surfmo/iStock via Getty Images

Please note all $ figures in $CAD, not $USD, unless otherwise stated.

Introduction

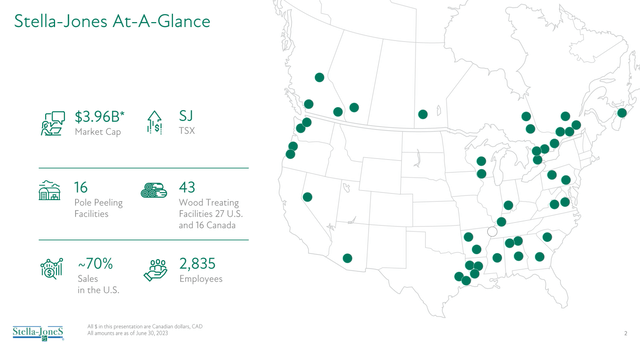

Stella-Jones Inc. (TSX:SJ:CA) (OTCPK:STLJF) is a manufacturer of railway ties and utilities poles. That may not sound like an exciting business, but over the years it’s produced fabulous returns for shareholders of Stella-Jones. Both of these business segments supply pressure-treated wood products and they go through a replacement cycle that ensures fairly steady and re-occurring revenues over the long-run. Despite being listed in Canada on the Toronto Stock Exchange, the company derives most (69%) of its revenues from the United States with the remaining 31% coming from Canada. Today, Stella-Jones is a market leader in pressure-treated wood products with 43 wood treating facilities and 16 pole peeling facilities that help to generate over $3.3 billion of annual revenue.

Stella-Jones Overview (Investor Presentation)

Investment Thesis

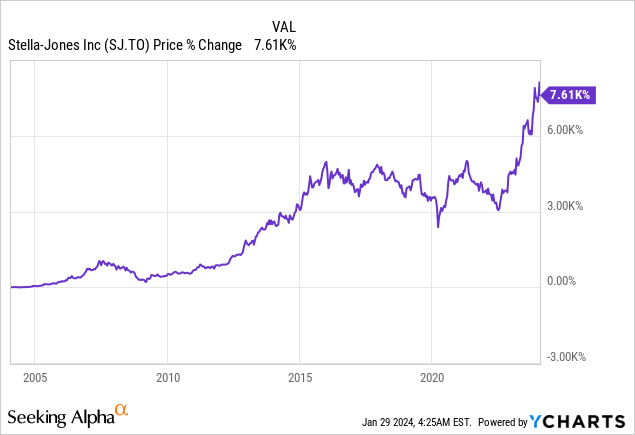

Historically, Stella-Jones has had a track record of delivering exceptional returns to shareholders. For example, since 2004, the company’s shares have returned over 7600%, making it by far one of the best performing stocks over the last 20 years.

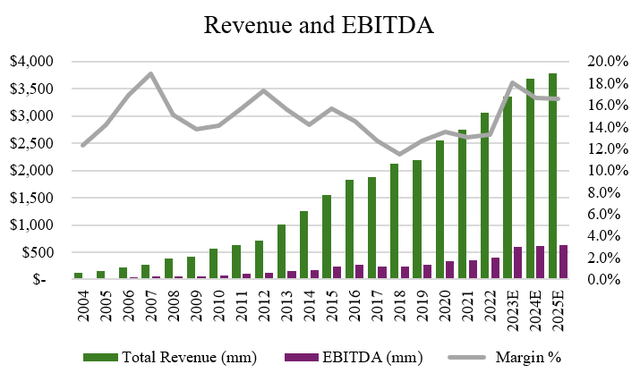

And this share price outperformance shows up in the numbers too. For example, over the last 20 years, Stella-Jones has produced CAGRs of 20.0% and 17.7% in revenues and EBITDA, respectively. On a shorter time period of 10 years, it’s still put up impressive growth rates with revenues and EBITDA growing at CAGRs of 12.8% and 14.4%, respectively.

Author, based on data from S&P Capital IQ

Compounding at such high rates of return is no easy feat. Warren Buffett, for example, widely considered among many to be one of the greatest investors of all time, compounded Berkshire Hathaway’s capital at a 19.8% CAGR, so clearly the long-term track record of Stella-Jones here is impressive, being one of the best performing stocks in Canada.

As I’ve mentioned before, it’s often the most boring businesses that make a lot of money and that’s certainly true in the case of Stella-Jones. One of the reasons the company has done so well historically is because it’s had a laser focus on making a series of very smart capital allocation decisions to grow both organically and by acquisition.

Some of the notable acquisitions the company has done include its acquisition of Tangent Rail Corporation (railway ties) in 2010, McFarland Cascade (utility poles) in 2012, RAM Forest and RAM Lumber in 2015, Cahaba (utility poles) in 2021, and Texas Electric Cooperatives (utility poles) in 2022. What all of these acquisitions had in common is that they were accretive to margins, complemented existing offerings, and had a focus on Stella-Jones’ core competencies in selling pressure treated wood.

While railway ties and utility poles are cyclical businesses, Stella-Jones benefits from long-term tailwinds that help it grow organically too. For example, railroads run along wood railway ties all the time which means that they need to be replaced at some point, usually on a pretty regular basis, to continue to serve railway infrastructure.

The same is true for utility poles. Harsh weather and natural disasters means that utility poles for the electric utility and telecommunications companies continuously need to be replaced. Along with key growth drivers like the increased need for utility pole maintenance as well as the growth and expansion of broadband, Stella-Jones is poised to deliver on these trends.

Stella-Jones should release full-year and Q4 numbers sometime next month, but even on Q3’s results, the company looks to be performing very well. During the quarter, the company saw sales climb to $949 million for Q3, which was up about 13% from last year’s quarter. Some of this was due to the acquisition of Texas Electric Cooperatives in late 2022, but excluding the acquisition and currency effects, sales would have still been up 7%.

Driving this growth was a 17% increase in organic sales in utility poles and railway ties primarily, but was offset by lower residential lumber and logs sales. In addition to railway ties and utility poles, Stella-Jones also has a residential lumber business that makes up about 24% of sales and this segment can be pretty volatile quarter to quarter and year to year given the price of lumber.

It wasn’t that long ago that lumber prices reached almost $1300 per thousand board feet in 2021 to about $575 today. When economic activity, particularly in the housing and repair and remodeling market is hot, this results in higher demand for lumber, benefitting this segment. As sales pick up again and return back to equilibrium, we should expect to see higher growth. While we’re still in line with management’s guidance, an analyst on the earnings call did note that while competitors saw volumes down, Stella-Jones had volume growth, which should translate over well into 2024 based on retailer partners’ sentiment.

Going forward, I would expect Stella-Jones to continue to do well based on its performance this quarter. With EBITDA margins increasing to 20.3% in 2023 compared to last year and the overall EBITDA figure increasing 62% to $193 million this quarter, it seems that the financials are improving. Moreover, with an improvement in guidance announced during the company’s Investor day in May 2023, it looks like Stella-Jones is going to exceed its guidance range of an EBITDA margin of 16%. Over the next few years, management expects that the utility pole business should be able to grow at a 15% CAGR and railway ties in the low-single digits for a combined infrastructure-related product category growth rate of 9% annually.

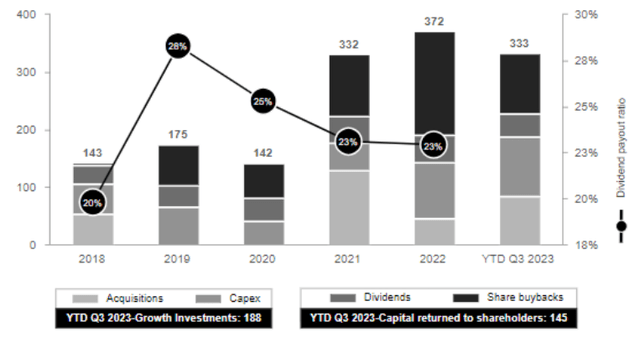

In my view, this should translate to excess cash returns to shareholders in addition to higher acquisition spend. Historically, the company has paid out about 25% of its earnings as a dividend (1.2% yield at present), using the remaining portion to buyback stock and do acquisitions. Since 2015, it has grown its annual dividend per share at a 14% CAGR while maintaining under 2.5x Net debt-to-EBITDA (currently at 2.4x). In addition to the dividend, the company has an NCIB in place for 5 million shares, or about 10% of total shares outstanding. I would expect the company might continue along a similar path and pay out about ~$50mm in dividends per year and ~$150mm of share buybacks driven by its strong free cash flow generation.

Over the last year, shares of Stella-Jones have been on a rapid rise with shares up about 53% in 2023, which has led me to wonder whether shares of the company are overvalued.

When looking at the current multiple of the stock, shares trade at an EV/EBITDA ratio of 10.0x or 9.5x forward EBITDA (2024). On a P/E basis, the company’s shares trade at 14.5x earnings or 13.5x forward (TD Estimates). In my view, considering that the company should be able to grow in low-teens (or high single-digits at worst), I believe the shares to be fairly priced.

Based on the 5 sellside analysts who cover Stella-Jones’ stock, there are 4 buy ratings and 1 hold rating. Collectively, the average price target is $90.64, with a high estimate of $95.83 and a low estimate of $85.84 (source: TD Estimates). From the current price to the average price target one year out, this implies potential upside of 13.3%, not including the 1.2% dividend yield, suggesting that analysts are moderately bullish on the near-term outlook on Stella-Jones’ stock.

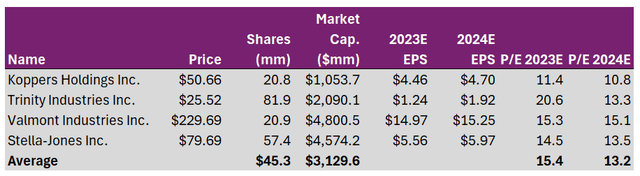

Looking at the peer group, I’d consider Koppers Holdings (KOP), Trinity Industries (TRN), and Valmont Industries (VMI) to be comparable peers to Stella-Jones. And observing their relative valuations, it seems investors are paying a bit of a premium to the peer group. While I think investors are certainly paying up for faster growth here, shares of Stella-Jones aren’t the bargain they once were a year ago.

Author, based on TD Estimates and data from S&P Capital IQ

Aside from the valuation risk here, the main risk I see in Stella-Jones stock is in its railway ties segment. As the second-largest segment, this category is slower growing. While we’ve seen strong indications from this quarter with the company being able to pass along price increases to its customers, I don’t expect this growth to continue. According to data from the Railway Tie Association, the long-term forecast is for steady demand in the low-single digits going forward. These are expenses the Class 1 rails will have to spend money on, but sometimes that can get pushed out into the future when times are tougher for them.

Conclusion

Stella-Jones has been a fantastic performer for shareholders over the last few decades and has a great track record of returning cash to shareholders via dividends and buybacks, along with the occasional big acquisition every couple of years. Impressively, the company has been able to do this without overextending itself on its balance sheet and has put up good growth over time. While I think the growth rate will be lower than what it has been historically, I think investors can have confidence in management’s focus on smart capital allocation decisions and the company’s market leadership in pressure-treated wood products. Despite recent impressive financial performance and positive guidance, I’m cautious at the current valuation. While I certainly don’t view shares as egregiously expensive, they certainly aren’t the no-brainer buy they were a year ago. I’ll be waiting patiently for the price to come down, closer to around 8.0x EBITDA (around 2-turns lower) to have more of a margin of safety.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.