Craig Hastings/Moment via Getty Images

MSD Overview

The MS Emerging Markets Debt Fund (NYSE:MSD) is a closed-ended fixed income fund focused on emerging markets. Within EM, it invests in a range of sovereign, quasi-sovereign, and corporate debt securities. Whilst the primary objective is to produce high income, the secondary objective is to seek some capital appreciation. The mandate allows them to invest in local currency as well as U.S. dollar denominated debt securities. Typically, however, MSD does not run any significant currency risk and neither does it utilize leverage. This makes it somewhat more conservative than some of its EM debt fund peers.

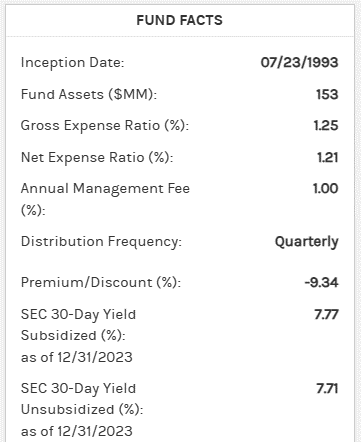

The fund has a very long history, dating back to 1993. Despite that, the fund size is a small $153 million. A key factor in this is like other EM debt funds over the last decade, performance has failed to meet the objectives of producing high income with capital appreciation. The expense ratio of circa 1.2% may be tolerable to the extent one expects this to change, i.e. that EM debt will be a strong performer in the next decade.

MSD facts

Many points in time last year saw MSD trading on a double-digit annualized yield, with the discount to NAV closer to 15%. After a major bounce back in the last couple of months of 2023 for EM debt, the yield on offer and NAV discount both reduced.

morganstanley.com Emerging Markets Debt Fund Overview

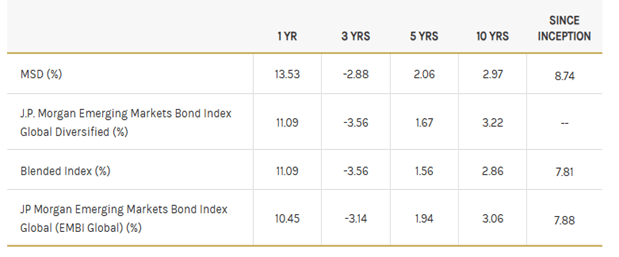

MSD past performance

EM debt has been a poor asset class over the last decade, and MSD has posted similarly low returns in that time. Last year did at least see them improve in both a nominal and relative to the benchmark sense.

morganstanley.com Emerging Markets Debt Fund Overview performance to Dec 31, 2023.

Given the discount to NAV it normally trades at, MSD is worth some consideration for EM debt exposure.

On the flip side, however, I would be mindful that the fund holds plenty of corporate bonds, so whether it is worth such risk is questionable.

When looking at a fund like this that has been around for so long, I like to check for various management personnel changes. The fund’s website lists four portfolio managers with the note “Effective July 19, 2022, Akbar Causer, Kyle Lee and Federico Sequeda have been added as Portfolio Managers on the Fund. Warren Mar is no longer serving at Portfolio Manager on the Fund.” For what it is worth, performance has been very strong since this date mentioned and these key changes.

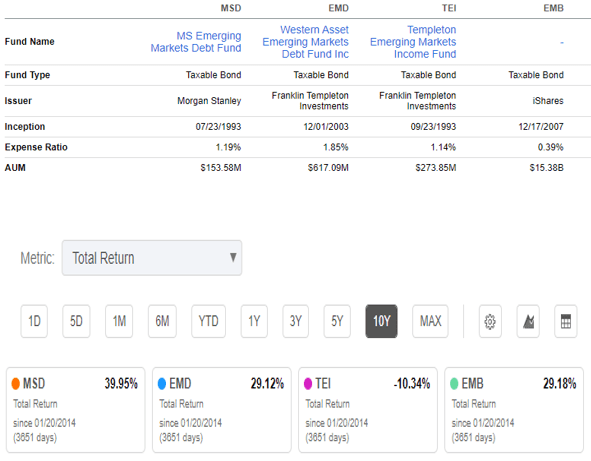

MSD peers’ analysis

In terms of some other long-standing EM debt closed end funds, MSD has been a better performer. This is backed up by the numbers, but I would also reference back to an earlier point I made about conservatism with taking currency and leverage risk.

Total Return 5 years to January 20, 2024, Seeking Alpha.

Funds like the Templeton Emerging Markets Income Fund (TEI) has performed a lot worse, for example, with currency bets hurting them in recent years. Then we have the Western Asset Emerging Markets Debt Fund (EMD) where the numbers are a lot closer to what MSD has achieved in the last decade. EMD though utilizes a significant amount of leverage and has a higher exposure to corporate debt.

Overall, I note MSD has been the better performer of this group in the last decade. Also, (in terms of these other CEFs mentioned above), MSD has done better with less volatility and risk.

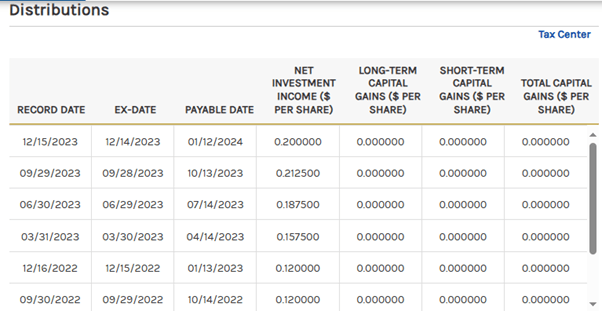

MSD distribution history

One shouldn’t extrapolate the last couple of distributions, given that late last year we witnessed a decline in EM bond yields. Now the yield on the underlying portfolio of MSD is 1-2% lower than what we saw at the start of Q4 last year.

morganstanley.com Emerging Markets Debt Fund Overview

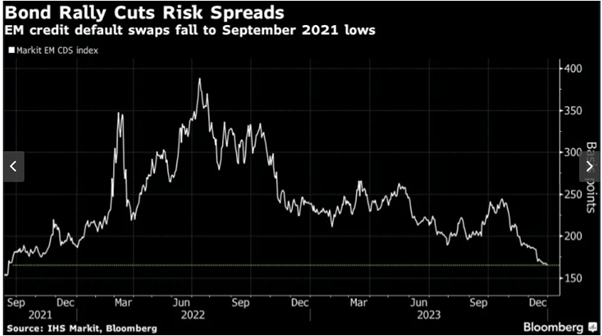

Emerging market bond spreads

Part of the explanation for the portfolio’s lower yields now compared to late last year is the major move in EM bond spreads.

IMS Markit, Bloomberg.

The chart above tempers my enthusiasm for the asset class. The fact that spreads have fallen since mid-2022 certainly makes sense, given the inflation shock experienced around then. The extent of the falling EM bond spreads though I am not so sure about. I am not so convinced the global economic outlook has improved much and in the meantime, geopolitical tensions remain elevated.

Adding to that, we have plenty of uncertainty in 2024 with more than 40 national elections scheduled worldwide. To quote directly from the linked article, “Together, those countries represent more than half of global GDP,” notes Joe Quinlan, head of CIO Market Strategy for the Chief Investment Office, Merrill and Bank of America Private Bank. Among them – in addition to the U.S. – are Taiwan, India, Indonesia and Mexico.”

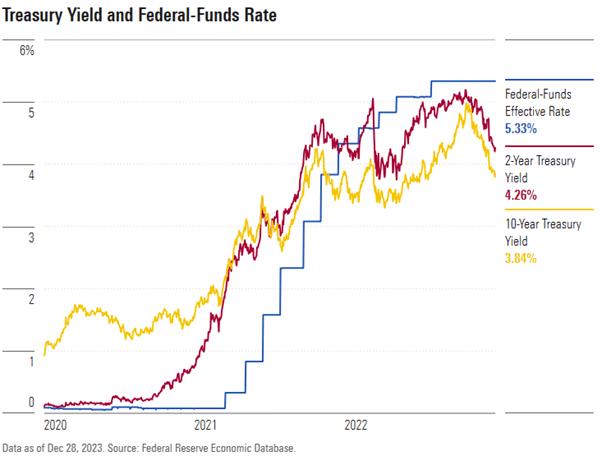

Outlook for US interest rates 2024

It was not only declining EM bond spreads assisting a bounce back in performance of MSD in the final couple of months last year. The backdrop of global government bond yields declining also assisted.

Federal Reserve Economic Database

Since around mid-October, US yields, whether it be in the shorter or longer end, rallied around 100bps, a huge move in such a short period.

I note the duration of the MSD portfolio is listed on their website as 6.85 years, albeit this was as of November 30th last year. Such a backdrop is helpful, but equally is a risk if this trend reverses.

Then, the fact that the final couple of months saw positive momentum pick up in an “everything rally” certainly didn’t hurt.

Such aggressive moves in risk assets across the board makes me at least want to avoid jumping in something like MSD at the present time after it has bounced 10% in just a few months.

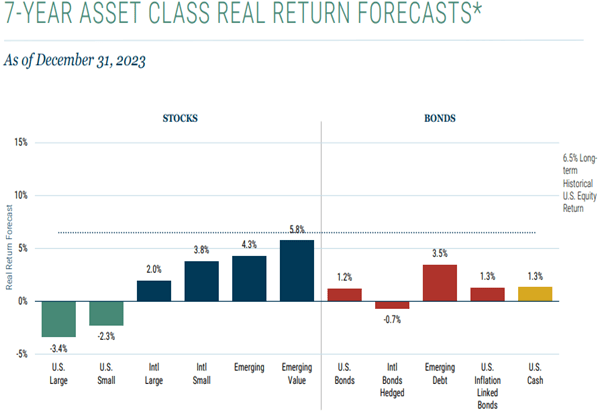

Are emerging market bonds a buy for 2024?

With this question, I am somewhat torn between the shorter term and longer term. As I mentioned just above, the asset class appears overbought on a short-term basis.

An increasing number of optimistic articles are coming out, expecting that the Fed may well engineer the very difficult task of a soft landing. This article notes that not only can this be an extremely rare feat, but also how markets are pricing in twice the amount of rate cuts that Fed officials are signaling.

This combination sets a scenario where it is very easy for markets to be disappointed, and thus places some pressure on EM bonds in the shorter term.

From a longer-term perspective, I view the fact that EM bond yields are nonetheless still quite high in terms of the last decade as encouraging. Even if the Fed cuts rates by less than the market hopes, it is still a reasonable backdrop for the asset class longer term. The inflation scares from a year or so ago seem to be subsiding, and the USD may have commenced a longer term bearish trend since late 2022.

When looking out on a 7-year timeframe, GMO’s latest forecasts still point to EM debt as looking relatively attractive.

GMO

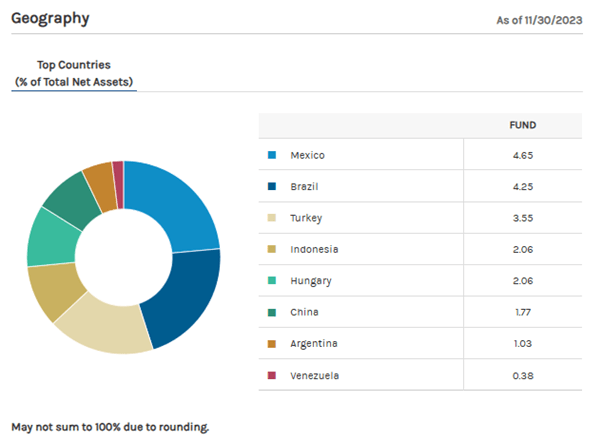

MSD country exposures

The fund is quite diversified from a country allocations point of view. I therefore continue to expect MSD to be less volatile than some of its peers.

morganstanley.com Emerging Markets Debt Fund Overview

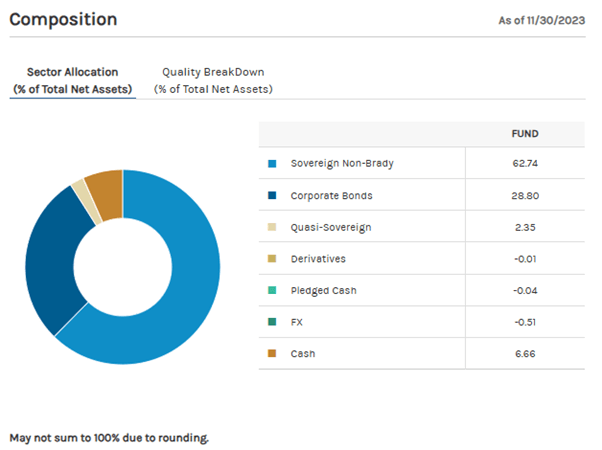

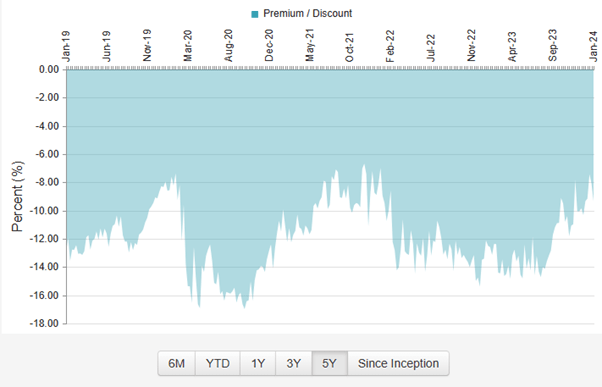

MSD sector allocations

morganstanley.com Emerging Markets Debt Fund Overview

MSD exposures via credit rating

morganstanley.com Emerging Markets Debt Fund Overview

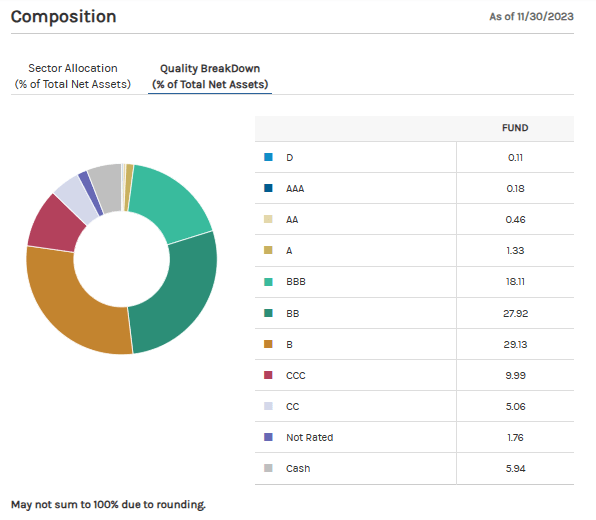

MSD discount to NAV

CEFConnect

The discount to NAV is not as attractive now, as it has spent a lot of time in the 10-15% range in recent years.

Last year, before EM bonds bounced back in the last couple of months, it often traded at around a 14% discount. The fund bought some shares back last year, but the data indicates it was a very tiny amount, around 1%. Given the large discount seen, that could be considered disappointing. I am nonetheless not that surprised, as they may be concerned about the shrinking of the already small fund size.

Activists Bulldog Investors have in recent times listed MSD as a holding of theirs. I do not foresee however them making MSD a prioritized activism target when the discount is under 10%.

MSD risks

Key risks for MSD include a short-term correction in the powerful rallies late last year in terms of both EM debt spreads and more generally global bond yields. If this was to occur, I would also expect the discount to NAV to again widen back out near 15%, which compounds such short-term risks.

Also, there is still plenty of uncertainty regarding the global economic outlook and geopolitical landscape. This comes in a year featuring so many scheduled national elections around the globe.

Conclusion

Whilst the acknowledged shorter-term risks keep me from considering investing in MSD right now, I regard it as a reasonable choice to put on a watchlist in case of a correction.

I prefer it over other EM debt funds and regard this space as more to watch for trades of a year or so rather than long term holds. In that respect, like last year, the volatility may present opportunities.

Early last year, I covered a different EM debt fund in TEI. I mentioned how I was relatively positive on EM bonds as an asset class for 2023 if one could enter after a bit of a correction. I also noted, however, I was unsure whether TEI was the best vehicle to use for such a strategy.

To me, it now shapes as a similar landscape for 2024. The volatility like in 2023 could again present good dips to buy exposures to EM bonds. MSD is one of the better choices to implement such a strategy. With markets currently very upbeat, though, I see MSD as one to consider as a buy around the lower part of the trading range seen last year. That is also likely to coincide with a more attractive underlying yield, likely in the 9-10% range again. I would also expect a discount to NAV of closer to 15% in such a scenario. For the time being, though, I only view MSD as a hold at best.