DNY59

Co-produced by Austin Rogers

Dividend investors have been dealt a pretty bad hand in recent years. Numerous factors are weighing on various dividend stocks’ performance.

- Steadily falling oil and gas prices have pushed down energy stocks (XLE), including midstream pipeline companies (MLPX).

- Slowing consumer spending on most categories is making growth harder to achieve for consumer discretionary companies (XLY).

- A weakening consumer also is translating into less ability for consumer staples (XLP) and discretionary companies to raise prices.

- Higher interest rates are weighing heavily on debt-dependent sectors like real estate (VNQ) and utilities (XLU).

- Higher rates also are pressuring the interest coverage of middle-market businesses that receive mostly floating-rate loans from business development companies (BIZD).

And on and on.

The only thing that has seemed to get investors excited to buy has been the burgeoning artificial intelligence trend. And though we’re also excited by the prospects of AI to have profound impacts on the economy, we believe dividend investors are much better off owning the companies that will use and benefit from AI rather than the companies making AI.

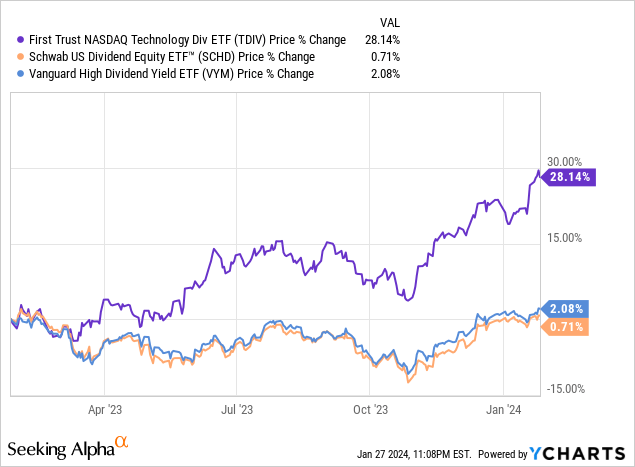

Even then, technology companies (TDIV) have performed dramatically better in recent years than broad-based dividend ETFs like the Schwab US Dividend Equity ETF (SCHD) and Vanguard High Dividend Yield ETF (VYM).

Could this trend of tech’s outperformance over other sectors continue? Yes, it could. We don’t believe AI is just a fad, although it will ebb and flow in its progress and popularity over time.

Plus, most other sectors outside of tech are tied to the performance of the real economy, rather than investors’ hopes and dreams of what might come in the future.

This is where we would advise caution for dividend investors.

Many of the non-tech companies in the “real economy” are vulnerable to a recession, and we think a recession is highly likely to manifest in the near future, if we aren’t in one already.

Admittedly, many pundits have been predicting a recession for a while now, but we think the signs of recession are only growing.

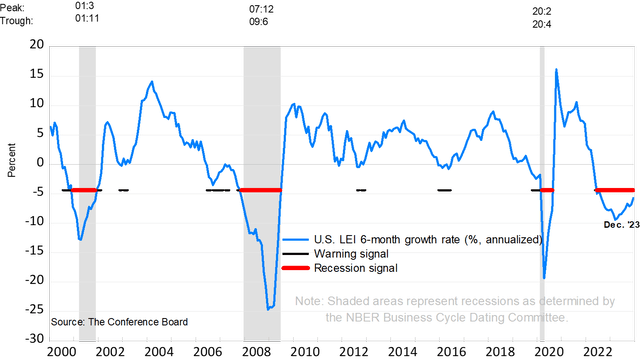

Take, for example, the Conference Board’s Leading Economic Indicators index, a very reliable predictor of oncoming recessions, that shows a high likelihood of a near-future recession:

How, then, should one invest in the face of a likely recession? Investors will often choose one of three strategies:

- Hide out in cash equivalent funds like money markets or ultra-short-term bonds (ICSH), which now pay 4%-5% yields.

- Flock into tech stocks basically as a momentum play, hoping that AI euphoria will take them even higher.

- Buy ultra-high-yielding dividend stocks to be less reliant on market appreciation.

Rather than follow any of these three paths, we recommend taking advantage of the current downturn by buying opportunistically priced yet recession-resilient dividend stocks with moderately high yields.

We would target stocks with ~7% yields, as well as a proven track record of raising their dividends through the last two recessions: the Great Financial Crisis of 2008-2009 and the COVID-19 pandemic.

Let’s briefly take a look at two examples.

Enbridge (ENB)

ENB is one of the largest and strongest midstream oil and gas companies in North America. Based in Canada, ENB owns a vast network of pipelines, storage facilities, processing facilities, and export terminals in Canada and the US as well as interests in offshore wind farms in Europe.

ENB has increased its dividend for 27 consecutive years, which means that its dividend growth track record spans not just the past two, but the past three recessions.

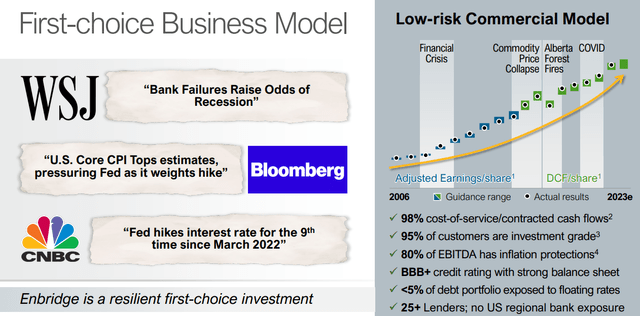

This record was built on a low-risk business model in which the vast majority of revenues derive from fixed-rate contracts – similar to a commercial real estate lease for its pipeline, storage, and terminal assets.

Moreover, 95% of its customer base is investment grade-rated, and around 80% of contracts (by EBITDA) enjoy some inflation-based fee escalators.

One of the primary reasons why ENB has sold off in recent years, other than the fact that its stock price is more or less tethered to the price of oil, is its debt load.

As midstream energy companies go, ENB’s leverage is quite reasonable at 4.6x net debt to EBITDA, less than 5% of total debt is floating rate, and its credit rating of BBB+ certainly does not signal trouble ahead.

Between organic growth from things like contractual toll/fee escalators and inorganic growth from ENB’s project development pipeline, ENB expects its distributable cash flow (“DCF”) to grow about 3% annually in the near term but 5% in the medium term.

In the meantime, ENB plans to keep its dividend payout ratio safely in the 60-70% range while using excess cash to invest in growth and engage in opportunistic share buybacks. That’s very attractive considering that ENB is today offering a 7.3% dividend yield.

Main Street Capital (MAIN)

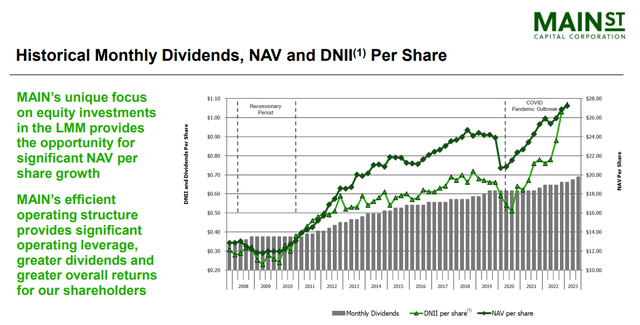

MAIN is a Houston-based, internally managed business development company with a strong, 15-year track record of raising its net asset value, increasing its dividend, and regularly paying hefty special dividends along the way.

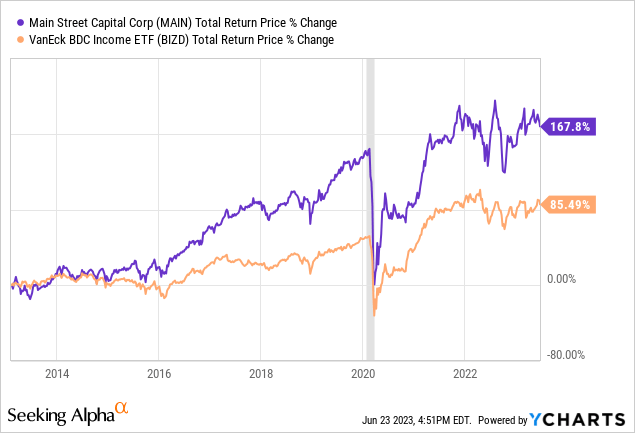

See MAIN’s drastic outperformance over the broader BDC index over the last 10 years:

Part of MAIN’s success and low level of losses over time has been its differentiated perspective on truly partnering with its borrowers for mutual success, rather than simply being one of several lenders.

Illustrative of this partnership model is the fact that MAIN typically takes significant ownership stakes in its borrower companies alongside its loans. MAIN’s average equity ownership of its lower middle-market borrowers is 41%.

The equity investments provide meaningful upside, while the debt investments provide downside protection.

MAIN’s conservatism begins with its shareholder-aligned, internal management team. Many BDCs have grown their total assets over time without meaningfully growing their net asset value (“NAV”) per share, distributable EPS, or dividends. Not so with MAIN.

That’s due in no small part to the shareholder-alignment of management and the board, who themselves own about $128 million of stock. Moreover, 50% of senior management’s compensation is in the form of restricted stock that requires continued growth in distributable net investment income (“DNII”), NAV per share, and dividends.

You don’t get much better alignment with shareholders than that!

So successful has MAIN been in its niche of extending short-term, floating-rate, first-lien loans to lower-middle market businesses that it has begun offering asset management services, thus opening up a new stream of high-margin revenue.

What’s more, MAIN is rare in the ranks of BDCs in that it enjoys investment grade credit ratings of BBB- from two major ratings agencies (S&P and Fitch). Its debt-to-equity ratio of 0.92x (or 0.77x excluding SBIC debentures) is relatively conservative, and its useful to remember that its debt features a mixture of floating and fixed rates while its loan asset portfolio is 99% floating rate.

Thus, higher interest rates are more beneficial than detrimental to MAIN.

This blue-chip BDC has increased its dividend for 13 consecutive years and held its dividend flat through the Great Recession period of 2008-2009, when many BDCs had to cut their dividends. That says a lot about the longstanding conservatism and defensiveness of MAIN despite operating in a higher risk industry.

Even then, it is today still offering a 6.4% dividend yield.

Bottom Line

During market downturns like the current one, investors tend to be the most skittish about buying stocks. They’re usually the most optimistic and pollyannish about potential risks during bull markets when valuations are high. And when valuations are low (like right now), all investors seem to see or care about are the risks.

But lower valuations and higher yields for strong companies inherently translate into lower risk. As we likely enter a recession soon, we think investors would do well to own high-quality, high-yielding names like these two.