The pharma giant had a horrible 2023, with its share price plummeting by more than 36%. It was one of the S&P 500’s worst-performing stocks of the year.

The company’s COVID-related product sales dropped as demand for vaccines fell. Saqib Iqbal, an analyst at Trading.Biz, suggests that Pfizer (PFE) stock is one to look out for in 2024.

- Pfizer (PFE) had a bad 2023, but there is a bullish case for the stock.

- Mr. Market may have overreacted to the stock.

- It is worth considering that the firm may overestimate COVID-19 sales.

Amidst this, Saqib thinks the stock has become too cheap when looking at the overall valuation. He says, “It’s possible that Mr. Market wasn’t looking at the company’s fundamentals and probably overreacted to its price in 2023.”

The company will announce its Q4 2023 earnings report on January 30. According to forecasts, earnings per share may come in at -0.18. In December 2023, the firm expects sales to range between $58.5 billion and $61.5 billion in 2024.

Pfizer (PFE) also declared a dividend of 42 cents for the first quarter. This was Pfizer’s 15th straight year of quarterly dividend increases, and the current dividend yield is 5.8%.

Pfizer (PFE) completed the $43 billion acquisition of the biotech company Seagen, which focuses on cancer, last month.

The Food and Drug Administration authorized Pfizer’s new medication, Padcev, in conjunction with Merck’s Keytruda for patients with advanced bladder cancer, the company disclosed a day after completing its Seagen takeover.

Saqib expects the firm may overestimate COVID-19 sales, resulting in an unimpressive revenue outcome in 2024.

He stated, “I don’t expect a major rebound in Pfizer’s stock this year due to its challenges in sales and profitability. However, if you are looking at a 5 to 10-year time horizon, Pfizer can be a good diversifier in your portfolio. As Pfizer strengthens its product pipeline and applies for additional approvals, monitoring how the stock fares will be crucial.”

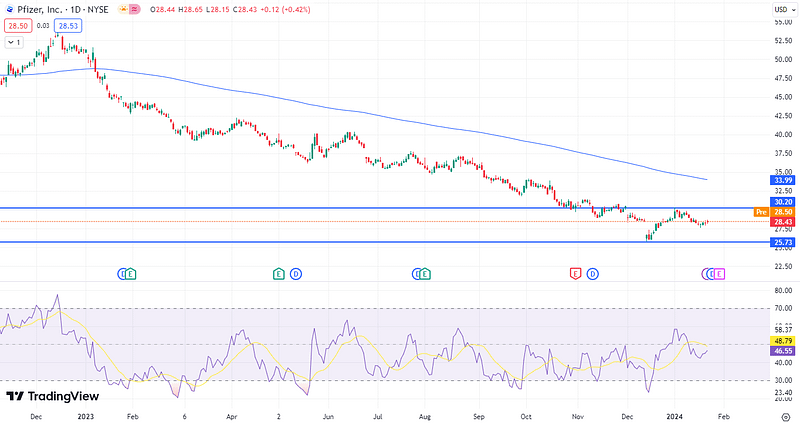

Regarding the technicals, 2024 has been a rough start for the PFE. The stock is trading well below its 200-day moving average. The RSI is close to 50, indicating neutrality.

The next resistance for the stock lies at 30.20; anything above that level can take the price towards 33.99. The support level is at 27.60. Dropping below, the price can go towards 25.73.