TERADAT SANTIVIVUT

Dear Fellow Shareholders,

We are pleased to provide you with the Third Avenue Real Estate Value Fund’s (the “Fund”) report for the quarter ended December 31, 2023. For the most recent calendar year, the Fund generated a return of +23.27% (after fees) versus +10.85% (before fees) for the Fund’s most relevant benchmark, the FTSE EPRA NAREIT Developed Index.1

The primary contributors to performance during the most recent quarter included investments in some of the Fund’s core holdings, including those involved with Residential Real Estate (Lennar Corp. (LEN), D.R. Horton (DHI), and Berkeley Group (OTCPK:BKGFY)), Commercial Real Estate (U-Haul Holdings Co. (UHAL), Prologis (PLD), and Big Yellow Group (OTCPK:BYLOF)), and Real Estate Services (CBRE Group (CBRE) and Brookfield Corp.). Notwithstanding, these gains were slightly offset by detractors during the period, which included the Fund’s investments in certain Real Estate Operating Companies (CK Asset Holdings and Trinity Place Holdings). Further details on a number of these holdings, other significant developments, and overall portfolio positioning are included herein.

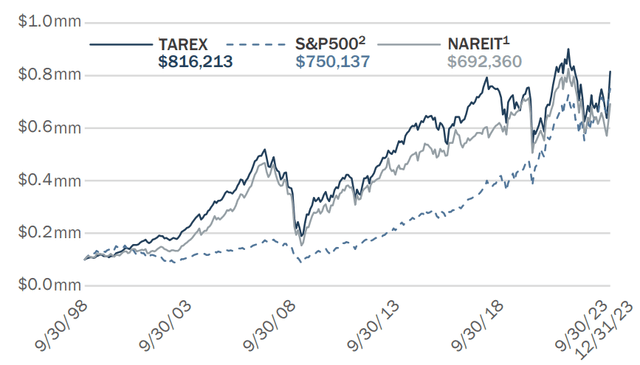

It is also important to note that few periods are likely to be as rewarding as the most recent one. Instead, the Fund’s long-term results seem to be a more relevant gauge of performance. To that end, the Fund has generated an annualized return of +8.65% (after fees) since its inception more than twenty-five years ago. As a result, this performance indicates that an initial investment of $100,000 in the Fund would have a market value exceeding $815,000 (assuming distributions had been reinvested), or more than the same $100,000 would be worth had it been placed into a passive mutual fund tracking the Fund’s benchmark (as well as the S&P 500) over the same time period.

VALUE OF $100,000 SINCE SEPTEMBER 1998

As of December 31, 2023

Hypothetical Investment since September 30, 1998 (Fund Inception Date September 17, 1998). Past performance does not guarantee future performance results.

Activity

The Fall season in Kansas City is usually synonymous with the American Royal Barbecue in September, football games at Arrowhead in October, and the lighting of the Country Club Plaza in November. However, this Autumn the area was associated with a somewhat less traditional event: a class action lawsuit against the National Association of Realtors (“NAR”) and the four largest residential brokerages in the U.S. for conspiring to inflate brokerage commissions in violation of federal antitrust laws.

For context, the residential brokerage business in the U.S. is a significant economic engine, estimated to employ more than 1.6 million nationwide and generate approximately $100 billion of revenues annually – largely due to commission rates averaging 5.5% of the total transaction price, a level that is more than two times the rate in most developed markets. The primary reason fees have remained elevated for the better part of four decades is the unique nature of the “listing” process in the U.S. Put otherwise, when a homeowner intends to sell a home in the U.S., that party typically hires a licensed agent who handles the process, including “listing” the home for sale on local Multiple Listing Services (“MLS”) so that potential homebuyers (and their agents) are aware of the property status. The MLS is however controlled by the NAR and local realtors, which require the selling agent to disclose the commission rate that a buyer’s agent would receive (irrespective of their arrangement with the customer), thus creating an incentive to “steer” homebuyers to those properties with satisfactory commissions.

While such an arrangement has been scrutinized for years, in October 2023 the U.S. District Court for the Western District of Missouri ruled in Burnett, et al v. The National Association of Realtors, et al that the NAR and various residential real estate brokerages and franchises operating within the state “conspired to require home sellers to pay the broker representing the buyer of their homes, and to pay an inflated amount”. Pursuant to the jury verdict, damages were awarded to the class Plaintiffs totaling more than $1.75 billion to be paid by the Defendants.

As expected, the ruling was quickly appealed by the remaining Defendants. Unanimous jury verdicts are difficult to remand, however, and similar cases are working their way through District Courts in other regions. Further, the Department of Justice (the “DOJ”) has seemingly expressed an interest in pursuing damages for such industry practices. As a result, the NAR finally acted after years of pressure and swiftly changed its long-held practice of requiring the seller’s agent to set (and publish) the commission rate for the buyer’s agent to gain access to the MLS, which has introduced an option not previously available to homebuyers: the ability to negotiate their own fee for brokerage services.

Insofar as Fund Management can infer, the ramifications from this shift in industry practices will be prompt and likely result in three key changes for the transaction process, brokerage industry, and the U.S. residential markets more generally, including:

- Fee Compression: With home purchasers now free to select their agents with economic arrangements in mind, pricing competition is likely to develop and initially compress commissions for the buyer’s agent. Should such a trend develop and leave total commission rates in line with fees in other markets, one could expect the average fee to decline by 2.0% in total and approach 3.5% in the aggregate.

- Customer Benefits: Such a shift would result in an estimated 35% reduction in annual brokerage revenues (without factoring in potential changes to transaction volumes) and place more than $30 billion of commissions back into the pockets of customers each year. To the extent this accrued to the homeowner (or seller), the impact could be quite substantial, especially when considering leverage. For instance, if a property was sold for $500k and the total commission rate declined by 2.0% ($10k), the additional value retained by the seller would amount to a 5.0% increase in the “equity” assuming a $300k mortgage loan was outstanding at the time of the sale.

- Industry Consolidation: Should the residential brokerage business follow the same path as other sectors that have encountered similar changes (e.g., financial services, telecommunications, et al), one could expect a wave of consolidation so that incumbents can gain scale and offset margin compression through additional volume and efficiencies. One of the primary caveats in this instance, though, is that the damages awarded in the recent case (and contemplated in ongoing cases) are so substantial, that new entrants (or reorganized entities) could lead to such consolidation.

Fund Management believes that the portfolio holdings most directly impacted by these changes are the U.S.-based homebuilders (Lennar Corp. and D.R. Horton). Although these businesses utilize direct-to-consumer sales practices, they still rely on the MLS for most listings. In fact, brokerage commissions are estimated to account for 2.5% of revenues each year. Should these fees be reduced going forward though, it would likely have a disproportionate benefit on profitability given the operating leverage. The Fund also has exposure to certain ancillary businesses that could benefit from these adjustments, particularly if fee compression increases transaction volumes given reduced friction costs. These holdings primarily include Fidelity National Financial (FIS) (title insurance), Lowe’s (LOW) (home improvement), and U-Haul Holdings (moving and self-storage). Fund Management intends to monitor the evolving landscape for other emerging opportunities – while factoring in an adequate margin of safety given the potential disruptions for most industry participants.

During the quarter, there was another notable ruling in the U.S. District Court for the District of Columbia. In this instance, the Court ruled in Berkeley Insurance Co., et al v. The Federal Housing Finance Agency (“FHFA”), et al that the FHFA had acted “arbitrarily and unreasonably” in its role as Conservator for the Federal National Mortgage Association (“Fannie Mae”) and the Federal Home Mortgage Corporation (“Freddie Mac”) while violating the “implied covenant of good faith and fair dealing” when it implemented the “Net Worth Sweep” in 2012. In conjunction with this unanimous verdict from the jury, the Plaintiffs were awarded damages of $612 million (without factoring in accrued interest), which includes the Fannie Mae Preferred shareholders and Freddie Mac Preferred and Common shareholders that did not “opt-out” of the class action suit (including the Fund).

The payment schedule for these damages is currently being contemplated by the Court, but Fund Management anticipates that the distributions will be made (net of attorney fees) within the calendar year, barring any unforeseen adjustments. As a result, the Fund is likely to receive its pro-rata share of the damages awarded to Freddie Mac Preferred and Fannie Mae Preferred classes – which could represent 15-20% of the current market value of its holdings in these issuers. More importantly, though, it is Fund Management’s view that the combination of this ruling, the related discovery, and the fundamental progress at Fannie Mae and Freddie Mac (which now have a collective net worth exceeding $115 billion) advances the prospects for the entities to exit Conservatorship as the “communities of interest” now seem more supportive of this path. Such a development would not only surface value for the various stakeholders, but also put Fannie Mae and Freddie Mac in a position where these “mission-critical” entities can foster additional liquidity to the secondary mortgage market, thus enhancing affordability, stability, and potentially new supply.

In addition to these developments, other significant items involving the Fund’s holdings during the quarter included the following resource conversion activities and corporate initiatives:

- Asset Sales: Rayonier (RYN) (a U.S.-based Timber Real Estate Investment Trust or “REIT”) announced the disposition of 55k acres of timberlands in Oregon for $242 million, implying $4.4k per acre, or more than two times the implied value per acre for Rayonier’s portfolio based upon the recent stock price. Rayonier’s management team has also indicated that it plans to sell another $750 million of timberlands within the next 18 months to further reduce debt levels and return excess capital to shareholders given the price-to-value discrepancy. In addition, Lennar Corp. indicated that it is marketing for sale its multifamily portfolio, which is comprised of 38 properties in 15 states with 11.4k units that should be highly coveted given the sub-markets and modern vintage. To the extent a transaction is effectuated, it is estimated that Lennar would generate more than $1.0 billion of net proceeds, which would not only surface value from this overlooked vertical but likely be returned to shareholders via share repurchases.

- Investor Updates: Prologis (PLD) (a U.S.-based Industrial and Logistics REIT) held a capital markets forum, where the management team reviewed the evolution of the business and highlighted their “customer focus”. The team also covered several material value drivers, including: (i) the “loss-to-lease” opportunity within the existing portfolio with market rents approximately 60% above in-place leases, thus representing nearly $3.0 billion of incremental cash flow3 that can be realized as leases renew, (ii) a 12k acre landbank that can accommodate more than 200 million square feet of additional properties, which is increasingly being used to deliver data centers given the higher capital values relative to industrial properties, and (iii) its Essentials segment, including the addition of rooftop solar panels at many facilities, which currently account for 555 Megawatts (“MW”) of installed capacity (and generates $40 million of operating profits) but is expected to comprise 7000 MW of capacity by 2030 (and generate approximately $800 mm of annual profits).

- Capital Market Transactions: Sun Communities (SUI) (a U.S.based REIT invested in manufactured housing, RV resorts, and marinas) sold its 10% stake in separately listed Ingenia Communities (an Australian-based owner of active-adult communities and RV parks) while repatriating the capital and announcing the intention to sell non-core properties within North America. These moves support a “return to core” strategy as the company further streamlines to close the discount to Net-Asset Value (“NAV”) and its closest peer. Furthermore, Five Point Holdings (a U.S.-based land development company) launched an exchange offer for its Senior Unsecured Notes, whereby it proposed to pay down $100 million of principal, while also extending the maturity date on the remaining amount to 2028 and introducing an optional amortization feature. The offer was accepted by more than 99.0% of the holders, thus allowing the company to move forward with the well-designed transaction that will further reduce debt and grant Five Point more flexibility as it seeks to unlock the value embedded in its incredibly scarce land positions – an amount that seems much more significant than currently implied by the prevailing price for its common stock, in Fund Management’s view.

The Fund participated in several of these developments, primarily by (i) increasing its position in Ingenia Communities (OTC:INGEF) alongside the Sun Communities offering and (ii) agreeing to engage in the Five Point exchange offer, which is expected to close in January 2024. The Fund also increased its position in Sun Communities during the period and trimmed back certain holdings for portfolio management purposes. These reductions included the Fund’s U.S.-based homebuilders (D.R. Horton and Lennar Corp.), Timber REITs (Weyerhaeuser (WY) and Rayonier), and U.S.-based Industrial REITs (Prologis and First Industrial (FR)) – all of which remain core holdings but seem more prudently sized following recent performance, in our view.

Positioning

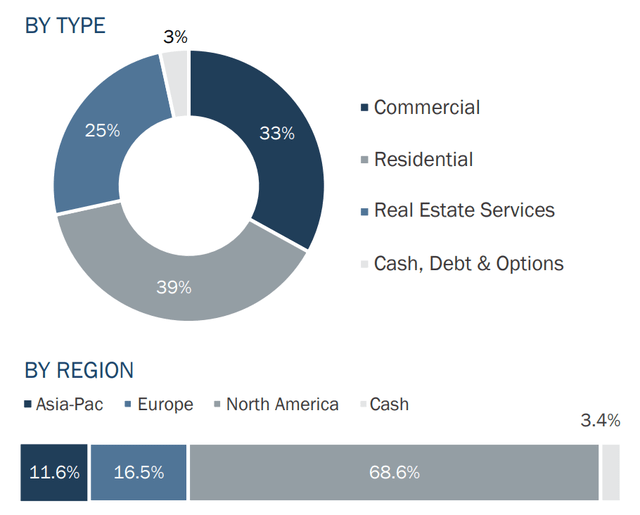

After factoring in the most recent activity, the Fund had approximately 38.5% of its capital invested in Residential Real Estate companies with strong ties to the U.S. and U.K. residential markets – where supply deficits remain after years of under-building. Together with near record-low inventory levels, there also remains significant demand for the single-family products at affordable price points (both for sale and for rent). Therefore, these Fund holdings seem positioned to benefit from a multi-year recovery in residential construction and ancillary activities, particularly as mortgage rates further subside. At the end of the quarter, these holdings included a diversified set of businesses including homebuilding (Lennar Group and D.R. Horton), timberland ownership and management (Weyerhaeuser and Rayonier), planned development (Berkeley Group (OTCPK:BKGFY) and Five Point Holdings (FPH)), niche rental platforms (AMH (AMH), Grainger plc (OTC:GRGTF), Ingenia Communities, and Sun Communities), as well as other ancillary businesses (Lowe’s and Trinity Place Holdings).

The Fund also had 33.0% of its capital invested in Commercial Real Estate enterprises that are involved with select segments of the property markets. At the current time, these holdings are primarily focused on companies capitalizing on secular trends, including structural changes driving more demand for industrial properties, self-storage facilities, and last-mile fulfillment (Prologis, U-Haul, Segro plc (OTCPK:SEGXF), First Industrial, Big Yellow, InvenTrust (IVT), and National Storage (NSA)) as well as the further densification and improvements taking place in certain urban corridors (CK Asset Holdings (OTCPK:CHKGF) and Wharf Holdings (OTCPK:WARFY)). In Fund Management’s view, each of these enterprises is very well-capitalized, their securities trade at discounts to private-market values, and they seem capable of providing compelling “real” returns – primarily by increasing rents, undertaking development activities, and by making opportunistic acquisitions.

An additional 25.1% of the Fund’s capital is invested in companies engaged in Real Estate Services. These real estate-related businesses are generally less capital-intensive than direct property ownership and have historically offered much higher returns on capital over the course of a cycle – provided they have favorable positioning within their respective segments. At the present time, these holdings include franchises involved with brokerage and property management (CBRE Group, Savills plc (OTCPK:SVLPF), and JLL (JLL)), investment management (Brookfield Corp. and Brookfield Asset Management (BAM)), as well as mortgage and title insurance (FNF Group, Freddie Mac (OTCQB:FMCC), and Fannie Mae (OTCQB:FNMA)).

The remaining 3.4% of the Fund’s capital is in Cash, Debt & Options. These holdings include U.S.-dollar-based cash and equivalents, short-term Treasuries, hedges relating to certain foreign currency exposures (Hong Kong Dollar), and the investment in the Senior Unsecured Notes of Five Point Holdings.

The Fund’s allocations across these various business types are outlined in the chart below, along with the exposure by geography (North America, Europe, and Asia-Pacific). In addition, the discount to NAV for the Fund’s holdings, when viewed in the aggregate, narrowed to approximately 14.0% at the end of the quarter by Fund Management’s estimates, and the holdings remain very well-capitalized (in Fund Management’s view) with an average loan-to-value ratio of 17% at the present time.

ASSET ALLOCATION

As of December 31, 2023

Fund Commentary

In early 1983, investment strategists Gary Shilling and Kiril Sokoloff co-authored a pioneering assessment of the financial landscape in Is Inflation Ending? Are you Ready? The obscure but highly regarded book was labeled through its subtitle as a “sober look at the prospects for a decline in inflation and how it affects your business and investments”.

Within the work, the co-authors present a compelling case for assessing the drivers of inflation, including its root cause over many centuries (i.e., government spending). They also expound upon their observation of the shift in the “nation’s attitude” towards fiscal spending in the 1970s, extrapolated the consequences to leadership and policy changes, and then forecasted what types of business strategies and investments would thrive (or suffer) in such an environment.

Shilling and Sokoloff’s foresight was nothing short of uncanny. Of particular note was their view that “real” interest rates (i.e., the difference between nominal interest rates and prevailing inflation rates) would remain elevated following a period of high inflation as negative “real” rates and previous capital losses on bonds would lead to fixed-income investors commanding “higher risk premiums” in the period ahead. As a result, the co-authors believed that capital would shift from speculation to savings to capture “real” returns, thus creating a more “stable and predictable” environment that would encourage productivity-enhancing activities and investment. They, therefore, suggested in the decade ahead that (i) “savers would be winners” and “borrowers would be losers”, (ii) financial assets, such as “high quality” stocks and bonds would prosper while “tangible assets” such as real estate, commodities, and collectibles would “suffer”, particularly if significantly leveraged, and (iii) a winning business strategy would be comprised of financial strength, with a focus on either proprietary products with pricing power, or low-cost producers with strict cost controls.

With Shilling and Sokoloff seemingly spot-on in their assessments, Fund Management believes it is worth examining whether such strategies are as relevant today as in 1983. This is especially the case when considering that inflation levels in the U.S. have moderated significantly over the past 18 months (and are still arguably overstated given the “lag” in the shelter component). To that end, it is our view that two of the three themes above remain paramount, while one may prove untimely.

Along these lines, Fund Management is of the view that a shift away from “tangible assets”, such as real estate and commodities, is not justified for two primary reasons. One, the speculative excess associated with these types of investments in the late 1970s seems less prevalent today, with valuations for “real assets” at near-century low levels relative to “financial assets” per Bank of America (“BofA”) Global Research and “under-owned” with less than 2.0% allocations in BofA client portfolios on average. Two, the “threat of inflation” has dissipated more recently but is by no means eliminated as government spending remains near record levels, with the U.S. budget deficit having exceeded 6.0% of Gross Domestic Product (“GDP”) in 2023.

On the other hand, the more recent shift in “real” rates is one that seems durable given the various distortions stemming from a recent decade-plus period of negative “real rates”, as well as the additional “risk premium” likely commanded by capital market participants after enduring one of the most significant setbacks in bond market history (i.e., 2020-2023). Therefore, Shilling and Sokoloff’s view that real rates would remain positive for a more extended period seems remarkably relevant today, as well as their projections that (i) “savers will be winners” and (ii) the ideal business strategy as one that would be comprised of “financial strength” and company-specific profit drivers.

To navigate such an environment, the Third Avenue Real Estate Value Fund has utilized its flexible mandate and further gravitated towards holdings that seem well-suited for such a landscape. To wit, Fund Management has concentrated the portfolio on issuers with securities available at modest prices relative to conservative estimates of their corporate net worth – with a specific focus on “high quality” entities exhibiting “pricing power” or distinct “operating leverage”, leaving them less dependent upon nominal inflation to increase revenues (and profits) in our view.

At the same time, these holdings seem incredibly well-capitalized with a net-debt-to-asset ratio of less than 20%, on average, mitigating against the prospects of refinancing significant amounts of debt at higher “real” rates and eroding cash flows. Further, more than two-thirds of the Fund’s holdings are structured as Real Estate Operating Companies (“REOCs”), allowing the entities to retain their capital and more reliably self-finance their expansion, as opposed to REITs, which comprise a large part of most listed real estate allocations and are required to distribute their earnings as dividends, leaving them more dependent upon the capricious capital markets for growth.

Fund Management recognizes that such a combination is not likely the most optimal strategy for a period of negative “real rates” (when value is transferred from savers to borrowers, rewarding significant leverage). However, a focus on durable assets that are conservatively capitalized and relatively simple to value is one that has always seemed sensible at Third Avenue. It is also an approach that seems particularly well-suited for higher “real” rates, which is why Fund Management believes the Real Estate Value Fund is indeed “Ready” for the period ahead.

We thank you for your continued support and look forward to writing to you again at the end of the next quarter. In the meantime, please don’t hesitate to contact us with any questions, comments, or ideas at realestate@thirdave.com.

Sincerely,

The Third Avenue Real Estate Value Team

Jason Wolf, CFA, Ryan Dobratz, CFA

IMPORTANT INFORMATION

This publication does not constitute an offer or solicitation of any transaction in any securities. Any recommendation contained herein may not be suitable for all investors. Information contained in this publication has been obtained from sources we believe to be reliable, but cannot be guaranteed.

The information in this portfolio manager letter represents the opinions of the portfolio manager(s) and is not intended to be a forecast of future events, a guarantee of future results, or investment advice. Views expressed are those of the portfolio manager(s) and may differ from those of other portfolio managers or of the firm as a whole. Also, please note that any discussion of the Fund’s holdings, the Fund’s performance, and the portfolio manager(s) views are as of December 31, 2023 (except as otherwise stated), and are subject to change without notice. Certain information contained in this letter constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,”

“estimate,” “intend,” “continue” or “believe,” or the negatives thereof (such as “may not,” “should not,” “are not expected to,” etc.) or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of any fund may differ materially from those reflected or contemplated in any such forward-looking statement. Current performance results may be lower or higher than performance numbers quoted in certain letters to shareholders.

Date of first use of portfolio manager commentary: January 19, 2024

- The FTSE EPRA/NAREIT Developed Real Estate Index was developed by the European Public Real Estate Association (EPRA), a common interest group aiming to promote, develop, and represent the European public real estate sector, and the North American Association of Real Estate Investment Trusts (NAREIT), the representative voice of the US REIT industry. The index series is designed to reflect the stock performance of companies engaged in specific aspects of the North American, European, and Asian Real Estate markets. The Index is capitalization-weighted.

- S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.

- Cash flow: Cash flow is the after-tax earnings plus depreciation that functions as a measure of a firm’s financial strength” (Source: Investopedia)

FUND PERFORMANCE

| Annualized | |||||||

| 3Mo | 1Yr | 3Yr | 5Yr | 10Yr | Inception | Inception Date | |

| Third Ave Real Estate Value Fund (Inst. Class) | 20.67% | 23.27% | 5.73% | 5.62% | 4.02% | 8.65% | 9/17/1998 |

| Third Ave Real Estate Value Fund (Inv. Class) | 20.58% | 22.92% | 5.46% | 5.35% | 3.76% | 6.28% | 12/31/2009 |

| Third Ave Real Estate Value Fund (Z Class) | 20.73% | 23.40% | 5.84% | 5.71% | N/A | 1.59% | 03-01-2018 |

TOP TEN HOLDINGS

| U-Haul Holding Co. | 6.40% |

| Lennar Corp. | 6.40% |

| Brookfield Corp. | 6.10% |

| D.R. Horton Inc | 5.70% |

| CBRE Group Inc | 5.20% |

| Prologis Inc | 4.80% |

| Weyerhaeuser Co. | 3.90% |

| CK Asset Holdings Ltd. | 3.90% |

| Wharf Holdings Ltd. | 3.80% |

| American Homes 4 Rent | 3.70% |

| TOTAL | 49.90% |

Allocations are subject to change without notice

Past performance is no guarantee of future results; returns include reinvestment of all distributions. The above represents past performance and current performance may be lower or higher than performance quoted above. Investment return and principal value fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. For the most recent month-end performance, please visit the Fund’s website at Third Avenue Management | Pioneers in Value Investing Since 1986. The gross expense ratio for the Fund’s Institutional, Investor, and Z share classes is 1.18%, 1.44%, and 1.10%, respectively, as of March 1, 2023.

Distributions and yields are subject to change and are not guaranteed.

Risks that could negatively impact returns include: overbuilding and increased competition, increases in property taxes and operating expenses, lack of financing, vacancies, environmental contamination and its related clean-up, changes in interest rates, casualty or condemnation losses, and variations in rental income.

The fund’s investment objectives, risks, charges, and expenses must be considered carefully before investing. The prospectus contains this and other important information about the investment company, and it may be obtained by calling 800-443-1021 or visiting Third Avenue Management | Pioneers in Value Investing Since 1986. Read it carefully before investing.

Distributor of Third Avenue Funds: Foreside Fund Services, LLC.

Current performance results may be lower or higher than performance numbers quoted in certain letters to shareholders.

Third Avenue offers multiple investment solutions with unique exposures and return profiles. Our core strategies are currently available through ’40Act mutual funds and customized accounts. If you would like further information, please contact a Relationship Manager at:

Third Avenue Management

675 Third Avenue, Suite 2900-05

New York, New York 10017

E: clientservice@thirdave.com

P: 212.906.1160

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.