grandriver

Summary

- The default risk is shallow thanks to low leverage (1.3x EBITDA) and ample liquidity. The fact that they trade close to par confirms this assumption.

- These baby bonds offer close to a 12% yield to maturity and are accessible for retail accounts.

Introduction

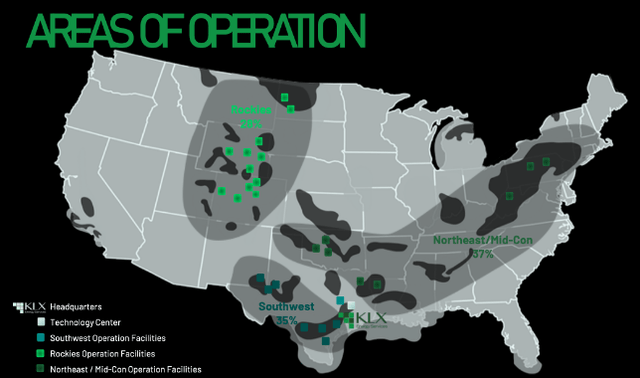

KLX Energy Services Holdings, KLXE, is a US onshore oil services company (fracking) whose origin is a spinoff made in 2018 when its parent, dedicated to the aeronautics sector, was acquired by Boeing. Over the past five years, the company has grown primarily through mergers and they continue to have that intention, prioritizing equity transactions. This highly fragmented sector benefits from consolidation as fixed costs are diluted over a larger base.

While it is true that the shares are trading at a very low multiple, about 3 times EBITDA, in line with the industry, the really interesting opportunity is in my opinion in its 2025 Notes. Despite the low multiple of the sector, which reflects some skepticism about future earnings, these Notes trade close to nominal value which implies no perceived refinance risk.

The Nov. 2025 11,5% Senior Secured Notes

These Notes, with ISIN USU4949EAA02, were issued in October 2018 and are senior secured, which means this debt is backed by KLX’s assets that were pledged as collateral. The interest is paid semi-annually in areas on May 1st and November 1st of each year.

This issuance currently amounts to $237.3 million. As of January 1, the company can redeem these Notes at face value (plus accrued coupon). To do so, in addition to relying on its credit line, for which it had at the end of Q3 $64m available plus $90m in cash, it will have to make another debt issuance.

It is expected that they will refinance this year before November, as these bonds mature in November 2025 and when there is less than a year to maturity, they will become current liabilities and the financial situation of the Company will seem to be “in trouble”. However, until they refinance, the yield is high for the risk assumed, and it makes sense for them to extend the term in anticipation of possible interest rate cuts, as they confirmed in a presentation last December.

The Company

KLXE is present in the main US basins and benefits from the increased activity in these basins, with sales being closely linked to the number of active rigs.

KLX Energy Presentation at Sidoti Small Cap Conference December 6th 2023

No customer accounts for more than 5% of revenues and its top 10 accounts for only 30%.

KLX Energy Presentation at Sidoti Small Cap Conference December 6th 2023.

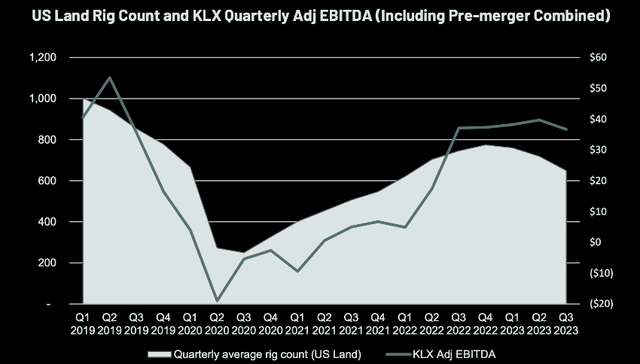

However, over the last year, they have achieved a certain level of resilience despite the drop in rigs mainly because of synergies achieved through the last mergers (QES / Greene)

The next chart shows the correlation between Adj EBITDA and US Land Rig Count and the above-mentioned acquired resilience.

KLX Energy Presentation at Sidoti Small Cap Conference December 6th

With this correlation in mind, the most important KPI to track the future financials of the company is the evolution of the number of active rigs in the United States. This number seems to have stabilized after a decline in H2 2023, as confirmed by Schlumberger’s recent conference call.

In North America, following a noticeable moderation of activity in the later part of 2023, we anticipate capital discipline to continue. Consequently, investment levels will be sustained at 2023 exit rates with minimum — minimal increase in activity as the region focuses on sustaining its record output from last year.

Source: Schlumberger’s Q4 Conference Call 19th January 2024

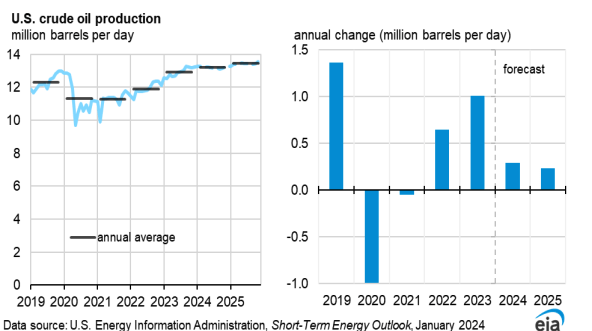

U.S. oil production is at all-time-highs and it is expected to keep growing as it is shown by the EIA (Energy Information Administration) estimations.

EIA STEO January 2024

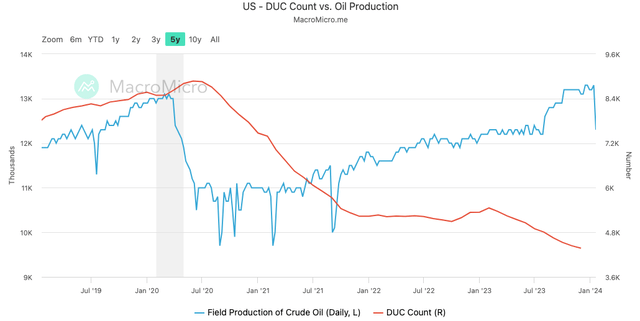

Part of the 2023 growth has come from depleting inventories of DUC (Drilled but Uncompleted Wells). Another part has come from productivity gains. But going forward, to sustain and/or grow oil production, the rig count has at least to stay at these levels.

Furthermore, the current price of WTI, at $77 per barrel, is more than enough to stimulate production in the United States and OPEC+ is showing its will to defend actual prices. In addition, CAPEX budgets have already been established for the year 2024 and they are not adjusted to short-term fluctuations of the oil price.

KLX was able to increase its credit facility and improve its terms last June. Additionally, last November, Moody’s revised outlook on KLX Energy Services Holdings to positive and affirmed at “Caa1” (LT- foreign currency) credit rating.

The current level of net debt is the lowest since 2018. The company has reduced its net debt by over $70m over the last 5 quarters to the end of Q3 2023. Given the current oil price, we can conservatively assume at least another $50m of cash generation from September 2023 to November 2024. This would mean the Company would have 200M$ in liquidity and should not find any difficulty in refinancing these Notes at improved terms.

Risks

This investment is subject to two main risks:

- A collapse in oil price, due to a hard landing, for example.

- Closely related to the above, a hard landing could “dry” liquidity from the bond market, thus making it impossible to refinance.

Nonetheless, KLX has survived the COVID-19 period with a much worse financial situation, and the Company, as a last resource, could always issue capital at the expense of shareholders to avoid bankruptcy.

Conclusion

Although the duration is expected to be less than 12 months, these baby bonds offer a very compelling yield with very low risk, as reflected by the fact that they trade close to nominal value. Consensus expects interest rate cuts in the second half of the year, which makes this investment opportunity even more interesting.