Igor Kutyaev/iStock via Getty Images

By Samantha McLemore

“The big money is not in the buying and selling, but in the waiting.” Charlie Munger

In this letter, we discuss the current environment and how we are responding. We also reflect on 2023: what we’ve done well and where we made mistakes.

Before we get to performance, I want to mention one important thing. One of our strongest guiding principles: always act in clients’ best interests. We seek out ways to add (rather than extract) value. At the beginning of this year, we cut our mutual fund fee breakpoints substantially. With any asset growth, this will help lower our fees for clients. You can expect us to continually strive to improve client value propositions. We are pleased the Patient Opportunity Equity strategy performed strongly in 2023, the first year after Bill stepped off the strategy. The strategy advanced 37.6% net of fees, nicely beating the S&P 500’s (SP500, SPX) 26.3% return. We have further work to fully recoup 2022’s losses, but 2023’s recovery continues our track record of rebounding strongly after disappointing performance. The markets ended a volatile year on a high note, surging to peak levels. Prior to November, the narrow market was led by the biggest names in the S&P 500. Most other stocks languished. The Russell 2000 (RTY) was down 4.5% in the first 10 months of the year, as soaring real yields pressured markets. In the second half of 2023 and early 2024, bond yields have driven the stock market. Empirical Research noted that in the 6-months ending Oct 2023, 60% of stocks’ return dispersion were explained by interest rate changes. In December, ten-year yields fell to their lowest level (3.8%) since July igniting a powerful rally. Early this year, yields popped pressuring stocks. As of this writing, the 10-year yield has struggled to rise much above 4%. Stocks are responding favorably. The fourth quarter reversal in long-term bond yields, along with a much-awaited Fed pivot and continued economic strength led to a broadening market rally that lifted nearly all boats. US indices closed out the year anywhere between strong (the Dow Jones Industrial Index up 16.2%) and extraordinary (the Nasdaq up 44.9% with S&P 500 +26.3% and Russell 2000 +16.9%). After such a strong year, one might expect growing enthusiasm for stocks. While December did see the largest monthly inflows for ETFs, skepticism remains abundant. Wall Street strategists royally missed the mark in 2023, projecting double-digit market declines. Forecasts remain muted for 2024 with flat returns anticipated (4767 S&P 500 vs. 4770 year-end level), a most unlikely outcome. After only a couple days of market weakness early in 2024, investor nerves flared up. Investment Company Institute (‘ICI’) reported record money-market fund assets. The NAAIM1 Exposure Index fell to levels not seen since early November. Put-to-call ratios again rose above 1, a sign of bearishness. We welcome the apprehension, a necessary source of fuel for an enduring bull market. Risks that could end the bull market abound: a recession, another surge in interest rates, and geopolitical risks, to name a few. It’s always the case that risks exist. 2023’s juicy gains occurred because of risks, not despite them. As is mostly the case, risks evolved either better than feared (no recession) or more manageable (rising rates, geopolitics). Markets reacted positively, climbing the proverbial wall of worry. A top risk, in our view, has been another Fed error. The Fed stayed accommodative far too long, contributing to an inflationary surge. We feared it would do the same on the other side. Higher, for longer equals too tight, for too long, resulting in recession. The fourth quarter delivered much to celebrate on this front. Inflation fell. November’s 6-month annualized core PCE (1.9%) sits below the Fed’s 2% target. Economic strength endured. The Atlanta Fed projects 2.5% real GDP growth in the fourth quarter. Employment remains solid as job losses linger below levels typically associated with recession. Finally, the Fed shifted its stance, saying it was done increasing rates and penciling in 3 cuts in 2024. Risk transmuted into return. With inflation much improved and the Fed ready to cut rates, a big risk is diminished. We are a little over a year into the bull market that began in October 2022. The economy appears solid. Disinflation continues. Consumer balance sheets are strong, with real incomes growing again. Valuations are broadly ok, with pockets of attractiveness (where we focus!). Investor skepticism remains high. If you can’t be confident about market gains in this environment, when can you? The answer is never. That happens to be most people’s default. That’s exactly why equities have historically offered the highest returns. You get paid to stomach the risks. With money market balances at all-time highs and the Fed on the verge of cutting rates, plenty of firepower exists for further market gains. December equity flows give a taste of what might occur if rate cuts encourage people to shift away from cash. While we expect the bull market to continue, returns aren’t likely to be as strong as 2023. 2024 started with a selloff, which isn’t surprising given how overbought markets were. Nevertheless, we see favorable odds for continued gains. According to Birinyi Associates, after 20%+ gain years, the S&P 500 rises 65% of the time, gaining an average of 6.5%. In election years, it rises 75% of the time, with an average gain of 8%. Mid-to-high single digit gains seem reasonable. This falls slightly below projected earnings growth for the year (10%), but these estimates typically fall. We don’t build portfolios based on macro forecasts. We are bottom-up, long-term, value investors. We believe a broad universe, an open mind and a disciplined, sound process should lead to strong returns. So far it has. In the Patient Strategy, which I’ve solely managed since the end of 2014, we’ve compounded at 12.1% per year (net of fees). That surpasses the S&P 500’s 11.8% and the S&P Value’s 9.7%. The magnitude of our outperformance was damaged by the popping of the innovative disruption bubble in 2021-2022, which we handled poorly. We are working harder than ever to improve our outperformance. We aim to deliver mid-teens returns, as we did prior to the pandemic. In this environment, we think that’s possible. While overall market returns will likely come down, we think low multiple “classic value” stocks have been left mostly for dead and offer very handsome return potential. Some of the Magnificent 7 are still attractively priced and innovative disruption stocks are perking up after a brutal 3-year bear market. We’ve just endured the worst performance of low multiple stocks in history. Many people call these stocks value stocks. We assess value more broadly with a focus on intrinsic value (the present value of future free cash flows). Growth matters. Some high growth names can be the most undervalued. We like having a mix of different types of undervalued securities (low-multiple “classic value” and secular compounders).

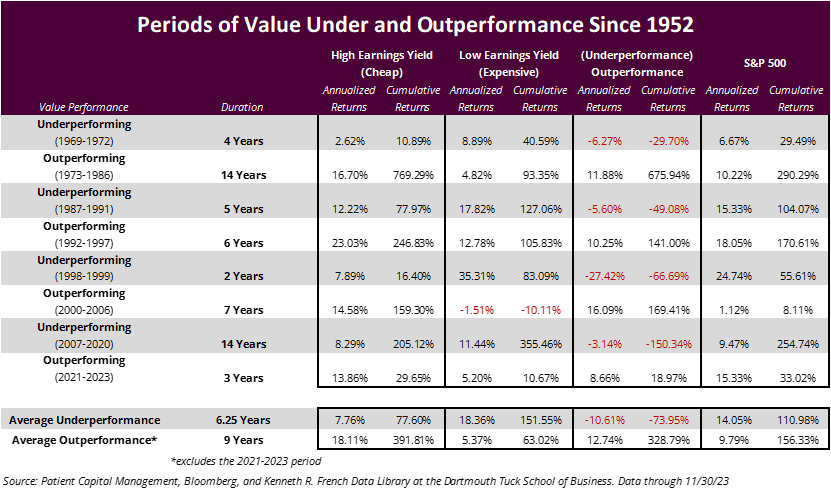

Regardless, previous episodes of low-multiple underperformance were followed by sustained and significant outperformance. In previous recoveries, low multiple stocks averaged 18%-plus annualized returns, more than tripling their high multiple counterparts, and nearly doubling the market’s return (9.8%). “Classic value’s” recovery began in 2021, but most people still favor high growth and doubt the outperformance will endure. See chart.

One caveat to our near-term “classic value” enthusiasm is the non-negligible risk of an AI-bubble, which could result in continued leadership by the Magnificent 7. As mentioned, they are not overly expensive and continue to be institutionally under-owned relative to the S&P 500’s hefty weight. While not our base case, it’s certainly possible. We have significant exposure to Amazon (AMZN), Alphabet (GOOG,GOOGL) and Meta Platforms (META), which we believe remain undervalued. Consequently, we believe we could do fine in this scenario. We think this would defer, not destroy value’s outperformance. As markets rallied, we made some adjustments to the portfolio. We significantly pared back exposure in some of our biggest winners, as names like UBER and COIN neared our assessment of fair value. We were able to add some quality assets at attractive prices. Everyone prizes quality these days, which leads to full valuations overall. Weakness in healthcare allowed us to buy Royalty Pharma (RPRX) and Illumina (ILMN), two excellent, high return businesses at attractive prices. We also bought Crocs (CROX) on weakness, another high-return, cash generative business.

Let’s recap where we think our process worked well, and where it fell short. First the positive:

- Opportunistic. We bought UBS (UBS) and Western Alliance (WAL) during the bank selloffs in March and May. UBS returned nearly 60% from where we started buying in the high-teens in March (vs. SPX +15%). WAL gained almost 150% from our initial May purchase price in the high $20’s (vs. SPX +15%). Though UBS and WAL did better than the group, regional banks broadly rallied as we avoided a recession and credit crisis. That wasn’t the bet we were making. We always look for opportunities in panic, believing some babies get thrown out with the bathwater so-to-speak.

- We believed UBS acquired Credit-Suisse for a steal with significant downside protection in the form of government guarantees. We knew short-term financial results would be messy. Fear combined with short-termism created an opportunity to buy an attractive, predominantly asset management franchise with high returns on equity and long-term earnings power of $4-5/share at 4-5x earnings. A classic case of time arbitrage.

-

- We initially bought EXPE in the middle of 2022 believing company fundamentals were much stronger than market expectations suggested, and their tech and infrastructure investments would lead to business improvements. We thought competitive concerns were overblown, and Expedia could continue to grow. Despite good fundamental performance, the stock languished from the time we bought it through early November. During this holding period, the “upside-to-downside capture” (how much it goes up on up days vs. down-on-down days) was poor and “alpha” non-existent. Those types of metrics just serve to quantify the market’s belief state. Since we look for areas where the market is wrong, we are often buying into poor quantitative characteristics. For Expedia, that all changed when it reported its third quarter results. Its direct-to-consumer business accelerated while competitors Booking Holdings and Airbnb slowed.

- This exemplifies our philosophy and process. We believe markets are pragmatically efficient and very difficult to beat. We look for sources of “edge” or places the market might be wrong. Areas of high disagreement can be a fruitful place to find an edge, but they tend to come with higher levels of volatility. It takes time and patience for the fundamentals to play out.

- Patience. At a macro level, our deep fundamental work, conviction in our stocks and risk analysis allowed us to hold when many others decreased market exposure at the worst time a year ago. A micro example of patience playing out is Expedia (EXPE), which was a top contributor for the year.

- WAL is also a high-return franchise. It was one of the biggest losers during the depths of the panic. At its lowest closing price ($18.20 in May), it traded for 2x what it’s estimated to earn this year ($7.77). People didn’t care because they saw the imminent risk of failure. Bank runs had killed competitors. Unlike competitors, Western Alliance published daily updates on deposit flows, which were encouraging and demonstrated a durable deposit base. Market failure expectations were completely disconnected from company fundamentals.

- These investments worked out well in the benign scenario that unfolded. However, our risk analysis was just as important to our investment decision as the prospective returns. We believed these investments were particularly attractive on a risk-adjusted basis. We believe they would have done well even if a recession occurred, though gains likely would have been delayed.

- Sound Fundamental Analysis.

Now onto areas for improvement. The late, great Charlie Munger’s philosophy was it’s important to “rub your nose” in your mistakes. We agree that focusing on errors keeps you humble and helps you improve.

While it’s easy to identify losses, we don’t think that’s the best way to assess errors. We like to distinguish between process and outcome. A coin toss that pays you $2 if you win, but costs you $1 if you lose is a good bet. It has a positive expected value. Half the time you will lose money, though. That doesn’t mean it was a mistake to take the bet. A strong, well-executed process will produce losers, just as a poor or nonexistent process can produce winners (“dumb luck”). We attempt to focus on process when assessing our mistakes.

- Farfetch. We will start with Farfetch (FTCH) because we were vocal about our belief in the long-term potential. In the fourth quarter, Farfetch entered a prepack admin deal (essentially a bankruptcy). We exited the stock in the third quarter after its disastrous results, but were surprised to see it fail so quickly given its cash and liquidity. Upon reflection, we attribute its failure to terrible execution and poor operational and financial discipline. Despite being our single biggest contributor to performance over the past 5 years, we made mistakes on Farfetch. We executed the process well with our initial buy decision. We saw a unique company with a huge total addressable market. The price had tanked because the market hated its purchase of New Guards Group. We thought the deal was attractive and there was a clear disconnect between fundamentals and market expectations. We initially bought the stock around $10, and thought it was worth $30. Our assessment of the deal was proven correct. Then the company benefited from the pandemic, entered a deal with Alibaba (BABA) and Richemont (OTCPK:CFRHF) on China, and rolled out its first large Farfetch Platform Services client (Harrods). It was nearly free cash flow breakeven in 2020. Initial execution appeared excellent. The stock rallied to $75. We sold a good amount, which is how it remains a top contributor over 5 years (our entire holding period). We should have sold it all. That’s hindsight bias, rather than a process error though. There were good reasons to maintain a position. One of the biggest mistakes investors make is not letting winners run. Farfetch was an early-stage company with a low penetration of its total addressable market. It executed superbly in our short ownership period. It was in a materially better position than when we purchased it. Our bull case was always significantly higher than the stock price. Our biggest errors were 1) how we revised our estimate of intrinsic value, 2) using the wrong reference class (Amazon), and 3) poorly assessing the financial and operational discipline. After those positive fundamental developments (and stock gains), we increased our central tendency of value to ~$110 at its peak. In retrospect, the magnitude of that increase was a mistake. Business values don’t nearly quadruple in a year and a half. Seems so obvious in hindsight. A central tendency of value can move more than a base case as odds of different scenarios shift. Regardless, in the future, extreme moves in intrinsic values will garner extreme rather than normal scrutiny. Also, we used the wrong reference class for FTCH. While we used many comparable companies, Amazon garnered too much emphasis. Despite knowing there is no other Amazon, we compared the companies more than appropriate. Using the wrong reference class led us to be much too bullish. Farfetch lacked key similarities: operational discipline and financial sophistication (although we didn’t figure that out until much later). Amazon almost went bust after the dot.com bubble burst. Jeff Bezos, “an authentic business genius” (Warren Buffett’s words), massively cut costs and restructured the business. Our first signs of this crucial difference came in late 2021 when we needed to advocate Farfetch be much more aggressive on costs. Important lessons: it’s a red flag to need to advocate, and managements can easily parrot your views back to you without internalizing them.Our concerns grew in late 2022 when Farfetch started taking on significant debt and put out very disappointing long-term targets they claimed were extremely conservative. At that time, we decided to put Farfetch on a short leash: any fundamental disappointments would be cause for exit. They performed well in the first quarter of 2023, which gave us the confidence to invite them to our first investor day. Then they totally whiffed the second quarter. We sold.Jose Neves “dreamed the dream,” which we believe ultimately killed the company. You want a CEO to be ambitious with aggressive goals. But Farfetch wasn’t built with the operational and financial discipline required to scale a successful business. Right until the end, Neves looked to deals to solve the company’s problems. Neves’ desire to build the platform for luxury inhibited the company’s ability to be realistic about the cost and executional actions required to sustain the business.We learned many lessons on this one, which will serve to improve our process. We plan to borrow an idea from the great value investor Chris Davis and create a wall of shame. Farfetch will be our first honoree. Mistakes happen. We want a culture open to making, admitting and correcting them when they do. Our goal is to always do better for clients. We believe our learnings from this experience will aid us in that effort.

- Missing the forest for the trees. The popping of the innovative disruption bubble damaged many investment track records in the past few years, ours included. While very few who invested in those companies got out, we should have done better. I gave presentations in late 2021 on the risk to growth stocks. We exited some names, like Peloton, based on unrealistic expectations. But we didn’t take these insights to their logical conclusions. Doing so would have helped us make the right call on Farfetch in 2021 (and others). We’ve implemented risk monitoring to help us recognize bubbles and other broad sources of risk.

- Unprofitable businesses. We’ve benefited greatly from investing in businesses early in their life cycles before they are well understood by the market. These types of investments can turn out to be the biggest winners. Oftentimes, early-stage businesses aren’t yet profitable. We will continue to invest in these sorts of companies but have reassessed their risk, which will impact position sizing and overall exposure.

We think the lessons learned help us improve. Our primary goal is to earn better returns for clients. We “eat our own cooking,” with significant personal investments in our funds. Even though we had a strong 2023, we still see attractive return potential. After our 2011 losses, our strategy was a top performer for two consecutive years. After being priced for recession just months ago, our cyclical names remain well below fair value with attractive upside elsewhere too. In addition, the market always offers new opportunities, and we are continually refreshing the portfolio.We appreciate your continued support. Please reach out if we can help.

Opportunity Equity Annualized Performance (%) as of 12/31/23

| QTD | YTD | 1-Year | 3-Year | 5-Year | 10-Year | Since Inception (12/30/1999) | |

| Opportunity Equity (gross of fees) | 17.91 | 38.93 | 38.93 | -4.62 | 10.30 | 8.14 | 7.93 |

| Opportunity Equity (net of fees) | 17.63 | 37.58 | 37.58 | -5.58 | 9.20 | 7.07 | 6.86 |

| S&P 500 Index | 11.69 | 26.29 | 26.29 | 10.00 | 15.69 | 12.03 | 7.03 |

Patient Strategy Annualized Performance (%) as of 12/31/23

| QTD | YTD | 1-Year | 3-Year | 5-Year | Since Inception (12/31/2014) | |

| Patient Strategy (gross of fees) | 21.23 | 45.26 | 45.26 | -5.07 | 15.88 | 13.63 |

| Patient Strategy (net of fees) | 21.08 | 44.58 | 44.58 | -5.54 | 14.29 | 12.12 |

| S&P 500 Index | 11.69 | 26.29 | 26.29 | 10.00 | 15.69 | 11.86 |

|

Footnotes 1National Association of Active Investment Managers PrData Sources: Bloomberg, Patient Capital Management, and Kenneth R. French Data Library at the Dartmouth Tuck School of Business.The NASDAQ Composite Index is a market capitalization-weighted index that is designed to represent the performance of NASDAQ securities and it includes over 3,000 stocks. The S&P 500 Index is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an index and unmanaged index returns do not reflect any fees, expenses or sales charges. The Dow Jones Industrial Average (DJIA) is an unmanaged index composed of 30 blue-chip stocks, each with annual sales exceeding $7 billion. The DJIA is price-weighted, reflects large-cap companies representative of U.S. industry, and historically has moved in tandem with other major market indexes, such as the S&P 500. The Russell® 2000 Index is a small-cap stock market index that makes up the smallest 2,000 stocks in the Russell 3000 Index. S&P 500 Value measures value stocks using three factors: the ratios of book value, earnings, and sales to price.S&P Style Indices divide the complete market capitalization of each parent index into growth and value segments. Constituents are drawn from the S&P 500. The NAAIM Exposure Index represents the average exposure to US Equity markets reported by our members. The put-call ratio is a measurement used by investors to gauge the overall mood of a market. CPI: Consumer Price Index measures the monthly change in prices paid by U.S. consumers. Free cash flow is earnings before depreciation, amortization, and non-cash charges minus maintenance capital expenditures. The HFRI 400 (US) EH: Fundamental Value Index is a global, equal-weighted index of the largest hedge funds that report to HFR, are open to new investment by US investors and offer quarterly liquidity or better. The Fundamental Value hedge funds that comprise the index are a subset of the HFRI 400 (US) Equity Hedge Index. The index is rebalanced on a quarterly basis. PCE: Personal consumption expenditures includes a measure of consumer spending on goods and services among households in the US. PCE, CPI, and inflation rates based on available data at the time the piece was written and are not guaranteed to stay the same in the future. Magnificent 7 is a group of stocks made up of mega-cap stocks Apple (AAPL), Alphabet (GOOGL), Microsoft (MSFT), Amazon.com (AMZN), Meta Platforms (META), Tesla (TSLA) and Nvidia (NVDA). A multiple is simply a ratio that is calculated by dividing the market or estimated value of an asset by a specific item on the financial statements. Earnings Yield is the inverse of the P/E ratio. Earnings yield is one indication of value; a low ratio may indicate an overvalued stock, or a high value may indicate an undervalued stock. Earnings per share (‘EPS’) is the portion of a company’s profit allocated to each outstanding share of common stock and serves as an indicator of a company’s profitability. Alpha, often considered the active return on an investment, gauges the performance of an investment against a market index or benchmark that is considered to represent the market’s movement as a whole. The excess return of an investment relative to the return of a benchmark index is the investment’s alpha.Portfolio Upside to Central Tendency of Value (‘CTV’) is a proprietary calculation based on our assessment of the intrinsic value of individual company holdings currently in the portfolio. Portfolio Upside to CTV refers to the weighted average expected return from each individual company reaching our estimate of intrinsic value from its current trading price. CTV is a probability-weighted estimate of what we believe is the intrinsic value per share for each individual company currently in the portfolio. As part of this process, we build detailed, long-term company models for a variety of scenarios and use multiple valuation methods, such as discounted cash flow (‘DCF’), comparable company analysis, private market analysis, historicals, liquidation, and LBO analysis. These different valuation methodologies are probability weighted to create our CTV. The analysis embeds both risk and return features and allows comparison across securities. Upside to CTV refers to the expected return from a stock reaching our estimate of intrinsic value from its current trading price.The information presented should not be considered a recommendation to purchase or sell any security and should not be relied upon as investment advice. It should not be assumed that any purchase or sale decisions will be profitable or will equal the performance of any security mentioned. References to specific securities are for illustrative purposes only. Portfolio composition is shown as of a point in time and is subject to change without notice.Portfolio holdings and portfolio discussion are for a representative Opportunity Equity account. Holdings discussed may or may not be included in all portfolios subject to account guidelines.Investors should carefully review and consider the additional disclosures, investor notices, and other information contained elsewhere in this document as well as the Offering Documents prior to making a decision to invest.All historical financial information is unaudited and shall not be construed as a representation or warranty by us. References to indices and their respective performance data are not intended to imply that the Strategy’s objectives, strategies or investments were comparable to those of the indices in technique, composition or element of risk nor are they intended to imply that the fees or expense structures relating to the Strategy or its affiliates, were comparable to those of the indices; since the indices are unmanaged and cannot be invested in directly.The performance information depicted herein is not indicative of future results. There can be no assurance that Opportunity Equity’s investment objectives will be achieved and a return realized. Returns for periods greater than one year are annualized.The views expressed in this commentary reflect those of Patient Capital Management portfolio managers as of the date of the commentary. Any views are subject to change at any time based on market or other conditions, and Patient Capital Management disclaims any responsibility to update such views. These views are not intended to be a forecast of future events, a guarantee of future results or investment advice. Because investment decisions are based on numerous factors, these views may not be relied upon as an indication of trading intent on behalf of any portfolio. Any data cited herein is from sources believed to be reliable, but is not guaranteed as to accuracy or completeness.Patient Strategy Composite Performance incepted in 12/31/2014 and is used to show Samantha McLemore’s individual track record where she was Lead/Sole PM on the strategy.Click for the Opportunity Equity Strategy Composite Performance Disclosure. Click for the Patient Strategy Composite Performance Disclosure.©2024 Patient Capital Management, LLC |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.