Itza Villavicencio Urbieta

SL Green Realty Corp. (NYSE:SLG), incorporated in 1997 and headquartered in New York, NY, is a REIT that owns, develops, and manages primarily office properties in the New York metropolitan area.

Though the portfolio is highly concentrated and its performance has been deteriorating, this is a conservatively financed undervalued business with strong liquidity that offers a safe dividend yield.

Portfolio & Performance

As of September 30, 2023, SL Green owned interests in 27 properties, aggregating 29,708,910 sqft, mainly in Manhattan and to a lesser degree in Suburban markets. They consisted of 20 office buildings, 2 retail ones, and 1 residential property, with another 4 under development/redevelopment. Of those, 20 were located in Manhattan and 7 were in Suburban areas.

Now, the office properties were 89.3% occupied according to the latest 10-Q which is average and the ones in the suburban market were 77.4% leased which is very low; the difference makes sense though because of the naturally lower demand for office space there. The retail properties averaged a 91% occupancy rate and the residential building 99%; I find the occupancy for the retail assets low, but my concern is somewhat offset by the relatively low exposure SLG has to them.

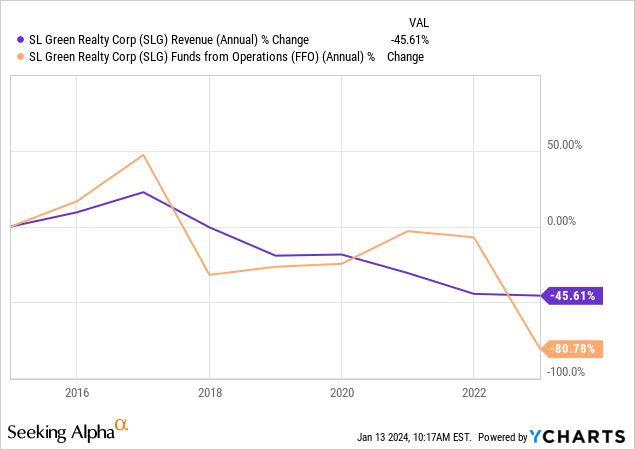

Regardless, the operating performance hasn’t been good at all in the last decade:

Unfortunately, more recent results don’t indicate a potential reversal of the trend as rental revenue and FFO have both shown a reduction, with same-store NOI marginally improving. Below, you can see the change from the average annual figures of the past 3 fiscal years to the last quarterly report’s annualized ones:

| Rental Revenue Growth | -15.89% |

| Same-Property Cash NOI Growth | 7.33% |

| FFO Growth | -29.94% |

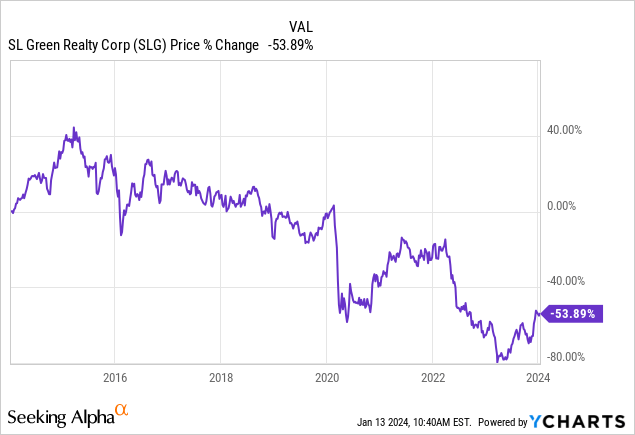

Not surprisingly, the market has been driving the price lower as long as the company has been experiencing a deterioration in its operating results:

That being said, there are some positive factors here that could reverse the trajectory of the operating performance. First, the more recent results are likely a reflection of the general crisis that hit the office space market and it makes sense that geographically concentrated REITs like SL Green would suffer from it the most, especially when lacking exposure to Sunbelt states. However, the trend of companies exercising back-to-work mandates is going strong, with another 500,000 NYC employees being expected to come back to the office this month, as noted by the SLG CEO in the last earnings call.

Moreover, back in late January 2023, 52% of the Manhattan employees were present in the workplace on an average weekday, up from 49% in September 2022. Further, a survey of Manhattan office employers between Aug. 23 and Sept. 15 revealed an increase to 58%. So signs of improvement are not only present in the broader context of the country.

Management, in my view, wouldn’t be able to communicate these trends effectively to show how overblown the office space crisis is because it cut its guidance back in October 2023. Also, 23Q3 rental revenue decreasing on a YoY basis certainly didn’t help but management attributed that to the sale of a joint venture interest during the second quarter of 2023 which resulted in the deconsolidation of the 245 Park Avenue investment. The market is justified in not appreciating these things, but they are not a reflection of a poor or failing business.

Leverage & Liquidity

On the bright side, SL Green doesn’t use much leverage (far from it actually with a debt/assets ratio of 35.8%) and its solvency profile appears strong; although its debt-to-EBITDA of ~14x is high and most probably a result of its low profitability, its current ratio of ~2x and interest coverage of ~2.3x show very strong liquidity.

Additionally, the debt’s weighted average interest rate was reported at 5.06% for the third quarter of 2023, which is not relatively high. And though about 15% of its total debt matures this year and ~13.5% of it in 2025, I believe that these are very small portions to materially change the cost of debt.

Dividend & Valuation

The REIT currently pays a monthly dividend of $0.25 per share, implying a 6.61% forward yield. Even though the REIT’s cash flow is decreasing, the payout ratio based on FFO is at 55.33% which makes a cut or suspension unlikely.

Additionally, the shares are trading at an implied cap rate of 8.78%; this may be lower than the median implied cap rate for office REITs, but it’s well above the average of ~7% for office space. Assuming 7%, NAV comes at $58.18 which makes the current price reflect a 21.98% discount and implies a 28.17% upside if the market corrects the price.

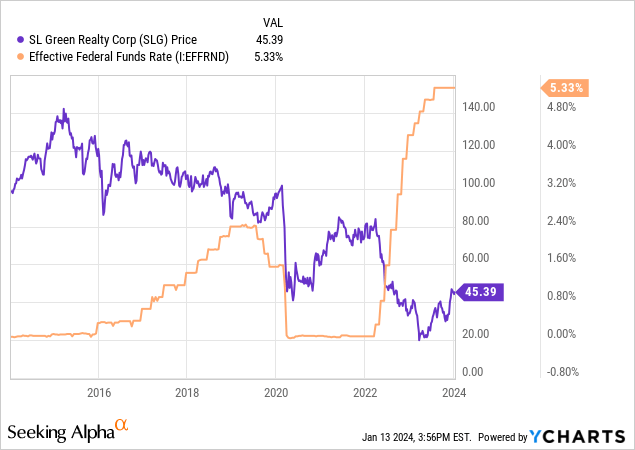

For what is worth, ~$60 is historically too low for SLG. And I have no reason to believe that the most recent fall below that level was related to anything other than the Fed hikes that began in 2022 because of the high inverse correlation you can observe below:

It’s actually impressive that the price fell just below $20 in 2023. Regardless, a 7% cap rate assumption may be unrealistic and the margin of safety is larger than I believe, so $45 is not bad at all.

Why I Wouldn’t Buy the Preferreds

No doubt, with such a low leverage and strong liquidity, it is easy to also like the Series I preferred shares (NYSE:SLG.PR.I) which are trading at a 14.4% discount to liquidation value.

However, their dividend yield is 7.63% right now; not that much higher than what the common shares offer. I don’t think it’s worth sacrificing the upside potential of SLG that is likely to be realized if the currently brighter Fed rate outlook persists or even improves.

This is how I view it at least. You may appreciate the greater safety the preferred could offer and not care about anything but the yield. In that case, you can safely reject my thesis on this.

Risks

First, there is a risk that a 7% cap rate actually proves to be too aggressive if demand for office space continues to deteriorate. I doubt it as I explain in an older post, but it is still likely so bear that risk in mind.

Another risk I’d like to mention is the concentration in Manhattan. I think I speak for many investors when I say that the attractiveness of REITs partly lies in the high geographical exposure they often offer. Manhattan could be a good place to own office space, but the lack of state diversification doesn’t hedge risks related to population fluctuations, unemployment rate changes, and rent price volatility.

Last but not least, you may realize an opportunity cost with this REIT if the upside is not realized within a reasonable time frame. That’s why I appreciate the high dividend yield that it offers today which could offset that cost to a high degree; it also helps an investor be more patient.

Verdict

In conclusion, I rate SLG a buy even though I have covered other office REITs in the recent past that are still more attractive.

What do you think? Are you a shareholder or intend to be? Why or why not? Leave a comment below and I’ll make sure to check as soon as I can! Thank you for reading.