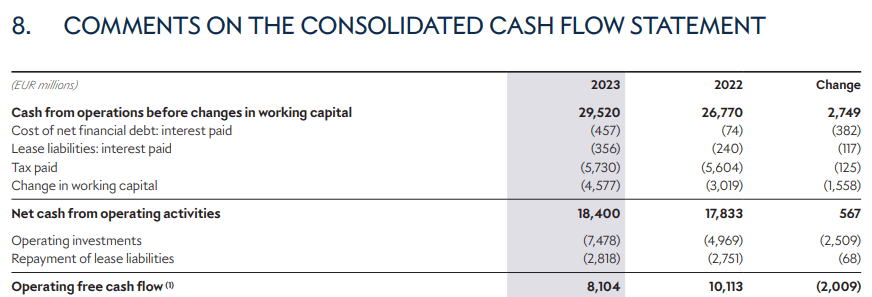

Cash flow statement

When we analyze the cash flow, we see that it has been declining for two consecutive years. Does this mean that the business is deteriorating? Not really. This decrease in cash flow is a result of a series of investments that the company is making, especially in acquiring real estate in prime locations in tier 1 cities and renovating its flagship stores, such as Tiffany’s in New York.

Considering that these investments are intended to boost long-term growth, I see no problem in sacrificing short-term cash flow. Additionally, as we have already seen, the balance sheet is perfectly healthy, so these investments do not jeopardize the company’s solvency.

Furthermore, if we take into account that these investments are extraordinary, meaning that once made, they do not need to be repeated next quarter, it is highly likely that in the coming quarters, this effect will normalize, and cash flow will rebound. Therefore, I believe that shareholders should not only be at ease with this decline in cash flow but also pleased because their capital is being invested in securing future growth. Another factor that has affected cash flow to a lesser extent is changes in working capital. Again, this effect should normalize in the coming quarters.

LVMH FY23 Annual Report

Bernard Arnault comments

After analyzing the financial statements, I want to review the most relevant points mentioned by Bernard Arnault, the CEO of the company, during the earnings call because I believe there are several important insights and lessons to learn here.

The first highlights what we just discussed about the decline in Free Cash Flow. It’s not a concerning drop as it is due to extraordinary investments focused on improving customer experience, enhancing the value of their brands, and ultimately ensuring future growth.

“Free cash flow is slightly negative because we made a number of investments.” – Bernard Arnault

The next comment seems significant as it demonstrates the dominant position that LVMH holds in the luxury sector. According to Arnault, the group owns 4 of the 8 most important brands in the industry. Moreover, he openly names the other 4 houses, which is beneficial for us to compare the performance of LVMH brands with these.

“In the soft luxury segment, we have the strongest brands in the world with Vuitton and Dior. And we have actually good competitors without mentioning two remarkable, Chanel and Hermes. And in the hard luxury category, that is Watches and especially Jewelry, we also have two outstanding brands at Tiffany and Bulgari. And in the competition, there’s a very good group that is the Richemont Group announced its two great brands, Cartier and Van Cleef, so amongst the eight brands considered the best.” – Bernard Arnault

The following comment addresses the limitation of supply in the world of haute couture. In this case, the limitation arises simply because these garments are very costly and require highly skilled artisans. Thus, even though the market is small, demand far exceeds supply, translating into brand-setting power for LVMH.

“Old couture is a very small market, but it’s developing because the most high-end products are those that are most widely sought after in the world. (…) We can’t deliver to our customers. I mean the workshops are what they require a huge amount of work to train the seamstresses to produce old couture dresses. It takes an inordinate amount of time, and we have to restrict the orders.” – Bernard Arnault

Closely related to my previous article where I explained the exclusivity-growth dilemma faced by luxury brands, I recommend revisiting it to understand why growth rates of 8 – 10% are more than adequate for these companies. In this context, Arnault comments on the growth pace of some of their Fashion & Leather Goods brands.

“We need to put the brakes on a bit because I’m often told that growth rates, why are you only delivering 8% to 9%? Well, I find that’s pretty good. And I hope that we won’t exceed that. I’d rather slow than push (…) We have so many successful products or we have to produce more, but we have to resist that to no point, they must be flawless quality, and you mustn’t be in a hurry when you’re achieving 8% or 9%, maximum 10%, that suits me fine. I don’t know for the analysts, it’s enough was never enough. We’re never happy.” – Bernard Arnault

Finally, a comment on the expected growth for 2024.

“Now for 2024, what we can say for 2024 is that I am personally very confident. I expect to continue the growth that was achieved in 2023.” – Bernard Arnault

Valuation

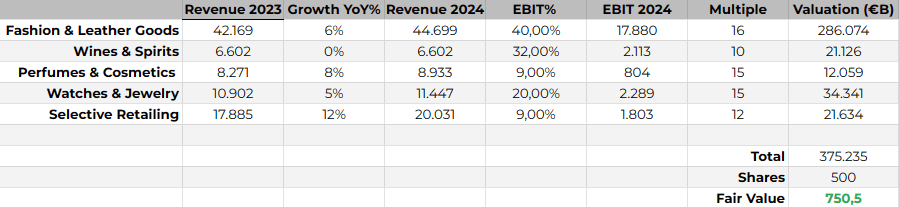

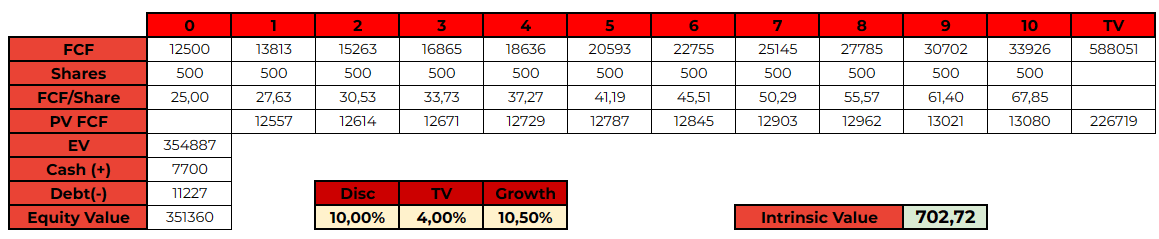

In my previous article on LVMH, I conducted two valuations, a sum-of-parts analysis, and a Discounted Cash Flow analysis. Following the 2023 results, I am updating both models to determine their new intrinsic value.

Firstly, for the sum-of-parts analysis, I aimed to be quite conservative, especially with regard to growth rates and multiples. It’s essential to note that sum-of-parts valuations do not operate as a perfect mathematical formula; they are merely indicative. The market is unlikely to value LVMH separately by its individual parts but rather as a whole. Therefore, it’s better to err on the side of conservatism. For example, if the Fashion & Leather Goods segment were to trade separately, it might have multiples more in line with Hermes (~40x) or at least other lower-quality brands like Moncler (~25x). On the other hand, a segment such as beverages is unlikely to command the 23x multiples that the entire LVMH group typically trades at. Hence, I want to emphasize that I prefer to be quite conservative in these types of valuations.

As you can see, I have taken a conservative approach to growth rates. While I believe that growth rates could be higher in certain segments such as beverages or fashion, I prefer to maintain a margin of safety in these valuations. The same applies to the EBIT multiples I assign. In the table below, you can see that the intrinsic value I derive from this valuation is around €750 per share.

Author’s Calculations

However, my favorite valuation method for these companies is the DCF because we can take into account the terminal value, which, for these companies, constitutes the majority of the value.

As I mentioned in my previous article, I believe a 4% terminal value for a company of this type is appropriate, and the discount rate I use is 10%. For the next 10 years, I will assume a 10.5% growth in FCF, slightly below its historical growth.

An important consideration is that, for the calculation of this valuation, I have normalized the FCF for this year. As we saw earlier, the cash flow for this year has been affected by changes in working capital and extraordinary investments in capex. Therefore, I have decided to normalize this effect by adding an extra €0.5 billion for working capital and €1.0 billion for extraordinary capex. I believe it is crucial to make this adjustment because, without it, the valuation could be distorted by this effect, and we might obtain an intrinsic value much lower than the actual one. As mentioned earlier, it is also likely that we will see an increase in the company’s free cash flow shortly when these extraordinary effects disappear.

Author’s Calculation

After these adjustments and applying the parameters we have discussed, we arrive at an intrinsic value of approximately €700. Therefore, considering both valuation methods, I believe we can conclude that LVMH’s stock, trading between €700-€750, is priced fairly, with a somewhat conservative approach. The prices we were seeing weeks ago around €650 presented a great opportunity to accumulate. Following the results presentation, the stock surged more than 13%, and currently, it trades close to €800. Hence, I think it is prudent to assign it a ‘Hold’ rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.