Souda/iStock via Getty Images

Introduction

America

Song by Neil Diamond

Far

We’ve been traveling far

Without a home

But not without a star.

Free

Only want to be free

We huddle close

Hang on to a dream

On the boats and on the planes

They’re coming to America

Never looking back again

They’re coming to America

The markets never fail to keep us guessing, but this year has shown even more evidence that predicting markets is a fool’s game. Remember my Q2 letter? For the first time in 23 years, all Wall Street strategists predicted negative stock returns for 2023. How did that turn out?

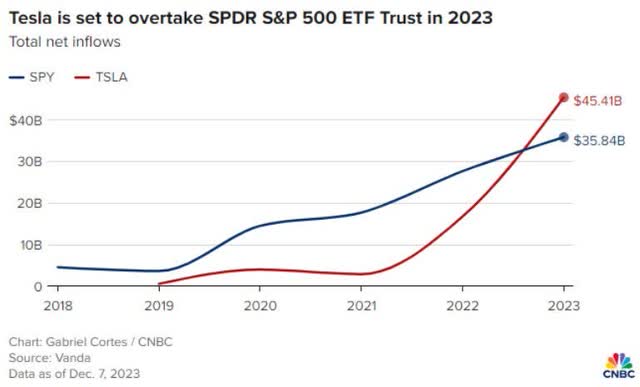

This year we have witnessed some astonishing statistics. At one point, the Magnificent Seven was responsible for the entire return of the S&P. More money has flowed into Tesla’s (TSLA) individual stock than into the S&P 500 ETF. Additionally, the Magnificent Seven boasts a market capitalization three times larger than the entire American small-cap stock market (2000 stocks).

If you want to be ostracized at an American cocktail party, simply state that you believe the Magnificent Seven will not continue to lead the market or suggest that Nvidia (NVDA) may be overvalued. It’s even worse than not believing in global warming or being unable to meditate.

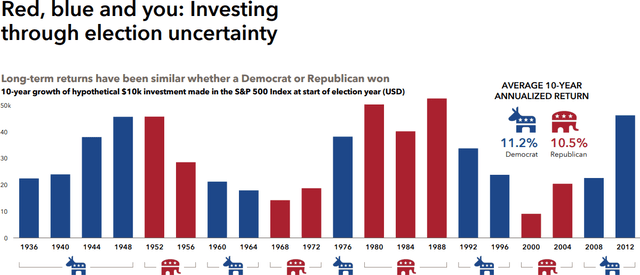

But here comes 2024, with one presidential candidate carrying ninety-one felonies, and the other facing an impeachment hearing with plummeting poll numbers. As we know, market discussions surrounding the presidential election will intensify. If you thought Wall Street strategists were bad at predicting markets, just try using politics as your guide.

From Irrelevant Investor Blog https://theirrelevantinvestor.com/2023/11/22/animal-spirits-literal-cash-on-the-sidelines/

Part I: American Economic Dominance vs. Polls

“According to most polls, Americans are ending the year in a sour mood. Trust in all public institutions, ranging from the government to the Supreme Court to the media and the military, is near historic lows. Four in 5 Americans confess to being worried about the economy and believe that it is getting worse. Fully two-thirds of respondents tell pollsters that the country is “on the wrong track.” The upcoming 2024 presidential election depresses everyone. War in the Middle East and the ongoing plight of Ukraine in the face of Russia’s invasion create a sense of a world in conflict, and the surge in illegal immigration has reached a point where there is an emerging bipartisan consensus that it must be addressed more forcibly.” -Zachary Karbell, Wall Street Journal

source: https://www.brainyquote.com/quotes/friedrich_nietzsche_107593

As we usher in the New Year, let us begin by reflecting on how fortunate we are to live in America. Despite our polarized politics, the constant flow of disheartening news on social media, and the involvement of our closest allies in two ongoing wars, the American economy continues to assert its undeniable dominance.

Surrounded by Canada, Mexico, and vast bodies of water, and possessing the world’s most formidable military, our nation remains impervious to invasion. This notion is well captured in Tim Marshall’s book I highly recommend, ” Prisoners of Geography“:

“Equally significant in modern times is the fact that anyone foolish enough to entertain thoughts of invading America would swiftly realize that it is home to hundreds of millions of firearms, readily accessible to a populace that deeply values its life, liberty, and pursuit of happiness. In addition to our formidable US Armed Forces, we have the National Guard, state police, and urban law enforcement units capable of rapid mobilization. In the event of an invasion, every town in the US, whether it be Folsom, Fairfax, or Farmerville, would rapidly resemble an Iraqi Fallujah.”

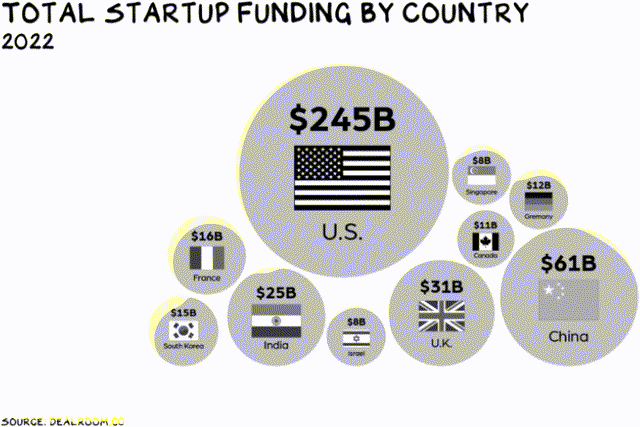

Over the past two decades, our already world-leading U.S. economy has surged in its dominance over the rest of the globe. Technology and innovation favor free markets, education, and the rule of law. Despite record political polarization, the economy remains resilient, particularly for entrepreneurs.

While America has thrived since emerging from the great fiscal crisis, the impact of social media and politics has left some U.S. citizens feeling psychologically strained and burdened with guilt.

Nonetheless, there is no shortage of positive news for our country.

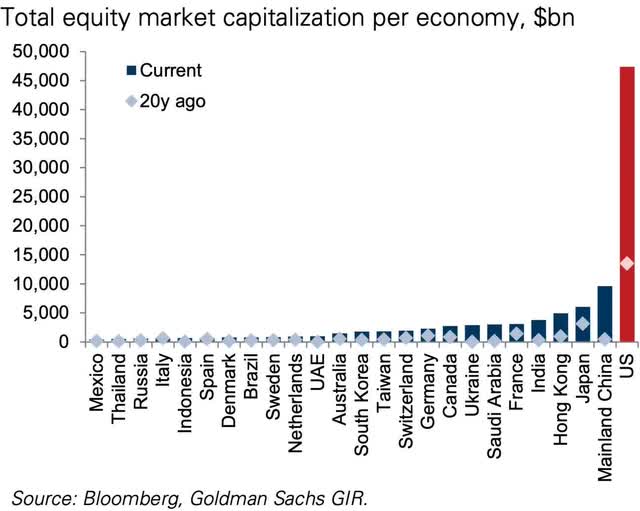

The U.S. stock market is of colossal scale, and the private equity sector is experiencing exponential growth. We have transitioned from being leaders with the deepest and most liquid markets to outright domination over our competitors, as highlighted by Barry Ritholtz’s blog.

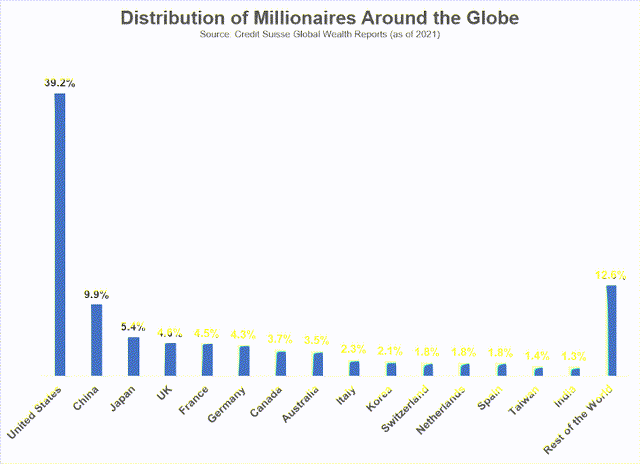

Distribution of Millionaires

The stock market’s and economic leadership of the United States has led to a record number of American millionaires. Despite comprising only 4% of the world’s population, America boasts 40% of the world’s millionaires. In contrast, China’s millionaires are moving their money out of the country, while our affluent citizens are merely relocating, often just a few states over from California.

source: https://awealthofcommonsense.com/2023/12/how-many-millionaires-are-there/

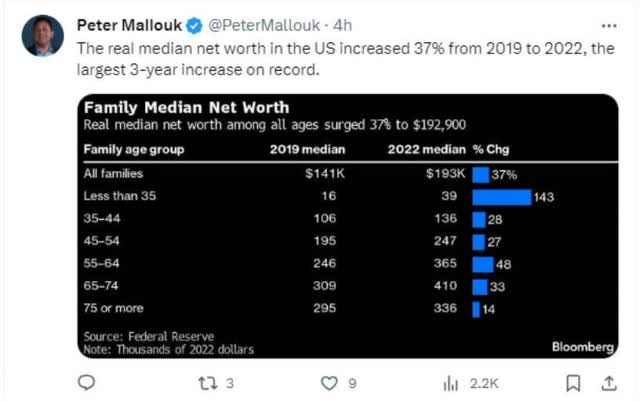

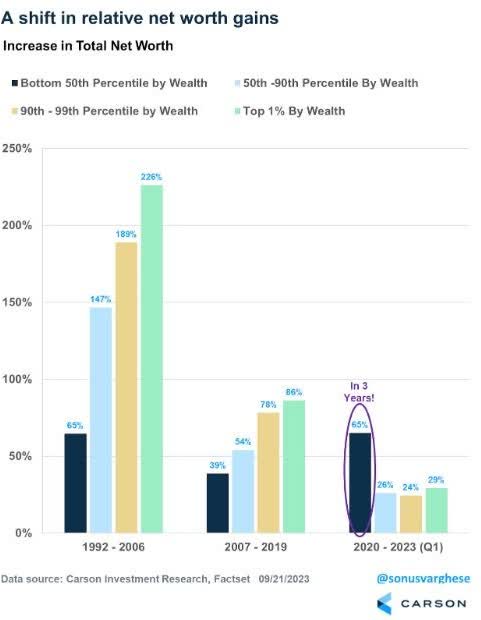

Bottom 50th Percentile See Large Increase in Net Worth

The prolonged period of low interest rates has had a negative impact, as the top 10% of income earners benefit the most from the rising values of stock portfolios, real estate, and business assets. However, the well-being of America’s bottom 50th percentile depends on increases in hourly earnings, and we are now witnessing significant gains among this group of U.S. wage earners.

A record number of Americans are poised to travel internationally, and cruise volumes have reached new highs. Just a few decades ago, a majority of Americans did not have the opportunity to vacation. Unemployment remains below 4%, with labor shortages observed across various industries. While border issues persist, America continues to admit more legal immigrants annually than the rest of the world combined.

From Irrelevant Investor Blog – https://theirrelevantinvestor.com/2023/09/27/animal-spirits-house-poor/

Additionally, the inflation-adjusted net worth of the median American family has recently experienced the largest three-year increase on record.

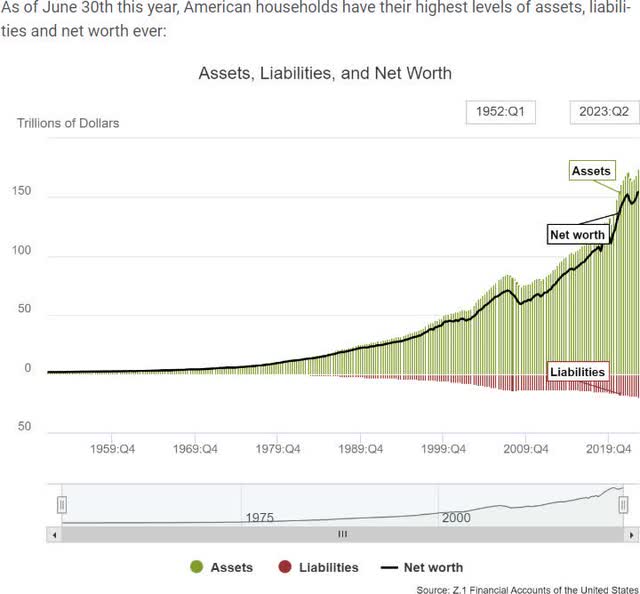

Personal balance sheets in the United States show high asset levels compared to debt, with much of the debt locked in at low interest rates.

“[T]he 2001 recession was mild. From 2001, when things bottomed out through the third quarter of 2007 (when things peaked before the Great Financial Crisis), total financial assets grew 64%.

That is not bad until you consider total liabilities surged a whopping 94% in that same time. There is a reason the 2008 debacle was a debt crisis. People borrowed too much money.

Now consider the growth in both assets and liabilities since things bottomed out from the Great Financial Crisis.

Since the end of the second quarter in 2009, assets have grown by 136% while liabilities are up just 40%. Assets have soared by more than $100 trillion. Debt has expanded by $5.7 trillion.

This means net worth has swelled by almost 160% from the bottom of the GFC.”

source: https://awealthofcommonsense.com/2023/09/how-rich-are-american-households/

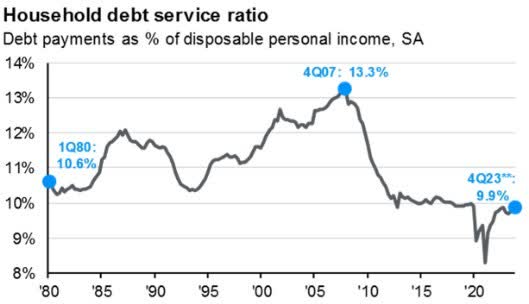

Furthermore, household debt services ratios are currently at their lowest levels in 50 years.

source: https://am.jpmorgan.com/us/en/asset-management/liq/

Contrasting with China, which was once expected to surpass the United States in economic leadership, the U.S. unemployment rate stands at 3.7%, with the tech sector even lower at 3.1%. In contrast, China faces a 16-24-year-old unemployment rate of 21.5%, often associated with the “lying flat” generation. They were going to overtake the United States economic leadership and we were supposed to teach our children Mandarin or get them ready to work at Walmart. How did that turn out?

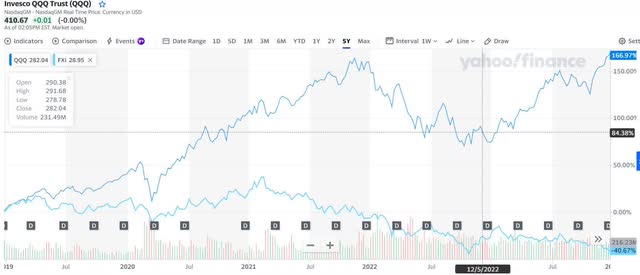

The American stock market has not only outperformed China’s, but it may be the biggest blowout in history.

5 Year Number-Nasdaq QQQ +167% vs. China FXI ETF -40%

The strength of the American economy is attributed to its willingness to take risks, embrace failure as a learning opportunity, recognize bankruptcy as a necessary part of the process, and accept that venture capital investments frequently result in total losses. These elements embody the painful realities of creative destruction and serve as the driving force behind American economic leadership.

The Myth of American Decline-Prof G/Scott Galloway Blog

source: https://www.profgalloway.com/least-bad/

Part II: It Is A Tech Thing

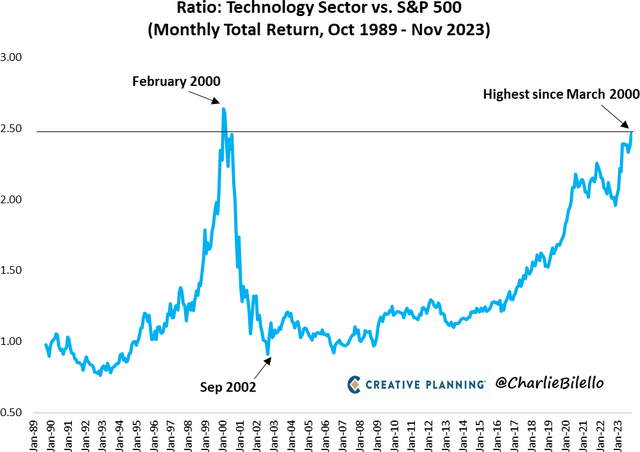

Keeping to the theme of my 2023 quarterly letters, we witnessed a substantial rally led by large-cap technology stocks, with little assistance from other sectors or market caps until the latter part of the fourth quarter of 2023. In terms of inflows, this year saw massive investments pouring into technology stocks and money markets. As a result, the rally in the technology sector has pushed its ratio relative to the rest of the S&P 500 to record levels not observed since February of 2000.

Sector ratios are a valuable tool for traders, allowing them to compare the performance of two sectors within the stock market. For instance, traders may evaluate how the technology sector is faring in comparison to the energy sector to ascertain which sector is currently outperforming the other. You can find an example of such ratio charts and their utility at https://trendspider.com/learning- center/ratio-charts/.

This chart specifically contrasts the technology sector with the other ten sectors in the S&P 500. It was the advancement of AI that propelled the large-cap tech sector into high gear for the entirety of 2023.

Having observed the markets for 25 years, there are few things that can truly surprise me, but I must admit that the Tesla chart has left me astonished. Over the past six months, Tesla’s performance has seen only a modest increase of less than 2%, and since its inclusion in the S&P 500 three years ago, it has grown by a mere 6%, compared to the impressive 27% gain achieved by the overall index during the same period. What’s even more remarkable is that between 2019 and 2023, more capital flowed into Tesla’s individual stock than into the world’s largest ETF, the S&P 500 SPY.

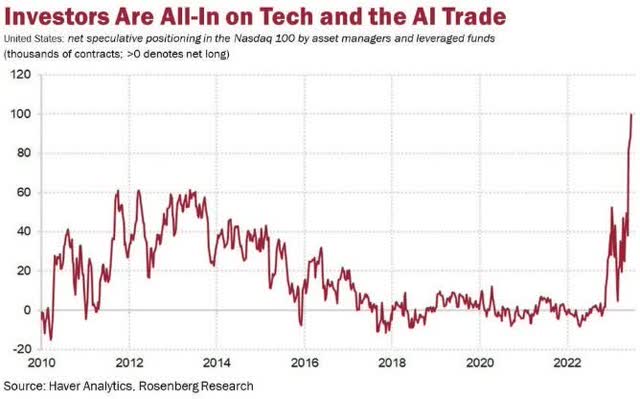

All-in on AI: Speculators have been stampeding into tech stocks. The combination of AI hype, passive flows favoring the big end of town, and the prospect of peak rates has powered up speculative fervor.@Callum Thomas (Weekly S&P500 #ChartStorm)

All you need to know about the chart below is a high number means a high amount of speculation in the sector.

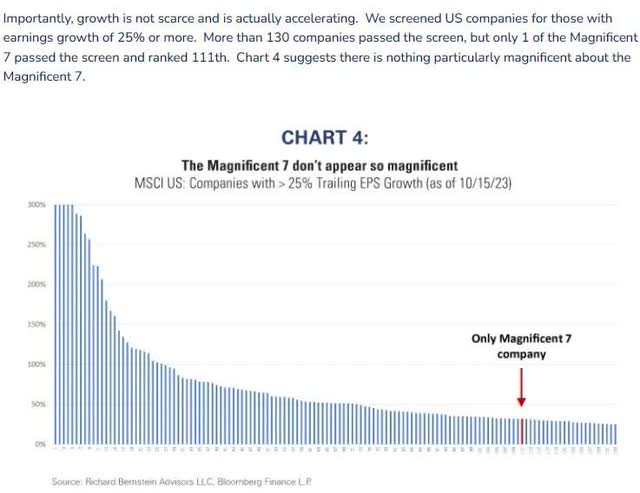

Can the large-cap tech boom continue with the Magnificent Seven leading the way? According to research by Richard Bernstein, 130 companies are experiencing growth rates of 25% or more, with only one of the Mag 7 included in that list.

If you’re interested in exploring an alternative perspective on the tech industry in 2024, I recommend checking out the following source: Richard Bernstein’s “Four for ’24: Year Ahead Outlook” on rbadvisors.com.

The future of the market is uncertain and complex, and I have no idea how tech will shake out, but it’s always prudent to consider multiple viewpoints.

Part III: What is Least Expected in 2024?

Remember that in 2022 most stock market experts predicted the stock market would return double digits, only to follow up in 2023 by predicting the stock market would experience negative returns. So, I am adding a twist to my year-end letters: comments on the least expected events. Keep in mind, I have no idea if any of the below will happen, but consensus is on the other side of the bet.

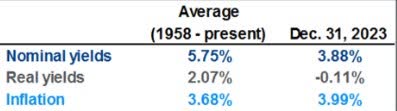

Interest rates go higher. Rates are not even back to 25-year median, and they are still negative on inflation adjusted terms.

JP Morgan Wealth

We have a recession as predicted by the inverted yield curve. There are zero signs of recession and soft landing is now a favorite phrase at every country club in the U.S. Wall Street and the American investing public is bulled up for 2024. Remember it was the exact opposite on January 1, 2023.

Technology stocks give up leadership with FAANGS/Mag 7 going negative. Apple (AAPL) and Google’s (GOOG)(GOOGL) recent losses in court are more serious than expected. This is American investing blasphemy. Artificial intelligence ends up over hyped, with Nvidia being the only company that figured out how to make money in early innings.

REIT stocks and commercial real estate post double digit total returns, outperforming the S&P. The office market starts clearing the decks in earnest at much lower prices, while multi-family, industrial and retail perform well.

The Bitcoin ETF is a “buy the rumor, sell the news” event as expectation of epic demand generated by the new product fall flat in the face of missing use cases. Halving? In the old days halving was called something different: “Ponzi scheme.” Who knows? But I am not betting on the concept of halving vs. use cases, right now this is still speculative investment for small positions.

Neither war ends or both wars end quickly. Take your pick on this coin toss on what is more unexpected. Is Ukraine going to give up land? Who is going to govern Gaza? Putin takes a bullet to head from inside. Seems like the guy who had the chance blew up in an airline “by accident.” Putin lost 90% of his original invading army to death or injury.

Ozempic drugs are over-hyped and go down. I do not know, the results look amazing, hence why no one expects them to sell off. Has there ever been a diet drug or supplement in history that did not produce negative side effects after becoming popular?

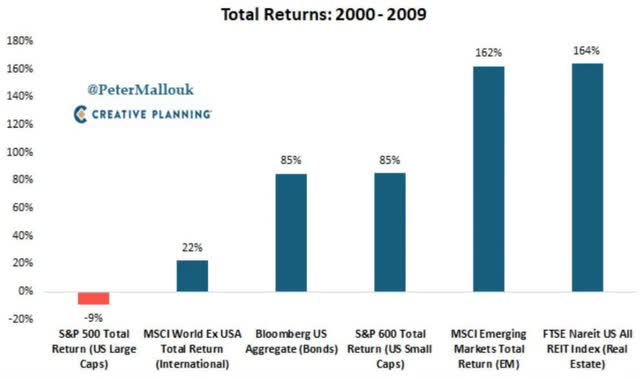

Reversion to the mean is dead. Small cap stocks, value stocks and international continue to underperform verse large-cap growth. The academics were wrong and cheap stocks stay cheap.

Oil surges back to $100, contributing to recession that everyone predicted in 2023. Alternative energy company bankruptcies pile up and as oil demand stays level. Alternative energy companies were funded during free money SPAC boom while traditional energy companies were building fortress balance sheets.

International stocks rally as dollar weakens outperforming U.S. stocks by double digits. China’s market recovers with its technology sector rallying 50%+ off single digit p/e lows. Let me know next time the guy next to you at the gym says he is loading up on international stocks.

Who Knows? Shit Happens!

4 for ’24: Year Ahead Outlook (rbadvisors.com)

Conclusion

The world is in conflict, and I do not want to make light of that serious fact, but the world is always in discord. American politics are a mess, but Washington is always in chaos. Recent history is worse, but the economy does not seem to care. People care, social media cares, cable TV cares, but the economy keeps on trucking. The business of America is business, waking up and going to work. The stock market frequently does the exact opposite of what the investing public expects, but the long- term power of compounding never dies. Expect the unexpected and control your emotions. Investing is a psychology game, not an IQ game. For the near future, America is leading the economic competition by multiple lengths.

“America” by Neil Diamond

My country ’tis of thee (today)

Sweet land of liberty (today)

Of thee I sing (today)

Of thee I sing

Today, today, today

Today, today, (today, today)

|

Disclosures Lansing Street Advisors, LLC is a registered investment advisor with the State of Pennsylvania. You can read more about the Lansing team at www.lansingadv.com. To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contained within should not be relied upon in assessing whether to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results Material compiled by Lansing is based on publicly available data at the time of compilation. Lansing makes no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use of such data. Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be forecast of future events or guarantee of future results. Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only. The trademarks and service marks contained herein are the property of their respective owners. Lansing Street Advisors is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance. Lansing Street Advisors may discuss and display, charts, graphs, formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.