ARMMY PICCA

By Tony Davidow, CIMA, Senior Alternatives Investment Strategist, Franklin Templeton Institute

Franklin Templeton’s Tony Davidow discusses the impact of various factors on traditional and alternative investments, highlighting the challenges and opportunities in private commercial real estate, private credit, and private equity.

Many of the same factors that impact traditional investments also impact alternative investments. Some provide headwinds, while others provide tailwinds.

For example, higher interest rates can favor private credit because of the floating-rate nature of most of the debt.

On the other hand, they may hurt commercial real estate as credit conditions tighten, and they can negatively impact private equity due to the rising cost of capital to finance transactions.

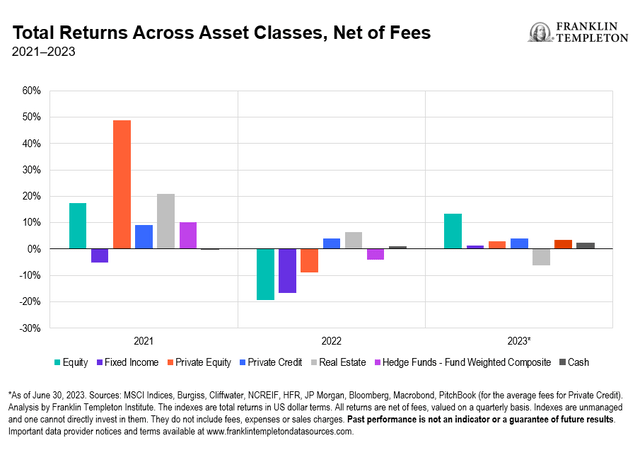

As we examine the performance of traditional and alternative investments over the last three years (Exhibit 1), we can see strong results in 2021 as the market peaked, then a sharp reversal in 2022, and a rebound in 2023.

This short window illustrates the differences across asset classes, with public equity losing more in 2022 but recovering more rapidly than private equity in 2023.

After a strong 2021, real estate delivered positive results in 2022, but lagged in 2023 due to rising interest rates and falling occupancy in the office space sector.

Exhibit 1: Total Returns Across Asset Classes

We summarize the challenges and opportunities below. As capital is allocated in 2024, note the distinction between putting capital to work today versus that which was committed prior to 2021, peak valuations for private markets.

Private commercial real estate

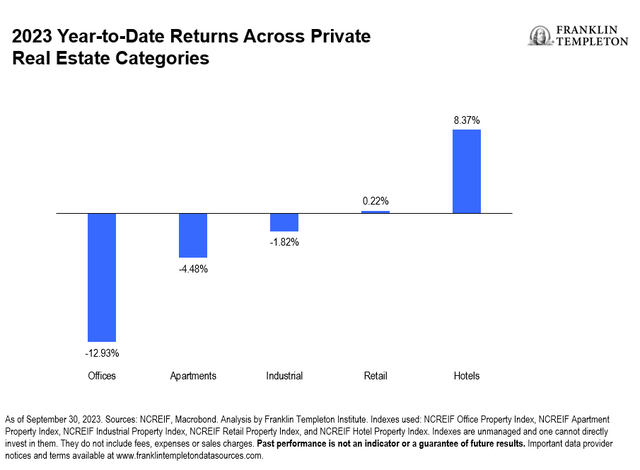

Commercial real estate had a challenging 2023 (Exhibit 2), with the office sector down nearly 13% through September, and apartments down nearly 4.5%.

Even the industrial sector, which has performed well over the last several years, was down nearly 2%. Hotels have been the best-performing sector, up over 8% through September.

Rising interest rates, and concerns regarding financial contagion post-Silicon Valley Bank (SVB), have created a challenging environment for many real estate sectors.

Exhibit 2: A Challenging Year for Commercial Real Estate

Headlines have focused on challenges to the office sector, as it faces headwinds for the foreseeable future.

We believe there may be opportunities for lenders who can renegotiate terms. In addition, we see attractive opportunities in industrials, multifamily and life sciences.

While the office sector has lagged, the industrial sector has delivered strong results, buoyed by a growth of warehouses and fulfillment centers.

Private credit

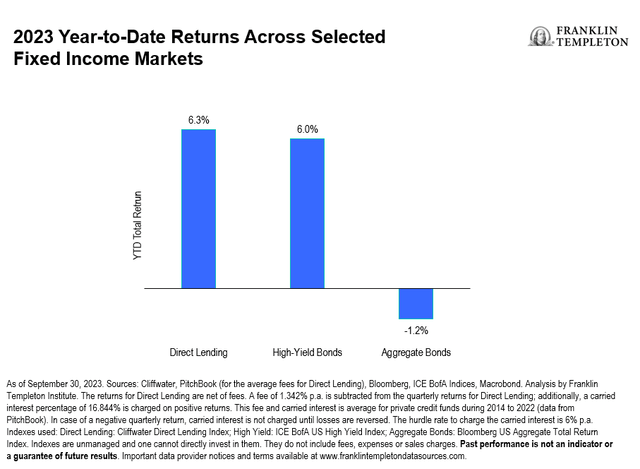

Broadly, private credit had a good year in 2023, mitigating the rise in interest rates with mostly floating-rate debt.

In fact, most risk assets, including direct lending and high yield, provided attractive returns (Exhibit 3). Given strong economic growth, defaults were limited, but that could change in the coming year.

Exhibit 3: A Good Year for Private Credit

Looking at 2024, the potential for a slowing global economy could affect the outlook for existing private credit investments and lead to more defaults.

For new investors, 2024 could present new opportunities. For example, the SVB collapse created a significant opportunity as banks retrenched from lending to small and middle market companies.

As the pendulum has shifted towards nonbank lenders, seasoned private credit managers may be able to lend capital at favorable rates and terms. As banks are less willing to lend, companies will need to refinance, giving private equity investors the opportunity to negotiate good returns and covenants.

Private equity

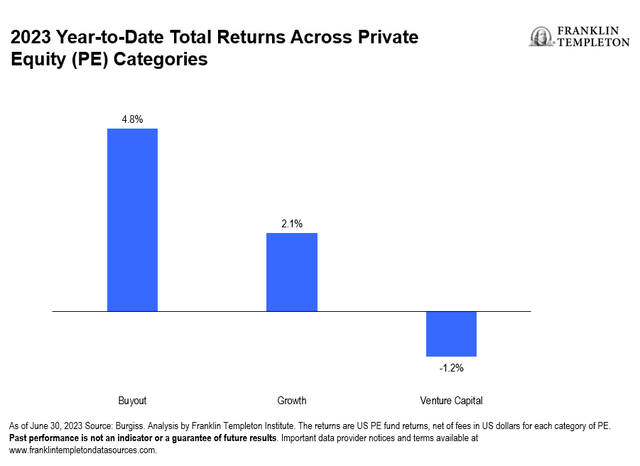

Private equity experienced mixed results in 2023, with buyouts and growth equity delivering positive results, and venture delivering negative returns through June (Exhibit 4).

Performance hasn’t been the issue for private equity; it has been the lack of activity, and the overallocation by many institutions.

Exhibit 4: Mixed Results for Private Equity in 2023

Coming out of a challenging 2022, many institutions found themselves overallocated and overcommitted to private equity.

This has been referred to as the “denominator effect,” as institutions found themselves overallocated to alternatives due to the decline in value of their public market positions relative to private markets.

The overallocation was exacerbated by the dramatic slowdown of exits, and existing commitments to private equity.

This presented an unprecedented opportunity to secondaries managers who were able to provide liquidity to institutions.

Managers were able to select prized assets at favorable valuations, and then assemble portfolios diversified by industry, geography, and vintage.

By diversifying their vintage years, they were able to shorten the J-curve, and potentially distribute capital to investors sooner. We believe this trend will continue.

Summary

In the coming year, we see both challenges and opportunities for allocating capital to alternative investments.

What are the risks?

All investments involve risks, including possible loss of principal.

Investments in many alternative investment strategies are complex and speculative, entail significant risk and should not be considered a complete investment program. Depending on the product invested in, an investment in alternative strategies may provide for only limited liquidity and is suitable only for persons who can afford to lose the entire amount of their investment. An investment strategy focused primarily on privately held companies presents certain challenges and involves incremental risks as opposed to investments in public companies, such as dealing with the lack of available information about these companies as well as their general lack of liquidity. Diversification does not guarantee a profit or protect against a loss.

Risks of investing in real estate investments include but are not limited to fluctuations in lease occupancy rates and operating expenses, variations in rental schedules, which in turn may be adversely affected by local, state, national or international economic conditions. Such conditions may be impacted by the supply and demand for real estate properties, zoning laws, rent control laws, real property taxes, the availability and costs of financing, and environmental laws. Furthermore, investments in real estate are also impacted by market disruptions caused by regional concerns, political upheaval, sovereign debt crises, and uninsured losses (generally from catastrophic events such as earthquakes, floods and wars). Investments in real estate related securities, such as asset-backed or mortgage-backed securities are subject to prepayment and extension risks.

Fixed income securities involve interest rate, credit, inflation and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. Changes in the credit rating of a bond, or in the credit rating or financial strength of a bond’s issuer, insurer or guarantor, may affect the bond’s value. Low-rated, high-yield bonds are subject to greater price volatility, illiquidity and possibility of default.

An investment in private securities (such as private equity or private credit) or vehicles which invest in them, should be viewed as illiquid and may require a long-term commitment with no certainty of return. The value of and return on such investments will vary due to, among other things, changes in market rates of interest, general economic conditions, economic conditions in particular industries, the condition of financial markets and the financial condition of the issuers of the investments. There also can be no assurance that companies will list their securities on a securities exchange, as such, the lack of an established, liquid secondary market for some investments may have an adverse effect on the market value of those investments and on an investor’s ability to dispose of them at a favorable time or price. Past performance does not guarantee future results.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.