gk-6mt

Introduction

Companies enabling global trade and commerce are crucial in the industrial sector. The logistics and transportation sector is an important pillar in portfolios. The industry, characterized by its fast-paced expansion into long-distance and global trade, plays a vital role in the modern economy. As e-commerce continues to expand, reshaping consumer behavior and supply chains, companies within this sector that can adapt quickly, leverage technology, and expand strategically are positioned for growth. FedEx (NYSE:FDX) emerges as an exciting company in these market dynamics.

FedEx has been growing in the logistics sector. Over the last decades, it has expanded its global reach and become a global behemoth. The company’s ability to integrate acquisitions of peers outside the U.S. has helped it achieve a leading position with its peer UPS (UPS). This article will summarize my investment thesis regarding FedEx, and I believe shares of the company are a BUY.

Seeking Alpha’s company overview shows that:

FedEx Corporation provides transportation, e-commerce, and business services in the United States and internationally. It operates through FedEx Express, FedEx Ground, FedEx Freight, and FedEx Services segments. The FedEx Express segment offers express transportation, small-package ground delivery, and freight transportation services. The FedEx Ground segment provides small-package ground delivery services. The FedEx Freight segment offers less-than-truckload freight transportation services. The FedEx Services segment provides sales, marketing, information technology, communications, customer service, technical support, billing and collection, and back-office support services.

Fundamentals

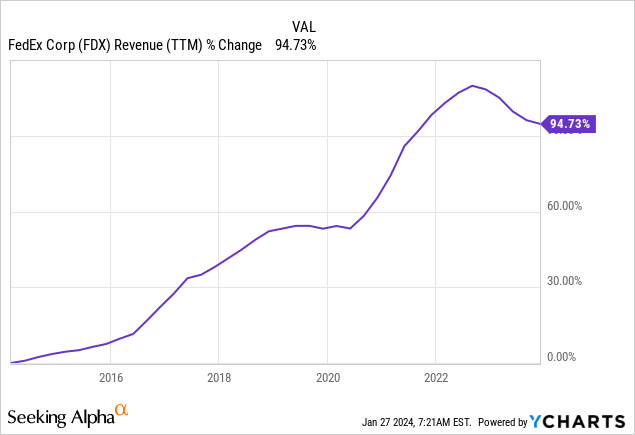

FedEx’s sales have seen an impressive increase of 94%, showing its strategic growth and market adaptability. This growth results from organic expansion and acquisitions, enhancing FedEx’s global presence and service capabilities. The TNT acquisition in 2016 for 4.4B Euros is a prime example, allowing FedEx to deepen its European market penetration and offer its customers a broader range of services. As seen on Seeking Alpha, analysts project FedEx to grow sales slowly, with sales expected to grow at an annual rate of about 2.5% in the medium term.

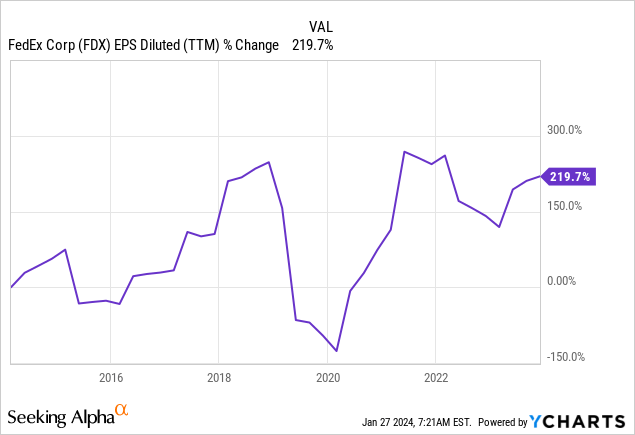

FedEx’s EPS (Earnings Per Share) growth has been remarkable, with a 220% rise over the last decade. This EPS surge reflects a synergistic blend of sales growth, prudent share buybacks, and an improved FCF (Free Cash Flow) margin as the company tries to lower costs. As seen on Seeking Alpha, analysts project fast growth for FedEx, with an expected annual EPS growth rate of around 16% in the medium term. The company will grow sales and improve its profitability and operational efficiency.

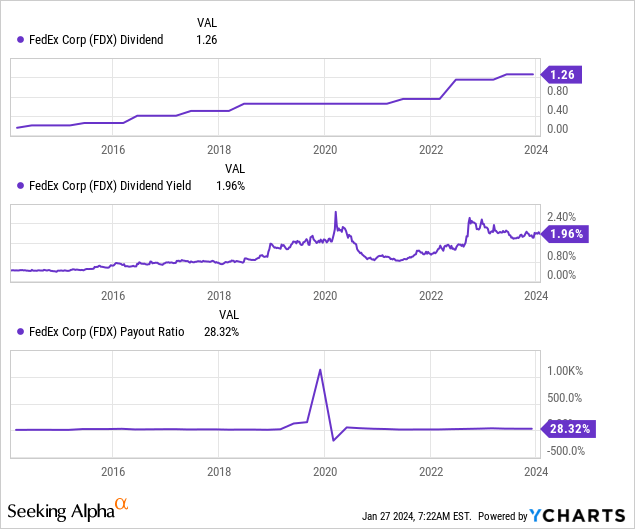

FedEx has a history of dividend payments with resilience and consistency. For 21 years, the company has not reduced the dividend payout, navigating market uncertainties and adapting to changing economic landscapes in challenges such as the pandemic and the 2008 financial crisis. In April 2023, FedEx announced a 10% increase in its dividend, which signals confidence in its financial stability and prospects. With a low payout ratio of 28%, the current 2% yield offers investors a sense of security and an expectation of continued growth in dividend payouts that are likely to be in the 10% area and even higher as the EPS growth is promising.

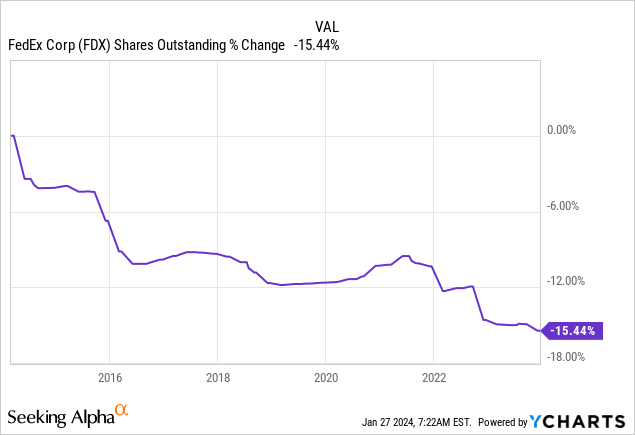

The company has a strategic approach to share buybacks, as it maintains a low dividend payout ratio and wishes to return more capital in a discretionary way. It has been effective in enhancing shareholder value. Over the last decade, FedEx has reduced its share count by 15%, supporting EPS growth and showing commitment to shareholders. In 2024, the combined allocations for dividends and buybacks are projected to reach $3.3 billion. This substantial allocation underscores FedEx’s focus on sustaining and enhancing shareholder value.

Valuation

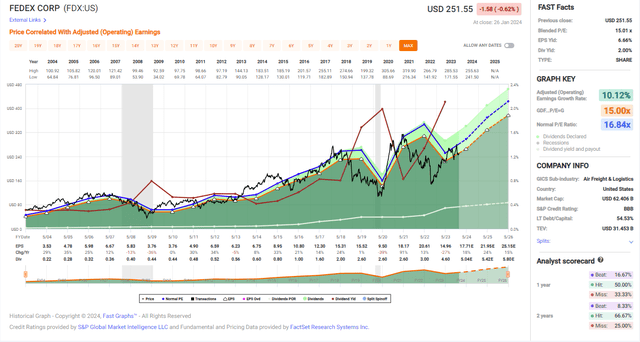

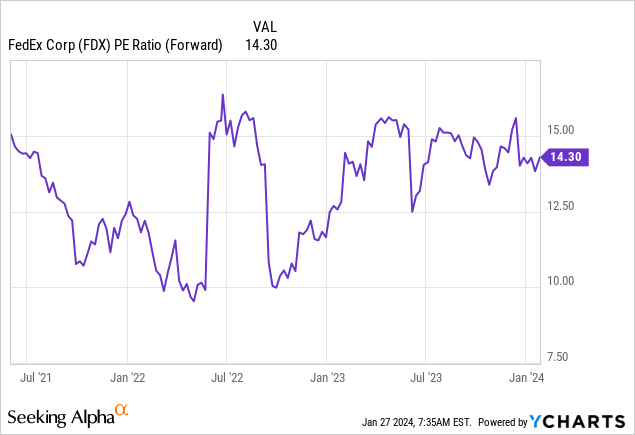

FedEx’s P/E (Price to Earnings) ratio is 14 times its 2024 EPS estimates. This valuation places it on the higher end of its P/E range, which has fluctuated between 10 and 15 over the last two and a half years. However, this valuation remains attractive given the company’s promising growth forecast of 16% annually. Despite its current price, it suggests that FedEx offers potential for significant growth, making it an appealing option for investors seeking growth in a stable and solid blue-chip company.

A deeper dive into FedEx’s valuation using Fast Graphs reveals an even more attractive investment opportunity. The company’s average P/E over the last 20 years is 17, compared to the current P/E of 14. This lower P/E ratio, coupled with an above-average growth rate (current forecast at 17% versus an average of 10%), indicates that FedEx is valued below its historical average and poised for faster growth. This graph helps me establish the thesis that FedEx offers a favorable entry point for investors looking to capitalize on its future growth trajectory.

Opportunities

The first growth opportunity is e-commerce and technology expansion. These technology-driven logistics solutions present a substantial growth opportunity. The company’s commitment to integrating state-of-the-art technologies and expanding its global e-commerce capabilities positions it to capture a larger market share in the rapidly growing e-commerce sector while working with various vendors who seek easy, sleek, and tech solutions to deliver their products. This focus not only aligns FedEx with current market trends but also prepares it to meet future demand trends and position it as a leader in logistics innovation. This is the most significant opportunity as it expands market share in the fast-growing realm of e-commerce.

“We are aggressively expanding in the e-commerce logistics space, utilizing our technology-driven solutions to cater to a broader market segment. This strategic move is expected to significantly enhance our market share and operational efficiency.”

(Raj Subramaniam – President and Chief Executive Officer, Q2 2024 Conference Call)

Another growth opportunity is the expansion into smaller and emerging markets. FedEx is poised to capitalize on the increasing demands for efficient global supply chain solutions, particularly in emerging markets. With its extensive network and logistics expertise, FedEx is well-equipped to address the complexities of global supply chains, offering customers a seamless and efficient service. This strategic focus broadens FedEx’s market appeal and cements its position as a global logistics leader. With a vast fleet of trucks and planes and the experience needed, it will likely succeed in entering new markets.

“The expansion of our global supply chain services, especially in emerging markets, is a key growth driver. Our ability to provide integrated logistics solutions positions us as a partner of choice in these rapidly growing markets.”

(Brie Carere – Executive Vice President, Chief Customer Officer, Q2 2024 Conference Call)

Another smaller opportunity is investments in sustainability initiatives and green solutions. In an era where environmental responsibility is increasingly paramount, especially in developed markets, FedEx’s commitment to sustainability and eco-friendly logistics solutions represents a forward-looking growth opportunity. As the company invests in sustainable practices and green logistics solutions, it not only aligns with global environmental trends but also attracts new customer segments, strengthening its overall market position and creating a higher barrier as new entrants will have to invest heavily in green and eco-friendly infrastructure. Thus, these investments are likely to make a differentiation.

“Our dedication to sustainable practices and the development of eco-friendly logistics solutions opens up new growth avenues. This commitment not only aligns with global environmental trends but also enhances our appeal to a broader customer base.”

(John Dietrich – Executive Vice President and Chief Financial Officer, Q2 2024 Conference Call)

Risks

The most prominent risk for FedEx is increasing global fuel prices. The fluctuations in international fuel prices present a significant challenge for FedEx, affecting its operational costs and profit margins. The company must continuously adapt its pricing strategies to offset these cost variations, which can impact its competitive positioning in the market. When we see wars in Europe and the Middle East, the risk of a spike in oil prices is higher, and it may hurt the company’s profit margin and erase its cost-cutting efforts.

“Managing the volatility of global fuel prices is a key challenge. These fluctuations impact our operational costs and necessitate strategic pricing adjustments to maintain our market competitiveness.”

(Stephen Hughes – Director of Investor Relations, Q2 2024 Conference Call)

Another risk for FedEx’s international operations is regulatory changes and geopolitical tensions in key markets. Changes in trade policies or geopolitical instability could disrupt the company’s logistics network and trading capabilities, impacting its global operations. If wars in Europe and the Middle East expand, we may see more disruptions to international trade. We already see challenges sailing through the Suez Canal and the inability of planes to use Russia’s vast air space, and if it continues, it may force the company to increase prices and lose market share.

“The evolving regulatory landscape and geopolitical tensions in key markets pose challenges to our international operations. We continuously monitor these factors to adapt and mitigate potential impacts on our global logistics network.”

(Raj Subramaniam – President and Chief Executive Officer, Q2 2024 Conference Call)

The cybersecurity threat is another specific risk today, especially with the war between Russia and Ukraine. In an increasingly digital world, cybersecurity threats and technological disruptions pose significant dangers to FedEx. The company’s reliance on digital and data-driven logistics solutions means a breach or significant technical failure could disrupt operations and affect customer trust. As digital capabilities save costs, if a cyber threat materializes, it may hurt the whole operation for several days, resulting in significant costs and lower margins.

“Staying ahead of cybersecurity threats and technological disruptions is imperative for our operations. We are investing in robust security measures and technology resilience to protect our operations and maintain customer trust.”

(Brie Carere – Executive Vice President, Chief Customer Officer, Q2 2024 Conference Call)

Conclusion

In conclusion, FedEx is a leading player in the logistics and transportation sector, backed by a history of solid growth in revenues and EPS. The company’s strategic initiatives in expanding e-commerce capabilities, enhancing global supply chain services, and investing in sustainability position it well for future growth. FedEx’s financial strength is further underscored by its commitment to dividends and share buybacks, reflecting its focus on delivering shareholder value.

However, the company faces challenges, including volatile fuel prices, regulatory uncertainties, and cybersecurity threats requiring careful execution. Despite these risks, the company is a compelling investment opportunity considering FedEx’s solid fundamentals, attractive valuation, and strategic positioning for growth. The balance of opportunities and risks and its current valuation solidifies FedEx as a “BUY” for investors seeking growth and growing income.