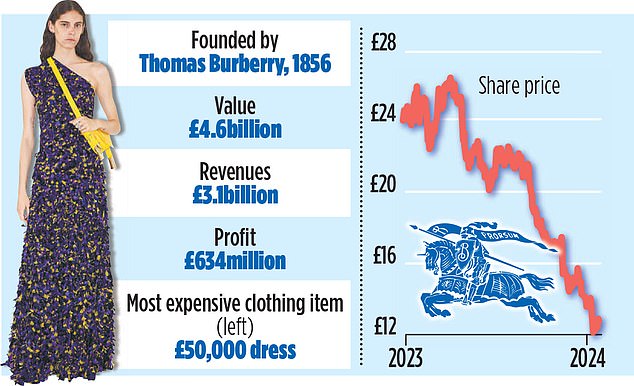

A profit warning and a drop in the share price have given Burberry a rocky start to the year – and the City believes it will get worse before it gets better.

Hedge funds have rounded on the luxury fashion house since mid-January when it confessed that sales had been weak over Christmas. The FTSE100-listed business had first sounded the alarm on trading three months earlier.

Almost 5 per cent of its stock is now out on loan to short sellers – including Mayfair hedge fund Marshall Wace – who will make money if the share price falls. This is up from less than 1 per cent at the start of this year.

Rocky road: A profit warning and a drop in share price have given Burberry a tough start to the year

Short positions against Burberry have not been this high since 2016, which was a turbulent year marked by falling profits, dissatisfied investors and a boardroom overhaul that led to the toppling of Christopher Bailey as chief executive.

Analysts are taking aim at the company, famous for its distinctive check, with a long list of banks including Goldman Sachs, Stifel, HSBC, Barclays, RBC and Jefferies all cutting the target price for its stock.

Founded in 1856 by draper’s assistant Thomas Burberry, the brand is best known for its trenchcoats. The company was forced to spend years recapturing its cachet as a high-fashion icon after its famous checked pattern became popular with football hooligans.

Burberry has ‘the building blocks’ in place for the next stage of its makeover, according to RBC analysts. But they add that a ‘less favourable luxury and macroeconomic backdrop’ may prove to be more challenging in the short-term.

Last week, luxury stocks received a boost when LVMH reported strong results, although the figures also showed that revenue growth was slowing – an indication that the industry is not out of the woods yet.

LVMH is helped by the fact that it has a plethora of brands including Louis Vuitton, Christian Dior and Moet & Chandon. This means that even if one part of the market is lagging, the chances are that others are thriving.

Burberry, on the other hand, will always be hamstrung by the fact that it is a one-brand business. Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown, said: ‘Huge listed conglomerates have a complete sweep of brands which means there is less volatility and they are less vulnerable to changes in spending.’

She added that Burberry – led by Jonathan Akeroyd – is more exposed than other luxury good groups to ‘aspirational’ shoppers who are not rich and are being forced to rein in their spending. Burberry has also pursued a strategy of raising prices, which may not be going down well. And then there is the question of whether people like the designs.

There has been a muted response to recent lines designed by chief creative officer Daniel Lee. Burberry could be a takeover target. Whatever happens this will be a critical year for the company.