Pgiam/iStock via Getty Images

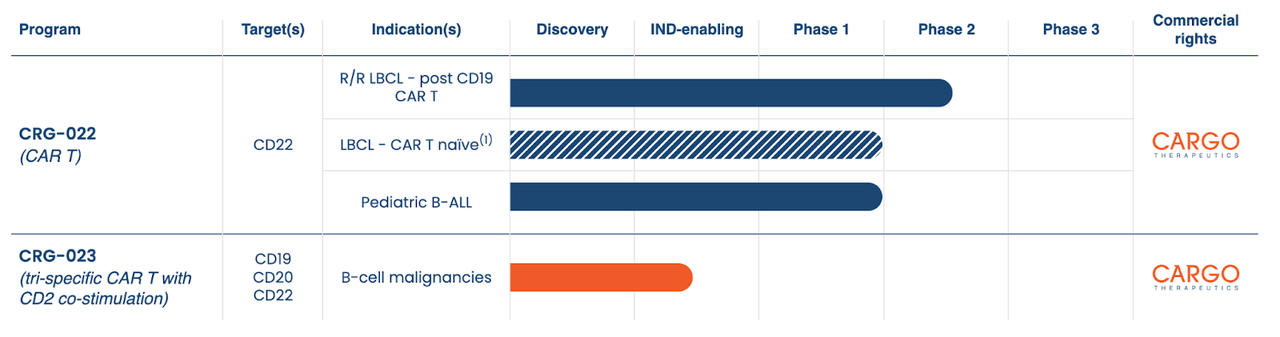

CARGO Therapeutics (NASDAQ:CRGX) IPO-ed in October with a plan to develop cell therapies for cancer patients. Its pipeline is as follows:

Lead asset CRG-022, licensed from the National Cancer Institute, is a CDD22 targeting CAR-T therapy in a potentially pivotal phase 2 trial in patients with r/r LBCL who have already been treated with a CD19 targeting CAR T. The first 7 patients have been dosed; interim results are expected in 2025. The same asset is also in the same indication but in patients that are CAR T naive, and apparently also in an earlier line setting. It is also in a phase 1 trial in pediatric B-ALL.

About this same program, the company remarks:

Based on data from the Phase 1 clinical trial conducted by Stanford and pending data from our ongoing Phase 2 trial in R/R LBCL – post CD19 CaAR T, we intend to discuss with the FDA initiation of a Phase 2 program in LBCL – CAR T naïve without completing earlier clinical trials in LBCL – CAR T-naïve patients.

Before we proceed, there’s a bit of major news for all CAR-T therapies which I need to discuss. Earlier this month, the FDA announced that, in light of potential risk of secondary T-cell malignancies after CAR-T treatment, that all CAR-T therapies need to carry a REMS (Risk Evaluation and Mitigation Strategy, basically a warning label on the medicine package) declaring this risk. The FDA text:

On Jan. 19, the FDA issued safety labeling change notification letters to all manufacturers of licensed BCMA-directed and CD19-directed genetically modified autologous CAR T cell immunotherapies requiring a revision to the package insert due to risk of T cell malignancies, with serious outcomes, including hospitalization and death. The FDA considers the serious risk of T cell malignancy to be applicable to all BCMA- and CD19-directed genetically modified autologous T cell immunotherapies.

Now, CRG-022 is a CD22 directed CAR-T. The FDA order is about all autologous BCMA- and CD19- directed CAR-TS, which, obviously, CRG-022 is not, although it is autologous. CD22 is also a B-cell surface protein like BCMA and CD19, with the difference being that while BCMA and CD22 occur on mature B-cells, CD19 occurs from early stage onwards. They also, of course, have different roles to play in oncogenesis. Now, whether the development of secondary T-cell malignancies has any bearing on only BCMA/CD19, or whether it is independent of the target, needs to be researched. Both Novartis, developer of Kymriah, and Bristol Myers Squibb, developer of Abecma and Breyanzi, have said they have not found such a causal relationship between CD19 or BCMA and T-cell malignancy. Gilead, developer of Yescarta and Tecartus, given to nearly 20,000 patients so far, have also denied such a causal relation. However, this REMS is going to be there, and this risk is not gone unless it is gone; how impactful the REMS will be for sales bottomline is debatable.

Now, coming to the disease space, LBCL and B-ALL are large B-cell lymphoma and B-cell acute lymphoblastic leukemia, respectively. LBCL has various subtypes, of which DLBCL is the most common and most well-known. There are approved CAR-Ts for both LBCL (DLBCL) and B-ALL. These include BREYANZI, TECARTUS and so on. However, there are various limitations of current CAR-T therapies. One of the limitations highlighted by CRGX is durability. In the ZUMA-1 trial run by Gilead, CRGX notes that 2nd+ line LBCL patients treated with Yescarta saw nearly 60% of these patients relapsing within 24 months. In contrast, a phase 1 trial run by Stanford saw the following:

-

CR rate of 53% (20 of 38 patients);

-

responses were durable with 85% of patients (17 of 20 patients) that achieved a CR maintained their response with a median follow up time of 23 months and a maximum of 43 months;

-

overall response rate (ORR) of 68% (26 of 38 patients), which was statistically significant;

-

median overall survival (OS) of 14.1 months;

A few points to note: ZUMA-1 had 101 patients and a 5-year follow up published this year saw a 58% CR rate, as against the 53% CR seen in 38 patients. Duration of response improved considerably in the 5-year follow up.

Here’s the complete ZUMA data for reference:

The data cutoff date for this analysis was 11 August 2021, and patients treated with axi-cel had a median of 63.1 months of follow-up (range, 58.9-68.4) from infusion. Among the 101 patients who received axi-cel, the investigator-assessed ORR was 83% (n = 84; 95% CI, 74-90; Table 2), and 58% (n = 59) achieved a CR. Among all treated patients, median DOR was 11.1 months (95% CI, 4.2-51.3). At data cutoff, 31 patients (31%) had an ongoing objective response and 30 (30%) had an ongoing CR. Concordantly, the median duration of CR was 62.2 months, whereas the median duration of partial response was 1.9 months (Table 2). Among patients who achieved a CR (n = 59), 37 (62.7%) had a CR by the week-4 assessment and 22 (37.3%) reached CR after the week-4 assessment. The median DOR was 34.7 months (95% CI, 7.8-not estimable [NE]) in those who had a CR by week 4 and was not reached (95% CI, 26.9-NE) in those who achieved a CR after week 4 (supplemental Figure 1).

There are various data points we do not have in this release, like the number of patients with 2nd line or greater therapy, numbers of relapsing patients and so on. Also note that mDOR was not reached at 60 months for those patients who achieved a CR after week 4. This differentiated data for when patients achieved CR is not available for CRGX.

What I am trying to say is, on the basis of durability of CR alone, CRG-022 does not differentiate – at least in these early trials – from established players. Median overall survival was also nearly double in the ZUMA trial, albeit at 5-year follow up.

Also note that in the CRG-022 trial, there were “two reports of cardiac disorders, which included grade 3 ejection fraction decreased and grade 2 heart failure.” It is not disclosed whether these were treatment-related; however in ZUMA’s data, no cardiac AEs are discussed.

Financials

CRGX has a market cap of $927mn and “cash and cash equivalents of $60.3 million and approximately $438 million.” Research and development (R&D) expenses were $22.2 million for the quarter ended September 30, 2023, whereas general and administrative (G&A) expenses were $6.5 million. At that rate, they have a cash runway of 10+ quarters.

PE/VC firms own 38% of the stock, followed by retail at 29% and institutions at 22%. FMR, RTW and Samsara are key holders.

Bottomline

CRGX has a great leadership and advisory team, including ex-Genentech and Janssen people. It managed to raise $200mn in a Series A financing backed by big name funds, and also made possible an upsized IPO. Big funds, clearly, think highly of this company; the Stanford connection, doubtless, having an impact. My point here was only that it is still early days for the company, and the programs are still not very differentiated from established players, even if the CD22 targeting does differentiate it ab initio.