MicroStockHub

Written by Nick Ackerman, co-produced by Stanford Chemist.

It’s been a while since we’ve revisited Virtus Total Return Fund Inc. (NYSE:ZTR) in a full dedicated update. However, what looked likely to happen has happened; that was the distribution cut.

We had noted that it was looking rather unsustainable based on the high rate and deteriorating environment. It was either cut the distribution or watch assets continue to erode away at a rather accelerated pace.

It’s an uphill battle at this time with trying to support the current distribution. I wasn’t confident in the payout previously, and it has now just become worse. Previously it was a 9.92% distribution yield and an NAV rate of 10.40%. With the sharp drop in share price, the distribution rate has risen to 14.04%.

However, the NAV has also dropped, pushing the NAV yield to 12.83%. DNP is having its own troubles this year, but its NAV distribution rate is still a more reasonable 8.38%.

So I would once again reiterate that the current level is unsustainable, given the heavy reliance on capital gains to fund the distribution. I would only feel more comfortable if net investment income rose rapidly or the NAV yield dropped considerably as assets appreciated. That doesn’t mean that they will cut, but at this point, it would be eroding capital to fund the distribution.

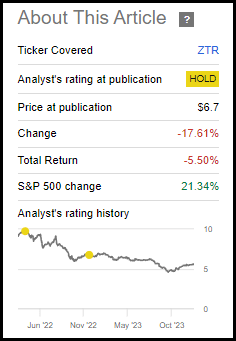

Since our update, the fund’s performance has continued to be weak.

ZTR Performance Since Prior Update (Seeking Alpha)

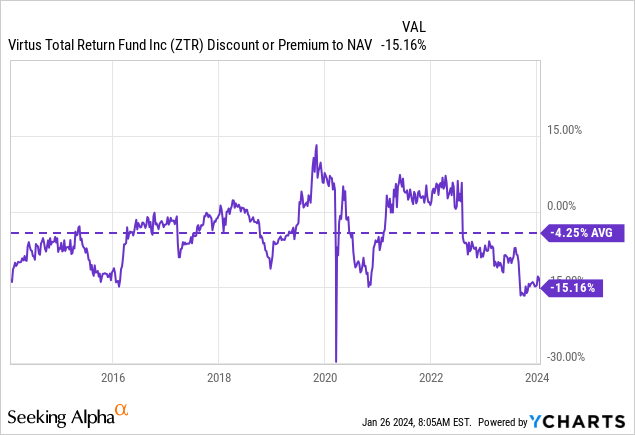

However, some of that weakness wasn’t entirely the utility sector remaining under pressure in 2023- it was actually the fund’s discount widening even further since that time. The discount widened dramatically after the cut, and it still remains at a fairly attractive level now.

Even after the distribution cut, the payout rate is still a bit elevated. However, it has taken off significant pressure, and it seems they would likely maintain this rate for the foreseeable future, barring a black swan event.

ZTR Basics

- 1-Year Z-score: -1.17.

- Discount: -15.16%.

- Distribution Yield: 11.54%.

- Expense Ratio: 1.31%.

- Leverage: estimated 29.64%.

- Managed Assets: $630.87 million.

- Structure: Perpetual.

ZTR’s investment objective is quite simple: “capital appreciation, with current income as a secondary objective.” They intend to accomplish the objective via a 60/40 split between equity and fixed income.

That said, they will focus the equity portion on “owners/operators of infrastructure in the communications, utility, energy, and transportation industries.” The fixed-income sleeve is designed:

“to generate high current income and total return through the application of active sector rotation, extensive credit research, and disciplined risk management designed to capitalize on opportunities across undervalued areas of the fixed income markets.”

Performance- Brighter Future Possible

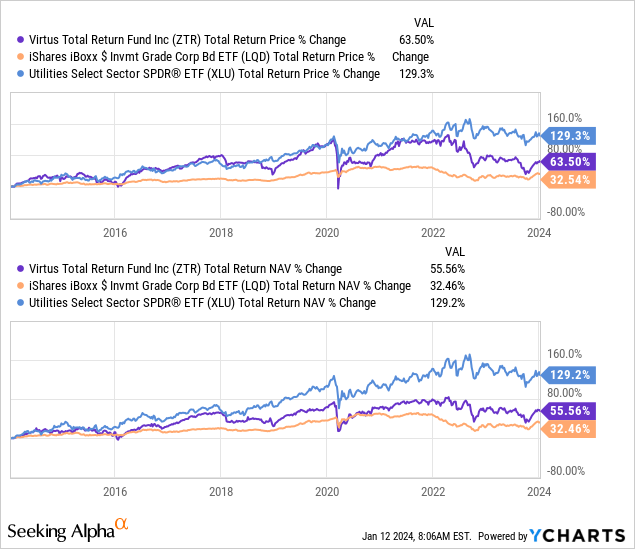

As noted, ZTR is a hybrid fund that invests in both utilities and fixed-income instruments. That includes both below and above-investment-grade quality, with a fairly even split.

While utilities were under pressure from rate increases, so was the fund’s fixed-income exposure. In particular, the fund’s investment-grade quality is more interest rate sensitive. That’s why a fund such as the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) has produced negative returns for the last few years and minimal returns over the last 5 and really 10 years. ZTR reported an effective duration of 3.89 years, with a weighted average maturity of 6.45 years.

As ZTR is leveraged, this would have increased the downside pressure on the fund in the higher-rate environment. Leverage costs increased, and the fund sustained further losses due to its leverage. When times are ‘good,’ they can be really good for the fund, but the caveat is that there is always this added risk.

Still, ZTR’s performance is in between LQD and the Utilities Select Sector SPDR® Fund ETF (XLU), as we would expect.

YCharts

We also note in every update on ZTR that this fund has made a couple of transitions. The fund today was a result of a merger in 2019, and then in 2020, they also removed the options strategy from the fund. Therefore, the longer-term history isn’t quite as relevant for the fund as it is today, but it can provide some color for what we have been dealing with in the last few years.

The significant decline on the back of interest rate sensitivity really wiped out a lot of total returns. That said, a lower rate environment could help out both the interest rate-sensitive fixed-income portions of its portfolio and the common equity sleeve of utilities. That is what we are expected to get going forward, as the Fed has announced its intention to pivot. Rather than looking at further rate increases, we are now looking at when the first cuts might start to appear.

An additional factor that makes this fund something worth considering is the current discount. It is trading at a deep discount on not only an absolute basis but also on a relative basis. Here is a look back at the last five years, which comprises mostly the history of what the fund is today. While I don’t suspect the fund will trade near parity with its NAV again- I think something along the lines of a ~5% discount could be reasonable over time.

Distribution- Discount Leads To Double-Digit

After the fund’s distribution adjustment led to a sharp drop in the fund’s share price, it actually helped still make it a double-digit distribution yield today.

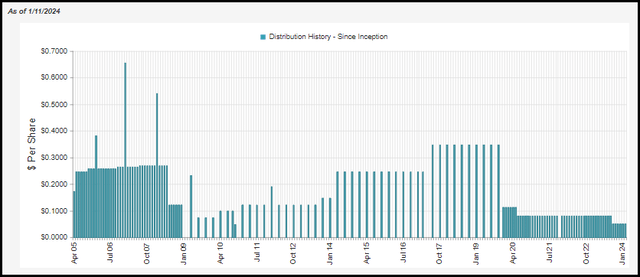

ZTR Distribution History (CEFConnect)

Based on the last closing price, the fund’s rate comes to 11.54% for shareholders. On the other hand, the fund’s NAV rate comes to 9.79%. That’s still fairly high when you have to consider the fund has to earn that to continue funding the distribution, but on top of that, they also have to pay the operating expenses. Still, we know they aren’t going to cut their payouts quickly, as they paid the last unsustainable level for longer than they should have.

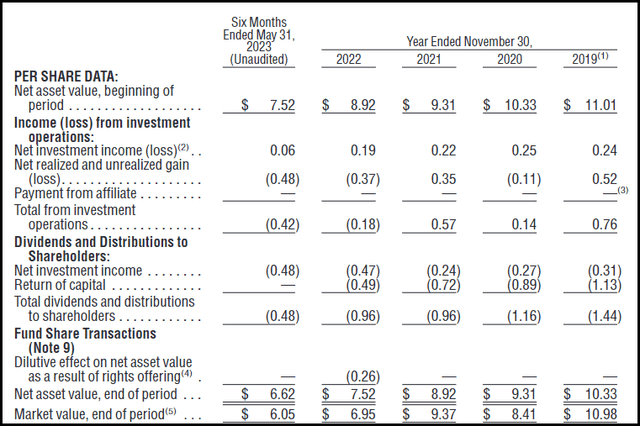

Additionally, going back to being able to potentially generate higher returns due to better performance in utilities and fixed-income space would also lead to this current rate continuing into the future. As is the case with most equity funds, they will require capital gains because net investment income doesn’t cover the entire payout. In the last semi-annual report, the fund saw an NII of $0.06 or an annualized rate of $0.12. This ultimately resulted in NII coverage coming in at 20%. The rest would need to be ‘covered’ through gains in the underlying fund.

ZTR Financial Metrics (Virtus)

Further working against the fund would be any more dilutive rights offerings. In 2022, that caused a hit of $0.26, or about a 3% hit to the NAV from the beginning of the fiscal year.

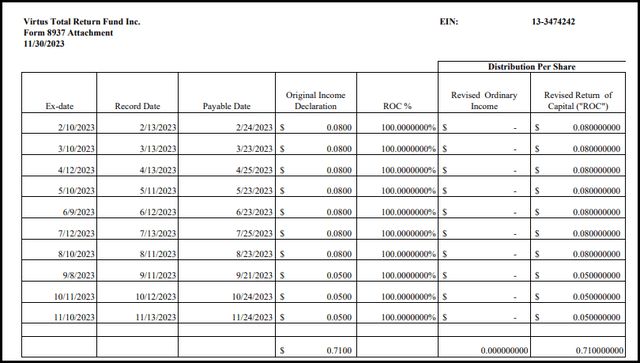

The fund should be releasing its next annual report in the next month or so, which will give us a better update on some of these metrics. Additionally, the fund has posted its Form 8937, which is when there is return of capital in the distribution. Given the significant losses of the fund over the last couple of years, it comes as little surprise that the entire distribution was classified as ROC in the prior year.

ZTR Distribution Tax Classifications (Virtus)

ZTR’s Portfolio

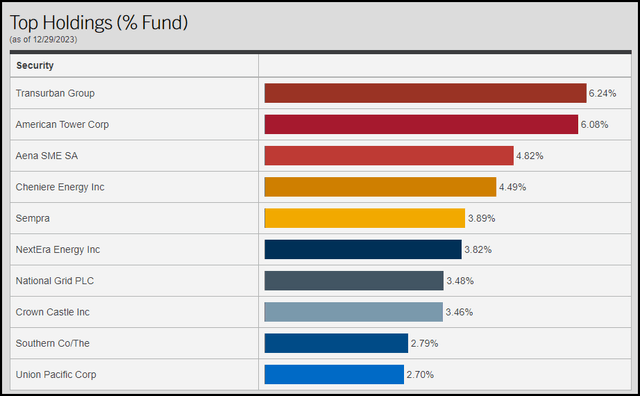

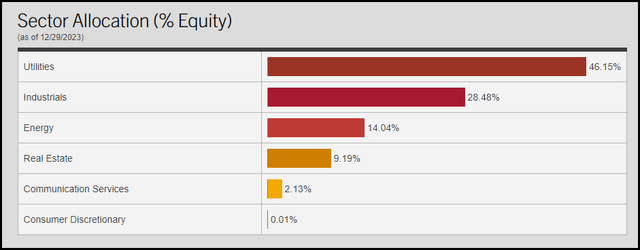

The portfolio is primarily dominated by utility exposure, but there is also a fair bit of industrial and energy exposure within the fund. Also within the equity sleeve is real estate exposure, and that comes thanks to the usual tower REITs, American Tower (AMT) and Crown Castle (CCI). Both AMT and CCI make an appearance in ZTR, and further, they make an appearance in the top ten positions, so there is seemingly a fair bit of conviction there.

ZTR Equity Sector Breakdown (Virtus)

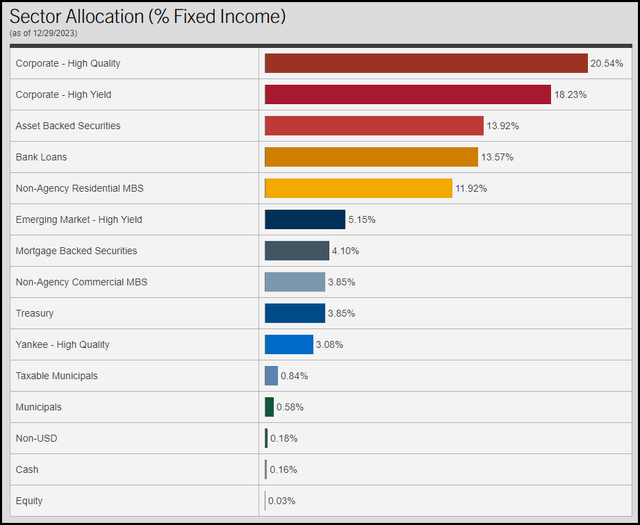

On the fixed-income side, they list high quality as the largest component, but that is followed right behind by high yield. Of course, high yield gives you exposure to higher income and lower relative interest rate sensitivity when compared to the high-quality sleeve.

Additionally, the fund lists asset-backed securities and bank loans. Those are generally going to be floating rate-based. Naturally, that would have had somewhat of an impact on offsetting the declines in NII. As we saw, NII still clearly declined, so it wasn’t enough to offset the negatives completely.

ZTR Fixed-Income Allocation (Virtus)

Generally speaking, the lower rate sensitivity of high-yield bonds and bank loans comes with a caveat. That is, the trade-off allocated to those securities comes with a higher risk of defaults. Defaults are on the rise as well due to the Fed’s tightening policies over the last couple of years. Of course, that was in an effort to tame inflation, which has been coming down as well.

That said, with a portfolio split between the two, ZTR is fairly balanced overall. Further, given the utility exposure of the fund on the equity side being the largest weighting, it could even be considered a fairly defensive fund. Some of that defensiveness is then offset by the leverage employed to attempt to generate enhanced returns.

Along with AMT and CCI making their way into top positions, we also see some other familiar names that tend to show up in other infrastructure-related funds. That would be names such as NextEra Energy (NEE), a staple for all utility-focused funds, and The Southern Company (SO). Additionally, the Transurban Group (OTCPK:TRAUF), Aena S.M.E., S.A. (OTCPK:ANYYY), and National Grid (NGG) also highlight that the fund isn’t afraid to go around the globe to invest.

It has been over a year since we’ve given ZTR a look. However, these names, except for ANYYY, were all top ten holdings previously as well. NEE saw its percentage weight fall, but it was quite a tough year for NEE throughout 2023. That was a contributing factor to the allocation change. However, at the end of fiscal 2022, ZTR held 397,134 shares of NEE. As of the last NPORT for the period ended August 31, 2023, they held 371,866 shares of NEE. So they also reduced their exposure to through this period as well.

Conclusion

With all that said, that’s why, even despite the rough annualized performance of the fund and a distribution cut, I’ll flip to a “Buy” rating on the back of cautious optimism. The Virtus Total Return Fund’s discount presents a compelling opportunity, along with the potentially brighter future of utility and fixed-income performance. That would further bode well for the fund’s current distribution, which is attractive but still requires significant capital gains to fund fully.