Justin Sullivan

Popular denim maker, Levi Strauss (NYSE:LEVI), reported its Q4 results on Thursday. Despite notable developments such as the announcement of a new global productivity initiative, as well as the official start of Michelle Gass’ tenure as CEO, markets appeared to shrug off LEVI’s report.

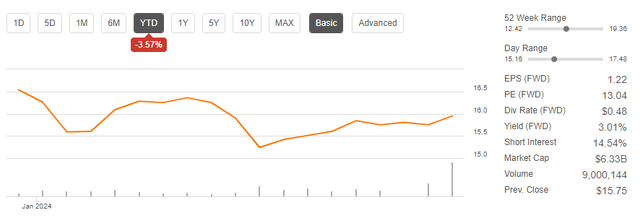

Shares ended the week largely flat, following swings between gains and losses immediately following the release. YTD, the stock is down about 3.5%.

Seeking Alpha – LEVI YTD Share Price Return

In prior coverage on LEVI, I have expressed bullishness due primarily to the company’s discounted valuation. I also viewed the company’s growing international business and direct-to-consumer (“DTC”) sales channel as a key strength.

The stock has gained over 20% since my update, outpacing the S&P’s 15.5% gain in the same period. I believe LEVI could gain further in the periods ahead, supported in part by the prospects of new leadership, margin expansion, and continuing strength in LEVI’s international business.

Levi Q4 Results Recap

Levi reported mixed Q4 results, which included a +$20M miss on revenues and overall earnings in-line with expectations.

While the revenue miss is worth the mention, it’s more important to note that LEVI’s U.S. market, their largest operating region, returned to growth during the quarter. The market also reported 10% growth in its DTC channel, including 13% growth in e-commerce. And looking ahead to fiscal 2024, LEVI sees continued growth in the region in the low single-digit range.

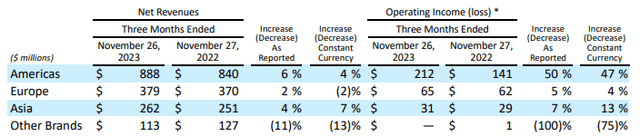

LEVI Q4 Earnings – Summary Of Operating Performance By Region

Outside of the Americas, LEVI also reported growth in Europe. The gains here were despite unfavorable weather conditions for denim through the first half of the quarter. Overall, the region reported 1% growth, with double-digit DTC growth, including e-commerce up 33%.

Elsewhere, Asia continues to be Levi’s largest bright spot. During the quarter, revenues were up 7% YOY and 24% from two years ago. And for the full fiscal year, Asia grew 18% following growth of 24% in the year prior.

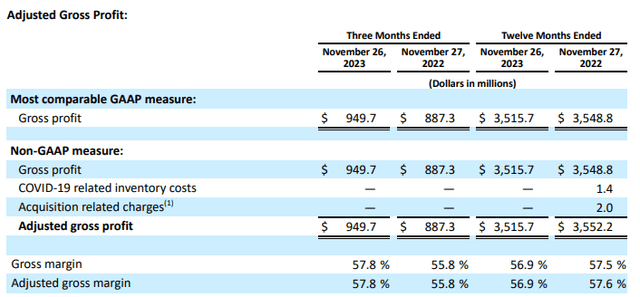

More to the bottom line, LEVI reported a 200 basis point YOY expansion in gross margins to 57.8%. Ultimately, this contributed to a 30% YOY increase in EPS. And in fiscal 2024, the management team is expecting another increase of about 9%, with targeted adjusted diluted EPS of $1.20/share at the midpoint.

LEVI Q4 Earnings – Comparative Summary Of Gross Margins

Looking ahead, LEVI’s margin profile should further strengthen due to several factors. First, they have no plans to enact price cuts in fiscal 2024. In addition, they discontinued their Denizen brand in Q4, one of their lower margin product offerings. And finally, they announced a global productivity initiative that is expected to result in +$100M in savings.

Takeaways From LEVI Q4 Results

International Growth Remains Robust: In Q4, Levi continued realizing success in their international business. Growing 4%, performance in the segment surpassed the overall company. The outperformance comes as its share of total revenues continues to grow. In fiscal 2023, international sales represented 56% of total revenues, up from about 53% last year. Select regions are also exhibiting outsized growth. Asia, for example, has grown about 30% since 2019.

Levi Taking Necessary Steps To Grow Margins: Over time, LEVI expects to attain operating margins of 15%. At present, the company appears to be setting the foundation in getting there. In Q4, LEVI discontinued Denizen, one of two of their value-oriented brands. The exit is notable in that the brand operated on a lower margin profile. LEVI can now focus their value efforts exclusively on Red Tab, which carries higher gross margins.

Levi also announced that the workforce would be reduced by 10-15%, resulting in savings of approximately +$100M. The reductions are but one component of Levi’s global productivity initiative, Project FUEL. The initiative is necessary, in my view, given Levi’s significant investment in their DTC model in recent years.

Michelle Gass’ Comeback Opportunity: At Kohl’s, incoming chief, Michelle Gass, ended her career with a protracted battle with activist investors. The battle followed successful initiatives spearheaded at Kohl’s under her watch, including the Sephora integration, as well the partnership with Amazon (AMZN) regarding product returns.

With Levi, Gass will have the opportunity to advance the company’s strategic vision of relying less on department store sales and more through DTC, a channel that has seen significant investment in recent years. Gass will also be tasked with implementing LEVI’s global productivity initiative, Project FUEL. While it won’t be easy following in the footsteps of her predecessor, Chip Bergh, Gass will likely benefit from Levi’s stronger operational footprint to start the fiscal year.

Is LEVI Stock A Buy, Sell, Or Hold?

LEVI ended the 2023 fiscal year on a strong note. The blue-jean maker continued reporting growth in its DTC channel, a key component of the company’s strategic vision. It also returned to growth in its Americas division.

Levi also ended the fiscal year with new leadership in Michelle Gass, a promising executive who likely is eager to mount a comeback following her departure from Kohl’s. The announcement of Levi’s productivity initiative appears to be a start. The initiative, which includes a 10-15% reduction in the workforce, is necessary, in my view, for LEVI to attain its profitability goals.

LEVI currently trades at a discount to the owner of Wrangler jeans, Kontoor Brands (KTB). LEVI carries a price/sales multiple of about 1.0x to KTB’s 1.3x. LEVI’s forward earnings multiple of 13.3x is also slightly discounted to KTB. In my view, improving margin prospects and the potential for positive directional change via new leadership warrant a reassessment in LEVI. Wall Street currently sees about 6% of remaining upside in the stock. I believe LEVI could outperform this target and settle about 10% higher through a successful implementation of their productivity initiative. I, therefore, continue to view shares as a “buy.”