studiocasper/iStock via Getty Images

IQLT strategy

iShares MSCI Intl Quality Factor ETF (NYSEARCA:IQLT) started investing operations on 1/13/2015 and tracks the MSCI World ex USA Sector Neutral Quality Index. It has a portfolio of 301 stocks, a 12-month trailing yield of 2.27%, and a total expense ratio of 0.30%.

As described in the prospectus by iShares, the underlying index is derived from a developed markets index: the MSCI World ex USA Index. Each security in the parent index is assigned a quality score calculated based on return on equity (higher is better), financial leverage (lower is better), and year-over-year earnings growth stability. Then, it is weighted by the quality score multiplied by its weight in the parent index. Finally, weights are adjusted so that sectors have approximately the same weight as in the parent index, with a maximum of 5% by constituent. The index is rebalanced twice a year. In the most recent fiscal year, the portfolio turnover rate was 28%.

This article will use as a benchmark the largest developed markets ex-US ETF: Vanguard FTSE Developed Markets ETF (VEA).

IQLT portfolio

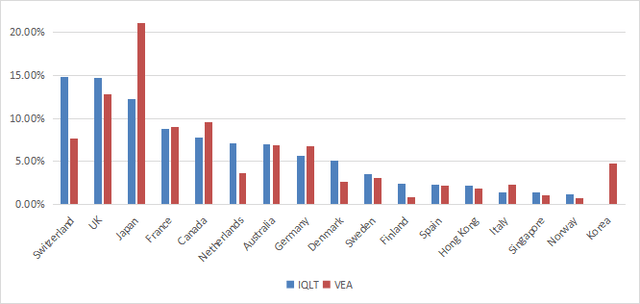

The fund is mostly invested in large and mega-cap companies (about 90% of asset value). The heaviest countries in the portfolio are Switzerland (14.9%), the U.K. (14.7%) and Japan (12.3%). Other countries are below 10%. Compared to VEA, IQLT overweights Switzerland and Northern Europe, underweights Japan and ignores South Korea. It is better balanced across countries.

IQLT geographical allocation (Chart: author: data: iShares, Vanguard)

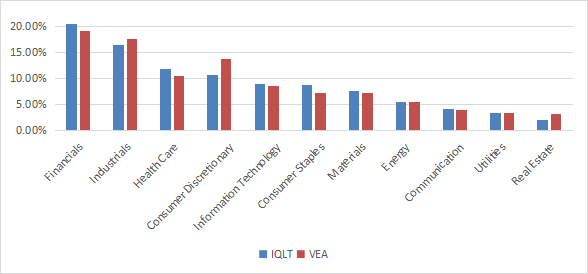

The heaviest sector is financials (20.4%), followed by industrials (16.4%), healthcare (11.8%) and consumer discretionary (10.7%). Others sectors are below 9%. The sector breakdown is quite close to VEA due to the sector-neutral methodology.

IQLT sector breakdown (Chart: author: data: iShares, Vanguard)

IQLT is more expensive than VEA regarding aggregate valuation ratios, but it shows better growth metrics, as reported below. The cash flow growth is especially good.

|

IQLT |

VEA |

|

|

Price/earnings |

16.39 |

13.69 |

|

Price/book |

2.9 |

1.58 |

|

Price/sales |

1.98 |

1.19 |

|

Price/cash flow |

12.41 |

9.09 |

|

Earnings growth % |

17.07% |

15.94% |

|

Sales growth % |

10.08% |

9.12% |

|

Cash flow growth % |

18.37% |

6.83% |

The top 10 holdings, listed in the next table, represent 25.9% of asset value and the largest position weighs 4.9%. Risks related to individual companies are moderate, but the portfolio is significantly more concentrated than VEA, which has about 11% in the top 10 holdings and only 1.44% in the top name.

|

Name |

Weight% |

Sector |

Location |

Local Ticker |

|

ASML HOLDING NV |

4.9 |

Technology |

Netherlands |

ASML |

|

NOVO NORDISK CLASS B |

3.51 |

Health Care |

Denmark |

NOVO B |

|

NESTLE SA |

3.31 |

Consumer Staples |

Switzerland |

NESN |

|

LVMH |

2.78 |

Consumer Discretionary |

France |

MC |

|

ROCHE HOLDING PAR AG |

2.19 |

Health Care |

Switzerland |

ROG |

|

ALLIANZ |

2.09 |

Financials |

Germany |

ALV |

|

ASTRAZENECA PLC |

2.05 |

Health Care |

UK |

AZN |

|

BHP GROUP LTD |

1.85 |

Materials |

Australia |

BHP |

|

NOVARTIS AG |

1.68 |

Health Care |

Switzerland |

NOVN |

|

ZURICH INSURANCE GROUP AG |

1.52 |

Financials |

Switzerland |

ZURN |

Performance

Since its inception, IQLT has outperformed VEA by 14.6% in total return. The gap in annualized returns is about 1%.

IQLT vs VEA, total return since inception (Seeking Alpha)

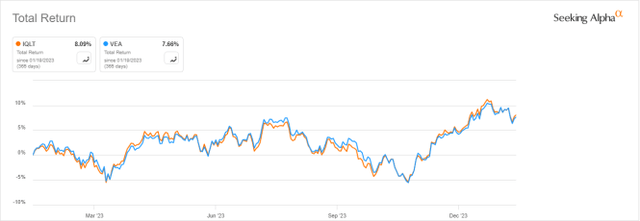

The difference in the last 12 months is hardly significant:

IQLT vs VEA, 12-month total return (Seeking Alpha)

IQLT vs. competitors

The next table compares characteristics of IQLT and four passively managed, factor-based developed markets ex-US ETFs:

- iShares MSCI EAFE Value ETF (EFV)

- iShares MSCI EAFE Growth ETF (EFG)

- Schwab Fundamental International Large Co. Index ETF (FNDF)

- Goldman Sachs ActiveBeta International Equity ETF (GSIE)

|

IQLT |

EFV |

EFG |

FNDF |

GSIE |

|

|

Inception |

1/13/2015 |

8/1/2005 |

8/1/2005 |

8/15/2013 |

11/6/2015 |

|

Expense Ratio |

0.30% |

0.34% |

0.36% |

0.25% |

0.25% |

|

AUM |

$7.35B |

$16.91B |

$10.62B |

$11.58B |

$3.36B |

|

Avg Daily Volume |

$35.57M |

$90.80M |

$74.03M |

$31.86M |

$14.09M |

|

Holdings |

324 |

506 |

418 |

942 |

726 |

|

Top 10 |

25.82% |

17.99% |

24.37% |

12.39% |

10.72% |

|

Turnover |

28.00% |

22.00% |

19.00% |

15.00% |

14.00% |

|

4 Year Avg Yield |

2.40% |

4.03% |

1.41% |

3.19% |

2.62% |

IQLT has the highest turnover and is the least diversified. Its expense ratio and liquidity are average among peers. The trading volume is sufficient to satisfy long-term investors and short-term traders as well.

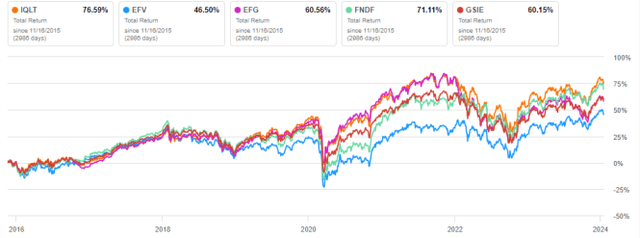

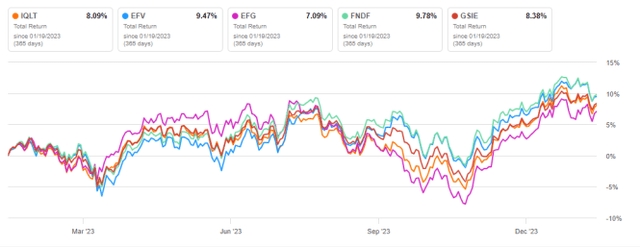

The next chart compares total returns since 11/16/2015 (to match all inception dates) and over the last 12 months. IQLT is the best performer on the longer time frame, shortly ahead of FNDF. It is in the middle of the pack on 12 months.

IQLT vs competitors since 11/16/2015 (Seeking Alpha) IQLT vs competitors, last 12 months (Seeking Alpha)

Takeaway

iShares MSCI Intl Quality Factor ETF holds about 300 ex-US international stocks, weighted based on market capitalization and a quality score. The fund is well diversified across countries, sectors, and holdings. It is quite expensive regarding valuation ratios, but growth metrics and historical performance are superior to a developed market ex-US benchmark. Moreover, it has outperformed four of the most popular factor-based ETFs in the same stock universe. IQLT looks quite attractive for investors seeking international diversification in time-tested large companies.