eyecrave

Mid-America Apartment Communities, Inc. (NYSE:MAA), founded in 1977 and headquartered in Germantown, TN, is a REIT engaged in the business of owning, developing, acquiring, and operating multi-family apartment communities across the country.

It has a remarkably well-diversified portfolio, low leverage, incredibly strong liquidity, and its business has grown steadily over the years. More importantly, though, the dividend profile appears to be excellent and the shares are trading at a significant discount to NAV even based on conservative assumptions.

Portfolio & Performance

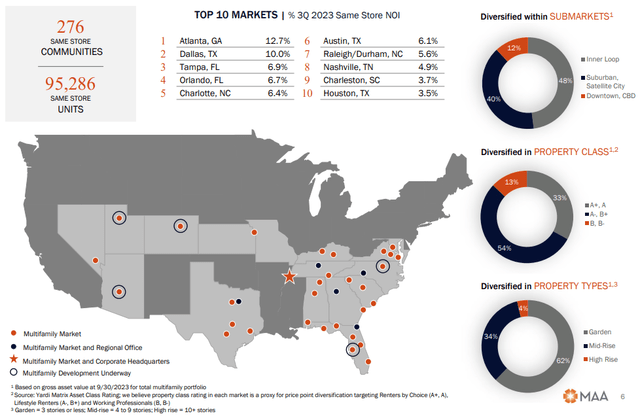

As of September 30, 2023, the REIT owned 276 same-store communities that consisted of 95,286 same-store apartment units, located in the Southeast, Southwest, and Mid-Atlantic U.S. regions.

The same-store occupancy for the third quarter of 2023 was 95.7%, only 10 bps lower on a YoY basis.

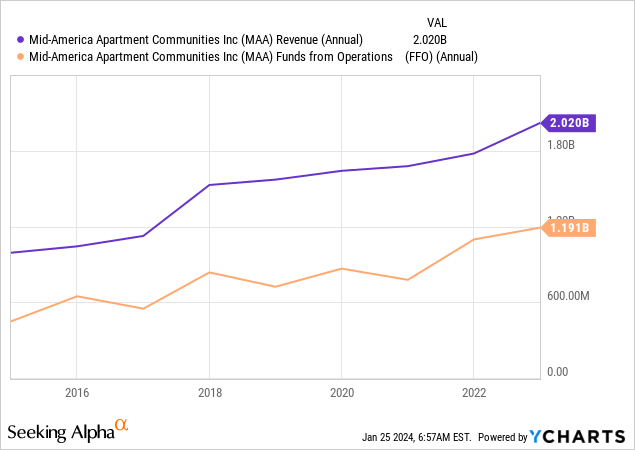

Zooming out, the REIT’s operating performance has been quite decent during the last decade, depicting a steadily growing business:

More recent results indicate a greater momentum; below, I compare the difference between the average annual figures from the past 3 fiscal years and the last quarter’s figures annualized:

| S.P. Rental Revenue Growth | 17.29% |

| S.P. NOI Growth | 18.15% |

| FFO Growth | 19.61% |

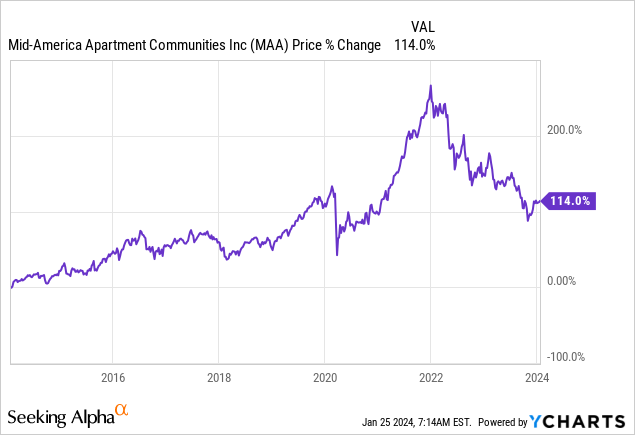

Regardless, because of the slow growth over the long term, it’s not surprising that MAA hasn’t been loved by the market as much as other REITs, with the price increasing very slowly over the years as well:

Leverage & Liquidity

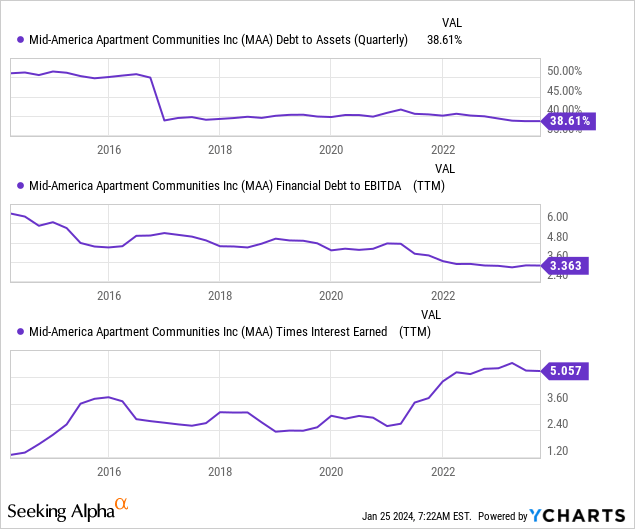

When it comes to its solvency profile, this REIT scores very high; its debt/assets ratio is below 40%, it has an incredibly low debt/EBITDA ratio at 3.3x, and its interest coverage is impressive at 5 times.

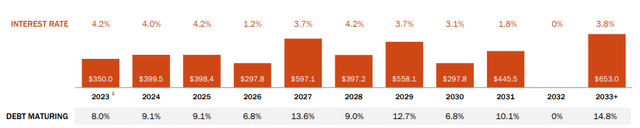

Additionally, its cost of debt comes at a weighted average interest rate of 3.4%, which is remarkably low under the current environment. Unsurprisingly, it’s also 100% fixed-rate. Also, there’s no need to worry about a potentially higher cost that could pressure profitability because even though the amounts coming due involve a higher interest rate for 2024 and 2025, they appear to be small against the company’s total debt:

And the maturities look very well laddered for the next 10 years; to a degree I have never seen before I might add.

Dividend & Valuation

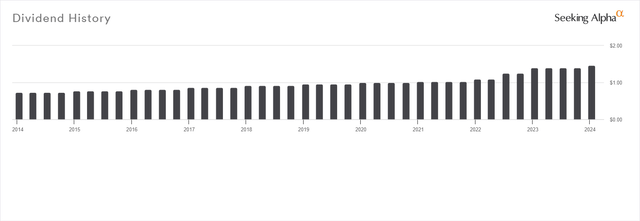

The company pays a quarterly dividend of $1.47 per share, suggesting a forward yield of 4.44%. With a payout ratio of 68.19% based on FFO and 13 years of decent increases in a row, I think that this would work for a conservative dividend portfolio.

MAA also scores very high as a value pick. Yes, it is not much cheaper than its peers on a P/FFO basis:

| Stock | P/FFO |

| MAA | 14.64 |

| ESS | 15.61 |

| UDR | 14.85 |

| CPT | 14.35 |

| EQR | 15.56 |

| Average | 15 |

But its shares are trading at an implied cap rate of 6.02% right now. To give you an idea, cap rates for multi-family residential properties are forecast to average 4.85% this year. This REIT’s portfolio may not be average, but to be conservative I used this rate as the appropriate one for the value of MAA today. Apparently, the shares are trading at a 23.53% discount to NAV ($175.31), reflecting a 30.77% upside to fair valuation.

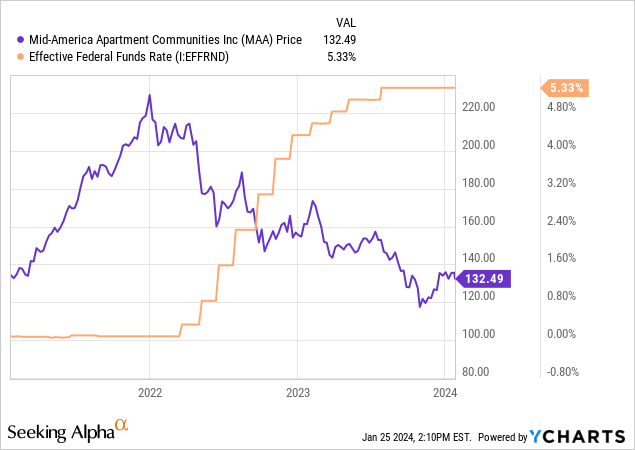

However, if the Fed rate goes back to the 2021 level in the next couple of years, multifamily properties may go back to be traded at an even lower average cap rate. For the optimistic calculation, I used the average of 2021 (3.82%) to arrive at a 42.35% discount to NAV ($232.55) which suggests a 73.47% upside to fair valuation.

While this is the optimistic end of the range, I always feel more comfortable with that end when that figure is familiar territory for the shares. And in this case, MAA got close in 2022:

The reason I included the Fed rate change above was to point out that the current price of MAA is most likely the product of higher interest rates that followed the actions of the Fed in 2022, shortly after MAA reached its peak. Such a strong inverse correlation aids in absolving the REIT from a serious fundamental weakness and provides more clarity on why the current opportunity exists in the first place.

Risks

But of course, the opportunity can only exist in retrospect if interest rates start falling and the market reprices the shares at a more reasonable price, preferably close to NAV. The “if” here implies a risk; even if you don’t lose money in the unfortunate scenario that interest rates don’t fall in the short term, you could realize an opportunity cost.

Another risk is the scenario in which our conservative cap rate assumption doesn’t align with reality and therefore gives us a false picture of the REIT’s NAV. The realization that an investment lacks a margin of safety could motivate one to sell at a loss in order to transfer capital to another opportunity.

Verdict

Regardless, I think a cap rate expansion is unlikely. So given that this is an excellent business being offered at a great price, I rate MAA a buy at current levels. The dividend yield is also high enough to reward shareholders while they wait for the interest rate fog to start clearing; at the same time, MAA works well as a dividend pick.

Your thoughts? Leave a comment below if you want, as I’m looking forward to knowing if you own this REIT or intend to; or whatever you may want to share with the community. Thank you for reading!