cemagraphics/iStock via Getty Images

Dear clients and fellow shareholders:

If there was anything that economists were clear about a year ago, it was that the U.S. was in for a challenging 2023. More than two-thirds of the economists at the 23 large financial institutions that do business directly with the Federal Reserve predicted an impending recession. The reasons were evident-the housing market was declining, banks were tightening lending standards, interest rates had reached their highest levels since 2008, inflation stood at 7%, real wage growth was negative, and the Conference Board’s Leading Economic Index had fallen for nine consecutive months.

Instead of recession, the U.S. economy defied expectations and grew more than 3% in 2023. The U.S. stock market similarly outperformed expectations, with returns ranging from 14% (DJIA) to 24% (S&P 500).

Our stock portfolio matched the S&P 500’s (SP500, SPX) 24% return.

The forecasting failure of the broader economic community in 2023 was hardly a rarity. In late 2021, both Federal Reserve Chairman Powell and Treasury Secretary Yellen confidently predicted that inflation would be transitory. Wall Street analysts echoed this sentiment, projecting that 2022 equity returns would be modest, but positive. Instead, inflation was triple the Fed’s forecast and the S&P 500 declined 19%.

Our stock portfolio declined 7% in 2022. (Your actual equity portfolio returns in each year likely differed somewhat from our model, due to your specific asset allocation, possible legacy positions in your account and/or rounding errors.)

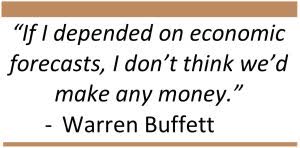

Reflecting on his and his colleagues’ failures in 2022, the chief global strategist for the Barings Investment Institute confessed, “we all approach the coming year with a certain level of humility.” We highlight the recurrent failures of the economic forecasting community not simply for sport, but to underscore a crucial point. (Although poking fun at economists is an easily mastered sport for almost anyone.) We realize that if someone is paid to make economic forecasts, they will inevitably produce them. We just advise not paying any significant attention to either the forecasts or the forecasters unless you are simply seeking a new form of entertainment. Certainly, don’t use them to inform your investment decisions.

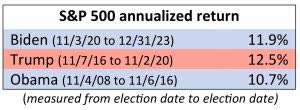

Please try to remember that as the news becomes even more dominated by the presidential election. There are few things certain, either in politics or economics. However, we can express a high level of confidence in one aspect of political affairs: whatever the outcome, 40% of voters will be absolutely convinced that we have elected as president someone who is a scoundrel, cognitively impaired, incompetent – or perhaps all three. Of course, this percentage mirrors the reactions observed in each of the past several presidential elections, and yet neither did the stock market plummet to zero, nor did unemployment skyrocket.

This isn’t to suggest that we believe that the selection of the president is inconsequential; there are plenty of things we would do differently from both the current and immediately preceding presidents if (God forbid) we were in that position. There is a long list of things we think are in need of fixing and there are plenty of ways we could argue that the country appears to face significant challenges. However, regardless of these concerns, the values of businesses will continue to be determined by the present value of the underlying cash flows those businesses generate, not whether the president is able to feed himself or is perceived as the second coming of Mussolini.

2023 stock highlights

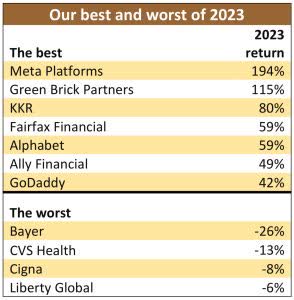

As we regularly emphasize, rather than trying to predict the economy or even the stock market, we focus on buying valuable companies when their stock prices don’t reflect the underlying values of those businesses. This often leads us to buy stocks for which there is little or diminished investor appetite – and it rarely results in us buying the hottest stock in a given year or quarter.

Some of our best performing positions in 2023 were investments that probably wouldn’t have seemed logical to someone making decisions on the basis of macroeconomic forecasts or what seemed obvious at the time. In the face of higher interest rates and tighter lending standards, few economists would have expected that homebuilder stocks would have a second straight year of substantial price increases. But those bearish sentiments were based on first level, or superficial thinking. Looking beyond the headlines, we realized that a decade of underbuilding by residential developers, combined with an early 2022 sell-off in the prices of homebuilder stocks, offered a valuation discount so large that we had to repeatedly ask ourselves what we might be missing. We made our first investment in homebuilder/developer Green Brick Partners (GRBK) in early 2022 at $21/share. After almost doubling in 2023, the shares are currently priced at more than $50.

Additionally, some of our best performing positions in 2023 were financial-oriented companies that conventional wisdom would have suggested would not fare well in the face of higher interest rates. Private equity firm KKR & Co. (KKR), Canadian insurer Fairfax Financial (OTCPK:FRFHF), online bank Ally Financial (ALLY), bank service provider FISERV (FI) and asset manager Brookfield Corporation (BN). Meta Platforms (META, holding company for Facebook, Instagram and other addictive social media properties) was another security that many deemed unownable in early 2023. Facebook earns massive amounts of advertising revenue, too much of which we believed the company was wasting on very expensive, non-core projects. Apparently, someone at Meta HQ finally agreed, as the company began exhibiting serious expense discipline, resulting in improved earnings – as well as a 194% return on the stock for the year.

Merchants Bancorp (MBIN) $33.53

We recently purchased shares of Merchants Bancorp, one of the best run banks you’ve never heard of. The company has compounded its tangible book value 30% annually for the last five years – compared to 7% for First Horizon, 9% for JP Morgan and only 4.5% for the S&P 500. MBIN consistently earns a 25%+ return on tangible equity, operates with one of the best efficiency ratios in banking yet, at our purchase price of five times earnings, it carried one of the lowest multiples in the entire sector.

Over the years, Merchants has carved out a couple of highly profitable niches in its Multifamily Mortgage and Mortgage Warehousing business units.

Merchants – Multifamily Mortgage

The agency-backed, Multifamily Mortgage business consists primarily of funding low-risk loans that meet the underwriting standards of various government programs, under an “originate to sell” model. Merchants serves as an authorized agency lender for Fannie, Freddie, FHA, and USDA – the list of financial institutions with this designation is surprisingly small. (Of the more than 4,600 banks in the U.S., only a couple dozen are authorized agency lenders.)

The attractive return on assets (ROA) generated by this business is significantly enhanced because, as the company almost immediately sells these loans, this segment only ties up approximately $400 million in assets, while earning as much as $40 million annually. Given this agency lending model produces a very short-term loan book (94% of these loans reprice within 30 days), it faces minimal interest rate risk.

As evidence that this agency lending business is attractive, one of the largest agency lenders in the U.S. is mortgage broker Berkadia, which not coincidentally happens to be joint venture between Warren Buffett’s Berkshire Hathaway and Jefferies Financial (formerly, Leucadia National, hence Berkadia). Depending on the year, Merchants regularly holds a top 3 or 4 position in this industry, along with Berkadia, Citigroup and JPMorgan. More than 40% of MBIN’s financings are for affordable housing, making the company the third largest affordable housing lender in the U.S.

Merchants – Mortgage Warehousing

Like the agency lending business, the company’s Mortgage Warehousing business produces a series of very short-term loans, minimizing both credit and interest rate risk. In this segment, the company loans money to non-bank mortgage originators, funding their new mortgage loans over the short period from the date of origination until the non-bank originator can sell the mortgage to investors. These loans typically turn over every 15-to-20 days, significantly reducing interest rate risk. And because the loans are match funded with customers’ custodial deposits, there is essentially no credit risk on these loans.

As mortgage rates began to increase throughout 2022, both new mortgage originations and refinancings declined – almost 50% according to the Mortgage Bankers Association. Not surprisingly, MBIN’s mortgage warehousing business declined from 58% of the company’s earnings to 20%, yet the company’s total earnings were essentially flat for the year due to similar-sized growth in its agency-backed, multifamily and traditional banking businesses.

Merchants – Valuation

Merchants is one of the most efficient lenders in the country, with near nonexistent net charge-offs, de minimis interest rate exposure, and an improving net interest margin as the company continues to grow. Company insiders own 45% of the shares and the CEO has been a recent buyer in the open market. Our purchase price of $35 was only 1.3 times the company’s tangible book value and five times earnings.

The market likely “penalizes” the company’s stock price for a couple of reasons, none of which concern us. A portion of the company’s earnings are derived from selling assets – an accounting category that superficial stock analysts generally consider as non-dependable. While this is true for a company that earns a huge gain from divesting an entire business line or massive real estate holding, selling assets (very short-term loans) is MBIN’s core business.

The reason analysts likely don’t understand the nature of Merchant’s core business is that the company makes little-to-no effort courting institutional investors. The company does not provide earnings guidance and holds no earnings calls. Instead, the company executives (who, remember, own almost half of the company’s shares) spend their energy and effort running one of the best and most efficient lenders in the country. We like that allocation of executive resources.

We expect future earnings increases should approximate the company’s growth in underlying book value, resulting in a business we think is worth at least $60/share today.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.